24Option is one of the leading online brokers. They boast the latest technology on their trading platform and pride themselves on offering an easy system. The new partner is also rich and advanced. The firm operates under the name Rodeler Limited and has its headquarters.

The firm is regulated by CySec but has stopped offering binary options. They have added both CFDs and Forex trading to their offering, and have also expanded their customer support to include managing large investment portfolios. While they will continue to offer existing customers binary trading, their focus is now on CFD and Forex trades. This includes Bitcoin pairs.

They aim to offer a user-friendly trading service and also give traders the tools they need to make a profit – including some of the highest limits in the industry.

24Option Review – Important Details;

-

- Demo Account – Yes

- Minimum deposit – £250

- Minimum trade – from 0.1 lots

- Signal service – Yes

- Bonus Details – As a CySec regulated broker, 24option no longer offers bonuses or trading benefits.

- Mobile App – Yes. Provision has been made for Android and iOS.

Trading platform review

24Option offers a user-friendly platform geared towards fast, easy trading, as well as a mobile trading app. Traders can choose from different trade types and assets.

Returns can vary based on the underlying asset performance, but the platform does have a low spread, which means competitive trading costs. Forex and CFD payouts will depend entirely on the movement of the underlying asset, as with any other broker.

The trade area is clearly outlined. Traders can directly select the underlying asset they wish to trade from the list, or by filtering the screen to the class or category, via the dropdown.

The trading window is always visible next to the list and will update once a different stock or underlying asset is selected. The price chart on the trading window can be enlarged to allow a more detailed analysis of the price action.

Trade history

Below the trading window is the area for open trades. From here, traders can see all the trades they have opened. It is marked whether it is currently money or not. The opening price and current price are both displayed, as is the expiration time. The window with open trades will also display a ‘Close’ value – this is a value that the trader can ‘cash in’ at the moment – either to close a profit or to reduce a loss. These are only offered at certain times within a trade, but add to the trader’s options and are conveniently placed.

Trading history is also shown in this area. All completed trades are listed, open and close prices and of course the net result of the trade. There are also three tabs for traders to stay on top of market changes. A trade alert tab, a daily market update tab and the very useful economic calendar tab. It is an excellent source for finding the most important financial statements that will be made available to the markets in the near future.

Trader Choice

The platform delivers forex and credits on commodities, selected stocks and indices.

In addition, the firm now also offers CFD trading and ‘forex per trading’. This allows users to trade in a more traditional way. It also allows users to trade using leverage. This is a big difference if traders are more used to the ‘fixed risk’ of other investment vehicles.

As part of the forex push, 24option now also offers forex pairs for Bitcoin. This allows traders to take a position on cryptocurrency versus USD or GBP, for example.

As the CFD offering is relatively new, more markets will be added during the coming month. Spreads are currently around 0.05% and compare quite well with more established CFD brokers.

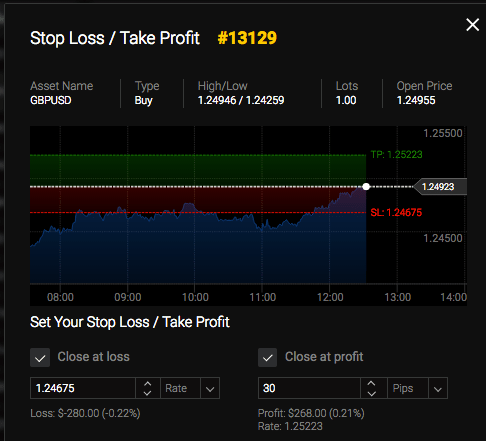

These new types of trading also include the option to set stop loss levels. This is an important part of risk management when using leverage. Traders can also set up ‘take profit’ points.

Stop loss screen:

Mobile app

24Option offers a smooth and easy mobile trading platform, and it works with both Android and Apple devices. When logged into the full site, traders can view a demo of the mobile app. Customers can also choose a variety of devices for that demo.

The application has a very simple interface, with each phase of the trading process in a clear simple process. The screens are large and easy to use. This reduces the risk of mistakes due to a quick or hard-to-find button. Apart from easy trading, the app can also display the trading history and open trades. The trading history can therefore be viewed wherever a trader is. It is a slick trading app and is an excellent addition to the range of features the brand offers. It was created with the merchant in mind, but has been thoughtfully developed to ensure that it offers a full range of features on different devices.

Payout

Since 24option has now withdrawn from binary options, the payouts are not comparable to other binary brokers. CFD and forex payouts are scalable, based on both leverage and the price movement of the underlying asset.

Traders can manage risk via tools such as stop losses. They can also choose the level of leverage to use per trade. However, with CFD and Forex, losses can exceed initial deposits.

Withdrawal and deposit options

24option offers a variety of deposit and withdrawal options.

Withdrawals are normally returned to the source of the funds. The accounts do require some form of valid ID and proof of address before withdrawing. This is to comply with the laws of money laundering. If funds were deposited via credit card, details for that card will also be required for the withdrawal.

Withdrawal problems and complaints are usually about delays in this proof of identity process. So it’s worth sorting out before asking for withdrawal. This can avoid problems and ensure quick withdrawal times.

Free withdrawals

Gold and Platinum account holders can enjoy regular free withdrawals. Standard account holders receive their first withdrawal free. The remaining withdrawals may be a percentage charge and this figure will depend on the method used – for example Skrill will have a 2% charge. Withdrawal requests can be made at any time.

Traders can also make a deposit at any time. The minimum deposit is £250 (funds can also be deposited in USD and EUR – but once the currency in which the account operates cannot be changed). 24 Options wants to emphasize the safety of the deposit process and make it as easy as possible to deposit funds. As soon as the minimum deposit is made, the funds appear immediately, so that traders do not delay in taking out options.

CFDs

24Option recently announced the addition of CFDs (Contracts For Difference) to their platform. The trading area has now been redesigned internally (rather than the previous TechFinancial platform), and they have improved their platform to now have the option to trade CFDs.

Although the initial offering is quite limited, this is an interesting move from the firm and is an area of trade that is likely to expand within the binary sector.

The main difference between CFD and Forex platforms is that traders can use leverage. Levels up to x200 are available. This is a big change for anyone used to the fixed risk nature of binaries. Traders need to understand this difference. The platform also offers stop loss tools – a must for the extra risks with leverage.

24Option Review – Other Features

The firm offers the following features and benefits to its clients:

- Multilingual support – the brand is an international company that offers trading support in different languages, including English, Spanish and Italian.

- 24/5 trading – They offer trading when relevant markets are open

- Education Center – The site offers a variety of educational resources for traders at all levels. It includes regular market updates, educational videos, e-books and a traders manual for beginners to get started.

- Copy Trading – Follow the trades made by winning traders