Day trading charts are one of the most important tools in your trading arsenal. But it is difficult to understand Renko from Heikin Ash, or to judge the best interval from 5 minutes, intraday or by tick chart. Here we explain charts for day trading, identify free charting products and hopefully transform trading without charts.

This page outlines the best trading charts for 2020, including bar charts, candlestick charts and line charts. It then provides guidance on how to set up and interpret your charts. Finally, you’ll get the best tips on where to get the best free and paid for mapping software.

Best charts for day trading

There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. Your job is to find a chart that best suits your individual trading style.

Each chart has its own advantages and disadvantages. However, day trading with candlestick and bar charts is particularly popular as it gives more information than a simple line chart.

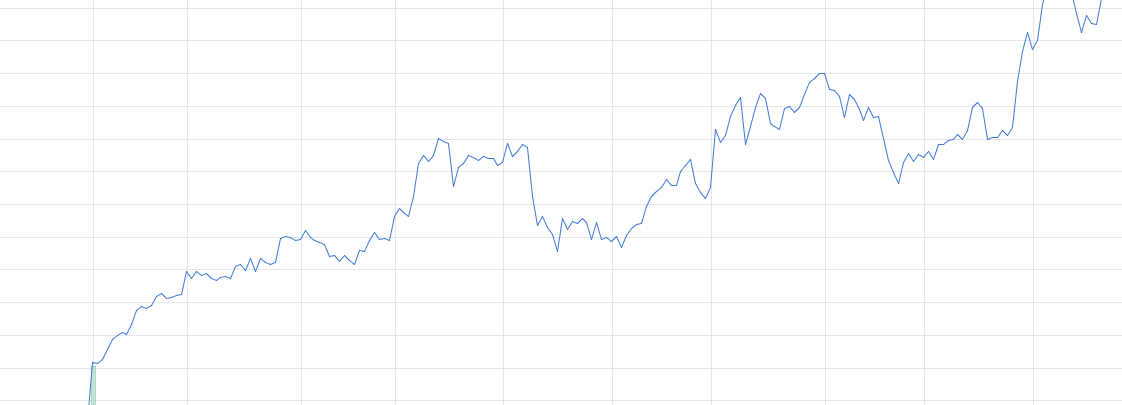

Line charts

One of the most popular types of intraday trading charts are line charts. But it only gives you the closing price. You will still select a time frame, but the chart will only show the closing prices for that period, for example five minutes.

Each closing price is then connected to the next closing price with a continuous line. A line chart is useful for cutting through the noise and gives you a brief overview of where the price has been. However, you don’t want to base your trading decisions solely on this data, as essential information is missing.

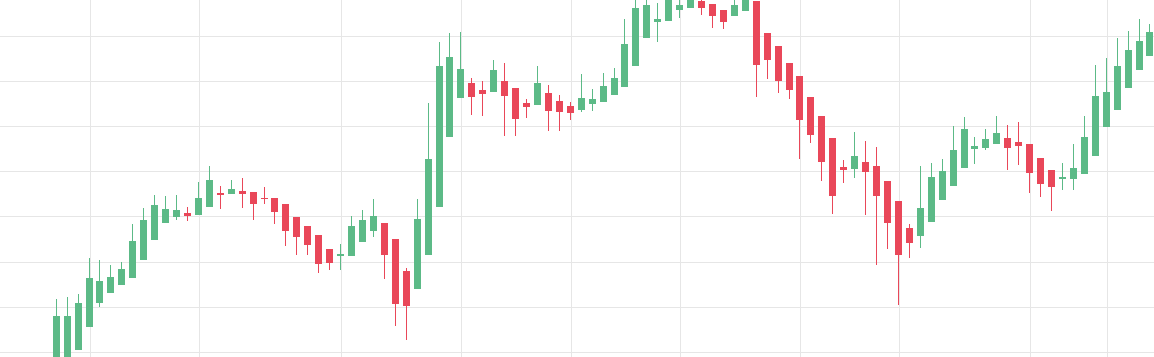

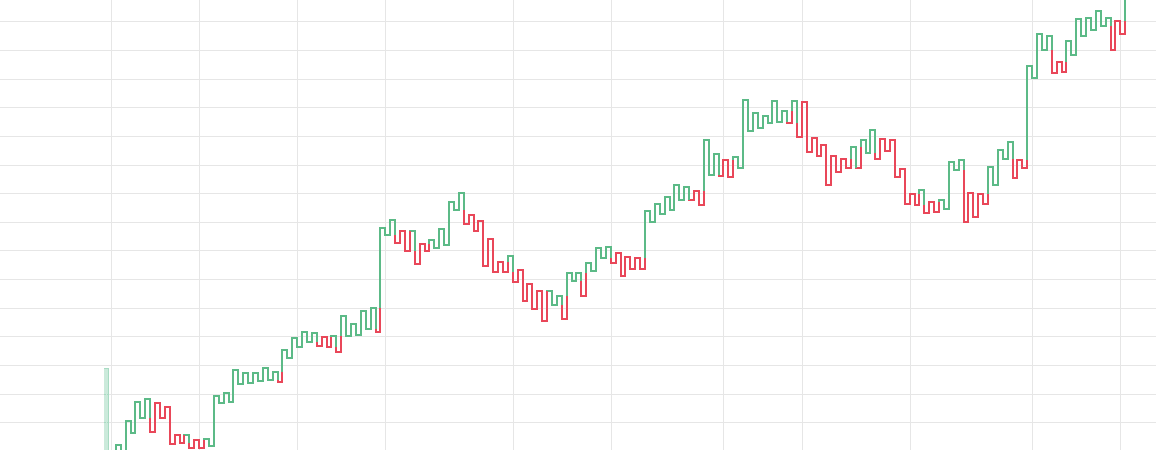

Bar and Candlestick Charts

Most trading charts you see online are bar and candlestick charts. It gives you the most information, easy to navigate. Simply put, they show where the price has traveled within a specified period of time.

The size of the bar/candle depends on the time frame you have chosen for. Let’s say that the price bar or candle is generated every five minutes. Bar and candlestick charts will show the price of the first trade that occurred at the start of that five minute period, plus the highest and lowest trade prices during that period. In addition, you also see the final (closing) price of the five-minute period.

Below you will find more tips to find the best intervals for day trading charts.

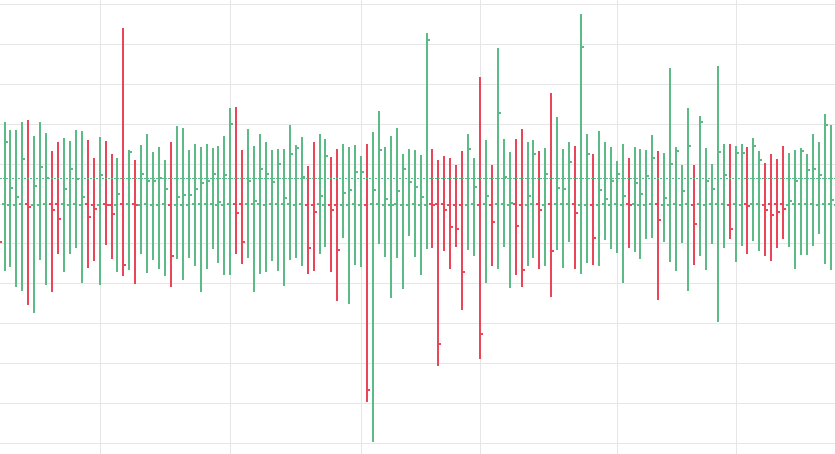

Bar Charts

Bar charts consist of vertical lines that represent the price range in a specific period. The horizontal lines represent the opening and closing prices. If the opening price is lower than the closing price, the line is usually black and red for vice versa.

Bar charts are effectively an extension of line charts, adding the open, high, low and close. It remains relatively simple to read, while providing you with some important data to act on.

Tick

Day trading with ticks is not common, but some traders swear by it. The bars on a tick chart develop based on a specific number of transactions. So a 415 tick creates a new bar every 415 transactions.

This allows you to edit your entries with ease, which is why many people believe that ticks are best for day trading. It will not be affected by time, so in times of high trading activity you can form a bar every minute, but in slow periods it can take several hours. This means that in high volume periods, a tick chart will show you more important information than many other charts.

Candlestick Charts

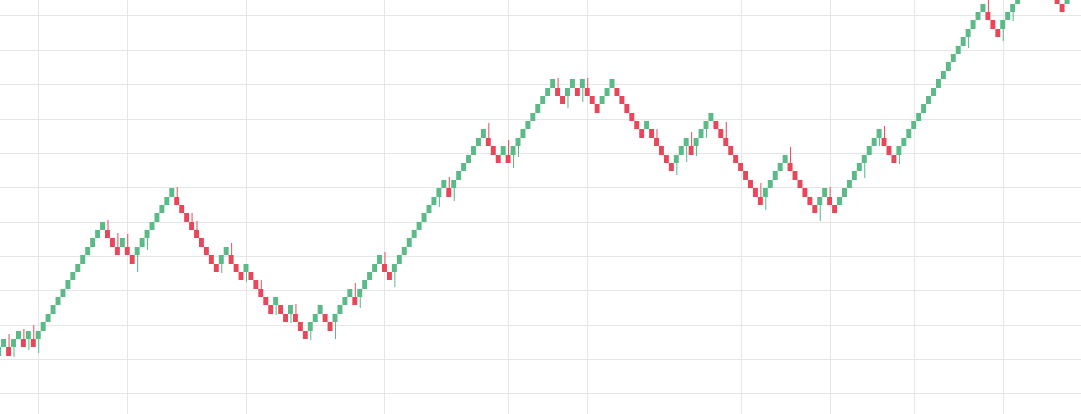

Heikin-Ashi

If you day trade, a pdf with heikin-ashi charts will probably come across your screen at some point. This form of candlestick chart originated in Japan in the 1700s.

Why do people use it? Because they filter out a lot of unnecessary information, you get a crystal clear view of a trend. This makes it ideal for beginners. But they are also handy for experienced traders. The Heiken-ashi chart will help you keep trending trades and spot reversals straight away.

Renko

If you are looking to day trade with charts, you may want to consider a Renko chart. ‘Renko’ comes from the Japanese word for bricks, ‘renga’. A Renko chart only shows you price movement. You will not get any time or volume indications.

As soon as the price exceeds the top or bottom of the previous brick, a new brick is placed in the next column. White bricks will be seen if the trend is up and black bricks if the trend is down. It is especially useful for identifying key support and resistance levels.

Kagi

All a Kagi card requires is the reversal amount that you specify in percentage or price change. Once the price turns in the opposite direction through the predetermined reversal amount, the chart changes direction.

You see different line widths in a Kagi chart. If the market is higher than a previous swing, the line will thicken. Similarly, if it goes below a previous swing, the line will become thin.

Kagi charts are good for day trading because they highlight breakouts of swings and lows. It is also fantastic for finding support and resistance levels, allowing you to spot the bias of the market.

Timing

Online you will see many day, 1, 5, 15 and 30 minute charts. All chart types have a time frame, usually the x-axis, and this determines the amount of trading information they display.

While most are based on time, some will focus on the number of trades. The most common are:

- time

- check mark

- Share

- Price range

A 5-minute chart is an example of a time-based time frame. Every 5 minutes a new price bar is formed showing the price movements for the five minutes. Any number of transactions can appear during that time frame, from hundreds to thousands.

Part of your day trading chart setup should specify a time interval. If you don’t plan on being glued to your screen all day, you probably want to use a lower time frame. If you plan to be there for the long haul, a higher time frame might suit you better.

This is simply because you only trade for a few hours, a 15 minute chart will only create a limited number of measures. No matter how good your charting software is, it will struggle to generate a useful signal with such limited information.

Indicator issues

There is another reason why you should consider time in your chart setup for day trading – technical indicators. Not all indicators work the same with all time frames. You may find lagging indicators such as moving averages work best with less volatility. You can then benefit from a longer moving average on your daily chart than if you used the same setup on a 1-minute chart.

There is no wrong or right answer when it comes to time frames. Just remember if you are reading charts for day trading, firstly, how long will you be on your screen waiting for the signals to show? Second, what time frame do the technical indicators work best with?

Understanding Day Charts

So you’ve set up your card. But now you need to master the day trading chart analysis. It’s no use having a map with all the answers if you can’t decipher the lines, ticks and bars to get your hands on it.

Technical indicators

Add too many indicators, and there will be a sea of colors and lines that slow down the decision-making process. Many people make the mistake of cluttering their charts and not being able to interpret the data. Instead, consider some of the most popular indicators:

- Volumes indicator – this will not tell you what price the price is going, but it will let you know if there is a significant number of trades, and if the big players are in the game.

- Simple Moving Average (SMA) – A ten period moving average is one of the most common indicators among intraday traders. This will highlight an important price movement early and show in which direction. Choose a slower moving average and you may lose profits if the trends end or reverse.

- Average True Range (ATR) – This gives an accurate depiction of volatility based on the actual price of the instrument. This leaves you with no choice but to assess each security on an individual basis. This ensures that accurate trading decisions are made.

- Oscillators – These are a group of indicators that usually flow between the upper and lower bounds. This is handy if the trend is not clearly visible. The most popular are RSI, MACD and Commodity Channel Index (CCI).

Chart Patterns

How do you know when thousands of trade possibilities are on your chart, when to enter and exit a position? You should be on the lookout for the best day trading patterns. Patterns are great because they help you predict future price movements. They operate on the basis that ‘history repeats itself’.

Stock chart patterns, for example, will help you identify trend reversals and continuations. You will usually find two themes in your chart analysis, breakdowns and reversals. The former is when the price clears a predetermined level on your chart. The latter is when there is a change in the direction of a price trend.

Some of the most popular patterns are listed below.

- Morning consolidation

- Late consolidation

- Little to no price retracement

- Spring in support

- Out of range against resistance or support

- Pennant

- Head and handle

- Ascending triangle

- MetaTrader – This is ideal if you are looking for daily forex charts. Trading with this MetaTrader offers in-depth and easy to navigate charts. You also get a number of time frames to choose from.

- eSignal – eSignal offers extensive customization but a relatively limited variety of technical indicators. It is ideal for beginners who want to familiarize themselves with trading cards.

- NinjaTrader – This low cost integrated trading and charting software system offers crystal clear charts in every format under the sun. You will also benefit from research tools and a handy trading simulator.

- Sierra Chart – This trading platform not only offers easy charting, but you also get extensive technical analysis tools. It also offers a demo account, plus real-time and historical data.

- TradeStation – You benefit from flexibility and multi-data charts. Additionally, you get access to indicators with alerts and a number of intelligent drawing tools.

- Technician – You get real-time daily charts for all US stock markets and forex. Plus, you get delayed data from global stock exchanges and futures markets.

- TradingView – You get real-time stock charts on 1, 3, 5 and 15 minute timeframes. You can also get forex and bitcoin charts, while futures data is delayed. You get access to hundreds of technical indicators and the ability to set up watchlists and alerts.

- FreeStockCharts – You get trading charts for crypto, futures, stocks and all the other major markets. You get time frames of 1, 2, 3, 5, 10 and 15 minutes to choose from. You can save portfolios, create different chart layouts and take advantage of a whole host of technical indicators and charting tools.

- Descending triangle

- Triple bottom

- Head and shoulders

et al have all the technical analysis and tools just a few clicks away.

Most brokers offer charting software, but some traders opt for additional, specialized software. If you are new to day trading with charts, the standard software you get from your broker should cut the mustard.

All of the popular charting programs below offer line, bar, and candlestick charts. They also all offer extensive customization options:

If you want a free free map software, consider the more than adequate examples in the next section.

Free charts

The good news is that many day trading cards are free. You get most of the same indicators and technical analysis tools that you would pay for live charts. You will also find that some of the free options offer a space for traders to follow experienced traders, and discuss instruments and markets with each other.

These free charting sites are the perfect place for beginners to find their feet, and provide you with the best chart reading tips. Some also offer demo accounts. This gives you the opportunity to trade with simulated money first while finding the queues. It’s ideal to try a bunch of different charts until you find the right one to complement your trading style.

Some of the most popular free online trading cards are:

Key points

Trading cards are detailed on this page. So you should know that trading without charts on that day misses out on a wealth of useful information. Used correct charts can help you sift through past price data to better predict your future changes. There are quite a few mapping software out there, including several free options. View charts with generous customization options, offering a variety of technical tools to identify your telltale patterns.

You can also find an outline of popular patterns, next to easy to follow.

Software

You can find a whole range of charting software, from day trading programs to web-based platforms. With good mapping software, you can easily create visually appealing maps. You mo