This material is not intended for viewers from EEA countries. Binary options are not promoted or sold to retail EEA traders

Welcome to the largest expert guide to online binary options and binary trading. BinaryOptions.net has been training traders worldwide since 2011, and all the articles are written by experts in the financial sector. Regardless of your current experience, we offer thousands of articles and reviews to help you become a profitable trader in 2020. If you want to discuss deals or brokers with other traders, we also have the world’s largest forum with over 20,000 members and lots of daily activity. Start trading today!

EU Traders – Despite the ESMA ban, binary options trading is still possible. For example, brands regulated in Australia still accept EU traders and offer binary options. Our brokers list is tailored to your area – the list of the list is to allow dealers in the area.

EU traders can also trade as ‘experts’. ESMA rules only apply to retail investors, not professionals. Traders are only classified as professionals if they meet two of the following three criteria:

- Size and volume of the transaction. 10 transactions of ‘significant scale’ per quarter (the broker’s view of ‘significant’ varies)

- Portfolio size. Total investment portfolio of more than 500 million euros. Interests can be through the broker.

- Experience. You have worked or worked in the financial sector and gained experience with complex financial products.

The broker may need proof. Switching to jargon means you lose some regulated consumer protections, but you should avoid ESMA changes altogether (including reducing leverage and access to binary options).

Another alternative for the EU trader is a new product launched by the brand to combat the ban. One such alternative is the FX option (based on IQ options), which offers the same fixed risk as the binary option and expiration. The main difference is variable payouts based on price changes in underlying asset prices. Read more about FX options

Africa Popular Brokers

What is a binary option and how do I earn money?

Binary options are a fast and very simple way of financing, which allows investors to speculate on whether asset prices will rise in the future, including Google stock prices, bitcoin prices, USD / GBP exchanges, etc. Interest rates or prices. The turnaround time is only 60 seconds, so you can trade hundreds of times a day in the global markets.

If your predictions are correct before trading, you usually receive a credit of $170 – $195 for a successful trade if you invest 70-95%, exactly $70. This makes risk management and trading decisions much simpler. The result is always a yes or no answer. You can win or lose everything. Therefore, it is a ” binary ” option. Risks and benefits are known in advance and this structured reward is one of its attractions.

Binaries traded on the exchange can also be used. That is, the trader does not trade with the broker.

To start trading, you must first have a regulatory brokerage account (or license). Choose one from the list of recommended brokers, which only contains brokers marked as trusted. Top brokers have been selected as the best choice for most traders.

If you are completely new to binary options, you can open demo accounts with most brokers, try out the platform and see what you are trading before depositing real money.

Introductory video – how to trade binary options

This video introduces the concept of binary options and how trading works. If you want to know more details, read the whole page and follow the link to more detailed articles. Binary trading doesn’t have to be complicated, but like any other subject, you can become an expert and perfect your skills.

Option type

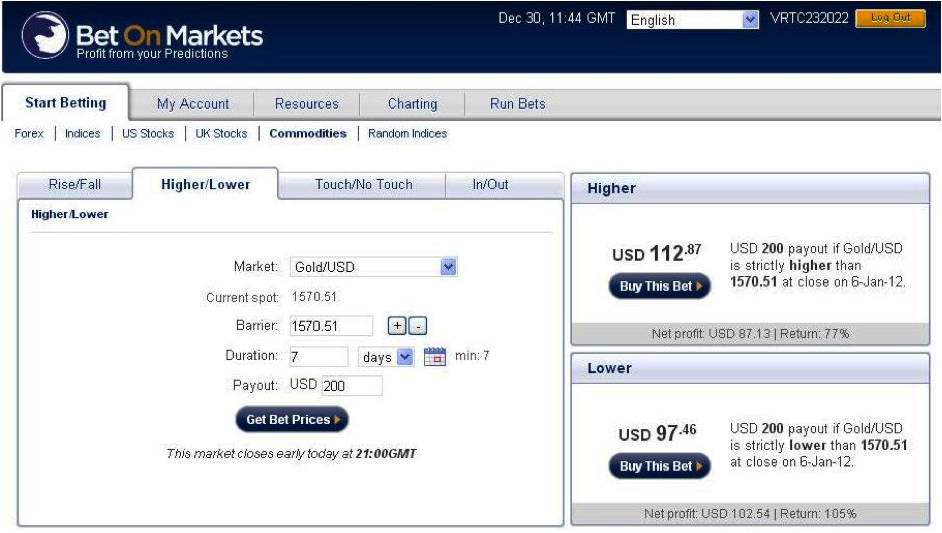

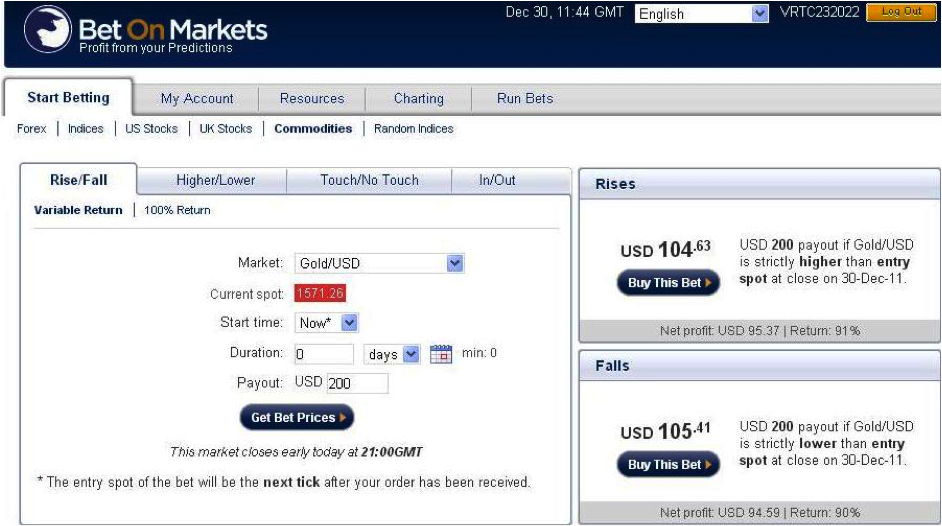

The most common type of binary option is a simple ‘Up / Down’ transaction. But there are other types of options. A common factor is that the result has a ‘binary’ result (yes or no). Among the available types are:

- Up / down or high / low – Basic and most common binary options. Will the price be higher or lower than the current price at expiration?

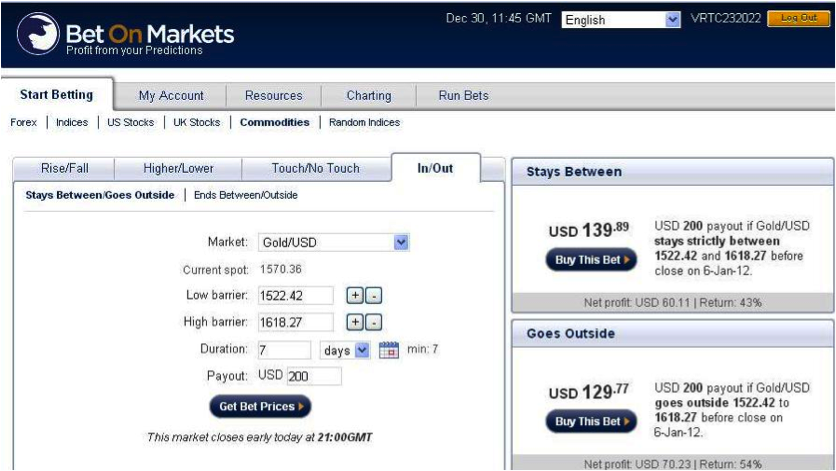

- I / O, Range of Boundary – This option sets the ‘high’ number and the ‘low’ number. Traders predict whether the price will complete inside or outside this level (or ‘boundary’).

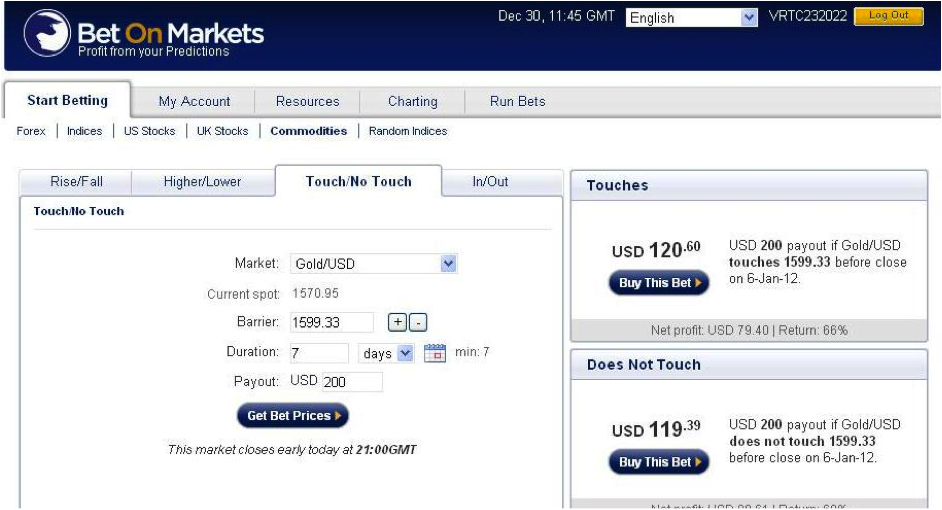

- Touch / No Touch-The level is set higher or lower than the current price. The trader must predict whether the actual price will ‘hit’ that level at any time between trading hours.

The touch option allows you to close the deal before the expiry time. If you touch the price level before the option expires, the “touch” option is paid immediately, regardless of whether the price moves away from the touch level. - Ladder – This option trades like a normal up/down trade, but instead of using the current strike price, the ladder has a predetermined price level (the ‘ladder’ rises or falls gradually). These options usually require significant price swings, so the payouts are often more than 100%, but not both sides of the deal.

How to Trade Step by Step Guide

Below is a step-by-step guide to placing binary trades.

- Choose a broker – find the best sites for binary trading with ourbroker reviews and comparison tools .< /li>

- Choose assets or markets to trade – the list of assets is large and includes commodities, shares, cryptocurrencies, forex or indices. For example oil prices or Apple share prices.

- Select expiration date – the option can expire from 30 seconds to a year.

- Set transaction size – remember that 100% of your investment is at risk. So consider the transaction amount carefully.

- Click on currency / order or buy / sell – does the asset value go up or down? Some broker label buttons are different.

- Deal Check & confirmation – Many brokers give traders the opportunity to verify that the information is correct before confirming a deal.

Choose a broker

Option fraud has been a significant problem in the past. Industry and unlicensed operators have taken advantage of binary options as a new exotic derivative. These businesses are thankfully disappearing as regulators finally start to act, but traders still need to find a regulatory broker.

Notes! Do not deal with brokers or use the services on the blacklist and scam pages, but use the services recommended here on your website. Here are some shortcuts to help you decide which broker is best.

- Compare all brokers to compare these features and offers of all recommended brokers.

- Bonus and benefits – if you want to get extra money for trading or other promotions and benefits.

- Low deposit broker – if you want a real deal without depositing a large amount.

- Demo account – if you want to use a ‘real’ trading platform without depositing money.

- Halal broker – if you are one of the growing Muslim workers.

Asset list

The number and variety of assets that can be traded varies from broker to broker. Most brokers offer options on major stock indices such as FTSE, S&P 500 or Dow Jones Industrial, as well as popular assets such as major forex pairs including EUR/USD, USD/JPY and GBP/USD. Commodities including gold, silver and oil are also widely available.

Individual stocks and shares can also be traded through many binary brokers. Not all stocks are available, but generally you can choose from 25 to 100 popular stocks like Google and Apple. This list is always growing as demand arises.

The list of assets is always clearly listed on all trading platforms, and most brokers provide a complete list of assets on their website. Full asset listing information is also available within the overview.

Expiry Time

Expiration time is when the transaction is closed and settled. The only exception is if the ‘touch’ option has reached the preset level before expiration. The expiration period of a particular transaction is from 30 seconds to a year. Binaries initially started with a very short expiration date, but demand now guarantees a variety of expiration dates. Some brokers give traders the flexibility to set unique expiration times.

Decay generally falls into three categories:

- Short / Turbo – usually classified as expiration of less than 5 minutes.

- Normal – from 5 minutes to ‘final’ expiration, which expires when the local market for the asset closes.

- Long-term – Any expiration at the end of the day is considered long-term. The longest expiry period is 12 months.

Regulation

At first, it is slow to react to binary options, but regulators around the world are now starting to regulate the industry and feel its presence. Currently, the main regulators are:

- FCA (Financial Action Authority) – British regulatory authority

- Cyprus Securities and Exchange Commission (CySec) – Cyprus regulator (‘passed’ EU-wide under MiFID)

- Commodity Futures Trading Commission (CFTC) – US regulatory authority

- Australian Securities and Investments Commission (ASIC)

Malta and the Isle of Man also have regulators. Many other authorities are particularly interested in binaries in Europe, where domestic regulators are working to tighten CySec regulations.

Unregulated brokers still operate and some are reliable, but a lack of regulation is a clear warning sign for potential new clients.

ESMA

Recently, the European Securities and Markets Authority (ESMA) banned the sale and marketing of binary options in the EU. However, this ban only applies to brokers regulated in the EU. This leaves the trader with two choices for maintaining the trade. Firstly, it is possible to deal with an unregulated company – this is very dangerous and undesirable. Some unregulated businesses are responsible and honest, but many are not.

The second option is to use companies regulated by agencies outside the EU. Australia’s ASIC is a strong regulator but does not enforce any bans. This means that ASIC regulators can still accept EU traders. Consult the broker list for the regulatory or trusted brokers in your area.

There is also a third option. Traders registered as ‘experts’ are exempt from the new ban. The ban is intended to protect ‘retail’ investors. Professional traders can continue to trade with EU regulated brokers such as IQ Option. To be classified as an expert, account holders must meet two of the three criteria:

- Open more than 10 offers per quarter more than €150.

- Do you have assets of €500,000 or more

- I have been working at a financial company for 2 years and have experience with financial products.

How to set up a trade

Understanding certain types of events, such as event types or price barriers, settlement and expiration dates, allows you to trade different types of binary options. Every transaction has an expiration date.

When a trade expires, the behavior of the price action based on the type you choose determines whether it is a profit (money) or a loss (non-don). Additionally, price targets are the key level that traders set as benchmarks to determine outcomes. If you describe the different types, you can see that the price targets apply.

There are three types of transactions. Each has different variations. These are the following:

- low high

- In / out

- Touch / no touch

Let us take it in turn.

Low high

The essence, also called up / down binary trading, is to predict whether the market price of the exercise will be higher or lower than the strike price you choose before expiration. If the trader expects the price to rise (‘rising’ or ‘high’ trade), he buys a currency option. If the price is expected to fall (“low” or “drop”), then buy the put option. The expiration time can be as low as 5 minutes.

Note: Some brokers classify Up / Down into different types. A trader buys a call option if the price is expected to rise above the current price, or a put option if the price is expected to be lower than the current price. On some trading platforms this may be indicated as a rising / falling type.

In / out

In/out types, also known as “tunnel offers” or “border offers”, are used to trade price consolidation (“in”) and classification (“out”). How does it work? First, the trader sets two price targets to form a price range. Then buy the option to predict whether the price will stay within the price range / tunnel until the price expires (In), or whether the price will move out in either direction.

The best way to use tunnel binaries is to use the pivot of the asset. If you are familiar with pivots in Forex, you can trade this type.

Touch / no touch

This type assumes price action that touches the price barrier. The “touch” option is a type of purchase of a contract from which the trader will profit if the market price of the purchased asset touches the strike price set before expiration at least once. If the price action does not reach the price target (event) before expiration, the transaction ends with a loss.

“No touch” is the opposite of touch. Here we bet on the price action of the underlying asset without touching the strike price before it expires.

This type has dual touch and dual touch. Here, traders can set two price targets and either touch both targets before expiration (double touch) or buy a contract that is betting at a price that does not touch both targets before expiration (double no touch). In general, if the volatility in the market is high and the price of several price levels is expected, you should only use Double Touch trades.

Some brokers offer all three types, while others offer two types, and there are types that only offer one variety. Some brokers also place restrictions on setting the expiration dates. To get the most out of the different types, traders are encouraged to buy brokers that offer maximum flexibility in terms of type and expiration time.

Mobile app

All the major brokers offer a fully developed app for mobile trading, so trading via mobile devices has never been easier. Most trading platforms are designed with mobile users in mind. Therefore, the mobile version is not the same as the full web version of an existing website, but very similar.

Brokers accept both iOS and Android devices and generate versions for each. The download is fast, and merchants can also log in via the mobile site. Our reviews contain more details about each broker’s mobile app, but most of us know that this is a growing trading area. Traders want to respond immediately to news events and market updates, so brokers give you the tools to trade wherever you are.

Transactions FAQ

What is the binary option?

“Binary option” means a transaction with a yes / no answer with the result ‘binary’. This option pays a fixed amount if they win (‘in money’), but if the binary transaction fails, the entire investment is lost. It is a form of fixed income financing option.

How does stock trading work?

Trade stocks through binary options;

- Select inventory or inventory.

- Identify the desired expiration date (the time when the option ends).

- Enter the transaction or investment size

- Determine whether value will rise or fall and put or call

The above steps are the same for every broker. You can add more complicated hierarchies, but the simple up/down trade type is most commonly used when trading stocks.

Outgoing and call options

Call and call are simply conditions for call and put options. If the dealer thinks the base price will go up, you can place a call. But if you expect the price to drop, you can make a foot trade.

Different trading platforms contain different trading buttons, some switch between buy/sell and currency/enter. Others discard phrases and name them all. Almost all trading platforms make it absolutely clear in which way traders open their options.

Are binary options a scam?

Financial investment instruments are not scams, but unreliable and dishonest brokers, trading robots and signal providers.

The point is not to build the concept of binary options based on a handful of dishonest brokers. The image of these financial products suffers because of these operators, but regulators have slowly begun to prosecute criminals and pay fines, and the industry is cleaning up. Our forum is a great place to raise awareness of wrong behavior.

This simple check can help everyone prevent fraud.

- Marketing promises big returns. This is a clear warning sign. Binary is a high risk reward tool and should not be sold as it is not a “monetize online” plan. Operators who make such a claim are probably untrustworthy.

- I know the broker. Some operators do not know who the account is because it is ‘funneled’ for the broker who connected the new customer with the partner. Traders need to know which brokers they will be trading! These funnels often belong to the ‘get rich quick’ marketing discussed earlier.

- Cold call. Professional brokers won’t make a call – they don’t market it like that. Cold calls often stem from unregulated brokers who are only interested in initial deposits. If you join a company that has been contacted in this way, you should proceed with extreme caution. This includes email contacts. All forms of contacts are blue.

- Terms of Use. Read the full terms and conditions if you receive a bonus or offer. Until many trades have been made, some include settling on the initial funds (along with bonus funds). The first deposit is the merchant’s cash. Legitimate brokers do not claim to be their own prior to the transaction. Some brokers also offer the option to cancel the bonus if it does not meet the trader’s needs.

- Don’t let someone else trade for you. Do not allow the “account manager” to trade on your behalf. Although there is a clear conflict of interest, these employees of the broker will encourage traders to make large deposits and take greater risks. No dealer may trade on his or her behalf.

What is your best trading strategy?

Binary trading strategies are unique to each trade. We have a strategy section and have ideas for traders to experiment with. Technical analysis is used for charts, indicators and price behavior studies for some traders. Fund management is essential to ensure that risk management applies to all transactions. Different styles are suitable for different traders, and strategies will evolve and change.

There is no single “best” strategy. Traders need to ask questions about investment goals and risk appetite and know what is best for them.

Is gambling option gambling?

It totally depends on the habits of the trader. Without strategy or research, short-term investments will win or lose based on fortune. Conversely, a dealer with a well-studied deal will do everything in his power not to rely on real estate.

You can gamble with binary options, but you can also trade based on value and expected profit. Therefore, the answer to the question will be given to the trader.

Advantages of binary trading

The main advantages of binaries are the clarity of risks and benefits and the trading structure.

Minimal financial risk

If you’ve traded foreign exchange or its volatile cousins, crude oil or spot metals like gold or silver, you probably know one thing. Leverage and margins, news events, cuts and price requests can all have a negative impact on trading. Things are different in binary options trading. It is not controversial, and phenomena such as slips and price pulls do not affect the trading results of binary options. This reduces the risk of trading binary options.

Adaptability

The binary options market enables traders to trade financial instruments across currency and commodity markets as well as indices and bonds. This flexibility is unmatched and gives traders the knowledge of how to trade these markets, the one stop shop to trade all these markets.

Simplicity

Binary trading results are based on one parameter, direction. Traders are essentially betting on whether a financial asset will end up in a certain direction. Additionally, traders have the freedom to set an expiration date to determine when a trade ends. This gives the opportunity to start trading well initially. Not in other markets. For example, loss control can only be achieved through stop loss. Otherwise, if the trader makes a reversal to give room for profit, the trader has to endure the bearish trend. The simple thing here is that in binary options traders do not have to worry about other markets.

Greater control of trades

Traders can better control the binary trading. For example, if a trader wants to buy a contract, he knows in advance what profits and losses will be obtained if the transaction is at a monetary price. Not in other markets. For example, if a trader enters a pending order in the forex market to trade influential news events, there is no guarantee that his trade will be filled at the opening price, or that the losing trade will end at the end of the loss.

High payout

Payouts per transaction are generally higher in binary than other forms of trading. Some brokers offer up to 80% payout on trades. This can be achieved without harming your account. In other markets, such payments can only occur if a trader ignores all money management rules and exposes a lot of trading capital to the market, expecting one big payment (which in most cases never happens).

Accessibility

To trade highly volatile foreign exchange or commodity markets, traders must have a reasonable amount of money as trading capital. For example, a commodity transaction with a daily maximum exchange rate of 10,000 days in high volatility times will trade tens of thousands of dollars. However, some brokers have a lower entry requirement for binary options because people can start trading at prices as low as $10.

Disadvantages of Binary Trading

Reduced trading odds for certain banker trades

The price for a binary options trade is significantly reduced when the winning percentage of that trade is very high. It is true that some trades offer 85% dividends per trade, but these high dividends are only possible if the trade is made because the expiration date is far from the trade date. Of course, the transaction in such a situation is more unpredictable.

Lack of good trading tools

Some brokers do not offer their clients useful trading tools such as charts and technical analysis functions. Experienced traders can solve this problem by acquiring these instruments elsewhere. A trader who has no experience with the market is not happy. This makes a difference as operators mature and realize the need for these tools to attract merchants.

Limitations on risk management

Unlike forex, where traders get an account that can trade mini and micro slots with a small account size, many binary options brokers set up the trading floor. The minimum amount a trader can trade in the market. This makes it easier to lose too much capital when trading binaries. For example, a forex broker can open an account for $200 and trade microchips, allowing traders to expose only the allowed amount of capital to the market. Even with a $200 account, it would be hard to find many binary brokers that can trade for less than $50. In this situation, four trade losses will blow your account.

Transaction loss cost

Unlike other markets, where the risk/reward ratio can be controlled and dominate in winning trades, the probability of a binary option is a risk-reward ratio for losing trades.

Edit agreement

If you are trading a market, such as a forex or commodity market, an iterative analysis of a transaction in the first one can be a mistake, then you can close it with a minimal loss and open another profitable one. This is mitigated if binaries are traded on the exchange.

Spot forex and binary trading

These are two alternatives traded in two different psychology, but both can be understood as investment instruments. One is TIME centric and the other is PRICE centric. Both work with time / price, but focusing on each other is an interesting part. Spot forex traders can overlook time as a factor in their trades, which is a big mistake. Successful binary traders have a more balanced view of time / price, so they simply become more balanced. Binaries are inherently more focused on discipline and risk management by forcing them out of their winning or losing positions within a given time. In forex trading, this lack of discipline is the biggest cause of failure for most traders. Because they simply lose their position for a long time and reduce their winning position in a short time. In the case of binary options that are not available due to the expiration of time, the end of the transaction is won or lost. Here are some examples of how it works.

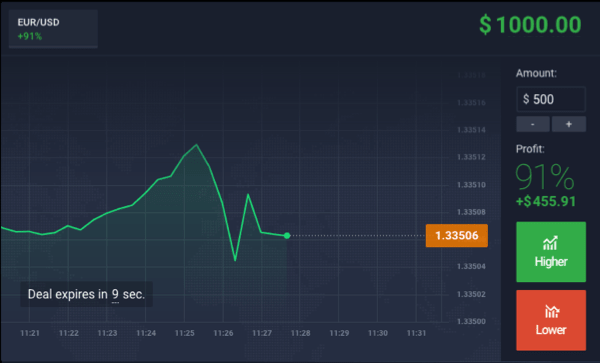

The above is a transaction to buy EUR/USD at a price and time of less than 10 minutes. As a binary trader, this focus would obviously be better than the example below, where forex traders who focus on price ignore the time factor. The psychology of focusing on the limits and the double axis helps to become a better trader.

The main advantage of bait trading is the same failure if the price rises exponentially from one point. In other words, if you entered a price at which the value is expected to rise, but the price does not rise, but accelerates into a downtrend, most spot traders tend to wait or concede a losing position add. Will come again. As time approaches in the opposite direction, most spot traders find themselves in undesirable positions because most spot traders do not plan their time on distraction, which lacks a trading discipline.

By applying limits due to the nature of binary options, both Y = price ranges and X = time ranges can better account for the trade. It will simply make you a better overall trader from scratch. On the contrary, they demand a higher chance of their nature, because each bet means a profit of 70-90% against a 100% loss. So the win rate should be 54%-58% on average. This imbalance causes many traders to over trade or retrace their trades, which is just as bad as losing or adding positions as a forex trader. To be successful, you need to practice money management and emotional control.

Finally, when starting out as a trader, binaries can provide a better base for learning to trade. The simple reasoning is that focusing on TIME / PRICE is like finding two ways to cross the street. The average forex trader only looks at the price. This means that you only look in one direction before crossing the street. Learning how to trade with both time and price in mind will help you become a complete trader.