We’re going to answer the question all the time: How does Robinhood work? Robinhood is a free, US-based stock trading app that enables 100% commission-free stock, options, cryptocurrency and ETF trades. This guide will teach you everything you need to know about Robinhood so you can trade effectively.

If this is your first time on our site, our team at Trading Strategy Guides welcomes you. Be sure to click the subscribe button to get your free trading strategy delivered to your inbox every week.

The biggest reason why the RobinHood is so popular is because of their commission-free nature. In short, they charge no trading fees and they have a minimum account of $ 0. Which begs the question, how does Robinhood earn?

We are going to answer this question and more in the coming sections. At the end of this guide, you will know exactly how Robinhood works and how to start trading.

In 2019, the RobinHood app managed to become the largest online stock broker in the US, surpassing E-TRADE. Until this year, E-TRADE was the largest broker in terms of the number of customers. Today, Robinhood is the most popular mobile trading app, with over 6 million customers.

First, let’s start by answering the first basic question, what is the Robinhood?

What is Robinhood?

Robinhood is a broker-dealer app that allows users to trade stocks, options and ETFs with zero commission fees. You can also buy and sell cryptocurrencies on Robinhood App.

Robinhood allows users to trade cryptos such as Bitcoin, Ethereum and Litecoin. Because the Robinhood does not charge any trading commissions, it is much easier for a beginner trader to learn how to make money. The second advantage you have is that there is no minimum deposit requirement to start trading with Robinhood App.

You can start investing with Robinhood App with any amount. The downside is that they don’t offer tax-sheltered accounts like IRAs or other types of retirement accounts. Another downside of Robinhood is that they don’t offer automated trading features right now.

You can trade the following instruments in the RobinHood app:

- supplies

- ETF

- Reits

- options

- Cryptocurrencies

RobinHood was the first brokerage account to introduce $0 commission trading. Normally, when you start trading stocks, a stockbroker will charge you between $5 and $15 to buy stocks. If you want to take profit and sell, the stockbroker will charge you another fee.

This is not the case with Robinhood. The Robinhood app also allows users to profit trade through Robinhood Gold, their premium account level. Their commission-free model and a wide variety of tradable instruments saw this app experience meteoric growth in 2019.

Now let’s answer another question that many new prospective traders have:

Is Robinhood safe?

Is Robinhood Legit?

Is Robinhood legit? Is the Robinhood app secure? These are legitimate problems that any individual investing in the stock market may have. You can trade with peace of mind because your money on RobinHood is protected by the Securities Investor Protection Corporation (SIPC) up to $500,000 for securities and up to $250,000 for cash claims.

Additionally, Robinhood is also regulated by the Financial Industry Regulatory Authority (FINRA), making Robinhood safer to use. As far as the security is concerned, the money of the investor is very well protected.

Since Robinhood is a stockbroker, it must be regulated by the financial regulatory authorities in the US, namely the Securities and Exchange Commission (SEC). In addition, Robinhood is also regulated by the SEC, and it also has other security procedures to protect your hard-earned money and your private data.

Although opening an account with Robinhood is different from the traditional stock brokerage account, they are still required by law to collect certain information from their customers. This includes trading activities and tax information. To submit the tax forms for information, you must give them your Social Security Number (SSN).

But the app doesn’t come without its dangers.

Trading on the go and being an inexperienced trader can be a recipe for disaster. That’s really the only danger the RobinHood App poses. That’s because it bills itself as millennials’ most popular app for investing.

And we know that many Millenials still lack the financial literacy to become a successful stock trader.

The good news is that the app itself is simple and easy to use, even for new traders.

Next, we’ll give you a basic idea of how Robinhood works. See below:

How does Robinhood work?

RobinHood works the same way as any other online and options broker . You follow the same standard process:

- First, you submit your application form to open an account with Robinhood.

- Secondly, you transfer your funds to the RobinHood account.

- Once the money hits your Robinhood account, you can start buying and selling stocks, options, ETFs and cryptocurrencies.

If you’re not familiar with Robinhood’s sleek interface, you should know that it offers several ways to buy stocks.

In the next section, we’ll show you an example of how you can buy and sell stocks on Robinhood from the comfort of your smartphone.

Using an investment app can be intimidating and scary, but it’s actually quite easy Buying and selling stocks on RobinHood is as simple as following the 7 steps:

- Upload the RobinHood app.

- Search for your favorite stock, ETF or cryptocurrency.

- Tap on the “Trade” button.

- The next page gives you the option to buy or sell. Tap the “Buy” button.

- Select your Order type in the top right and the number of shares you wish to buy.

- Confirm your order.

- Swipe up to submit the order.

Pro Tip – To be as efficient as possible, you can create a watchlist for quick access to your favorite stocks.

Don’t forget to read our guide where we have outlined the general principles and the best way to pick stocks for day trading: Best stocks with mountains of cash.

Now let’s talk about something more controversial; how does robinhood earn money ? See below:

How does Robinhood earn money?

Can a stockbroker make money without charging a commission and offering free stock trading?

It seems that RobinHood has managed to appeal to investors and continues to earn income from various sources of income. Moving forward, we’re going to break down how RobinHood can afford to offer you commission-free trading and still make money as a company.

The way Robinhood makes money is actually very transparent. All the income sources are listed on their website. RobinHood App does not charge a trading fee like its competitors E*TRADE or TD Ameritrade. But Robinhood generates its profits from the following revenue streams:

- Premium Accounts. Robinhood Gold is a premium feature that enables margin trading and other benefits. RobinHood Gold starts at $5 per month.

- Margin Interest. Like any other stockbroker, RobinHood earns interest on customer cash, in the same way that banks collect interest on cash deposits.

- They charge $10 for any transaction made via a phone call.

- They can also help with the purchase of foreign stocks for about $35 – $50.

- Payment for order flow. This is a common practice in this industry.

Again, there are no hidden fees for RobinHood! You could now argue that the sell flow to high frequency trading (HFT) results in a delayed fill of your order. Your order to buy shares may be passed to these HFT firms before going to the actual exchange. This in turn can lead to worse filling of your order, so it is seen as a hidden cost in the execution of the trade.

But everyone in this business is probably selling your order to these HFT firms before it gets passed on the exchange. So there is no exemption from this practice. You have to get used to it and accept it as a way of doing business.

If you want to learn how to work high frequency then check out our HFT guide HERE.

Since we are followed by a wide variety of traders, we can discuss another topic that we are sure some of you will appreciate. Namely, we are going to give you a quick guide on how to trade options on Robinhood.

See below:

How to trade options on Robinhood

Before buying and selling options on RobinHood, make sure options trading is unlocked on your Robinhood account. Depending on your experience level, you will get a level 2 designation if you are a beginner trader and a level 3 designation if you know how to execute more complicated options strategies.

With a level 2 designation, you can trade the following options:

- Buy call and put. Learn how to buy stock options by following the step-by-step guide on how to trade stock options for beginners.

- Covered calls. Become a smart options trader with this covered call strategy.

- Cash covered deposit.

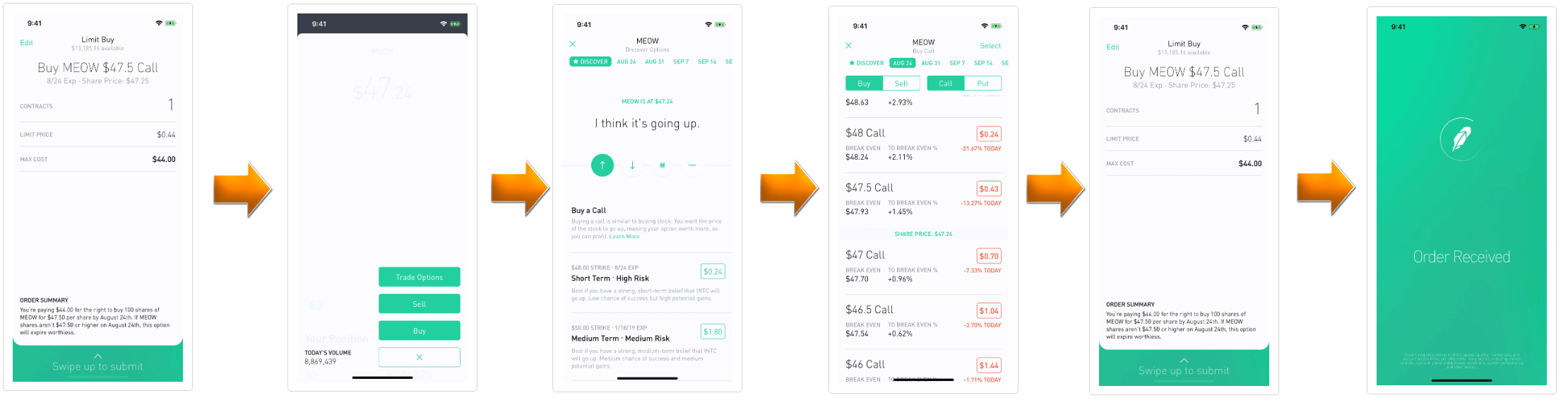

Opening an options trade on RobinHood is as easy as following these three simple steps:

- Tap on the magnifying glass and search for your favorite stock that you want to trade options on.

- Tap Trade in the bottom right corner of the Stock’s Detail page.

- Tap on trading options.

(Click on the picture to enlarge) Take a look at the different options trading strategies in our Options Investing Strategies Guide.

Final words – how to earn money on RobinHood

For a certain type of stock traders, the RobinHood app can be the best stock trading app.

Just because the barrier to opening a RobinHood account is so low, you still need to do your own research if you don’t want to disappear. Follow our guide on how Robinhood works before you click the buy button.

Get a Free Stock with Robinhood If you open a new account today, you can open it now and get a free stock by opening an account with this link. Although we have already given you some reason, RobinHood is legit, but it cannot guarantee that you will always earn money.

But you know that your funds are secured and that you are trading shares via a trusted trading platform. If you have no problem with How Robinhood Earn? and you would like the ease of trading through your smartphone to continue trading your free stocks today.

Thanks for reading!