The Murrey Mathematical Trading Lines Strategy is the most attractive Forex trading strategy because it is suitable for all time frames and it can be used to trade different markets such as stocks, commodities and Forex currencies.

Murrey Math is a complex set of support and resistance levels that behave more or less the same as pivots, but it also provides some insights into whether the current trend should continue or reverse. The Murrey math concept was developed by T. Henning Murrey in 1995 and was described in detail in his book “The Murrey Math Trading System For All Traded Markets.”

First of all, we must emphasize that one of the most important principles of Murrey mathematics is that the markets behave in the same way. The main assumption is therefore that smart money behaves the same in all markets, and that the different markets therefore have the same characteristics.

Definition of the mathematical lines of Murrey

The Murrey math is based on observations made by WD Gann in the first half of the 20th century. The Murrey mathematics was inspired by the Gann theory and he created a geometric system that can be used to describe the price movements of the market in time. The geometry facilitates the use of Gann trading techniques. The Murrey math geometry is very elegant in its simplicity, making the Murrey math trading lines strategy a perfect automated fractal trading system. The core element of the Murrey trade is that the price movement of any market will retrace in multiples of 1/8, 2/8 to 8/8. As prices move in 1/8s. Murrey math divides prices into 1/8 intervals.

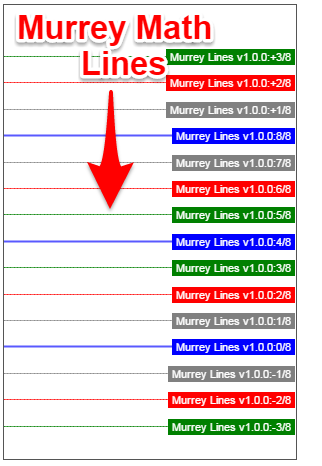

Murray Math Lines

The Murrey Math lines consist of 8 “pivots”, with each line having a different meaning to the price action. What the Murrey mathematical trading strategy essentially does is divide the price into 8 important levels, with the 8/8, 4/8 and the 0/8 levels being the most important pivots.

Now…

Before we move forward, we need to define the indicators you need to trade in the Murrey Mathematical Trading Lines Strategy and how to use Murrey Lines.

The only indicator you need is the:

Murrey Lines indicator which can be found on most popular Forex trading platforms (MT4 and TradingView) under the indicator library.

The Murrey lines have nine main components or variables plus 6 extra pivots that can reveal extreme oversold or oversold conditions, and each of them will tell you a different story about the price action as follows:

- [+3/8] P – Imminent Bearish reverse

- [+2/8] P – Extreme conditions, can turn around at any time

- [+1/8] P – Leftover conditions

- [8/8] P – Ultimate Resistance, Overbought Extraordinary Circumstances

- [7/8] P – Poor level, place to stop and turn around

- [6/8] P – Strong Pivot Reverse

- [5/8] P – Top of the trading range

- [4/8] P – Important support / resistance pivot

- [3/8] P – Bottom of the trade section

- [2/8] P – Strong, Twist, Reverse

- [1/8] P – Poor, place to stop and turn around

- [0/8] P – The hardest line to fall under is oversold conditions

- [-1/8] P – Oversold conditions

- [-2/8] P – Extreme oversold conditions, can reverse at any time

- [-3/8] P – Impending bullish reversal

Now that we have a solid idea of what each of the Murrey lines are, it’s time to outline the Murrey trading rules. Without further ado, here is a step-by-step guide to Murrey trading:

Strategy for Murrey Math Trading Lines

(Rules for a buy trade)

Step 1: Look at the 15 minute time frame and make sure we are trading below the 4/8 Murrey Lines (the middle blue line)

The first buying condition of the Murrey trading strategy to be verified is that the price must trade below the 4/8 Murrey Lines. Although this strategy can be applied to all time frames for the purpose of this Murrey trading strategy we are going to use the 15 minute chart.

The Murrey lines are dynamic pivots that change with fluid price action, which is one of the reasons why the price action will usually be between 0/8 and 8/8 Murrey lines, with the 4/8 pivot being the most important level. Also read this strategy on day trading price action. It is not enough that the price trades below the 4/8 Murrey Lines, which brings us to the next condition of the Murrey Math Trading Lines strategy:

Step 2: Once the price trades below the 4/8 Murrey lines, it must also trade below the 2/8 Murrey lines.

The main reason why we also need the price to drop below the 2/8 Murrey Lines is that we need the price structure to create space between the Murrey lines. This will ensure that once we break higher again, it increases the probability of the 4/8 Murrey lines being successfully broken.

A picture speaks a thousand words, so here’s a look: All we need to determine is where to start in our long trade, which brings us to the next step of our Murrey Math Trading Lines strategy:

Step #3: Start a long trade once we reverse and break above the 4/8 Murrey Lines.

The 4/8 Murrey line is the line in the sand for buyers and sellers and has the ability to correctly indicate a change in market sentiment once it is broken. In this regard, we want to enter a buy market order as soon as we break above the 4/8 Murrey lines.

If you want to be more conservative, you can always wait for the closing price of candles to make sure it is a real breakout.

Now it’s time to learn where the ideal place to hide our stop loss is, which brings us to the next step:

Step 4: Place your protective stop loss below the 0/8 Murrey lines

The 0/8 Murrey lines are the most difficult pivot for the price to fall below, which is why it is the ideal place to hide our protective stop loss order. There is also no need to add any extra buffer as we don’t want to lose more than necessary.

Now let’s go ahead and determine where we can take our profit:

Step 5: Take partial profits (preferably 50% off your entire order) on 6/8 Murrey Lines and also move the SL to BE

The 6/8 Murrey line is the first strong pivot from which the price can turn, so we want to take our profits there. At the same time, the next action you should take is to protect your remaining position by moving your SL to BE.

Now let’s go ahead and see where we need to liquidate the remaining part of our trade.

Step #6: Take the final profit on 8/8 Murrey Lines

Ultimately, we need to exit trade once we reach the 8/8 Murrey line, which is the ultimate resistance level, and it indicates extraordinary conditions that have been overbought in the market.

It is important to mention that if the market breaks the 4/8 pivot both times on both sides, it is best to wait until you can clearly apply the Murrey trade setup by applying step 1 to step 3.

Note ** The above was an example of a trade with the Murrey Math Trading Lines Strategy. Use the same rules – but in reverse – for a sale. In the figure below you see an actual SELL trade example using the Murrey Math Trading Lines strategy. Here are some trading conditions you want to avoid in the forex market.

Closing

The Murray Math Trading

Lines strategy is the ultimate support and resistance system because unlike the simple support and resistance levels, the Murrey lines are mathematically driven and have a greater influence on how the price reacts to each of these levels.

The same Murrey trading principles outlined in this article can be applied to any instrument because, according to Murrey, “all markets behave the same way like a herd”, and can be used on any time frame to suit your trading style.

Thanks for reading the Murrey Trading Strategy.