TD Ameritrade is a publicly traded online broker that boasts over 7 million users and processes around 650,000 trades every day. The extensive offering facilitates the trading of stocks, forex, futures, options, ETFs and other securities. This review examines all aspects of their service, including account fees, trading platforms, mobile apps and much more.

The firm offers a variety of trading platforms and is also first to market with innovative trading tools. This has enabled them to offer a flexible trading center for traders of all levels.

There are a variety of account options that also cater to different types of traders.

The thinkorswim platform was originally a completely different brand, but has now been brought under the umbrella of TD Ameritrade. It compliments the other platforms, which already provided web-based or mobile trading on Android or iOS. Although the platforms are familiar, they are rich and flexible.

Account Types

The standard individual TD Ameritrade trading account is relatively simple to open. Once you’ve filled out the necessary forms and TD Ameritrade has finished checking, you can start trading. As mentioned above, there is no minimum deposit required to open an account. However, the minimum electronic financing is $50.

If you want to use margin, you need a minimum balance of $2,000. This will allow you to double your purchasing power, but you may have to pay interest on the loan.

Trading Platforms

Whether you live in Africa, once you’ve logged into your brokerage account, you’ll have access to the same robust TD Ameritrade trading platforms. You actually have three options, TD Ameritrade.com and trade architect which is web based as well as think screen for desktop applications.

TD Ameritrade.com

This web-based platform is ideal for new day traders looking to ease themselves into trading. Having said that, you will encounter a whole lot of information, which can make navigating the site somewhat difficult. Fortunately, you can use the ‘Ask Ted’ chatbot to answer questions.

You also get access to a portfolio planner tool. This allows you to set up a target asset allocation plan, which helps create a balanced portfolio of bonds. You can choose between a standard model or you can build and customize one yourself to ensure optimal results with your strategy.

Commercial Architect

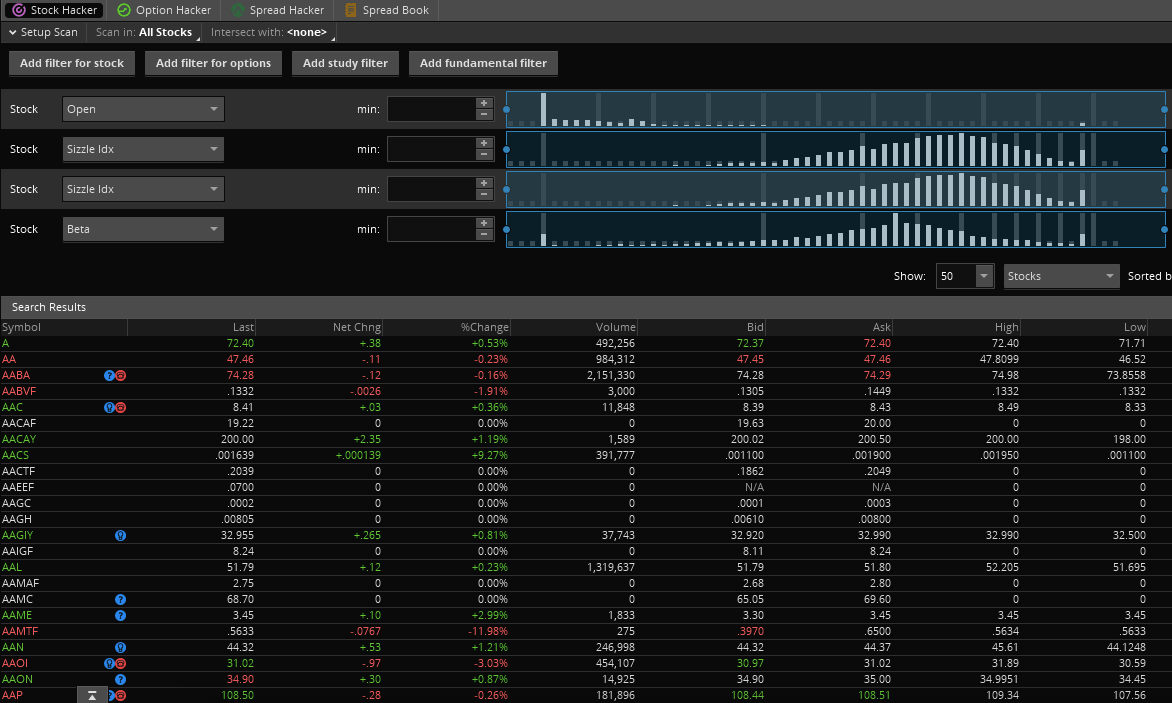

TD Ameritrade’s Trading Architect is the next level in terms of trading tools and real-time features. For example, you get news feeds, heat maps on the market and a whole lot of orders. The platform is also clean and easy to use. Accessing data feed is simple, you can customize charts, and there are also 30 stock and option screeners.

The system is also streamlined so that completing basic tasks, such as placing stop-loss limits and following stop orders, is quick and hassle-free. In addition, there are options trading tools such as probability analysis, profit and loss charts, as well as target zone tools. As a result, trading architect is a good choice for traders with some experience who want to invest a modest sum of money.

Thinkorswim

Thinkorswim, which was originally a stand-alone broker until TD Ameritrade took it over in 2009, is considered the crown jewel in the platform offering. Once you download this desktop platform, serious traders can take advantage of all the features found in the Trade Architect, plus advanced trading capabilities. In fact, it is so sophisticated that only TradeStation offers such a comprehensive platform.

You get access to dozens of charts streaming real-time data and over 300 technical studies for each chart. This is actually the largest number in the industry and each study can be customized. Discover ThinkScript, which is the signature language of thinkorswim, and you can also create your own indicators.

You also have:

- backtesting

- Business Profiling

- Set up FRED data

- Customizable screens

- Sophisticated tools for analyzing earnings

- Graphs for scanning and sharing stocks in real time

- The ability to play historical markets recognizably

- Access to both economic and corporate calendars

Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. Customization can go as far as the user’s imagination will take. When it comes to trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction.

Also note that all three platforms can be used to trade a wide variety of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin.

Minimum initial deposit

One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. It is good for beginners and those with limited starting capital. In fact, this is fantastic compared to prices at other competitors, where account minimums can range from $500 to $10,000.

Distributions and commissions

Reviews and research show that TD Ameritrade does not fare so well in terms of margins and commission fees. Commissions are higher than the industry average at $6.95 per trade for stocks and ETFs. It is actually twice as expensive as other discount brokers. In fact, if you compare TD Ameritrade vs Etrade, Interactive Brokers and Scottrade, only Etrade costs as much.

With that said, you can take advantage of 101 commission-free ETFs. The only downside is that any commission-free ETFs sold within thirty days of purchase are subject to a $13.90 trading fee.

The question that will be answered next is the powerful trading tools and extensive research resources sufficient to make this high brokerage a good value for your money?

Bonus

There are a number of special offers and promotional bonuses available for new traders. In fact, cash bonuses for new accounts range from $100 for deposits between $25,000 and $99,999, to $1000 promotions for high dollar accounts.

On top of the deposit bonuses, TD Ameritrade occasionally releases promo codes giving users up to 500 free trades. It’s also worth keeping an eye on their website for transfer bonuses.

Leverage

Forex spreads are pretty much industry standard and you can also take advantage of forex leverage. It is essentially a loan, which allows you to increase your position and possibly increase the profit. However, trading on margin can also amplify losses.

Moreover, the margin of TD Ameritrade is one of the most expensive in the industry. The base margin rate is 7.75%, while the maximum rate is 9%. You will also need to maintain a minimum balance of $2,000 for a margin account.

Other Trading Fees

Once you have your login details and start trading, you will incur certain trading fees. For example, withdrawal from local wire will cost $25. Transferring accounts costs $75, and a forced margin sellout is charged at $25 plus brokerage commission.

Even so, the pricing structure of TD Ameritrade is quite transparent. Plus, unlike Interactive Brokers, you don’t have to pay any annual or inactivity fees.

Overall, TD Ameritrade is higher than average in terms of commissions and spreads. However, their minimum account requirements and generous promotions help negate some of the costs. So, if you’re looking for low futures, options and mutual fund fees, you might want to look elsewhere. If you’re looking for a cheap start and a generous cash welcome, TD Ameritrade could be a wise choice.

Mobile apps

When you open a new account, you also get access to two mobile apps, TD Ameritrade Mobile and TD Ameritrade Mobile Trader. The former is designed for beginners and casual investors. The latter is for very active traders who need numerous features and advanced features. Overall, iPhone, iPad and Android app reviews are very positive.

TD Ameritrade Mobile

While you can log in with your username and password, there are also Touch ID login features. Once logged into the app, you can adjust positions and view watchlists. Accessing much of their in-depth research is simple while margin balance and account information is quick and easy.

In addition, you can use analysis of social signals. You will also find that the mobile app is compatible with both iOS and Android devices.

TD Ameritrade Mobile Trader

The Mobile Trader application allows advanced charting, with an impressive 328 technical studies. Plus, you get a long list of ordering options. The interface is smooth and easy to navigate. Reviews show that even making complex options trades is stress-free.

You have in-app chat support that will connect you directly to a customer service advisor if you’re having trouble and the app isn’t working.

There is even a screen sharing feature. This allows you to connect your thinkorswim desktop platform to the Mobile Trader app. You simply select the quote tab, choose a color next to the search bar that matches thinkorswim, pull up a quote and thinkorswim follows your lead. In fact, it is so thorough that some users consider it to be the best in the industry right now.

Having said that, some reviews indicate that being able to screen and set advanced alerts would improve the Mobile Trader app even further.

Methods of payment

Customers can make direct deposits and withdraw money with relative ease through the TD Ameritrade network.

You can choose to electronically transfer money from your back to your TD Ameritrade account. You simply need your bank account number and any applicable security codes. Completion usually takes 30 minutes to 3 business days. However, you must transfer a minimum of $50 and can transfer a maximum of $250,000.

The most popular financing method is bank transfer. There are no limits on contributions and the settlement time is one business day. However, you may need to check any other day’s trading rules or the transfer fees charged by your bank.

You can also use Paypal to fund your account and make withdrawals. Finally, you can also fund your account via checks or an external transfer of securities. It may also be worth checking their website to see if there are any current rewards or offers for using specific funding methods.

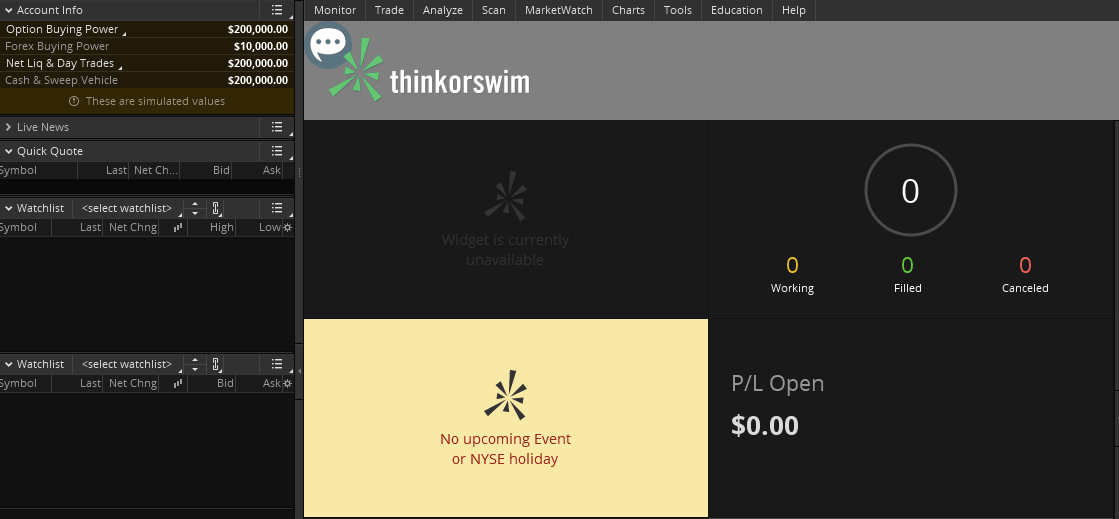

Demo-account

TD Ameritrade also offers a free demo account called PaperMoney. Funded with simulated money, you don’t have to risk real capital until you feel confident. This is a fantastic opportunity to familiarize yourself with the markets and develop strategies. It’s also a fantastic way to test the TD Ameritrade trading platform.

For paper trading, you only need a few basic details, including your name, email address, phone number and location. Once your confidence has grown, it’s simple to close your demo account and upgrade to a live trading account.

Additional features

User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:

- Social Signals – The Social Signals feature provides a real-time stream of relevant algorithmically filtered tweets. You also get a summary map of the most discussed brands. Many find it easier to use than StockTwits.

- Peer Comparison – on the Peer Comparison tab, you can find clean customizable charts that show a security’s recent performance against its competitors. This is then followed up with a table of relevant statistics.

- Free Research – You can find breaking news from Zacks, Dow Jones, briefing.com, plus a number of other sources. In addition, there is analysis from Market Edge, CFRA, Credit Suisse and Vickers.

- Interactive Learning – TD Ameritrade offers a number of ways you can learn, from videos and articles to slides and quizzes. In addition, they will monitor your progress and award points and virtual trophies as you improve. In fact, the reviews of video training are quick to point out how comprehensive and useful their educational resources are.

- Earnings Calendar Tools – This allows you to track earnings announcements from companies of interest. This can help you prepare for upcoming data releases and predict future price movements.

Regulation and License

In the day trading world, it is important that you can trust your broker. It is therefore essential to make sure that it is well regulated and licensed.

Over four decades, TD Ameritrade has been recognized for facilitating regulated international access to traders. The company is regulated by FINRA. Additionally, customer accounts are protected under FDIC (deposit accounts held at TD Bank) and SIPC. In addition, the excess SIPC cover is provided by London insurers.

What this means is that your funds are protected in a variety of scenarios, such as TD Ameritrade becoming insolvent. They are licensed in different places, from the US to Hong Kong. However, check their full website to see regulatory details for your location.

Advantages

There are a number of very good reasons to choose TD Ameritrade, including:

- There is a large variety of instruments.

- You get fast and reliable customer service.

- You can make advanced orders including OCO and brackets.

- TD Ameritrade offers rich in-depth research and educational resources.

- The extended 24 hour trading hours enable international access to the markets.

- It facilitates automatic synchronization between desktop and mobile trading platforms.

- There is access to more than 350 technical studies, 20 charting tools and 8 Fibonacci tools.

- You get free access to the advanced thinkorswim platform, without any minimum account.

- Access to more than 100 commission-free ETFs and hundreds of mutual funds with no transaction fee.

- Portfolio Margin gives some users increased leverage by basing margin requirements on total portfolio risk.

- You can choose between three trading platforms and ensure that there is a platform for traders of all experience levels.

- There are automated trading capabilities, including robo-advisors of their investment

- Management services and essential portfolios. Reviews show high levels of customer satisfaction.

- The Economic Data Tool provides access to a range of data on the health of global economies.

- On the platform you will find active chat rooms to share ideas and communicate with thousands of experienced traders.

Disadvantages

Despite the number of TD Ameritrade advantages listed above, there are also several disadvantages to their offering, including:

- The trading costs are inevitably high. When you put TD Ameritrade vs OptionsHouse and other competitors, you realize that TD Ameritrade’s commission rates for stocks and ETFs in particular are way above the industry norm.

- You will get a $19.99 short-term trading fee if you sell any of your commission-free ETFs within 30 days.

- Broker-assisted trading commissions are around $44.99, while other firms keep prices between $25 and $35.

- You also have strict margin maintenance requirements to deal with.

- Security can be enhanced by using a two-factor authentication feature. A feature that several competitors do offer.

- New traders can be overwhelmed by the vast amount of information and tools available. As a result, novice traders want to look for a cleaner, more streamlined trading platform.

For those trading bitcoin to penny stocks, all of the above points have subtracted TD Ameritrade reviews and valuations. However, there are many positive aspects. Whether the advantages outweigh the disadvantages will be a personal choice.

Trade hours

TD Ameritrade trading and office hours are industry standard. The company was one of the first to announce that they would offer 24-hour trading. This means users can instantly respond to overnight news and events such as global elections.

This move also increased their appeal in Asia, as those who had a stake in US stocks could now speculate on price movement. Clients can trade 12 ETFs in the room between Sunday 8:00 PM EST and Friday 8:00 PM EST.

So, for those interested in premarket hours and a variety of instruments, from index funds to bitcoin (BTC) futures and options, there will always be a trading opportunity at TD Ameritrade.

Contact and customer service

TD Ameritrade now offers 24/7 support via email, text and even Facebook Messenger. User reviews show that the wait time for phone support was less than two minutes. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. Simply go to their website for the 24 hour number where you are based.

Emails are usually returned within 12 hours. Agents are well trained with in-depth knowledge of both trading platforms and accounts. They will be able to help you with any TD Ameritrade.com login problems, or if the site is down.

Unfortunately, the ‘Ask Ted’ live chat support is only for customers using the thinkorswim platform. There is therefore room for improvement in this area. But if you have access to live chat, they can help you with everything from forgotten usernames and premium trading to referral bonuses and option approvals.

Overall, it appears that traders were extremely satisfied with TD Ameritrade’s customer service and help desk. But if you want direct contact, you can go to their many offices or attend one of their events. You can also go to their ‘Contact Us’ section for the nearest postal address to your location.

A brief history

Headquartered in Omaha, Nebraska, TD Ameritrade has been serving clients since 1971. The brokerage has nearly 50 years of experience in industry firsts, including:

- 1998 – TD Ameritrade was one of the first to show touch trading.

- 1994 – They were also one of the first to champion online day trading.

- Late 1990s – TD Ameritrade introduced online options for order entry and electronic trade confirmation via email.

- 2000s – They were the first to guarantee 10 second speed for trading and to create paperless accounts.

Thus, over the years, they have continuously made headlines with innovative solutions to merchant matters. As a result, they now offer global trading in a wide variety of instruments, including bitcoin, money market mutuals, bonds and other fixed assets.

Go to their official website and you will see that the purpose of the broker exchange has always remained the same. They “empowered customers by helping them take control of their financial lives.” But what do user reviews say when you go under the headlines?

Safety and Security

TD Ameritrade takes customer safety and security very seriously, as they should. This means that personal information is protected by advanced firewalls. Anomaly detection and intrusion technology is also used to detect any unusual behavior from your account.

TD Ameritrade websites are secure and use 128-bit encryption to transfer all data between your computer and their websites.

There is also a TD Ameritrade Asset Protection Guarantee that will reimburse your account if you lose money due to unauthorized activity. Their website states that they will “reimburse you for the cash or shares of securities you have lost.”

Although your data and account are relatively safe, there is still room for improvement. For example, a two-factor authentication would further improve their current system.

TD Ameritrade Ruling

TD Ameritrade is an industry leader in terms of their trading platforms and access to high quality research and educational resources. Throw in a $0 minimum deposit requirement, detailed user manuals, and access to after-hours trading, and this should be a serious contender for your broker list.

However, highly active traders may want to think twice because of high commissions and margins. The lack of custom hotkeys and direct access to routing can also give reason to break. Overall, if you are a moderately active trader who wants a strong platform and access to extensive research, TD Ameritrade may be the right choice.