Compare crypto alternatives: there are now different ways to invest in cryptocurrency. There are a number of investment alternatives in Bitcoin that we talked about in particular a few months ago. This includes not only old coins for direct or real trade, but also other options for crypto investment. The most common are mining and corporate investments. Not all cryptocurrency investments are suitable for all investors. What is company ownership or mining?

How is it different from the currency purchase of Bitcoin and Co. These and other questions are answered here to show investors what opportunities they have. Nevertheless, cryptocurrency is a welcome option that benefits. But the investment must be well considered and calculated. We offer a variety of options, opportunities and risks to find the best option.

Encryption Alternatives

- Currency purchase: short term, long term and ICO

- Mining Investments: Hardware Mining and Cloud Mining

- Steak as borrower

- Social participation: shares, revenue sharing, silent participation

- Alternatives for coding depend on your own capital

- Financial experts see great opportunities in cryptographic alternatives.

- Conditionally recommended Security for Bitcoin Group SA

- Mining as a future investment

- Stocks of technology companies as an alternative to cryptocurrency

Compare coding alternatives – overview of different investments

In addition to direct currency purchases (long-term and short-term investments and ICOs), there are different alternatives for investors. Mining is an example. This includes cloud mining or hardware mining. It is also called Straking as an alternative to cryptocurrency or direct investment. If the Crypto Alternative Test is considered, the participation of the company should also be missed. In addition to quiet partnerships, share purchases and profit sharing are also important. The decision on choosing an appropriate investment is always his own behavior, as well as the ambition of the trader. When comparing cryptographic alternatives, investors should first ask the following questions:

- What risks can you take?

- Which yield measurement do you want?

- What is your interest?

- How much time do you want to spend on the agreement?

Based on the answers to your questions, we will choose the best alternative for coding. Many professionals still rely on the direct investment and purchase of Bitcoin and Co., but there are numerous other possibilities in the market. In our tests, let’s look at the cryptographic alternatives to the currency investment, the traditional investment option.

Currency Purchase: Long-Term Investing in Bitcoin and Stocks

A real alternative to cryptocurrency has not existed for a long time, because investors really liked to invest in digital currencies. In addition to or as an alternative to existing payment systems, Bitcoin has become increasingly popular and has also been found as an investment property. Many traders buy digital currencies directly and store them for the long term. So the temptation was at least the prospect of a price increase actually happening for Bitcoin. Later the coin will have to take Kursplus and sell it again. Not only Bitcoin, but also other cryptocurrencies, this approach is very much in demand among many investors. For example, if you recognized the potential of Bitcoin at an early stage and acquired it in 2010,

Short term trading in the stock market

With many investors, short-term investing in digital currencies is very popular. It is mainly traded on the stock exchange, especially with contracts for differences. More and more major providers offer ETFs as well as CFD trades. Meanwhile, there are future cryptocurrencies. Above all, CFD trading is especially important for many investors, as it is very short-term and requires only a small amount of capital. But he is also very speculative. This risk is exacerbated by apparent price fluctuations in almost all digital currencies. How many percentage points can already determine whether the investment will yield or close at a loss?

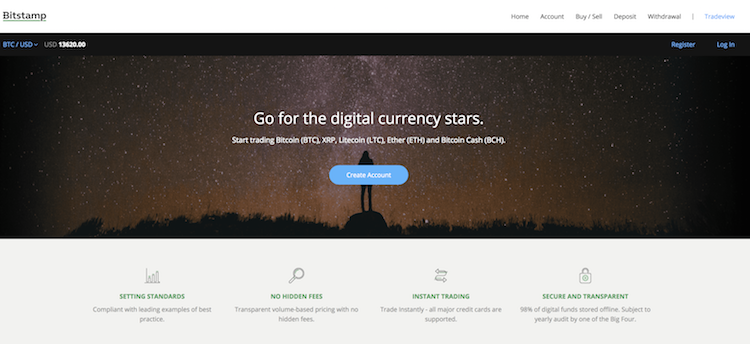

Kyk na Bitstamp se webwerf vir crypto-uitruil.

Early Coin Offerings That Benefit New Investors

There is a new way to buy money, corporate financing. The so-called initial coin offering, short ICO, is a digital currency unit, but is used to finance the company’s capital. For example, it is offered on a crowdfunding platform and is intended to provide the company with new capital as soon as possible. Generally, ICO purchases do not include the purchase of company shares. Moreover, they do not have the right to participate in the distribution of profits. Only digital tokens are issued and can later be traded on the platform. Ethereum is currently one of the most popular development platforms.

Crypto alternatives for testing: investments in infrastructure

Regardless of whether infrastructure investment can be described as the best alternative to coding or not, each investor must decide for himself. By this I understand the so-called mining, processing or production of new digital currencies. Focus on the blockchain used by the enterprise. Of course, anyone who works with mining can earn money. The connected blocks of cryptocurrencies must first be split and then reassembled before being further processed on the network. It not only requires a lot of computing power, but also a ‘miner’. You can earn money from people providing this computing power and “mined” blocks. Mining is divided into two variants.

- Hardware exploitation

- Cloud Mining

Hardware exploitation

In the case of hardware mining, in particular, individual users shadow special components (e.g. graphics cards, processors) to generate hash values for the blockchain. In this way, they earn money by providing (increased) processing power. Again, this is one of the coding alternatives. However, private mining has major drawbacks such as increased power costs and hardware investment.

Cloud Mining – an Alternative to Cryptocurrency for Direct Purchases

As the need for mining gradually increased and individual miners could no longer achieve computing power, the enterprise developed on this basis. They offer so-called cloud mining. Miners get a hash rate through monthly payments that a blockchain generates. Monthly subscription fees are based on cryptocurrency and hash rates. Tests have shown that the use of cryptographic alternatives, for most proponents, the required currency, such as Bitcoin or Ethereum, usually does not exceed the monthly package.

If you are the best alternative to encryption?

Steaks are not an idea for many investors, but they can also be used to make money. But it requires a certain investment. Investor starts the Wallet app after buying crypto tokens. This adds weight to the mining nodes in the proof-of-stake network, improving ‘voting power’. Give this token, and you will win the cryptocurrency of that number.

Alternatives to Cryptocurrency: Participation in the Enterprise

In addition to buying cryptocurrency directly, there are other cryptographic alternatives. This includes, among other things, corporate connections that make the participation of investors easy. Investors earn profits by participating directly as shareholders (direct purchases or ICO purchases). Best of all, the ICO does not represent a direct transfer of the shares of the company and is not entitled to profit sharing. Instead, it is used as a short-term new fund for the business. On the other hand, if you bet on crypto-shares, you are of course buying them, participating in profits and receiving dividends. In addition, the stock purchase represents a partial purchase of the business.

Market overview – what investments promise?

The hype for bitcoin and stock prices continues unabated and new digital currencies are added every day. At first, it was very popular to invest directly in coins. Those who own bitcoins use it not only as a means of payment, but also for long-term speculative purposes. It also works with other digital currencies. However, there are also cryptographic alternatives with other alternatives in the test. For example, more and more brokers are betting on cryptocurrencies, offering speculations on price trends. The main focus here is on CFDs. The supply in this sector is increasing as the demand from traders increases. Meanwhile, major brokers such as IQ Options have broadened the range of trading products.

Traders who want to get used to trading can use the demo account of IQ Option.

Mining with New Investment Tips

Mining, especially cloud mining, is attracting more and more investors. With enough computing power and relatively little effort, investors can profit from cryptocurrency without directly investing or tracking current chart records. A simple calculation of the net profit shows how profitable the mine actually is. For this reason, you should not miss the idea of this investment opportunity when comparing coding alternatives. The mining income of 100% is classified as follows (according to the Berenberg estimate):

- 54% hardware

- 4% cooldown

- 15% electricity

If you subtract all the expenses, you get a profit of 27%. Measured against the rate of return probability of other trading instruments, this option is considered the best cryptographic alternative for many investors. As you know, every coin has two sides. Even in this case, it is often impossible to guarantee the cooling process required for a high computing power, because all electricity costs and hardware purchases are a very high investment for many private miners. That’s why so many investors apply for monthly subscriptions from cloud mining providers. Here the percentage profit is quite low, but the cost of electricity, enough space or cooling is also omitted.

Shares as a Coding Alternative

As a result of digital currencies, securities are also becoming increasingly important. It focuses on the stock of Bitcoin Group SA or a company that provides hardware components that actively work with blockchain technology. In the meantime, numerous (new) companies have been established in this area. In the first place the paper of Bitcoin Group SA. The securities are now more uncertain than interesting. There was a hype around cryptocurrencies in 2016/2017, but there is not much to see in the first quarter of 2018. Not only the cryptocurrency, but also the stock market. There is also a technical warning as the paper slips below 50 euros. Based on the price analysis, we can see that there are technical sell signals, which can lead to additional paper losses. Reminder: At the end of November 2017, the newspaper was still listed for 86.20 euros. This example clearly shows how volatile the whole area around cryptocurrencies is.

IBM as the winner of the scholarship

Investors are feeling some joy in Bitcoin stocks, but there is a literal cryptocurrency winner. This includes, for example, the securities of IBM. The company relies on the Stellar Lumens, a cryptocurrency announced in October 2017. For the American technology group, we work with the financial services provider Stellar.org and the payment specialist KlickEx. The goal is to build a cross-border payment system based on blockchain. IBM is thinking ahead and investors know this effort. Safety has made good grounds and is one of the winners among many other newspapers.

Market Outlook-Crypto currency will drive FIAT money

The profitability of investments in cryptocurrencies is shown by the analysis of important financial experts. There are bipolar voices always warning against the purchase and use of digital currencies, but advocates are still on the rise. Digital coins are not really at hand, but more and more service providers offer payments in Bitcoin and Co. The simplicity of the payment method is particularly important, because it facilitates the processing and lowers the transaction costs. But sometimes it doesn’t replace existing currencies like Euro or USD. In practice, it lacks the necessary infrastructure. But not only Goldman-Sachs analysts agree, the digital economy in particular can be a solution to the weak economy. Since there are not enough financial services in developing countries, trading in digital currency can be done in the traditional way. Moreover, domestic currencies in these regions are exposed to high inflation. It will not exist due to the increasing use of digital currencies. Therefore, especially in developing countries, cryptocurrencies are a good alternative to FIAT currencies. It will not exist due to the increasing use of digital currencies. Therefore, especially in developing countries, cryptocurrencies are a good alternative to FIAT currencies. It will not exist due to the increasing use of digital currencies. Therefore, especially in developing countries, cryptocurrencies are a good alternative to FIAT currencies.

Futurists, especially Thomas Frey, share this view. In a “future” magazine, American futurists believe that digital coins have recently replaced 25 percent of traditional currencies by 2030. The reason is the efficiency of cryptocurrency. Apart from the executive director of the International Monetary Fund (Christian Lagarde), we have confirmed that cryptocurrency can replace central and international banks.

Financial experts also see good opportunities for investments in cryptocurrency in the long run. Dr James Canton of the Global Futures Institute states:

‘New investment opportunities in cryptocurrency are expected to grow exponentially.’

‘I think it’s a traditional investment in stocks and bonds going through a cycle of cryptocurrency investing.’

Banks Still Hesitating Bitcoin and Co.

In particular, the international stock exchange founded Bitcoin in 2017, so that cryptocurrencies were found again on Wall Street. The German digital exchange EUREX and the Russian stock exchange were subsequently introduced to Bitcoin IPO. But financial service providers are sometimes less open. Only a few investment banks and hedge funds found the courage to offer bitcoin and other cryptocurrencies. This is mainly due to price volatility over the past few months.

In short: traders are looking for more than alternatives to cryptocurrencies

If you don’t want to invest directly in Bitcoin and Co, you can find many of the crypto alternatives in the test. This includes not only mining, but also corporate or civil investments. On the other hand, digital currencies differ only from wallet providers, but have arrived on different platforms. If they were relatively unknown a few years ago, they are now an interesting investment destination. There are new digital currencies and investments almost every day. It has also included bitcoin futures since 2017. Interesting are not only the securities of the cryptocurrency, but also the shares of the slide stream. This includes, for example, enterprise manufacturers for hardware, software and new technology solutions. Even IT companies, such as the American company IBM, have been stimulated by working with crypto-portals.

A closer look at this proposal will help the comparison. Interested investors can find useful tips on crypto investing, etc. Compare forex brokers and CFD providers as well as crypto brokers. This is the abbreviation for binaereoptionen.com. Expert advice from experts and deep expertise from suppliers. News on individual topics complete suggestions in the portal. If you want to get as much information as possible, this is you. In addition to cryptocurrency investment, other financial sectors are also our task!

Special attention should be paid to the recent report on cryptocurrency markets from the Blockchain Transparency Institute, where “laundering transactions” are reported as a kind of market manipulation method where traders simultaneously sell and buy financial products. Of financial products.