What is a binary option and how do you earn money?

A binary option is a fast and extremely simple financial tool that allows investors to speculate whether the price of an asset will rise or fall in the future, for example the price of Google shares, the price of Bitcoin, the stock exchange USD / GBP rate, or the price of gold. The duration can be as short as 60 seconds, making it possible to trade hundreds of times a day in any global market. Before you make a trade, you know exactly how much you can earn if your prediction is correct, usually 70-95%; If you invest $100, you will receive a credit of $170 – $195 for a successful operation. This makes risk management and business decisions much simpler. The result is always a Yes or No answer: you can win everything or lose everything, therefore it is a “binary” option. Risk and reward are known in advance and this structured reward is one of the attractions. The exchanged binaries are now also available, which means that the traders are not trading against the broker. To start trading, you first need a regulated (or licensed) brokerage account. If you are completely new to binary options, you can open a demo account with most brokers, to test your platform and see what it is like to trade before depositing real money.

Introductory Video – How to Trade Binary Options

These videos will introduce you to the concept of binary options and how trading works. For even more details, read the entire page and follow the links to more detailed articles. Binary trading doesn’t have to be complicated, but as with any subject, you can train yourself to be an expert and hone your skills.

Types of options

The most common type of binary option is the simple “Up/Down” swap. However, there are different types of options. The only common factor is that the result will have a “binary” result (Yes or No). These are some of the types available:

- Up / down or high / low: the most common and basic binary option. Will a price end higher or lower than the current price at expiration?

- In / Out, Range or Limit – This option sets a “high” number and a “low” number. Traders predict whether the price will end up inside or outside these levels (or ‘limits’).

- Touch / no touch: they have levels that are higher or lower than the current price. The trader must predict whether the actual price will “hit” those levels at any time between the trade time and expiration. Note that the trade with a touch option can be closed before the expiration time: if the price level is touched before the option expires, the “Touch” option will be paid immediately, regardless of whether the price later moves away from the touch level.

- Ladder: These options trade like a normal rise / fall trade, but instead of using the current strike price, the ladder will have predetermined price levels (‘staggered’ progressively up or down). This is often far from the current strike price. Since these options generally require significant price movement, payouts will often exceed 100%, but both sides of the trade may not be available.

How to trade – step by step guide

Below is a step-by-step guide to placing a binary trade:

- Choose a broker – use our broker reviews and comparison tools to find the best binary trading site.

- Choose the asset or the market to trade – Asset lists are huge, covering commodities, stocks, cryptocurrencies, currencies or indices. The price of oil, or the price of Apple shares, for example.

- Select expiration date: options can expire between 30 seconds and one year.

- Set the size of the trade – remember that 100% of the investment is at risk, so consider the size of the trade.

- Click on Call / Place or Buy / Sell: will the value of the asset go up or down? Some broker buttons differ.

- Verify and confirm the operation – Many brokers give operators the opportunity to make sure that the information is correct before confirming the operation.

Choose a broker

Options fraud has been a big problem in the past. Fraudulent and unlicensed traders have taken advantage of binary options as a new exotic derivative. Fortunately, these companies are disappearing because the regulators have finally started to act, but traders should not look for regulated brokers just yet. Note! NEVER work with a broker, or use a service that appears on our blacklist and scams page; stick to the ones we recommend here on the site. Here are some shortcuts to pages that can help you determine which agent is best for you:

- Compare all brokers – if you want to compare the features and offers of all recommended brokers.

- Bonuses and offers – if you want to make sure you get extra money for trading or other deals and offers.

- Brokers with low minimum deposit – if you want to trade for real money without having to deposit large amounts of money.

- Demo accounts: if you want to try a “real” trading platform without depositing money.

- Brokers in Halal: if you are one of the increasingly Muslim traders.

Asset Lists

The amount and variety of assets you can trade varies from broker to broker. Most brokers offer popular asset options such as major currency pairs including EUR/USD, USD/JPY, GBP/USD, as well as major stock indices such as the FTSE, S&P 500 or Dow Jones Industrial. Commodities such as gold, silver and oil are also offered. Stocks and individual stocks can also be traded through many binary brokers. However, not all stocks will be available, but you can usually choose between 25 and 100 popular stocks, such as Google and Apple. These lists are constantly growing as demand increases. Asset lists are always clearly listed on each trading platform, and most brokers make their full asset lists available on their website. This information is also available in our reviews, including currency pairs.

Expiry dates

Expiry time is the point at which a trade is closed and settled. The only exception is when the “Touch” option reached a predetermined level before it expired. The maturity of any operation can vary from 30 seconds, to a year. While binaries initially started with very short expiration dates, demand has ensured that there is now a wide range of expiration times available. Some brokers even give the traders the flexibility to set their own specific expiration time. Adults are usually grouped into three categories:

- Short term / Turbo: this is typically classified as any expiration in less than 5 minutes.

- Normal: this ranges from 5 minutes to the “end of day” expiration dates that expire when the local market closes for that asset.

- Long-term: any expiration after the end of the day is considered long-term. The longest maturity can be 12 months.

Regulation

Although initially slow to react to binary options, regulators around the world are now starting to regulate the industry and make their presence felt. The most important regulators currently include the following:

- Financial Conduct Authority (FCA) – UK regulator

- Cyprus Securities and Exchange Commission (CySec) – Cyprus

- Regulator, often “passport” throughout the EU, under MiFID

- Commodity Futures Trading Commission (CFTC) – US regulator. UU.

- Australian Securities and Investments Commission (ASIC)

There are also regulators operating in Malta and the Isle of Man. Many other authorities are now particularly interested in binaries, especially in Europe, where national regulators are interested in strengthening CySec regulation. Unregulated brokers still operate, and while some are trustworthy, the lack of regulation is a clear warning sign for potential new clients.

ESMA

Recently, ESMA (European Securities and Markets Authority) decided to ban the sale and marketing of binary options in the EU. However, the ban only applies to regulated brokers in the EU. This gives operators two options to continue operating: first, they can trade with an unregulated company; this is extremely high risk and is not recommended. Some unregulated companies are responsible and honest, but many are not. The second option is to use a company regulated by organizations outside the EU. ASIC in Australia is a strong regulator but they will not implement a ban. This means that ASIC regulated companies can still accept EU traders. Check out our broker listings for trusted or regulated brokers in your region. There is also a third option. Traders who register as ‘professionals’ are exempt from the new ban. The ban is only intended to protect retail investors. A professional trader can continue to trade on EU regulated brokers such as IQ Option. To be qualified as a professional, an account holder must meet two of these three criteria:

- Open 10 or more trades per quarter, of €150 or more.

- Do you have assets of €500,000 or more.

- They have worked in a financial company for two years and have experience in financial products.

How to set up a business

The ability to trade different types of binary options can be achieved by understanding certain concepts such as the strike price or price stop, settlement and expiration date. All exchanges have expiration dates. When the trade expires, the behavior of the price action according to the selected rate will determine whether it is in profit (in the money) or in a losing position (out of the money). Moreover, price targets are key levels that the trader sets as benchmarks for determining the results. We will see the application of price targets when we outline the different types. There are three types of trades. Each has different variations. It is:

- High low

- In out

- Touch / No touch

Let’s take one after the other.

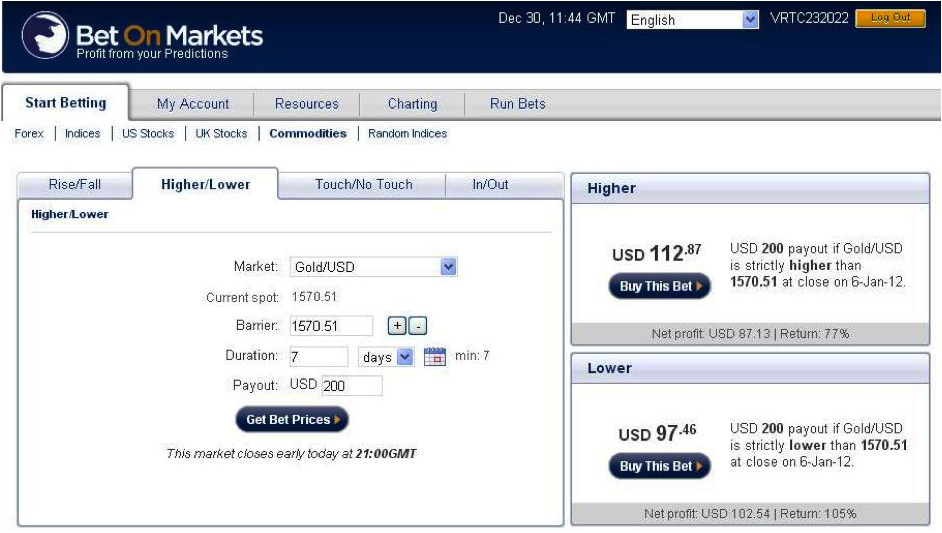

High low

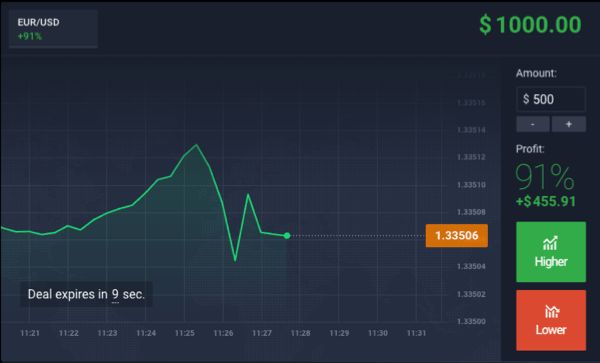

Also called an up/down binary trade, it is to predict whether the market price of the asset will be higher or lower than the strike price (the selected strike price) before expiration. If the trader expects the price to rise (the ‘Up’ or ‘High’ trade), he buys a call option. If you expect the price to go down (“Low” or “Down”), buy a put option. Expiration times can be as low as 5 minutes.

Note that some brokers classify Up / Down as different types, where a trader buys a call option if he expects the price to rise above the current price, or buys a put option if he expects the price to fall below current prices . You can see this as a kind of rise / fall on some trading platforms.

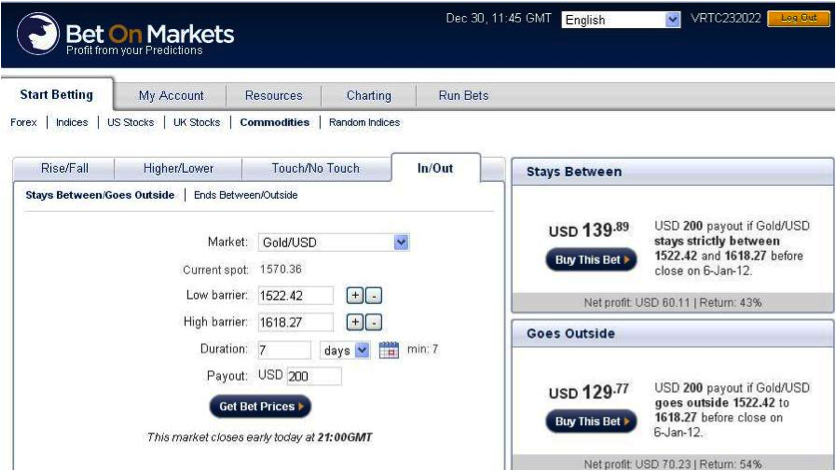

In out

The entry / exit type, also called ‘tunnel trade’ or ‘limit trade’, is used to negotiate price consolidations (‘entry’) and breaks (‘exit’). How it works First, the trader sets two price targets to form a price range. He then buys an option to predict whether the price will stay within the price / tunnel range until expiration (In) or whether the price will break in either direction (Out).

The best way to use tunnel binaries is to use the pivots of the asset. If you are familiar with forex pivots, you should be able to trade this guy.

Touch / No touch

This rate is based on price action hitting a price barrier or not. A “Touch” option is a rate at which the trader buys a contract that will generate profit if the market price of the purchased asset reaches the target price at least once before expiration. If the price action does not touch before the expiration of the strike price (the strike price), the trade ends as a loss. A “No Touch” is the exact opposite of the Touch. Here you bet that the underlying asset price action will not touch the strike price before expiration.

There are variations of this type in which we have Double Touch and Double No Touch. Here the trader can set two price targets and buy a contract that bets on the price by touching both targets before expiration (Double Tap) or not touching both targets before expiration (Double Without Tap). Normally, you would only use Double Touch trading when there is intense volatility in the market and prices are expected to clear different price levels. Some brokers offer all three types, while others offer two, and others only offer one variety. Additionally, some brokers also place restrictions on setting the expiration dates. To get the most out of the different rates, traders are encouraged to look for brokers that give them maximum flexibility in terms of the types and the maturities that can be set.

Mobile Apps

Trading through your mobile device is made very easy as all major brokers offer fully developed mobile trading apps. Most trading platforms are designed with mobile users in mind. So the mobile version will be very similar, if not the same, as the full web version on traditional websites. Brokers cater to iOS and Android devices and produce versions for each. Downloads are fast and merchants can also register via the mobile site. Our reviews contain more details about each broker’s mobile app, but most are aware that this is a growing trading area. Traders want to respond immediately to news events and market updates, so brokers provide the tools for clients to trade wherever they are.

Questions about trading

What does binary options mean?

“Binary options” means, in a nutshell, an operation where the result is a “binary” Yes / No answer. These options pay a fixed amount if they win (known as “in the money”), but lose the entire investment if the binary trade loses. In short, it is a form of financial returns with fixed returns. How does a stock exchange work? Steps to trade a share through a binary option;

- Choose the action or equity.

- Identify the desired expiration date (the time at which the option ends).

- Enter the size of the trade or investment.

- Decide whether the value will increase or decrease and buy or sell.

The previous steps will be the same in all corridors. More layers of complexity can be added, but if you are trading stocks, the simple up/down trade type remains the most popular.

Buy and sell options

Call and put are simply the conditions for buying or selling an option. If a trader believes that the underlying price will increase in value, he can open a call. But where they expect the price to drop, they can place a sell price. Different trading platforms label their trading buttons differently; some even switch between Buy/Sell and Call/Set. Others drop the set phrases and switch altogether. Almost all trading platforms will make it clear in which direction an operator is opening an option.

Is binary options a scam?

As a financial investment tool, they are not a scam per se, but there are brokers, trading robots and signal providers that are unreliable and dishonest. The point is not to reject the concept of binary options, which is based only on a handful of rogue brokers. As a result of these vendors, the image of these financial instruments has suffered, but regulators are slowly but surely starting to prosecute and fine, and the industry is being cleaned up. Our forum is a great place to raise awareness of irregularities. These simple checks can help everyone avoid scams:

- Marketing that promises big profits. This is a clear warning sign. Binary is a high risk/reward tool – it is not a “make money online” scheme and should not be sold as such. The operators making such claims are unlikely to be trustworthy.

- Meet the broker. Some operators will ‘channel’ new customers to a broker they associate with, so the person has no idea who their account is with. A trader must know the broker he is going to trade with! These funnels often fall into the ‘get rich quick’ marketing discussed earlier.

- Cold calls. Professional brokers will not make cold calls, they will not trade like that. Cold calls will often come from unregulated brokers just to get an initial deposit. Be very careful if you join a company that has contacted you in this way. This will also include email contact, any form of contact out of the blue.

- Terms and conditions. Read the full terms and conditions when taking a bonus or offer. Some will include locking an initial deposit (in addition to bonus funds) until a large amount of transactions have been made. The first deposit is the trader’s cash – legitimate brokers will not claim it as theirs before any trade. Some brokers also offer the option to cancel a mortgage if it does not meet the merchant’s needs.

- Don’t let anyone change for you. Avoid having any “account manager” trade for you. There is a clear conflict of interest, but these brokers will encourage traders to make large deposits and take greater risks. Traders should not allow anyone to trade on their behalf.

What are the best trading strategies?

Binary trading strategies are unique to each trade. We have a strategy section, and there are ideas for traders to experiment with. Technical analysis is useful for some traders, combined with charts, indicators and price action research. Money management is essential to ensure that risk management applies to all operations. Different styles will suit different operators, and strategies will also evolve and change. There is no single ‘best’ strategy. Traders should ask questions about their investment goals and risk appetite and then learn what works for them.

Is the game binary options?

It will depend entirely on the habits of the trader. Without strategy or research, any short-term investment will win or lose based on luck. In contrast, a well-researched trader will make sure that he has done everything in his power not to rely on luck. Binary options can be used to bet, but can also be used to trade based on value and expected profits. Then the answer to the question of the merchant will be reduced.

Benefits of binary trading

The main advantage of binaries is the clarity of risk and reward and the structure of the trade.

Minimum financial risk

If you’ve traded forex or its more volatile cousins, crude oil or spot metals like gold or silver, you’ve probably learned one thing: These markets are high risk, and it’s easy to get out of the market. Things like leverage and margin, news events, slips and new quotes, etc. can have a negative effect on trading. Trading binary options is different. There is no leverage to deal with, and phenomena such as sliding prices and price quotes have no influence on the results of binary options trading. This reduces the risk in binary options trading to the barest minimum.

Flexibility

The binary options market allows traders to trade financial instruments spread across the currency and commodity markets, as well as indices and bonds. This flexibility is unmatched and provides traders with the knowledge of how to trade these markets a one stop shop to trade all these instruments.

Simplicity

A binary trading result is based on a single parameter: address. The operator is essentially betting whether a financial asset will end up in a specific direction. Furthermore, the trader is free to determine when the transaction ends by setting the expiration date. This gives a trade that initially started badly the chance to end well. This is not the case with other markets. For example, loss control can only be achieved using a stop loss. Otherwise, an operator must endure a reduction if an operation takes an unfavorable turn to give it room to be profitable. The simple point here is that the binary options trader has less to worry about than if he had to trade other markets.

Greater control over trades

Operators have better control over binary operations. For example, if a trader wants to buy a contract, he knows in advance what he will gain and what he will lose if the trade is not done with money. This is not the case with other markets. For example, if a trader places a pending order in the forex market to trade a high-impact news event, there is no guarantee that his trade will be filled at the entry price, or that a losing trade at the exit shop will not be closed. loss.

Higher payments

Payouts per trade are usually higher in binary options than in other forms of trading. Some brokers offer payouts of up to 80% on one trade. This can be done without obstructing the account. In other markets, such payments can only occur if a trader ignores all money management rules and exposes a large amount of business capital to the market, expecting a large payment (which never happens in most cases).

Accessibility

To operate in the highly volatile commodity or currency market, an operator must have a reasonable amount of money as trading capital. For example, trading gold, a commodity with an intraday volatility of up to 10,000 pips in times of high volatility, requires trading capital in the tens of thousands of dollars. However, binary options have much lower entry requirements as some brokers allow people to start trading as low as $10.

Disadvantages of binary trading

Reduced Trade Truths for Sure-Banker Operations

Payments for trading binary options are drastically reduced when the chance of a successful trade is very high. Although it is true that some operations offer payments of up to 85% per operation, such high payments are only possible when an operation is performed with the deadline set at a certain distance from the date of the operation. Of course, trades in such situations are more unpredictable.

Lack of good business tools

Some brokers do not really offer useful trading tools such as charts and technical analysis functions to their clients. Experienced operators can remedy this by obtaining these instruments elsewhere; Inexperienced traders new to the market are not so lucky. However, this is changing for the better, as operators mature and realize the need for these tools to attract traders.

Limitations in risk management

Unlike Forex, where traders can obtain accounts that allow them to trade mini- and micro-lots on small accounts, many binary options brokers set a trading floor; minimum amounts that a trader can trade in the market. This makes it easier to lose too much capital when trading binaries. As an example, a forex broker may allow you to open an account with $200 and trade micro-lots, so that an operator can expose only acceptable amounts of his capital to the market. However, it will be difficult to find many binary brokers that allow you to trade under $50, even with a $200 account. In this situation, four losing trades will blow up the account.

Cost of losing trades

Unlike other markets where the risk/reward ratio can be controlled and configured to give an advantage for winning trades, the possibilities of binary options tilt the risk-reward ratio in favor of losing trades.

Commercial corrections

By trading in a market such as the foreign exchange or commodity market, it is possible to close a trade with minimal losses and open a profitable market, if repeated analysis of the trade shows that the first trade was wrong. However, if binaries are traded on the exchange, it is reduced.

Spot forex vs binary trading

These are two different alternatives marketed with two different psychologists, but both can make sense as investment tools. One is more focused on TIME and the other is more focused on PRICE. They both work on time/price, but the focus you’ll find on each is an interesting gulf. Forex traders can see time as a factor in their trading, which is a big mistake. The successful binary operator has a more balanced time/price view, which simply makes it a more complete operator. Binaries by nature force a position to exit, win or lose a position within a specified period of time, with a greater focus on discipline and risk management. In forex trading, this lack of discipline is the biggest cause of failure for most traders, because they will simply lose longer positions and reduce winning positions for shorter periods. In binary options, which is not possible, as the time expires, you can win or lose trade. Here are some examples of how it works.

Above is a trade in EUR/USD in a price and time window of less than 10 minutes. As a binary trader, this approach will obviously do better than in the example below, where a forex trader who focuses on price and ignores the time element gets into trouble. This dual axis and power focus psychology helps you become a better overall operator.

The ultimate advantage of spot trading is that it fails a lot: to expand the profit exponentially from a price point. This means that if you enter a position that you believe will increase in value and the price does not rise but accelerates downward, the normal tendency for most bait traders is to wait or worse to lose positions. I think it will come back. Accelerating in time in the opposite direction desired, most decoy traders are caught in unfavorable positions, all because they do not plan time in their reasoning, and this leads to a complete lack of commercial discipline.

The nature of binary options forces one to have a more complete mindset to trade both Y = Price Range and X = Time Range as limits are applied. It will simply make you a better general operator from the start. On the contrary, according to their nature, they need a higher profit rate, because each bet means a profit of 70-90% against a loss of 100%. So your profit rate should average 54%-58% to break even. This imbalance causes many traders to overload or retrace the trade, which is just as bad as maintaining / adding to positions as a forex trader. To work successfully, you need to practice money management and emotional control. Finally, starting out as a trader, binaries can provide a better base for learning how to trade. The simple reasoning is that the combined TIME / PRICE approach is like looking both ways when crossing the street. The average forex trader only looks at the price, which means it only looks in one direction before crossing the street. By learning to consider time and price, one must become a general trader.