Currency trading (also ‘currencies’ or ‘currencies’) is the buying and selling of one currency for another. The operations are carried out according to the exchange rate indicated on the counter (OTC) or on the exchange platforms. The market is the largest in the world, with more than $5 trillion in daily transactions. Forex can be traded throughout the day five days a week. There is no central exchange for the coins, so they are traded worldwide from different sources. For each currency pair, the first currency in the list is the ‘base’ currency and the second currency is the purchase currency. So, with EUR/USD, the quoted price is how many US dollars are needed to buy 1 euro. Almost all financial news or global events will affect exchange rates. With markets available 24 hours a day and many brokers offering low commissions, a tight spread and high leverage, forex trading has become extremely popular with retail investors. However, it remains a high risk, especially when it comes to leverage.

How currency pairs work

Currency pairs are the starting point for currency trading. A “pair” is the two currencies to be traded. Then a trader will buy one currency with the other. So, for example, with the GBP / USD pair. The trader will buy pounds using the US dollar. If prices are quoted, they are always the second currency, then buy the first. With EUR/GBP, for example, the quoted price is the cost in pounds to buy 1 euro. However, note that the decimal point will move, making the price look a little strange to anyone who is used to exchanging currency for their holiday. In the EUR/GBP example, the trading rate is currently 8454.8. For tourists traveling to Europe, this equates to 84.5 pence buying 1 euro. The currency of the trading account does not matter, the broker will convert it as needed to buy or sell traders money. Retail currency trading simply speculates on the movement of exchange rates between currency pairs.

What are the main currency pairs?

The main currency pairs involve the US dollar:

- EUR / USD

- USD / JPY

- GBP / USD

- USD / CHF

Established, high-volume, dollar-based pairs are known as the “most important” pairs. In addition to these more traditional currency pairs, there is quickly becoming a much wider variety of currencies to trade – these are called “minor” or “exotic” pairs. Binary options brokers now offer options in 40 to 50 different currency pairs from around the world. Emerging markets have added a whole new element to Forex trading. These markets include regions such as South America and Asia. Currencies often represent market confidence in the entire economy of the area in question. Given the wide variety of factors that contribute to such economies, it is easy to see why prices are constantly fluctuating. However, smaller and exotic pairs see lower trading levels, which can affect volatility, but sometimes also availability.

What are exotic currency pairs?

They are typically called exotic pairs because they combine a major currency with a second currency from an emerging or smaller market, for example:

- TEST – Turkish lira

- NOK – Norwegian Krone

- SEK – Swedish Krona

- HKD – Hong Kong Dollars

What influences the currency markets?

What Affects the Currency Markets? Virtually everything. Almost all the world news can have an imaginable effect on currency prices. For example, the collapse in the price of oil led to a similar drop in the value of the Russian ruble. An economy so heavily tied to oil will rise or fall with the value of that product. There are of course additional factors to consider, but the example is clear. A more subtle example was the Indian rupee. The new management at the Reserve Bank of India has boosted investor confidence in the recovery plans for the Indian currency. The confidence was reflected in the strong performance of the rupee. While India’s currency directly benefited, other Asian currencies also moved higher, with regional performance a factor helping both the Philippine peso and the Thai baht. Another example is foreign policy. If a nation like China were to negotiate a deal with Russia over gas, both currencies could benefit. If the markets believe that one trading partner has the best side of the deal, one currency can gain while the other suffers. Traders can comment on future foreign policy and invest accordingly. These examples are some of the biggest and most obvious market drivers, but they illustrate the fact that the forex market is a very complicated market.

Volatility in the Forex Markets

Uncertainty in the markets usually leads to volatility. At the moment, the world economy is undoubtedly uncertain, which means that there are many opportunities for Forex traders. Binary options offer an opportunity to profit from uncertainty. The range of forex currencies available to trade via binary brokers has never been greater, and the right strategy for the right currency can be very profitable. Our reviews highlight brokers that focus on binary options exchange rates.

Opening hours of the currency markets

Some beginners skip some basics about Forex and go straight to strategy. This can be a mistake and lead to many lessons being learned the hard way (losing trades). One of these ‘fundamentals’ is knowing the hours when certain markets will be open. The currency market is open 24 hours. This is because banks and corporations are open at different times around the world. This demand provides liquidity to the currency pairs. However, each hour of the day has different trends based on which part of the world is open for business. Understand hourly market hours and hourly trends, and you can better apply your strategies.

Forex market sessions

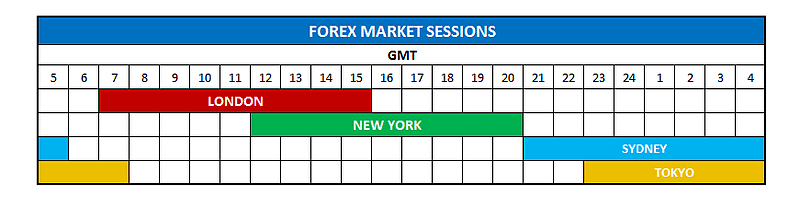

The main markets are open at different times of the day. Which market(s) are open directly affects the liquidity and volatility and currency pairs. For example, EURUSD is more liquid and volatile during the London and New York sessions, especially during the “overlap” period when London and New York trade. USDJPY generally has the highest volatility when Tokyo first opens and when New York opens many hours later. In general, currencies see greater liquidity when one or more markets that actively use or are using the currency are open for business. These are the GMT based forex sessions for UK traders:

The table does not show all the markets in the world. But the shown are the most important currency markets. The Canadian market is open while New York is open, and London overlaps with other European markets. Germany opens an hour before London; Therefore, some consider it the open, and not the beginning of the London session. However, on average, volatility does not see a significant increase until London opens.

Intraday volatility

Those important sessions directly affect the volatility of currency pairs. Hourly volatility follows certain trends. If your strategy is based on volatility, or you use a trending strategy, then focus on the times of the day where price movements are greatest. If you use a range trading strategy more, or prefer low volatility, you should use it during quiet times. See where the charts show a decrease in hourly volatility. 08:00 to 17:00 GMT offers the best trending opportunities, with 13:00 to 17:00 offering the biggest draws overall. Those looking for reduced volatility, or the times that are likely to be rather quiet, trade between 20:00 and 05:00 GMT. The USDCHF is very similar to the EURUSD in terms of the hourly volatility structure, although the USDCHF moves less each day and thus the total hourly volatility is several pips less. NZDUSD has hourly volatility much the same as AUDUSD, and they both move about the same amount each day.

Opening Hours Conclusions

Learning the basics, such as what the market sessions and hours mean to you as a trader, can make a significant contribution in strategy and time. No matter what period you’re trading, create a checklist to help you determine what type of market you want to trade. Do not try to “force” operations. It will also help to filter the trades and to take advantage of good opportunities.

Forex vs binary options

The biggest advantage of Binary Option over Forex Trading is the defined and limited loss that can be suffered in any trade. If you initially buy a binary option, what will be your maximum loss. It is defined by the cost of the option itself. You can also define your Forex loss trade by adding a stop loss order to your position, but two things can come into play:

- A choppy break in price against you where you intended to stop your losses after 30 pips but end up stopping after more than 30 due to market volatility.

- The temptation to move your stop loss as the market approaches because you feel that the momentum is not going to last. Ultimately, taking risks in trading can result in you losing much more than you initially considered.

In other words, it can eliminate the need for disciplined risk management. Often, traders end up emotional, which can end up being disastrous. With binary options, your maximum loss is always fixed and there is no risk of losing more. This is also related to the concept of volatility, with a binary option it doesn’t really matter how the market moves as long as it is in the money at expiration, whereas a position in Forex can often cause you to lose as a result of high volatility. of the market, to then see the price fall in their favor. Although both business methods have many common features, there are additional elements that distinguish them:

- Lever. Binary options are usually offered without leverage. Traditional Forex often offers large amounts of “gear”. Leverage is a double-edged sword. Some traders ask for the extra profit potential it offers, others will be concerned about losses that can lead to leveraged trading.

- Risk. Risk and reward are clarified from the start with binary options. The best and worst scenarios are known. In more traditional forex, the profit or loss may not be clear until the trade is closed. Leverage increases this problem.

- Capital requirements. Traditional forex will require more cash on account than binary options.

- Flexibility. Binary options can provide tangible and variety of options in a simple way. The same trading profile can be obtained with conventional Forex trading, but you need to think more on behalf of the operator.

- Fixed expiration. Forex traders can enter and exit trades without any definite endpoint. At the beginning of the option, a specific expiration must be determined.

- Supervision. A binary option can be allowed to expire at maturity, without additional risks. A currency trade should be monitored in case there are sudden price movements that could cause a stop loss or the like. Of course, binary files can also be swapped, so some traders may also prefer to control binary positions.

Trade speed

Binary options allow very short expirations. Expirations of only a few minutes are available, in fact even as little as a maturity of sixty seconds. In forex, it is very rare for the market to move enough to close its position in a few minutes, much less in just sixty seconds. As binary option payouts range from 75% to 90%, you can buy an option for say £200 and receive a profit of between £150 and £180 after a few minutes.

Distance to target

With Forex trading, you enter a position with the aim of the price level reaching a certain target which will inevitably be far from the current price. Binary options leave the strike price, the strike, in the money, creating greater chances that the option will be at expiration. With the forex price target potentially far from the current market price, a higher price movement is needed to make profits to the same extent. In Forex, if the current market price for EUR/USD is 1.1200, you should enter the trade with the idea that the market is going up or down, say 20 pips. In Binary Options, the exercise price is the current market price. 1.1200 and your option must be above or below that price even with only 1 pip for cash.

The benefits of Forex

The biggest downside to trading binary options is your required profit rate. If you apply the risk/reward ratios correctly in Forex, your individual profits should generally be higher than your losses. This is because you should enter each trade with a target profit that is greater than the stop loss, for example 35 pips versus 25. This means that even if you are only right 50% of the time, you should make money as your winning trades will be more earn if your losing trades. This concept does not work for binary options and it is easy to see why. With payouts around 75-90%, traders need to earn more than 50% of their trades to be profitable. With each separate trade, more funds are risked than would be earned if the option ended in the money. In this scenario, you need to get it right more than 50% of the time to make an overall profit. With binary trading, there is also no real secondary market. After buying an option, you may want to exit that position before expiration; Maybe you are trying to minimize your loss or maximize your gains if you think the market is changing. Therefore, you may want to sell the option you bought. To do this, you only have the option to sell it at the price indicated by the broker where you bought the option. While you can have multiple accounts with different binary options brokers and compare the prices of the option you want to buy before you buy it, once you do that, if you want to disconnect it, it closes the trade before it expires, you have no choice but to do so at the price shown by the broker. In Forex, of course, the market is free at any time and you know that you will get the fair market price to exit your trade and not the brokerage price.

To give a summary of Binary Options vs Forex discussion

Which trading option is the best, that is, the most profitable market to trade? Binary options or forex? It largely depends on your own level of commitment in terms of hours per day in front of a screen and discipline in risk management. With binary options, you may not need to be in front of the screen for many hours a day to constantly follow the markets, as may be necessary when trading in Forex. You can take your position and wait for the result with the assurance that your maximum liability is the cost of the option. You don’t have to worry about keeping your stop loss, it is set at the price you paid for the option and cannot be changed. One thing that both markets have in common is the analysis required to make a business decision. Regardless of the market you will be trading in, you will always look at Fundamentals and/or Technical Analysis. For both markets, you need to hone your analytical skills and create a profitable business plan or strategy.

Fundamentals of forex options trading

Here, a professional trader, and founder of a money management and trading advisory firm, shares his thoughts on the fundamentals of forex options trading and the system he personally uses. The strategy below is not a secret, but it is not well known either. The simplicity is the reason for its success.

EUR / USD

The currency pair I trade is usually the EUR/USD pair. This is because it is the most volatile but also predictable currency pair. It is still the most traded pair since the opening of the Forex markets to retail investors. The daily volume has increased tremendously since those early days. EUR/USD is also a pair that financial firms use to hedge income against market fluctuations. One problem that frequently appears on binary options forums is the volume of different strategies being discussed or offered. Most traders think that the more complicated the system, the more profitable it will be. If these forex strategies fail, the system gets blamed. However, the real problem is behind the scenes. No strategy will adapt to changing market conditions; The dealer must adapt. Many people argue that this strategy will not work under specific market conditions. However, the point is that the markets are binary; the price will only rise or fall. Ranking markets don’t really exist. Any system has the same ultimate goal: to locate the best entrances and exits for a particular operation. For example: an experienced trader will be able to easily detect support and resistance levels. A beginner cannot. The same novice investor can use a strategy using the following:

- Stochastic;

- MACD;

- RSI.

But what they fail to see is that these indicators give you the same entry points that the experienced trader uses. When trading binary options, it is key to locate the best entry point and know the next price move. Note: The following are personal opinions and a strategy I personally use. Everything should be read carefully. Don’t jump into high-risk methods without understanding how the strategy works. Consider trading with a demo account before risking real money. Be willing to set aside trades if something discourages you. Don’t force trades where there aren’t any, opportunities will come.

Forex Basics

The first point is to provide an overview of the currency markets in general: currency exchange is governed by the laws of supply and demand. Here’s a hypothetical example: Apple (a US-based corporation) sells 1 million phones across Europe, collecting €500 per product. EUR (€) is the base currency. They use HSBC as compensation, so these funds are received there. However, Apple reports in dollars, and its government account is with BOA. Then Apple earned €500 million which is in the HSBC account in Luxembourg. These funds should now flow to your BOA account and be changed to USD. Now they have to exchange currencies. The transfer order comes at 16:00 UK time on Tuesday. It will not transfer immediately. Banks will accumulate all your USD orders overnight. It is possible up to a month ago. The UER / USD pair is trading at 1.27000 at 6 GMT on Wednesday morning. So Apple’s BOA account will receive $635 million at 8 am EST. The order is set at 1.27000. How can banks, or retail investors, make money from this transaction?

How do investors benefit?

BOA will obviously get a commission from Apple, but what about HSBC? At 8 am GMT, the opening of the London markets, liquidity is 380 million euros. The price is 1.27010. 500 million euros is therefore equal to 635,050,000 dollars. Currently, markets cannot handle this trade. From the hypothetical example, this is what the markets look like. The outlook for euros is strong. Asian markets rose overnight. The fiscal cliff of the United States is being resolved. Millions of retail and sales investors take BUY orders and place their stops 10 pips below the current price. Now there is a pending liquidity of 300 million euros plus a current liquidity of 380 million euros. The total liquidity in USD at the moment is (1.27010) 482,638,000 USD and 381,030,000 USD pending (stop equivalent).

Exchange currencies

Market data shows that the stops are at 1 26910. So at 8.15 am GMT, the order comes to the SELL of the available liquidity (sell order of 840 million euros). The effect of this is to lower the price to 1.26905. The bank’s BUY orders are now activated. Other retail investors are now placing new orders to cover their losses. Price flies to 1.27099. Here we can gradually exit our BUY positions (if we continue to bank). As the trend still looks strong, people are buying our orders. On a chart this can be shown with smaller and smaller green candles following an uptrend.

Business result

Then the liquidity of the market increased to 380 + 300 = 680 million euros. We traded at 1.27099 with a gain of 9.9 pips (from 1.27000). Once leverage was considered, and the scale of these exchanges, enormous sums of money simply changed hands. Banks (and retail investors) use leverage to make huge profits from such moves. All this was merely an example. The truth is that the volumes are huge ($4 trillion daily). There are many traders, market makers and stakeholders in these markets, but that example shows how FX works, and it is critical in analyzing the levels and trends of the support and resistance (SR). These levels are defined by the biggest players. It also holds up very well because retail investors also see and use it. The smart money cycle occurs in three price cycles. Then we see a short-term channel where the price is stuck by some built-up strength.

Forex correlations

Forex correlations are an important tool. If you haven’t learned what it is, you could possibly injure all your operations. The correlations show which pairs move together. Moreover, it points to those moving in opposite directions. Not least, it will show which pairs are unrelated. All this helps to judge which offices we should take. This can reduce the risk and also provide additional trading opportunities that are not visible on the price chart.

How to read trading cards

Correlations are typically displayed with values ranging from -100 to 100. A value of -100 (inverse correlations) shows two currency pairs moving exactly opposite each other. If one rises, the other falls and vice versa. A figure of 100 means that two currency pairs are moving together. If one gets up, the other gets up too. Likewise, if one falls, so will the other. Numbers at the end of the spectrum are rare, but the closer the number is to -100 or 100, the higher the correlation. Therefore, figures above – / + 70 are a remarkable correlation. Anything above – / + 80 is a strong correlation. Consider the GBP/USD and EUR/USD transition above. Gives a figure between GBP/USD and EUR/USD of 89.6. This shows a strong correlation. Then rate USD/CHF with EUR/USD. This shows that the correlation between these two pairs is -95.4. This highlights a very strong inverse correlation. If the EUR/USD rises, the USD/CHF falls, and vice versa. In many pairs there is no relevant correlation. If a value (positive or negative) is less than 60, the correlation is not very strong. Anything around 0 shows that there is no correlation between the pairs at all. As an example are the NZD/USD and EUR/USD pairs. The correlation here is -1.7. This means that there is no daily correlation between these pairs. In other words, the rise or fall of the NZD/USD tells us absolutely nothing about what the EUR/USD can do.

Correlation Series

Correlation tables are created and updated daily and weekly based on time frames. All these conditions contain valuable information based on the term in which you work. For short-term trading, hourly and daily correlations are most important. The numbers change, so don’t take the above as gospel.

Why do Forex correlations matter?

There are several reasons to be concerned about currency correlations. The main reason I control them is to control risks. For example, a trader may assume that trading multiple pairs offered them diversification. This can only be ensured by knowing the correlations of the pairs. If you go long (buy) in EUR/USD, GBP/USD and sell (buy put) in USD/CHF, you have essentially taken 3 very similar positions. If someone moves against you, everyone is likely to move against you. The risk has effectively tripled. If leverage was also used, the risk is high. Another reason why forex correlations are important is that they can provide you with trades that you may not have seen. For example, you think that the EUR will rise against the USD (that is, that the EUR / USD will rise). You look at the chart and you don’t see a good trade setup.Since you know that GBP/USD generally moves with EUR/USD (based on current correlation), you can also check GBP/USD to see if there is a better trade setup. You also want to see if there is a trade setup to go short (put buy) on the USD/CHF as it usually moves in the opposite direction of the EUR/USD. High correlations (positive to negative) give you alternative swaps; choose the one with the best commercial intent.

Confirm trades

I also want to use forex correlations to confirm trades. If I find currency pairs with high correlations, I will use one pair to confirm trades on the other. For example, if the EUR/USD rises, and I want to go long (buy calls), I also want to see the GBP/USD rise. Since these pairs are highly correlated, they should move together. If it doesn’t, he warns me that maybe I should take a closer look at my artwork. This does not mean that you do not accept the exchange. These correlations change, and two pairs never move perfectly in harmony. This means you have very good reasons to trade (as you always should). Correlations can be a complicated statistical problem. Hopefully this introduction has given you enough concepts to do some homework yourself. Check correlations regularly to find out the relationship between currency pairs that can affect your trade. Use correlation data to control risk, find opportunities and filter trades. If you have trouble seeing how correlations work, try looking at the numbers in the correlation charts and then open the price charts for the two currency pairs. Notice how the pairs move relative to each other; By doing this, you can create a general understanding of the correlations.

Swing Trading – Definition and Examples

Stock exchange graph background, 3D illustration

A “Swing” operation is usually an operation that is open for one to five days. A trader tries to follow the momentum of an asset’s price, usually within an established trend channel. The idea of ‘swing trading’ comes from the stock market and is a type of trading strategy mainly followed by retail traders. The reason is that it is difficult for institutional traders to take positions of the kind of size they need without moving the market. This is not necessarily true for the Forex market, as the major pairs are all very liquid and there is a large interbank market. Traditionally, the trading positions vary with respect to the time horizon between the day traders and medium-term investors or traders. A day trader would hold for a few seconds or hours at most, while a medium-term investor might hold for a few weeks. However, the currency market is a whole different kind of ball game. Even in the hottest bullish trend or the wildest bearish trend, the day’s price action may have gone through a few ups and downs, rather than moving in one direction all day. Swing traders in the Forex markets can also be day traders and try to take advantage of the upward and upward price momentum. Their mission is to enter the market as soon as the momentum increases, but short out as soon as the market is lower again.

What is the analysis of the Swing strategy?

Because of their short holding period, swing traders are not as fundamental and focus primarily on technical analysis. It can be as simple as a 3-day moving average crossover strategy, adjusted to get in and out of positions early. Or a more elaborate mix of several overlapping technical indicators. In any case, the intention is the same, to get in early when the momentum changes and to change the position when the market falls back. So this strategy works especially well if the market is trending sideways rather than up or down. The currency markets have changed a lot, even if the market is clearly trending, but it can be painful to sell early enough in a bull market to effect the change.

Definition of the real market

Determining whether the market is currently sufficient within a given period is of utmost importance for the successful outcome of this strategy. You need to consider the time horizon in which you are working, in Forex markets changes occur in relatively shorter time intervals. Therefore, it is necessary to stick to the time horizon in which it operates to determine if the market is working sideways. A sideways market is defined when the maximum and minimum do not exceed the previous maximum and minimum, giving rise to the so-called channels, as well as other chart patterns. The shorter the period, the smaller the difference between high and low, or the shorter the price action channel. For day charts, you can expect most specialties to be nimble, rather than having the channels 2% to 6% wide. In comparison, if you look at a chart, the channel can be around 0.5% to 1.5%. Often, side markets can move in very tight ranges in periods of less than a day as the market consolidates its new level.

Let’s look at some examples

The hourly chart in the first image is for the USDCHF. As we can see, the pair is going through a relatively narrow price range of around 45 pips, between 0.98800 and 0.9925. The blue rectangle that runs from May 19 at 6:00 a.m. GMT from 24 May at 15:00 hrs. GMT highlights how the action of channeled prices was maintained during that period. The task of the swing trader is to try to go short or sell at points A, C and E and to go long or buy at points B, D and F. In swing trading there are no downtimes; the strategy is to be consistently long or short. So there are no lock-in and waiting periods, which can be useful if the market goes down, allowing you to get back into the market at a better price than the one that exited. However, it can be unbearable if the trend is strong and continuous. Therefore, it is necessary to identify an outline of the sideways price movement and the development of further momentum in one direction. From the table above it appears that there was in fact a break in the channel pattern. Three of the last four bars have closed above the blue rectangle, which would raise red flags for a swing trader. The side action may not have developed into a new emergence. However, the fact that the price has moved above its channel calls for caution. It will be necessary to wait whether the market has found new momentum or simply a higher top of the channel.

The hourly chart in the first image is for the USDCHF. As we can see, the pair is going through a relatively narrow price range of around 45 pips, between 0.98800 and 0.9925. The blue rectangle that runs from May 19 at 6:00 a.m. GMT from 24 May at 15:00 hrs. GMT highlights how the action of channeled prices was maintained during that period. The task of the swing trader is to try to go short or sell at points A, C and E and to go long or buy at points B, D and F. In swing trading there are no downtimes; the strategy is to be consistently long or short. So there are no lock-in and waiting periods, which can be useful if the market goes down, allowing you to get back into the market at a better price than the one that exited. However, it can be unbearable if the trend is strong and continuous. Therefore, it is necessary to identify an outline of the sideways price movement and the development of further momentum in one direction. From the table above it appears that there was in fact a break in the channel pattern. Three of the last four bars have closed above the blue rectangle, which would raise red flags for a swing trader. The side action may not have developed into a new emergence. However, the fact that the price has moved above its channel calls for caution. It will be necessary to wait whether the market has found new momentum or simply a higher top of the channel.

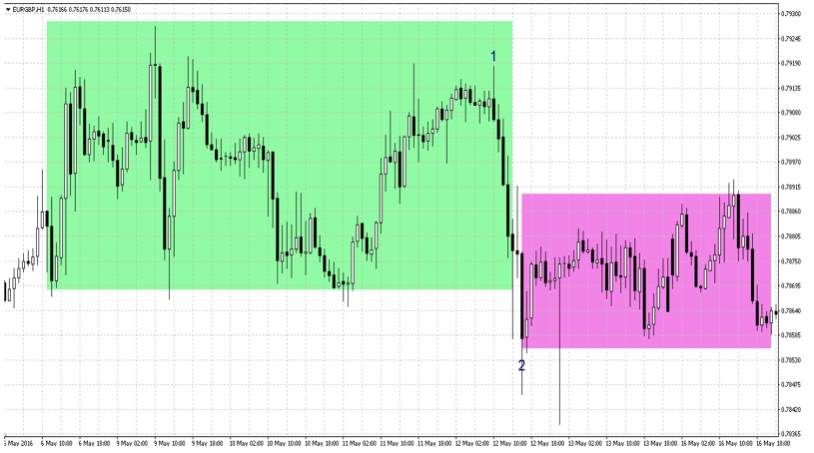

The hourly chart in the second image, for EURGBP, shows how price action moves from one side channel in the green rectangle to another side channel at a lower level in the pink rectangle. As the price moves from point 1 to point 2, it can be tempting to open a short position at point 2 with the view that a new downtrend is underway. Only to find that the price is now moving higher again and trading within a range. Ultimately, as always, you have to be careful, but even if you’re not a swing trader identifying a side market will help you avoid getting caught up in the pregnancy. By correctly identifying the market regime, you can avoid buying when the market is down or selling when the market is about to pull back.