Jesse Livermore, one of the greatest traders who ever lived, said that the big money is made in the big swing of the market. In this regard, Livermore has successfully applied successful trading strategies that work. This helped him achieve incredible financial results. A simple swing trading strategy is a market strategy where trades are held for more than one day. It is usually held between 3 days and 3 weeks. You can identify the right swing to increase your profit.

Our team at Trading Strategy Guides has written about other swing trading strategies that work. Read the Strategy for Trading Harmonic Patterns – Easy Step-by-Step Guide or the MACD Trend Following Strategy – A Simple Trading Strategy. These are some of the most popular strategies ever posted to Trading Strategy Guides.

This time we are going to describe a simple strategy for swing trading. This is similar to what Jesse Livermore used to trade. Let’s look at the swing trading strategy that Livermore used to predict the greatest stock market crash in history. This is the Wall Street Crash of 1929, also known as Black Tuesday. Here is another strategy called a weekly trading strategy that will keep you sane.

By the way, after the stock market crash in 1929, Livermore earned $100 million. Adjusted for inflation, that equates to about $1.39 billion today.

Wouldn’t you say that much money?

Get started with our simple swing trading strategy

If you were to take a swing trading course right now, I believe the current market conditions allow any trader using the right trading technique to achieve solid results. There are a few things I think we should consider before we begin.

One is to determine whether we should trade a counter system or a trending stock setup. Both can work, but you need to decide which one to use. I recommend that you use paper trading on a stock shaker the next time you develop one.

This article is going to have an in-depth look at an important technique for swing trading on daily charts. Although it can be considered advanced swing trading, this strategy is suitable for all investors. It is ideal for home studies. We will tell you how to do proper technical analysis and show you when to enter the trade and when to exit the trade. We will do this by teaching you how to set the right profit goal.

It is important to make sure you have a fully developed training plan before starting a swing trading system. This will help you prepare to be more successful and join the ranks of professional day traders. It is our goal to give you the trading opportunities and help you in every way to become the best swing traders. You can also learn how bankers trade in the forex market.

What is Swing Trading?

Strategies for swing trading are quite simple. Using an intermediate time frame (usually a few days to a few weeks), swing traders will identify market trends and open positions. Name swing trading comes from the fact that we are looking for conditions where prices are likely to swing upwards or downwards.

Swing traders can use a wide variety of technical indicators. What makes swing trading unique is that it combines various components of day trading with the speed of position trading. Swing trading indicators are mainly used to find trends that play between 3 and 15 trading periods. After analyzing these periods, we will be able to determine whether there have been instances of resistance or support.

The next step is to identify the bearish or bullish trend and watch for a reversal. Reversals are often referred to as pullbacks or countertrends. Once the countertrend becomes clear, we can choose our entry point.

The goal is to get into a position where the resistance will quickly return and prices will swing. This is exactly what Jesse Livermore was able to earn most of his fortune.

Now…

Before examining some of the key rules that make a swing trading strategy work, let’s first look at the benefits of using a simple swing trading strategy. You can also read about Budgeting in Forex for Better Trading.

What are the benefits of a simple swing trading strategy?

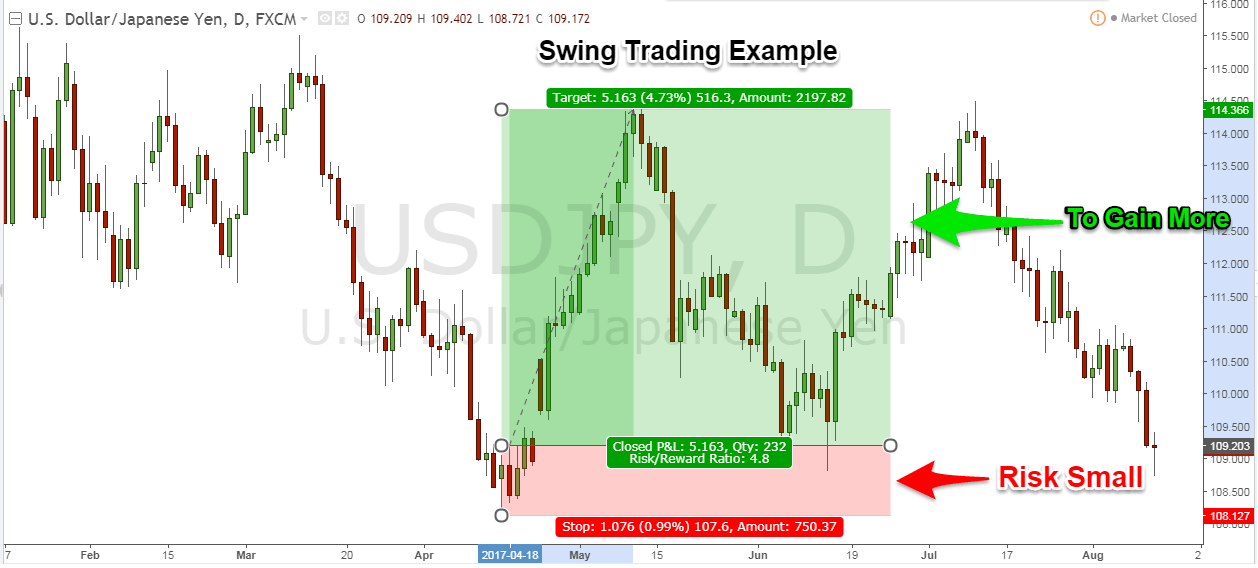

The biggest advantage of swing trading is that it offers high risk to reward trading opportunities. In other words, you will be risking a smaller amount of your account balance for a potentially much larger profit, compared to your risk.

The second benefit of using swing trading strategies that work is that it eliminates a lot of intra noise. Now you trade as the smart money does, which is in the big swing waves. Also read our ultimate guide to the Ichimoku Cloud.

The third advantage of swing trading is dependent on the use of technical indicators. Using technical indicators can reduce the risks of speculative trading and help you make clear decisions. While some swing traders also pay attention to fundamental indicators, this is not necessary for our simple strategies.

The final benefit of using a simple swing trading strategy is that you don’t need to be glued to the screen all day like with day trading strategies. A swing trading plan will work in all markets, from stocks, commodities, Forex currencies and much more.

Like any trading strategy, swing trading also involves some risks. Since swing trading strategies take several days or even weeks to play out, you may run the risk of ‘gaps’ overnight or during the weekend.

Another risk to swing trading is that sudden reversals can cause losing positions. Since you aren’t trading all day, it can be easy to get caught off guard if price trends don’t play out as planned. To reduce the risk of this, we recommend issuing stop orders for each new position. Stop orders can help you lock in your profits and can also help you minimize your losses.

Now…

Before we start, let’s first see what swing trading indicator you need.

The ONLY indicator you really need:

Bollinger Bands Indicator: This is a technical indicator developed by John Bollinger. Bollinger Bands are designed to spot overbought and oversold areas in the markets. It also measures the volatility of the market.

Our swing trading indicator makes it easy to manage the risks of trading and also takes advantage of price changes. Using a chart for candlestick trading can also be helpful. These charts provide more information than a simple price chart and also make it easier to determine whether a sustained reversal will occur.

Many swing traders also keep a close eye on multi-day chart patterns.

- Pattern of head shoulders

- Flag Patterns

- Cups and handle patterns

- Moving average crossovers (also consider the Ichimoku cloud)

- Triangle Trading Patterns

If there are higher lows and stable highs, it indicates to the traders that it is undergoing a period of consolidation. Consolidation usually occurs before a large price swing occurs (which in this case would be negative). Learning more about triangle trading and other geometric trading strategies can make you a much better swing trader.

This swing trading indicator consists of three moving averages:

- The central moving average, which is a simple moving average.

- And then on either side of these simple moving averages are shown two other moving averages at a distance of 2 standard deviations from the central moving average.

The figure above should give you a good idea of what Bollinger Bands look like. Most trading platforms have this indicator in their standard list of indicators.

If you are interested in learning more about how to profit from this amazing indicator – Bollinger Bands – look no further than our Bollinger Bands Bounce Trading Strategy.

The preferred setting for the swing trade indicator is the default settings, because it makes our signals more meaningful. We came to this conclusion after testing the strategy on different stakes.

Now let’s move forward to the most important part of this article, the trading rules of the swing trading strategy that works.

Before we go any further, we always recommend that you write down the trading rules on a piece of paper. This practice increases your learning curve and you will soon become an expert swing trader.

Let’s start…

Swing trading strategy that works

(Trading Rules – Sell Trade)

This strategy really only consists of two elements. The first element of a swing strategy that works is an entry filter. For our entry filter we are going to use one of our favorite swing trading indicators, also the Bollinger Bands. The second element is a price action based method.

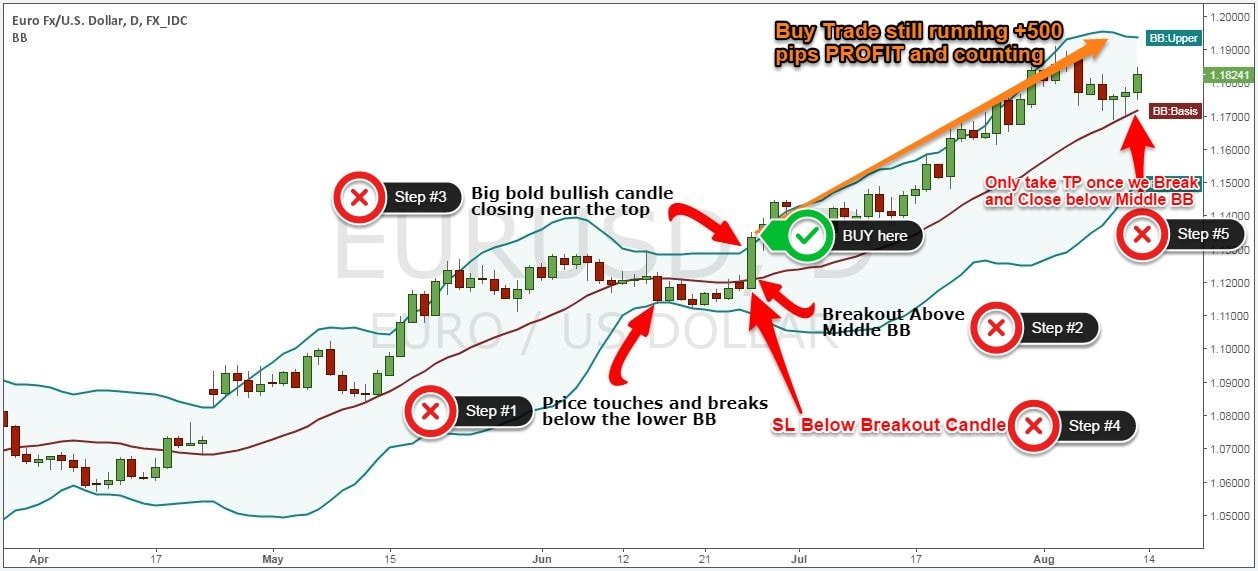

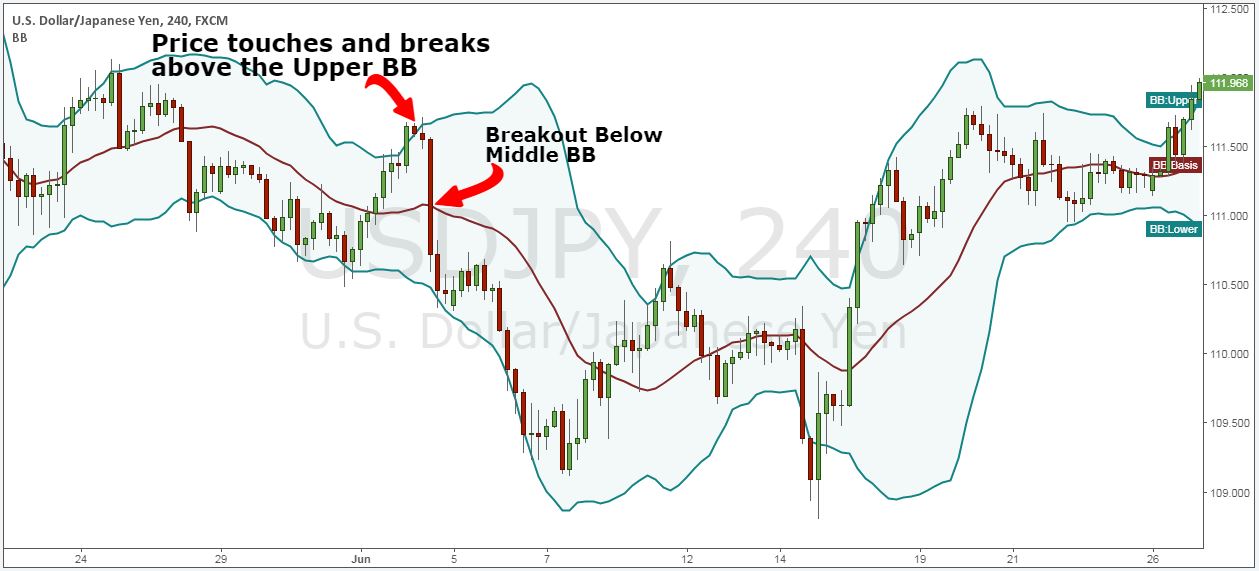

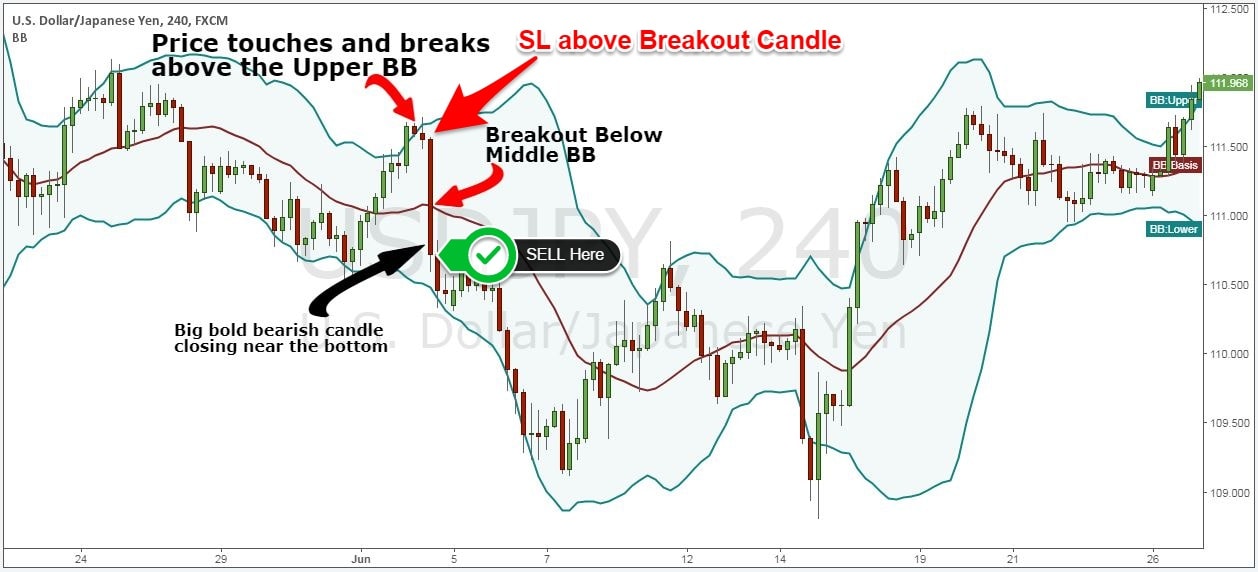

Step # 1: Wait until the price touches the upper Bollinger Band.

The first element that we want to see for our simple trading strategy is that we need to see the stock price move into over-high territory. Any swing trading strategy that works must contain this element.

Note * The preferred time frame for this simple swing trading strategy is the 4-hour time frame. This strategy can also be used on a daily and weekly time frame.

Step #2: Wait for the price to break below the middle Bollinger Bands.

After touching the upper Bollinger Band, we want to see a confirmation that we are in excessive territory and that the market is reversing. The logical filter in this case is to look for a break below the middle Bollinger Band.

This break below the middle Bollinger Bands is a clear sign in the shift in market sentiment.

We at Trading Strategy Guides do not trade breakouts without determining if there are actual buyers/sellers (in our case, sellers) behind the breakout. This brings us to the next step of our simple swing trading strategy.

Step #3: Swing Trading Indicator: The Breakout Candle should open a Big Bold candle that closes near the low range of the candlestick. → Sale at the end of the candle.

So far our favorite swing trade indicator has correctly predicted this sell-off, but we are going to use a very simple candlestick method for our entry. For the entry, we want to see a big fat bearish candle that breaks below the middle Bollinger Band.

The second element of this candlestick based method is that we need the candlestick to close close to the low range of the candlestick. This is an indication of strong sellers looking to drive this currency pair much lower.

Every swing strategy that works must have a simple entry filter.

We still need to define where to place our protective stop loss and where to take profits, which brings us to the next step of our simple swing trading strategy.

Step 4: We hide our protective stop loss above the Breakout Candle.

The distribution candlestick has a lot of meaning because we used it in our candlestick based entry method. We have assumed that this candle shows the presence of real sellers in the market. If the high of this candle were to be broken, it is clear enough that it is simply a fake breakdown, as there are no real sellers.

There’s nothing complicated about it, is there?

If you want to learn more about this momentum technique and managing momentum trading, read our article on trading strategies used by Professional Traders.

The next part of our simple swing trading strategy is the exit strategy based on our favorite swing trading indicator.

Step 5: Take profit once we break and close again above the middle Bollinger Bands.

In this particular case we look at a short trading example. So, if the price breaks above the middle Bollinger Banks, it is time to worry and take our profits, as this could mean a reversal.

The reason why we make a profit here is quite easy to understand. We want to discuss the gains against the early sign that the market is ready to roll over.

Comment * The above was an example of a SELL trade. Use the same rules but in reverse for a BUY trade. In the figure below you can see an actual BUY trade example using our simple swing trading strategy.