Comprehensive Wallet Provider tests can help anyone interested in digital currencies. Who wants to buy Bitcoins, Ethereum, Litecoin or one of many other crypto currencies, the prerequisites must be met and he must have an electronic wallet. It’s almost like a wallet that holds a real currency. The Google Wallet overview shows you the wallet types that exist, the differences and similarities, and the criteria to consider when choosing the right crypto wallet.

How Wallet works

The comparison of the wallet with the Fiat currency is not really questionable at first glance. Both have the same benefits, so you need to keep your personal assets and make payment transactions. The difference is that wallets are random digital character sequences. Network participants can usually use public databases to determine the amount in their wallets. Even so, you don’t have access to the assets and you don’t understand who owns them.

To illustrate how to access your wallet, Bitcoin Wallet is a practical example. Bitcoin has been a leader in the field of digital currencies for a number of years, so it is suitable for those interested in comparing wallet providers. Owners can access Bitcoin stored in their wallet via their public key. This should be done with the utmost care and should not be shared with others. Because it is valid: anyone who owns a private key will automatically have access to all the bitcoins stored in your wallet. In case of loss, there is no central cause to which the individual can turn. It’s still hard to prove that you own bitcoin (not a physical asset).

In addition to storing the private key, the wallet is also responsible for managing the public key. The difference with the private key is that the public key is shared with other Bitcoin owners to start trading. Therefore, the recipient of a bitcoin transaction must inform the sender of the wallet address (= public key) in order for BTC to change ownership. Each wallet belongs to only one private key, but for each transaction you can generate a new public key assigned exclusively to this wallet. The task of the wallet is also the management of all keys.

IQ options assured in Wallet provider comparison

Wallet experience: what type do you have?

According to the Wallet review, there is no single best wallet for every user. Because every crypto owner has different security, cost, flexibility and other criteria, there are several manufacturers in the wallet provider comparison. You basically have to distinguish between two types of wallets: hot wallets and cold wallets.

Hot Wallet ensures continuous availability

Hot Wallet is a digital wallet accessible at any time via the Internet. This represents a hot wallet because almost all crypto trading platforms can simultaneously deposit and store cryptocurrencies in customer accounts. In addition, there are many other providers in the wallet comparison that offer hot wallets without an integrated trading platform. However, those interested in preserving these forms of digital assets should remember that hot wallets always have a high security risk. Since the owner can access it from anywhere, even an attacker can gain access to the data by exploiting the security holes of the system. This is especially dangerous if the provider owns the private key of each user portfolio.

Therefore, it is best to use Hot Wallet only to store small amounts of related currencies. Get flexible access to some digital assets at all times without exposing your entire property to unnecessary risks.

The following wallet types are one of the hot wallets.

- Web wallet

- Mobile Wallet

Web wallets are searched through a browser, and for mobile wallets they differ mainly in the presence of programs for smartphones or tablets. The main advantage of these two solutions is undoubtedly the almost constant availability of cryptocurrency, but undoubtedly the loss of the smartphone at the same time due to the loss of the smartphone.

Cold Wallet means the best security

Where else can investors store their assets if not a hot wallet? The answer is a cold wallet. Experience has shown that you are much safer not being connected to the Internet. The wallet is the simplest tool to create a cold wallet, especially since it keeps your private key in the foreground. Slip and pencil are enough. Record the key and keep it as safe as possible. Assets in BTC, ETH, LTH or other currencies are also safe from hacker attacks unless others have access to them.

In the wallet provider test, you should therefore find many so-called hardware wallets, especially for keeping devices created with private keys safe. Most of them are no bigger than USB sticks and have similar functions. Once your hardware wallet is connected to your computer, tablet or smartphone via a USB cable, you can use special software or programs to manage your credits. There are also desktop clients that can be used to manage cryptocurrencies without being connected to the internet.

In the wallet comparison, the cold wallet is here:

- Hardware wallet

- Paper wallet

- Desktop wallet

Ledger offers so-called hardware wallet

Wallet Review: Web and Online Wallet

All the wallet species have been superficially described so far, so in the next step we will pay attention to detailed presentations of all solutions in the Wallet overview. Focus initially on the web or online wallet. But these are not two different types, but only two names using the same product.

Web-based wallet providers manage their private keys online on the server. As mentioned earlier, the trading platforms of Bitcoin, Ethereum and Co. usually online wallets. This is always the case if cryptocurrency can also be stored in the trading account. However, there are also crypto exchanges and marketplaces that do not actively participate in the payment process and provide a platform for stopping offers. In this case no online wallet is provided.

Permanent availability is the biggest advantage of a wallet. But according to the past few years’ experience, this is also the biggest weakness. Private keys in all wallets are stored centrally, allowing hackers to access them via targeted attacks. Investors can protect themselves from serious losses by paying attention to security when comparing wallet providers.

Smartphone Wallet Details

Many points that apply to web-based wallets can be transferred 1:1 to smartphone wallets. Smartphones are undoubtedly one of the devices that owners always carry, so the flexibility and availability of crypto assets is the best. The private key is stored directly on the device, so the wallet address can be sent in seconds, like a QR code or NFC. Therefore, digital money can be comfortably used for payment at the appropriate terminals.

Mobile wallet is not a full-fledged client with simultaneous access to the entire cryptocurrency network. For example, the size of the bitcoin blockchain is now more than 150 gigabytes, and must be downloaded from the device for this purpose. For smartphones, this is almost impossible. As a result, smartphone wallets are increasingly using Simple Payment Payment Verification (SPV), which only needs to store a small portion of the database on the device to perform secure payments. However, mobile wallet users should be very careful with their device and back it up regularly. Otherwise, your smartphone cannot access your wallet if it is lost or stolen.

Blockchain.info offers apps for iOS and Android

Coin management via tabletop

The above client that downloaded the full image of the blockchain connects us directly to the tabletop wallet. What many stakeholders don’t know about testing wallet providers: if you use the Bitcoin client Bitcoin Core, for example, you automatically have a desktop wallet. The same applies to other cryptocurrencies. You can also send and receive BTC using programs that provide access to cryptocurrency networks. It is also responsible for managing private and public keys.

But the client is not the only desktop wallet, and there are many other providers. It is usually suitable for providing a variety of functions, with an emphasis on issues such as security or anonymity, or for use on the following platforms:

- window

- Linux

- Mac OS X

The main advantage of the desktop wallet is that it is inaccessible to other computers behind the firewall. It belongs to the so-called cold wallet, they are not connected to the Internet and are suitable for storing large amounts of digital currencies. Because of this, it is inflexible. If you’re on the go and want assets in your desktop, it’s impossible.

Offline wallet: a useful device when it comes to security

If you want to ideally protect your crypto property from unauthorized access, you can find another form of Cold Wallet: hardware wallet. There are different vendors that offer devices of different sizes and designs. Most devices look and feel like standard USB sticks, so you can find room in every pocket. Therefore, it is also suitable for mobile use. However, if you want to store large amounts of digital coins and keep your device safe, we recommend using a hardware wallet. For example, there is a safe in the house or a safe. Password owners can add a PIN or password to their wallet to prevent theft.

However, hardware wallets are linked to a point not found in many other wallet solutions, and comparisons of wallets are absolutely essential: cost. It costs money to buy equipment, but many other wallet solutions are completely free. Most devices range from 70 to 250 euros and hardware wallets are also available at a high price. But those interested in using hardware wallets are often tied to availability. The demand for secure storage solutions from Bitcoin and Co. is large, so not all devices are always available immediately.

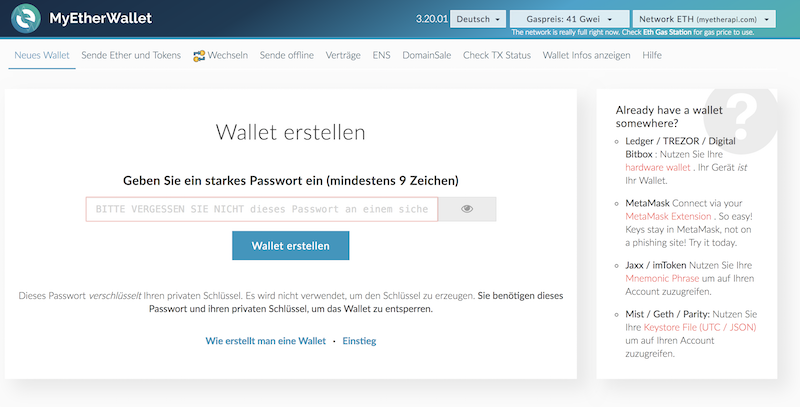

MyEtherWallet was also convinced of the proposal of a wallet comparison.

Paper wallet: archive via QR code

This is a very simple way to keep your private key, but at the same time a fairly secure way. At first I had to record the whole string, but now I have a program that prints public and private keys on a single piece of paper with a QR code. Scanning the private key gives you access to your own wallet, and you should never get it. On the other hand, you can trade in your own wallet by sending the QR code of your public key. By protecting laminate paper, you can protect it from most environmental influences, but it can be destroyed by fire. If you don’t have a backup, you will lose access to your wallet.

A variation of the paper wallet is a coin with the key engraved on it. In this way, despite being a digital currency, payment in a physical form using coins is possible. According to the wallet’s experience with this storage format, these coins are almost indestructible, but they can be lost quickly due to their small size. If the owner cannot make such a piece himself, the private key should not be obtained. Again there is a security risk.

Why is wallet comparison important?

Unlike the wallet solution, the needs of crypto owners are also different. People who don’t compare their previous Wallet providers or need someone else’s Wallet experience for their solution often choose a wallet that they are not 100% satisfied with. To achieve the best results, especially when investing in cryptocurrencies, everything must be right. After all, sometimes there is a lot of money at stake.

At this point, you can ideally be used to using Bitcoin, the market leader. In recent years, prices have risen too much, reaching a value of less than $20,000 per BTC. Since then, prices have fallen again, but if investors want to build a small fortune on cryptocurrency, it is clear which dimension they need to move in the meantime. Therefore, it is more important to stay safe in a place that is protected from unauthorized access. One possible model is to keep a large amount of money in a cold wallet and distribute a small amount to several hot wallets that can be used without detours.

For example, this system also uses major crypto exchanges. Up to 98% of the deposits are stored in cold wallets and protect them from external access. To process payment requests immediately, you can only use a small balance in your hot wallet. Crypto exchanges are frequent targets for hacker attacks, so you need to protect yourself from these types of threats. Despite the high security measures, if the attack is successful, only a part of the cryptographic assets is lost.

Other Wallet Provider-Exodus Wallet

These criteria should be considered in the Wallet test report.

A few factors should be especially noted when testing a wallet provider by stakeholders. In this way, the selected products can perfectly meet your requirements. As already mentioned, investments in cryptocurrencies are closely associated with high capital expenditures, so there should be no accidental aspects. When comparing wallets, investors should note the following properties:

- Cost: hardware wallets are always associated with their initial cost. Other solutions are mostly free, but sometimes involve fees.

- Security: Cold Wallet offers very high security, but many Hot Wallet solutions are at risk of third-party access or loss.

- Flexibility: if you use Hot Wallet, your crypto assets are always available. On the other hand, cold wallets are not available from outside.

- Availability: Depending on the model, there may be bottlenecks in hardware wallets and a higher demand.

- Support: this can help with problems with Wallet. Ideally you should support in German or English.

Conclusion: wallet comparisons are valuable for investors

There is no single way to digitally store assets in Bitcoin and other cryptocurrencies. As you can see from the Wallet experience, there is no absolute best, and each variant has its own pros and cons. Therefore, in the past, a combination of different solutions was created that could complement the shortcomings of one wallet with the advantages of another. There are dozens of providers on the market these days, so a complete comparison of options can definitely benefit investors.

Click here for more information on the Robo Advisor comparison.