Compare the best day trading brokers and their online trading platforms to make sure you get the best fit for your needs. Use the comparison of spreads, the range of markets and platform features to decide what will help you maximize your returns. It cannot be said that one single broker is best for everyone at all times – where to open a trading account is an individual choice.

Here we list and compare the top brokers for day traders in 2020 with full reviews of their interactive trading platforms. Whether you are a forex trader or want to speculate on cryptocurrency, stocks or indices, use our broker comparison list to find the best trading platform for day traders.

How brokers compare

Before you can find the best interactive brokerage for day trading, you need to determine your own investment style and individual needs – how often you will trade, at what hours, with how much money and with which financial instruments.

Then there are different factors that you can consider when choosing among all the top rated day traders. If you simply choose the cheapest, you may have to compromise on platform features.

There is no one size fits all brokers and their trading platforms. The best brokerage will note all your individual requirements and details.

These are some important points and areas to compare in this competitive market:

Costs

- Do they offer low commission rates? – As a day trader who places numerous trades during the day, low commissions over a long period of time will strengthen your total profit.

- Do they offer attractive margin rates? – If you can expect a higher return than the interest you pay on the loan, the generous margin rate will allow you to trade big with capital you don’t have to maintain.

- Do they have a complicated fee structure? – Brokerage costs can add up quickly. You need to look at the fine print to make sure you don’t end up with hidden charges later, such as when you want to withdraw your money. With that said, the cheapest day trading brokers usually make up the money in other areas, such as customer service.

- Do you need a minimum deposit? – Some brokers will require you to deposit significant capital to open an account and start trading. For example, if you day trade with Interactive Brokers, you need to put down some serious cash before you can start working.

- Does the broker have a daily trading limit? – Some restrictions are put in place to protect against extreme volatility and market manipulation. But the Interactive Brokers day trading limit can be set by you to avoid losing too much capital in one day.

- Do they offer different account types? – There are different accounts with different costs and attractive benefits. For example, choose between interactive brokers’ daily accounts and you can get lower commissions, greater leverage and improved technical analysis tools. Read more about account types here.

Trading platform features

- Do they have high-tech informational tools for research and analysis? – You need live price quotes, plus detailed charts and access to historical data will also help you trade smarter. The top ten online brokers all offer a wealth of tools and resources.

- How fast and efficient is their order fulfillment? This is very important if you are day trading because just a few seconds can cost you serious cash. Although many virtual brokers offer real-time execution, this still remains a problem. This highlights the need to have your broker tested first.

- How user friendly is their platform? – The trading platform provided by the broker must work for you. Most brokers offer several to choose from, some tick the boxes for the average day trader, others offer more advanced platforms for the veteran trader. Similarly, it matches your hardware: is the platform compatible on Mac, PC, Linux or whatever you use?

- Is there a mobile platform? – It is rare that a broker does not offer a mobile trading app, but the quality will vary. If it is important to trade on your mobile phone, it is essential to check the compatibility of the apps (Android, iOS or Windows, etc.).

Customer Service

- How good is their customer service? – Will you be able to get in touch with someone quickly if you need support or advice? This is especially important if something goes wrong such as a computer crash. Some brokers offer 24/7 customer support, with wait times of less than one minute.

- Do they have a ‘trading desk’? – The best brokers offer direct access. You don’t want to send an order to a train counter that then initiates it in the market. This is time consuming and may result in citations. When you confirmed that you wanted to continue, your chance probably disappeared.

Extras

- Do they offer any attractive extras? – Any ‘Open Account’ promotions? £100 free trading may not be everything, but it does mean you can iron out any kinks in your strategy before it’s your money on the line. Trading without a broker means zero free credit for trial and error.

- Are there account levels? Does a VIP account get free tier II data or reduced spreads?

- What returns are you getting on your cash? – You will find that you usually have something in your brokerage account. Some brokers don’t offer you a cent on that balance, but some give you 3-5%.

- Trading Strategy – can you implement your trading strategy, or even use auto trading, signals or copy trading at this broker?

Final word on comparing brokers

Do your homework and make sure your day trading broker meets your specific requirements. It’s always worth giving your potential day trading broker a test run. Set up a demo account, make sure you like the platform, and send a few questions to gauge how good their customer support is. Get this choice right, and your bottom line will thank you for it.

Need a shortcut? Check out the winners of this year’s DayTrading.com Awards.

Broker Reviews

Use this trading broker reviews table to compare all the brokers we’ve ever reviewed. Note that some of these brokers do not accept trading accounts from your country. If we can determine that a broker will not accept an account from your location, it is grayed out in the table.

| broker | demo | Min Dep. | MT4 | bonus |

|---|---|---|---|---|

| 24Option | Yes | $250 | Yes | None |

| Alpari | Yes | From $ / £ / € 5 | Yes | Yes |

| ATFX | Yes | 100 $ / € / £ | Yes | None |

| Avatrade | Yes | $100 | Yes | None |

| AxiTrader | Yes | 0 $ / € / £ | Yes | None |

| Ayondo | Yes | £1 | Yes | None |

| BDSwiss | Yes | 100 $ / € / £ | None | None |

| Binary.com | Yes | $5 | Yes | None |

| BinaryCent | Yes | $250 | None | Yes |

| Binomo | Yes | € / £ / $ 10 | None | None |

| BitMex | Yes | 0.0001 XBT | None | None |

| Capital.com | Yes | £ / $ / €100 | None | None |

| CityIndex | Yes | £ / $100 | Yes | Yes |

| CMC Markets | Yes | £ 0 | Yes | None |

| Degiro | None | 0 $ / € / £ | None | None |

| Deriv.com | Yes | € / £ / $ 5 | Yes | None |

| E-Commerce | Yes | $500 | Yes | Yes |

| Easy markets | Yes | €100 | Yes | None |

| eToro | Yes | $200 (US$50) | Yes | None |

| ETX Capital | Yes | £250 | Yes | None |

| Expert option | Yes | 10 $ / € / £ | Yes | Yes |

| Finq.com | Yes | $100 | Yes | Yes |

| Forex.com | Yes | $50 | Yes | None |

| Merging Markets | Yes | No minimum | Yes | None |

| FXCM | Yes | £300 | Yes | None |

| FXPro | Yes | $100 | Yes | None |

| FXTM | Yes | From $10 | Yes | Yes |

| High layers | Yes | $50 | Yes | None |

| IC Markets | Yes | $200 | Yes | None |

| IG Group | Yes | £250 | Yes | None |

| InstaForex | Yes | $1 to $10 (Account selection dependent) | Yes | None |

| Interactive Brokers | Yes | $10000 | None | None |

| Invest.com | Yes | £ 0 | Yes | Yes |

| Investous | Yes | $250 | Yes | None |

| IK Option | Yes | $10 | None | None |

| Just2Trade | Yes | £2500 | Yes | None |

| LCG | Yes | 0 $ / € / £ | Yes | None |

| Libertex | Yes | £ / €10 | Yes | None |

| Markets.com | Yes | $100 | Yes | None |

| Nadex | Yes | $250 | None | None |

| NinjaTrader | Yes | $50 | Yes | None |

| NordFX | Yes | $10 | Yes | None |

| site OANDA | Yes | $ 0 | Yes | None |

| Olymp Trade | Yes | € / £ / $ 10 | None | None |

| Pepperstone | Yes | £200 / $200 | Yes | None |

| Plus500 | Yes | $100 | None | Yes |

| Robin Hood | None | No min | None | None |

| Saxo Bank | Yes | $10000 | Yes | None |

| Skilling.com | Yes | 100 £ / € / $ or 1000 NOK, SEK | None | None |

| Spreadex | None | $1 | None | None |

| TD Ameritrade | Yes | None | None | Yes |

| TradeStation | Yes | $500 | Yes | None |

| Trading212 | Yes | € / £ / $ 100 | None | None |

| UFX | Yes | $100 | Yes | None |

| VantageFX | Yes | $200 | Yes | Yes |

| Videforex | Yes | $250 | None | Yes |

| XM | Yes | 5 $ / € / £ | Yes | Yes |

| XTB | Yes | $250 | Yes | None |

| ZacksTrade | None | $2500 | None | None |

| ZuluTrade | Yes | $1 to $300 (broker selection dependent) | Yes | None |

What is a trading platform?

The trading platform is the software used by a trader to view price data from the markets and to place trade orders with a broker. Market data can be obtained either from the broker in question, or from independent data providers such as Thomson Reuters. In this section, we discuss how to choose the best trading platform for day traders

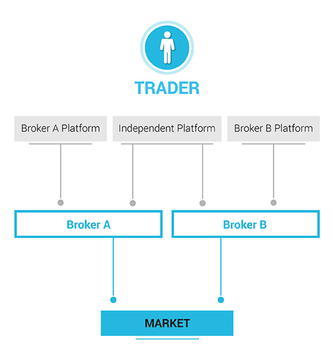

Normally, a broker offers their clients a trading platform that is more or less unique to that individual broker, but there are also independent platforms that can link to multiple brokers. An independent platform can be a good choice for the experienced trader, while using a broker’s own platform is the easiest way to get started for beginners.

Trading platform functions

The best day trading platform will have a combination of features to help the trader analyze the financial markets and quickly place the orders. In particular, a top review platform will offer excellent implementations of these features:

- Access to current and historical market data – A day trader needs to be notified of market price changes as soon as possible in order to act before an opportunity is gone or a loss is realized. Historical data is necessary for technical analysis and retesting of trading strategies. However, not all platforms have a retest feature, so check before committing to a particular software.

- Charts and other visual aids – Trends and market sentiments are best visualized through various charts and plotting of relevant technical indicators.

- Order Execution – Once you decide to place a trade, it must be executed immediately on the market. A great platform and broker will execute in less than a second. Traders using automated trading want to execute even faster, which usually counts in milliseconds depending on the strategy used and how price sensitive it is.

- Automated trading – A platform that offers automation features allows a trader to make market moves even if he/she is not at the computer at the moment. The classic “stop loss” function is a simple form of automation, but there are much more advanced platforms that allow you to program your own trading robot to execute elaborate strategies or to react faster than you can yourself do.

- Broker independence (optional) – You may want to become an expert on all the features of your trading platform, but you can still use the option to change which broker you use. The solution is an independent trading platform (listed below) that can link with different brokers.

Comparison of independent trading platforms

An independent trading platform is used to visualize market data and manage your trade, but it must be linked with one or more brokers to place a trade on the market. These professional day trading platforms usually offer a more advanced interface than that of the average broker, and help you find and place trades with one or more brokers of your choice. With the help of an independent trading platform, you don’t have to relearn a whole new software just because you switch to another broker.

Independent platforms often have advanced features such as enhanced charting and pattern analysis, automated trading and trade alerts/signals. Different platforms have different strengths. NOTE – Not all brokers support this kind of integration with independent platforms, so use our reviews to find them.

Trading Accounts

When choosing between brokers, you should also consider the account types offered. For example:

- Do they offer cash and/or margin accounts?

- Can you get managed accounts?

- Do they offer a single standard account, or do they offer different account levels?

The account that suits you will depend on various factors, such as your appetite for risk, starting capital and how much time you have to trade. Along with this is the breakdown of the various options, including their advantages and disadvantages.

Cash Accounts

Brokers in most days offer a standard cash account. This is simply when you buy and sell securities using the capital you already have, instead of borrowed funds or margin. Most brokers offer a cash account as their standard option.

Advantages

There are several benefits associated with cash accounts. First, because there is no margin available, cash accounts are relatively simple to open and maintain. You also have less risk than margin accounts because your initial capital is the most you can lose. Ultimately, you don’t have to pay the interest charges posted to the margin accounts.

Disadvantages

Trading with a cash account also means that you have less potential because there is no leverage. For example, the same profit on a cash and margin account can be a difference in returns of 50%, because margin accounts require much less capital. Additionally, you must wait until funds are settled in a cash account before you can trade again. With some brokers, this process can take several days. Overall, the absence of margin means that these accounts are probably not the right fit for the majority of active intraday traders.

Margin Accounts

Most brokers offer a margin account. Essentially, it allows you to borrow capital to increase your position. For example, you may pay only half the value of a purchase, and your broker lends you the rest. Note brokers apply margin restrictions on certain bonds during periods of high volatility and short interest.

Advantages

Margin accounts have several advantages. First, you can choose when you repay your loan, as long as you stay within the maintenance margin requirements. Second, you can leverage assets to increase your position and increase your returns. The interest rate is usually lower than credit cards or a bank loan. Finally, if you have a concentrated portfolio, you may be able to use existing securities as collateral for a margin loan.

Disadvantages

Despite the benefits, there are serious risks. With a cash account you can only lose your initial capital, but with a margin call you can lose more than your initial deposit. You also have interest charges to take in. In addition, you should check the maintenance margin requirements. If not, you may be shorted, resulting in forced liquidation of a margin call. In general, margin accounts are a wise choice for active traders with a reasonable risk tolerance.

Managed trading accounts

Some brokers will also offer managed accounts. A managed account is simply when the capital belongs to you, the trader, but the investment decisions are made by professionals. This can be referred to as an advisor on the account – these advisors have complete control over trades. There are two standard types of managed accounts:

- Mutual Funds – With these types of accounts, your capital goes into a mutual fund with other traders’ capital. The returns are then distributed among the investors. Brokers normally divide these accounts according to risk appetite. For example, those looking for big returns can put their money in a joint account with a high risk/reward ratio. Those looking for more consistent gains are likely to choose a safer fund. Minimum investments for composite accounts are approximately $2000.

- Individual accounts – With this account, your broker will manage your capital separately and make investment decisions that suit your needs. The biggest advantage is that you have an experienced professional on your side. However, you pay for the privilege with account maintenance fees and commissions. In addition, some brokers will impose a high minimum investment of at least $ 10,000.

In general, managed accounts are best suited for those who have significant capital but little time to actively trade. However, those with less capital and those with time or the inclination to enter and exit positions themselves may be better off with an uncontrolled account.

Account levels

Some discount day trading brokers only offer a standard live account. However, others will offer numerous account levels with different requirements and a range of additional benefits. For example, a bronze account can be the entry level account. Here you get access to chat rooms, a weekly newsletter and financial announcements and commentary. These entry-level accounts usually have low deposit requirements. If you were to deposit more, say more than $1000 and make a certain number of trades each month, you may be eligible for a Silver account. This can give you access to courses, a personal account manager and more in-depth market commentary. Deposit a little more, say $5000, and you may be eligible for a Gold account. For this you can get the following:

- 10% deposit bonuses

- Daily market research

- Referral Incentives

- A dedicated trading mentor

- Telephone access to an active trading community

Finally, some brokers offer a top-level account, such as a VIP account. To qualify for this account, you may need to deposit $20,000. For example, you may need to trade 500 lots quarterly. However, for your larger deposit, you can get even more help, as well as larger deposit bonuses, free trades and other financial incentives. You may also get full access to a wide variety of educational and technical resources. The best day trading brokers therefore offer a number of account types to meet individual capital and trading requirements. It is also worth keeping in mind that the more you can invest, the greater the benefits and the trading experience.

Final word on accounts

When choosing between brokers, you should consider whether they have the right account for your needs. The most important factors to consider are your risk tolerance, starting capital and how much you will be trading. Note that you can also open different accounts if you want to use different strategies.

Regulation and Licensing

One of the most important considerations when comparing brokers is that of regulation. There are a number of different regulatory bodies around the world. The reputation of these authorities varies, but almost all of them can give consumers a great deal of confidence in the brokers they license. Here are some of the leading regulators;

FCA (Financial Conduct Authority) – British regulator, with responsibility for all forms of trading and market speculation.

CFTC (Commodity Futures Trading Commission) – US regulator overseeing broker. SEC (Securities and Exchange Commission) – US regulator for exchanges and markets.

FSB (Financial Services Board) – South African regulator

CySEC (Cyprus Securities and Exchange Commission) – Cypriot regulator, often used to ‘passport’ regulated brands in Europe

BaFin (the Federal Financial Supervisory Authority / Bundesanstalt für Finanzdienstleistungsaufsicht) – German regulator

Financial Supervisory Authority Denmark (Finanstilsynet)

The European Securities and Markets Authority (ESMA) also provides a comprehensive guide for all European regulators, which impose certain rules across Europe as a whole – including leverage cap, negative balance protection, and a blanket ban on binary options. These rules only apply to retail accounts, not professional accounts.

How to try a broker for free

A demo account is an excellent way for beginners to practice a broker or trading platform and without using real money. A demo account is funded with simulated money, so you can try the platform functions of the broker and get familiar with the performance of the markets. A caveat: even the best practice platform can’t replicate the pressure that comes with real money on the line, but it’s a great way to learn the basics and get started with zero risk. Read more about demo accounts

How brokers make money

Even among the best day trading brokers, you will find contrasting business models. Having said that, there are two main types:

- Market Makers

- Over the counter brokers

Market Makers

Some of the best brokers for online trading are market makers. Market makers are constantly ready to buy or sell as long as you pay a certain price. This means that they can lose in price movements before they find a buyer / seller.

But because they take the risk, they seek compensation. So they set the bid price slightly lower than quoted prices while setting the ask price slightly higher. The small margin is where they can make their money.

This may seem like an insignificant amount. However, tens of thousands of trades are placed every day by good brokers for day trading that thissystems used. Surprisingly, those small margins can add up quickly.

Attention brokers using this day usually use these fixed or variable spreads:

- Fixed spreads – don’t change regardless of what happens in the markets. Because of the added risk, fixed spreads tend to be wider than variable spreads.

- Variable spreads – vary in response to market conditions. During the London and New York overlap, an increase in liquidity leads to tight spreads.

Let’s look at an example – if you want to sell 50 shares of Tesla, good market makers will buy your shares regardless of whether they have another seller. However, they can buy the Tesla shares for $300 each (the ask price), while offering to sell them to another trader for $300.05 (the bid price). That $0.05 is where your online broker makes their money.

OTC Brokers

Many of the best discount brokers for day traders follow an OTC business model. In fact, they are the most popular type of day trading broker. The immediate lure is the apparent lack of trading costs and commissions. However, on the best day trading platforms, it is not that simple.

Essentially, an OTC day broker will act as your counterparty. They will take the opposite side of your position. As a result, you don’t have to pay the same commission or fees. You simply trade against the broker.

The best OTC futures or CFDs, for example, can be hedged on both sides of the trade, promising a handsome margin. However, some of the best day trading brokers can also hedge to compensate for risk.

The equation

There are several key differences between online day platforms that use these systems:

- Increased Liquidity – The best brokers who follow the market maker model are effective as wholesalers, buying and selling to meet the needs of the market.

- Costs – Without finding market makers, it can find finding buyers and sellers. As a result, liquidity may drop and you may pay higher trading fees as entering and exiting positions becomes more difficult.

- Motivation – A marketer will earn money regardless of the outcome of your trade. While an OTC broker has an interest in you losing.

The top day trading brokers will often use a variation of one of these models. Check the reviews to see what model a prospective broker is using to get a sense of where and how they expect to make their profits.

Broker’s payment methods

Different trading brokers support different deposit and withdrawal options. The availability of one or more specific payment methods may be of interest to merchants, as fees and transit times vary between methods. For some merchants, it may be essential that a deposit or withdrawal happens immediately, while others are fine with a processing time of a few days. Any trader who regularly makes deposits or withdrawals will certainly want to be on the lookout for low transaction costs. Below we list different payment methods, which brokers support them, as well as tutorials on everything a trader needs to know.

PayPal brokers 2020 – which brokers accept PayPal deposits in Ukraine?

Paypal is by far the world’s most recognized form of online payment. The number of brokers accepting Paypal is increasing and Forex trading with Paypal is becoming especially common. Day trading with Paypal brokers is popular because of its security and how quickly transfers can be made between accounts.

Skrill Brokers 2020 – Which brokers accept Skrill deposits in Ukraine?

Skrill is a digital wallet accepted by many online forex brokers. The number of Skrill brokers is increasing due to its speed and security. Other benefits for brokers that accept Skrill are the acceptance of all major currencies and the ability to handle large deposits.

Trade in different regions

As the world migrates online, you could theoretically opt for day trading brokers in India or anywhere else on the planet. However, there are tax considerations and regulations to remember before choosing a day trading platform in Australia, Singapore or anywhere else outside of your country.

- Tax Considerations – Where you trade and where your broker is located can affect what and how much taxes you have to pay. Will you pay capital gains tax? Will you pay net income tax? If you start day trading with brokers from Canada, will you pay foreign and domestic taxes? If you are considering joining a distant broker, you should first find the tax implications.

- Regulation – Regulation is important for several reasons, but your financial security is one of them. Choose brokers that are regulated in establishedfinancial systems, such as the EU, the US or the UK. A broker that is regulated in Bermuda is better than no regulation, but you can still run into problems.

Canada and the US also have trading days for pattern days – but both are quite separate. Read more about this on the rules page. Note that the Canadian daytime platforms may differ significantly from both US and European versions, and platforms in South Africa will also differ.

Short line

The broker you choose is possibly your most important investment decision. Everyone’s requirements are different, so there is no clear universal winner to look to. Instead, in your comparison, you should consider which of the factors listed above are most important to you, and then you will be able to find the best broker for your needs.