Nadex is a fully regulated exchange regulated by the Commodity Futures Trading Commission (CFTC) and is legally permitted to accept US residents as clients. Nadex operates in the United States, but is part of the IG Group, which is based in London. They offer real exchanges with buy and sell positions that are completely open to traders and traders.

Offering modern trading tools and advanced features, Nadex offers a high-quality trading experience. Documented exchange rates highlight the transparency that Nadex provides to the service. They describe their business as follows:

‘Provides the ability to match contract buyers and sellers in an easy way (Nadex does not benefit from the profit or loss of a transaction, but simply receives a full open exchange fee) ”

Review Summary

- Nadex demo account – Yes (open free demo account)

- Minimum deposit – $250

- Minimum transaction – $1

- Bonus information – there is currently no active bonus structure.

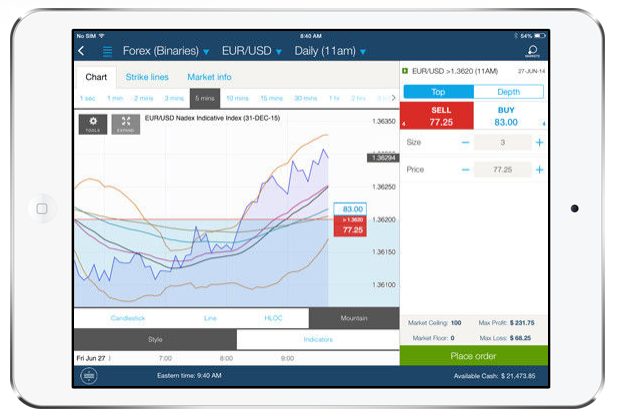

- Mobile app – NadexGo.

- Signal service no

Nadex offers its customers the following features and benefits:

- Transparent transaction costs – Nadex is clear about how to raise money.

- Advanced Charts – Charting and technical analysis tools are some of the best in binary options.

- Training – The company takes dealer training to the next level. There are regular free webinars on how to use the platform, as well as how to earn constant income.

How to use trading platform

Nadex offers a real trading experience. This means that traders have the option to buy and sell on both sides of the asset. Traders can also request their strike price. If another client wants to trade the other side of the option, it is opened at that price.

The first thing to choose is the asset to trade. It can be found through the ‘Finder’ window on the left side of the trading platform. Selecting a market opens a suggested option expiration time (times are shown in Eastern Time)

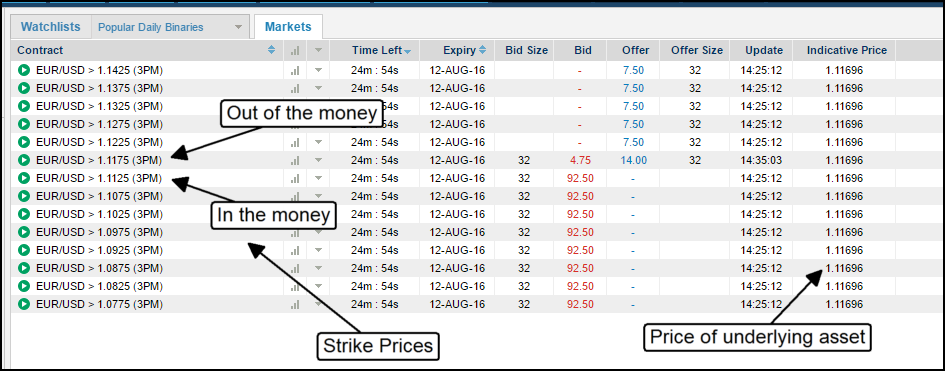

After selecting expiration and assets, the market window is refreshed. The current price level available for trading is displayed. Generally, there are about 10 price levels. For example, Nasdaq trading offers 10 levels. Each level is traded according to whether the closing price (expiration price) is above or below the indicated level. The settlement price of Nadex binary options is 0 or 100, so the exchange rate varies between 0 and 100. 100 indicates a positive result (so the asset is completed above or below a certain price) and the option settles to zero. For example, property prices have more than the target price do not end the negative consequences if the option is exercised. Remember that traders can buy and sell positive and negative results.

Clicking on an asset in the market list or clicking on the ‘bid’ or ‘offer’ figures will open the trading ticket. Clicking on the bid or offer button opens a ticket with the pre-selected ‘sell’ or ‘buy’ option.

Rental tickets look at the expiration time, price level, bid size and current bid and offer prices. The user must then click on the sell or buy button (if not already selected) and check the size of the transaction (the investment amount). The numbers at the bottom of the ticket highlight the maximum loss and the maximum payout, depending on the transaction size entered. ‘Max loss’ can be intimidating, but you can close the trade at any time if the price moves against it. Traders can also change prices – this is an exchange component of trading in Nadex. The trader asks for a price at a higher or lower price than the current price and waits until his position ‘matches’.

Each option is publicly traded, allowing clients to close their open trades at any time, allowing them to profit or minimize their losses. If the option expires without further trading, the maximum and minimum figures for the ticket will have two effects.

Once the transaction is set as per need, the trader clicks on the ‘Order’ button. If it matches, it will appear in the ‘Open location’ window. If the transaction is ‘matched’ (in whole or in part) you will be taken to the ‘Work Orders’ screen. If the order matches, both ‘open positions’ and ‘work orders’ are updated. Nadex also sends an email confirmation next to this window. You will also receive an email once your order has been confirmed.

Deal selection

Nadex offers binary trading for forex pairs, commodities (gold, silver, etc.) and stock indices. Each asset has a variety of price ranges, so if a trader is looking for a quick price move or long-term trading in a currency pair against a specific stock price index, Nadex offers it.

Nadex offers more than 5000 contracts at once.

Touch Bracket ™ agreement

The Nadex Touch Bracket ™ contract is a new type of contract introduced by Nadex. The contract operates between two ‘brackets’ (floor price and ceiling price). The price moves between the price levels and the actual asset price. This attraction ensures that they work with built-in risk management tools and have no slippage. Opening costs are the maximum capital at risk.

Flexible ‘micro-lot’ trading scales can secure these contracts with lower capital requirements for the novice investor, but can expand into specialized trading to make the most of leveraged trading.

Mobile App

Nadex offers the most comprehensive and comprehensive mobile trading app on the market. This app is free and written and optimized for different mobile platforms. The app is called NadexGo

Quick and important application tasks contain all the functions available on the entire website. There is everything for traders in account maintenance, charting, trading apps.

While all the data the trader needs is displayed, the layout is clear, making trading very simple. The trade ticket trading area is already optimized for ease of use with the same display as the entire website platform.

The NadexGo mobile app includes all the features of the entire website and leads the way in binary options.

Call distribution payment

It is not easy to compare payments from Nadex with other brokers – other brokers do not offer real exchanges. Binary options are paid according to the strike level at which the trader can open the option.

For example, if the trader brings 50 and the makeup is 100, the payout is practically 100% (for example, you could risk 100 dollars and you got 200 dollars when the trade was completed). 100 then dropped the payout to around 50% (high risk amount and low profit).

The transaction fee incurred when opening a trading position and closing the position before expiration is $1 per contract per side. Otherwise, the contract held at expiration will be charged a $1 per contract settlement fee upon completion of the money. These rates are transparent (you can see exactly what is happening in each trade) and represent ‘better value’ trades than traditional options. More information about Nadex charges can be found on their website.

dissatisfaction

Nadex doesn’t complain much. Traders sometimes struggle with platforms because they are very different from the ‘counter-top’ brokers, which are better known as the platform. The demo account gives traders a chance to get used to the platform before trying a new strategy, but the user may be frustrated if the trade is lost or missed due to the confusion with the platform.

The training material provided by the company is very good. The platform is unique and requires specific training materials. The tools range from video to manuals, and the site regularly hosts a series of webinars to help traders implement lessons in a live trading setting. Once exchanged, the exchange platform is executed in a simple way similar to the more familiar platform. The fee charged at the transaction is clear and transparent and never complains again.

This brand is definitely not a scam. It is owned and operated by IG Group in London and regulated by the UK FCA. CFTC supervises and regulates US exchanges to allow trading to US residents.

The regulation of the business could not be stricter, and users can subscribe, deposit and trade with absolute confidence.

How to withdraw and deposit

Nadex allows US residents to fund their accounts through debit cards, ACH transfers. Residents outside the United States may only use debit cards or landlines.

If the bank transfer is more than $5000, Nadex will refund the bank fee of $20 to the trading account.

Withdrawals can only be made via ACH or wire transfer. Residents outside the United States may use wire transfers only. Withdrawal options can be found in the ‘Account Funding’ menu under ‘My Account’. ACH transfers are free and take about 3 to 5 days, but wire transfers require a $25 fee, but are usually processed the next day.

Information about withdrawals is not straightforward in Nadex, so it is worth clarifying clearly before asking for payment. CFTC regulations require many of these steps, but this is a matter of frequent delays between traders and brokers, which is an area that needs to be thoroughly scrutinized before funding. This ensures that there is no shock and that traders know exactly what to expect when requesting a withdrawal.

General questions

Who Regulates Nadex?

Nadex is regulated by the CFTC (US Commodity Futures Trading Commission). This is one of the strongest levels of regulation in the sector.

Who owns Nadex?

Nadex is owned by the British IG Group. They have a branch office in London and are listed on the London Stock Exchange. The IG Group also operates the UK Broker IG Index.

Trading hours?

The Nadex website is available 24 hours a day, but many assets can only be traded based on their local trading hours. Like for example London-based shares, you can only trade during UK trading hours, but some products, such as the S & P500, is traded electronically 24 hours a day. Some forex trades are traded globally, so they are open 24 hours a week, but the volume may vary from time to time.

Is Nadex a broker?

NADEX is not a binary options broker in a “traditional” sense. NADEX is an exchange and an exchange is where traders gather to do business. Nadex is a clearing house for Nadex trading that provides a platform to make sure everything is in compliance with CFTC regulations and handle all necessary money and other obligations.

There is an exchange rate of $1 per contract for each transaction. Remember that exchanges make money by facilitating trades, not when they lose.

This is important because it eliminates any conflict of interest that may arise when trading with an EU broker. NADEX doesn’t care what you win or lose, it costs a small fee (more on the website) per contract and is where the profit comes from.

Foreign style brokers make money when they lose money and not win. The ‘account managers’, signals and automated trades offered by some brokers are often deceptive.

What makes NADEX better and where the real pleasure comes from is the person facilitating the transaction. You trade with other traders, such as yourself and market makers, who function only as liquidity providers, not as platforms that function only as liquidity providers.

How to make money on NADEX

The way to make money on NADEX is to buy and sell binary options. These options work like binary EU styles in some ways, but not the other way around. On the one hand, they can be held until they expire, in which case they will all lose or receive the maximum payout. On the other hand, they are based on the strike price and can continue to trade until its expiration.

The main difference between them and why they trade differently is how they operate. EU-style binary options use asset prices as the strike price at the time of purchase. If the price goes up or down, you will lose or gain money depending on the type of option you bought. NADEX Binary Options are based on the selected strike price from the list of available offers and can be withdrawn or withdrawn.

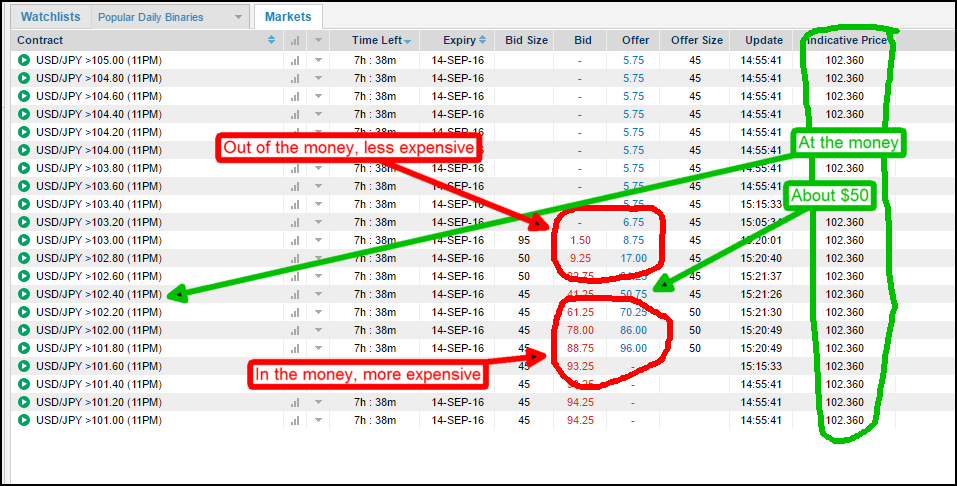

EU-style options allow you to trade any amount you want, just enter the numbers on the trade screen. For example, the NADEX option is sold in lots, so if you want to buy EUR/USD at say 1.0545, you can buy one, two or ten. The price of each lot depends on the strike, the bankruptcy and the market pressure. Option prices range from $0 to $100, $0 is the minimum payout, and $100 is the maximum. It costs more naturally in the money options, but it costs less in the money options. At expiration, when the option closes, you receive $100 per lot. You get $0 if the option is locked at money. Before the option expires, the price depends on the price of the underlying asset. The profit you make is the difference between $100 and what you paid for. In general, the money option is around $50, which means a trade return of $50 or 100%, much better than the 70% to 80% you get with EU-style binaries.

strategy

It is a bit of an understatement to say that NADEX binary options are a bit confusing for new traders. There are some important differences between this US CFTC-regulated binary options trading and traditional spot binary trading offered by European and foreign brokers. However, these differences have opened up new possibilities for trading and profits that are never available in other forms of binary trading.

Before we go into more complicated details about opening and closing NADEX positions, let’s examine the specific differences between Spot Binaries and NADEX. The foreign spot binary options broker named on standard trading with high / low digital options has two types of positions. Call and turn it in. If you are optimistic you buy a phone, if you are bearish you buy a foot, and in both cases you buy from a broker. If you beat the broker, you keep your money if you lose the broker. You cannot sell options outside of the Early Out situation. NADEX has only one type of post, called Lot, that can be bought and sold. If you are optimistic, you buy it; if you are optimistic, you sell it.

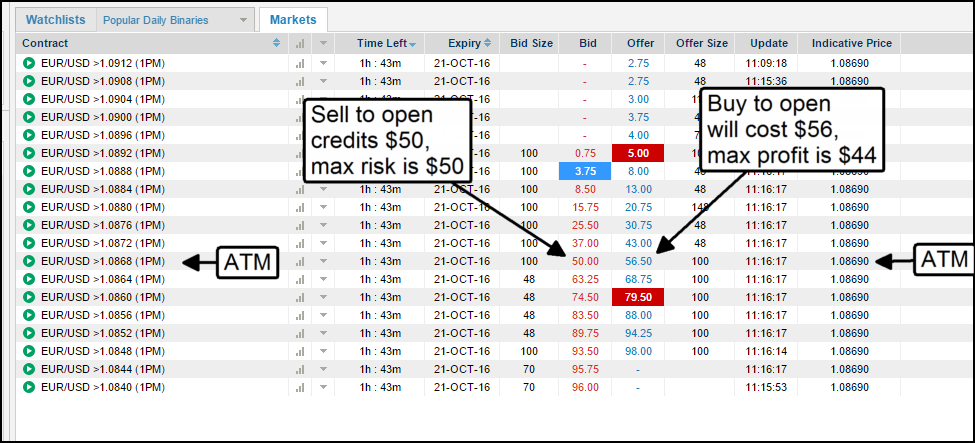

How buying and selling works

This is how it works. NADEX lots are listed at various offer prices, some cash, some cash, one or two in the neighborhood or cash. For this discussion, I will only focus on the At-The-Money strike for simplicity, because the buy (buy, sell, bullish) and sell (sell, sell, bearish) amounts to around $50. What you need to remember is to open a position in buy or sell. So buying a NADEX lot is the same as buying an EU-style call. Selling a NADEX lot is almost like buying an EU foot. The difference is that using NADEX is OPEN OPEN, not Open To Open, so it is a bearish position, so you can get credit.< /i>

See example below. In this NADEX alert chart for the 1:00 expiration of EUR/USD, the 1.0868 alert is At The Money. If you want to buy a long position, call, the offer is priced. It’s another dealer to sell give away. If you buy at $56.00 and your asset price is higher than the strike price, the maximum profit in The The Money is $44, which is the difference between the amount you paid and the maximum payment on expiration, $100. If you want to sell a short position, just enter the foot and you will receive a bid price. This is the price another trader is trying to buyIn this case the option is $50. This means you will receive a credit of $50 in your account, and the asset price keeps it at Out Of The Money (if you win another trader if you win). Your risk is if the asset price is locked in The Money, in which case you will have to pay up to $100, but don’t worry. Since you’ve already paid $50, it’s really only $50, so the risk is $50.

The easiest and best way to make money with the NADEX option is to hold the option to earn maximum income until it expires. But sometimes you may want to close early to take profits or cut losses. This is another area where confusion can occur.

The thing to remember is that you have already opened the mail, and now you need to close the mail. If you bought a long position, call (buy), lock the closing price, sell and receive the bid price. If the price is higher than the price you paid for the option, you will profit. If you sell a short position and sell it for open, you need to buy ‘n closing price to close the position.

Opening and closing

The key is to remember two things. First, there is only one type of stance you can open or buy. The second thing to remember is that you must hold against what you have unfolded to establish your position. When you open the door and buy, close the door and close the door when you open the buy.

NADEX Beginners Guide

The biggest complaint about NADEX is that it is not easy. Of course, NADEX is not as easy as trading on an offshore, EU or CySEC style broker. What you need to know in one of those places is the direction you want and how much risk you want to take.

If you enter the price of the underlying asset during the strike price, if the asset price moves in the right direction from there, you will be the winner and pay the displayed percentage when you buy the option. It is not that simple in NADEX, but I believe it when I say that it is much better than other forms of binary trading that I know of.

There are three things to know about NADEX trading.

1. Options are priced in 0-100 way

Since it is binary in nature, there are only two possible outcomes at expiration: $0 or $100. You get $0 if the option closes the money, and $100 if you close the money. The details of the transaction are that the value fluctuates between $0 and $100 as the underlying asset and market pressure moves before the option expires. The option is less money if there is no money, and more expensive if there is money.

Income at maturity is the difference between what you pay and what you receive. If your options expire in the money, then pay $45 and get $100, you get a profit of $55 or 122%. 122%, much better than elsewhere. Most importantly, you don’t need to hold NADEX options until expiration; you can buy or sell it at any time. If the trade moves in the money and the option shows profit, you can sell it, but you may not get the maximum return.

2. NADEX binary options are traded as ‘lots’ which are priced in the market.

Leverage prices include the price of an asset, the exercise price of an option and the time to expiration. Brokers abroad do not have the market pressure that affects the prices, and if you want to trade $ 500, then enter $ 500 in the amount Amount and click Enter to complete the transaction. If you trade $500 using the “lot system” and the cost of 1 (1) lot is $50, you should buy 10 (10). If the price of the lot is $65, you can only buy 7 (7) without exceeding the limit.

3. Promotional Price

Each asset has a listed expiration date with each available exercise price. The strike price is the price level at which the option is monetized. In terms of pricing options, the at-the-money option always trades around $50, and the probability that the option will move up or down is about 50/50. When the exercise price is monetary, that is, if the asset price exceeds the exercise price, it is more expensive because it is likely to generate a profitable closing price. The strike is more expensive the deeper the money is until the price is fixed. If the strike price is not in the currency, that is, if the asset price is lower than the strike price, the cost is less than $ 50 and more ATMs are available until it is completely worthless. In terms of standard and oriented style trading, ITM or ATM options are less risky, while ATM options are riskier. If the signal is strong, the ATM option, which is only $30 to $40, will naturally return from 150% to 230%.

Simple Selling Strategy for NADEX Binary Options

NADEX binary options are different from EU-style spot binaries, so you can actually sell and get paid. Read on to learn how to use a simple selling strategy.

First, let’s reiterate that NADEX options sell a lot, option strikes are pre-set at-the-money and at-the-money, and all options are worth $0 or $100 at expiration. During the lifetime of an option, the time between the start of the transaction and the expiration time varies in price from $0 to $100, depending on the exercise and exercise of the underlying asset. In the case of a bullish position, for a position where the strike was purchased in the belief that the price would rise, the difference between the price paid for the position and the amount paid back at expiration is $0 .or $100.

If the option expires at the money and receives $0, the position cost is lost. If an in-the-money option expires, you get $100, you earn profit, and deduct the option cost of $100. If you bought the in-the-money option, the cost is about $50 and is about $50 or 100% .

In the case of a bearish position, it therefore proceeds in the same way as the buyer. Selling a strike pays the other side of the position of the matching buyer. If the buyer pays $40, they pay from $60 to $40 to $40. The most you can lose is 60 dollars. It will be profitable if the option expires to 0, while the buyer will be profitable if it expires to $100. In this case, if the binary is worthless, then $60 is paid back to the buyer for $40, then $100 will be paid.

The price of the ATM money option is around $50 per lot. If you sell one for $50 and close it with money, you have to pay $100. $100 is $50 of your money and $50 received as an option premium. If the option closes the desired amount, it keeps the premium (the owner of the option has a contract that has no value and does not have to pay anything) and then earns the amount.

- Buy at NADEX / Bullish Position – buy an option offer, pay the asking price and make a difference of $ 100 from the cost of the option. Your risk is the price of the option.

- Sell against a NADEX / Bearish position – sell the option strike price, receive the bid price and make the profit profit if the option ends the money. Your risk is the difference between $100 and your receipt.

The mechanism of buying and selling options on NADEX offers several possibilities. The simplest and perhaps most effective for the directional trading of binary options is the hedging strategy. Hedging can help you use one position to offset the cost of another or to maximize your profit before expiration. Think about this. Receive a signal for an optimistic deal and buy a 50 dollar option at an ATM. The underlying asset rises and rises to the next resistance target, but can sell the next high strike at the same time for $50. In other words, the total cost is $0 dollars, so just wait until it expires. If your assets remain between the two strikes, you can earn the maximum return if you lose nothing.

Advanced traders can use put options to target non-directional strategies. This strategy works best in markets where asset prices are falling or limited by resistance. One way is to target credit sellable strikes that are likely to liquidate the money. For example, consider this transaction setup for the S & P 500. Prices are close enough to reach value, but fall in the short term with two strike prices that are sufficiently safe to be price safe. Prices are already priced, so no price change is necessary. You only need to sell $31.50 free for $5.

Some of the links to third party websites that are on our website are affiliate links. This means that if you click on a link to a third-party website or purchase a product from a third-party website, a fee or fee may be charged.