Swing trading options strategy

The swing trading options strategy is an uncomplicated approach that will generate quick and safe profits. This is the best option for swing trading options that our team at Trading Strategy Guides has used for many years to search the market for significant returns. You can identify the right swing to increase your profit.

If you are new to options trading, we recommend that you start by reading our very profitable options guide that will help you trade stock options: How to Trade Stock Options for Beginners – Best Strategy for Trading with options.

The swing trading options strategy has three focus advantages:

- The potential to experience significant gains on your initial investment.

- The best options for swing trading can limit your risk exposure.

- You can trade high priced stocks with a very small account.

If you are trading a small trading account, swing trading options are a good strategy to leverage your initial investment. You don’t necessarily need a lot of capital to trade with the best options for swing trading, as you can trade the ‘expensive’ stocks like Amazon, Netflix or Alphabet without spending large amounts of money.

The swing trading options strategy tends to mostly stick to the basic Calls and Puts Options.

If you want to buy a stock, you buy Call Options. Conversely, if you want a more convenient way to sell a stock, the best way is to buy call options. Also read the weekly trading strategy that will keep you healthy.

Why options for swing trading?

The simple reason why we have chosen Swing Trading Options as the most important strategy to profit from trading the stock market is because of the huge profit potential.

Everyone loves to earn big profits and the swing trading options strategy is a safe and secure investment tool to achieve your money goals.

Now…

Let’s go a little deeper and describe some of the more prominent principles behind Swing Trading Options.

Swing Trading Options Strategy – Buy Call Options

The swing trading options strategy is a six-step process that can be applied in ANY market. What you are about to learn are simply the best options for swing trading.

You can simply think of it as a set of principles that can help you understand options trading and how to effectively implement a swing trading options strategy.

Also read our simple gold trading strategy here.

Step # 1: Choose the right stock

This is immediately your first step when looking at Options for swing trading.

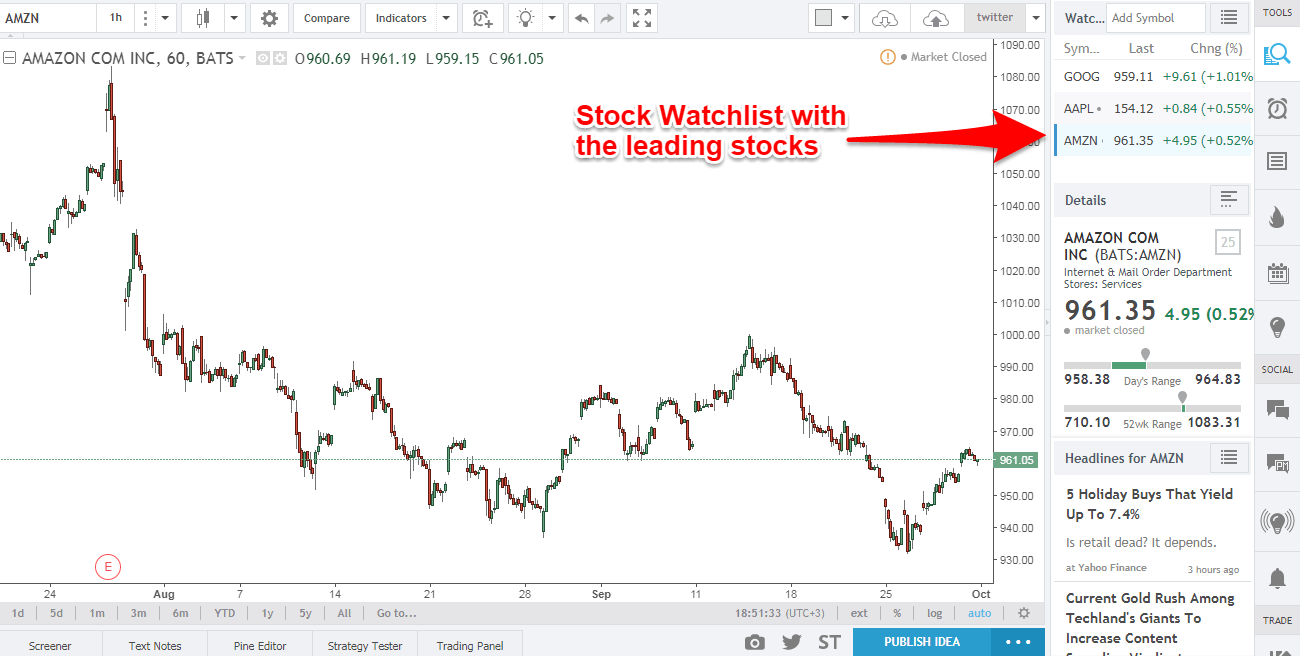

Choosing your stock can be a daunting task because there are numerous stocks listed on the New York Stock Exchange and available for trading. Of course, what you want to do is compile a solid sector list of the leading stocks.

Wait for move out and a large percentage move in your stock list and use the stocks to implement the swing trading options strategy.

Even better, if the bigger percentage move is due to some earnings reports and a strong catalyst is behind, because that means the share price is being driven by strong fundamentals.

Step #2: Assess the market environment, look for Bullish Trend if you want to buy call options

You had to know what kind of market you are successfully trading the best options for swing trading.

Once you understand what kind of market you are in, it will guide you on which side of the trade you want to be, long or short.

The simplest method to define a bullish trend is to look at a series of higher highs and higher lows.

Additionally, you need to determine the overall market trend, also determine the characteristics of your market environment: low volatility versus high volatility. This will help you to choose the expiry date of your Options for swing trading later. Also learn about the difference between options vs RSU .

Step #3: Choose your strike price

The next step that a swing trading options strategy should give you is the strike price.

Pricing the strike can be a difficult task if you don’t know what to look for. What you want to do is ideally pick an out-of-the-money option, but one that isn’t too far out-of-the-money and goes in-the-money.

What is the money option?

According to Investopedia, “out of the money (ATM)) is a term used to describe a call option with a strike price that is higher than the market price of the underlying asset, or a put option with a strike price that is lower than the market price of the underlying asset. ”

Step 4: Choose your expiration date – monthly options

An optimal swing trading strategy requires giving your stock enough time to come through your strike price so that it can pay you on that call option, otherwise your option may expire worthless.

As a general rule, if your expiration time is too large, on the one hand, the risk decreases, but at the same time, the percentage profit also decreases.

In other words, if you buy more time, you are going to be taking significantly less risk and your potential losses are going to be much smaller.

The best approach for swing trading options is to use monthly options as you get a relatively higher percentage profit.

Step #5: Optimize entries and exits – buy on pullbacks

The most important part of the best options for swing trading is optimizing your entries and exits.

As a general rule, be aware that swing trading options takes time and you need to be patient.

With the best options for swing trading, you can also afford not to have the best type of entries on some of your swing trades, because as long as you are patient, you can get cheaper prices.

When buying call options, one trading tactic you can use to optimize your entry is to buy on pullbacks.

You can use our trading tactics here to trade the pullbacks: How to profit from trading pullbacks?

Also, always define a maximum stop loss after buying an option and align your profit with where you think the market will be before your option expires.

Step #6: Manage the trade

In periods of low volatility, you want to reduce your position when swing trading Options.

If you still believe in your trade, and you think you need more time, you can roll your option over to the next month. This is what the smart money trades so they don’t lose due to time wasting.

* Note: the time decay is simply the ratio that measures the changes in the price of an option relative to the decrease in time to expiration.

The most profitable options trading strategy should be suitable for executing both Put and Calls options.

* Note: Above is an example of a buy call option using the trading tutorial. Use the exact same rules – but in reverse – to buy a put option.

In the figure below you can see a real example of buying options using the best options for swing trading.

Closure

The swing trading options strategy is a powerful option for swing trading, but like any other strategy, it does require some knowledge to use it correctly. We hope our best swing trading options will help you earn steady profits.

There are many opportunities to make money with Options for swing trading because it can be very profitable and is a much safer way to trade than simply trading stocks. You can also take our Trader Profile Quiz.

The daily volatility in the stock market tends to shake a lot of people out of their trades, and the best options for swing trading tend to lighten the price action a bit, so they tend to reflect a bit more stable trading opportunities. Also read the best strategy for binary options.

Thanks for reading!