The exponential moving average is the oldest form of technical analysis. It is one of the most popular trading indicators used by thousands of traders. In this step-by-step tutorial, you will learn a simple exponential moving average strategy. Use what you learn to transform your trading and become a successful long-term trader! A moving average can be a very effective indicator. Many traders use exponential moving averages, an effective type of moving average indicator, to trade in a variety of markets.

An exponential moving average strategy, or EMA strategy, is used to identify the dominant trend in the market. It can also provide the support and resistance level to execute your trade.

Our team at Trading Strategy Guides has already discussed the topic trending towards systems. You can review the trend here, MACD Trend Following Strategy – Simple to Learn Trading Strategy. You can also learn the basics of support and resistance here, Support and Resistance Zones – Path to Successful Trading.

Make sure to go through the recommended articles if you want to better understand how the market works. Building a foundation of understanding will dramatically improve your outcomes as a trader.

The exponential moving average EMA strategy is a universal trading strategy that works in all markets. These include stocks, indices, Forex, currencies and the market for cryptocurrencies such as the virtual currency Bitcoin. If the exponential moving average strategy works on any kind of market, it works for any time frame. In simple terms, you can trade with it on your preferred card. Also read the hidden secrets of moving average .

First, let’s look at what a moving average is and the exponential moving average formula. After that we will go to the most important rules of the exponential moving average strategy,

Exponential moving average formula and exponential moving average explained

The exponential moving average is a line on the price chart that uses a mathematical formula to smooth the price action. It shows the average price over a certain period. The EMA formula puts more weight on the recent price. This means that it is more reliable because it responds more quickly to the latest changes in price data.

An exponential moving average tries to reduce the confusion and noise of everyday price action. Second, the moving average smooths the price and reveals the trend. It even sometimes reveals patterns you can’t see. The average is also more reliable and accurate in predicting future changes in the market price.

There are three steps to the exponential moving average formula and the calculation of the EMA. The formula uses a simple moving average SMA as a starting point for the EMA value. To calculate the SMA, you take the sum of the number of periods and divide it by 20.

We need a multiplier that makes the moving average focus more on the latest price.

The moving average formula brings all these values together. This forms the moving average.

The exponential moving average formula below is for a 20-day EMA:

Initial SMA = 20-period sum / 20

Multiplier = (2 / (Time Periods + 1)) = (2 / (20 + 1)) = 0.0952 (9.52%)

EMA = {Close – EMA (previous day)} x multiplier + EMA (previous day).

The general rule is that if the price is trading above the moving average, we are in an uptrend. As long as we stay above the exponential moving average, we should expect higher prices. Conversely, if we trade below, we are in a downtrend. As long as we trade below the moving average, we should expect lower prices.

Before we go any further, we always recommend that you write down the trading rules on a piece of paper. This exercise will increase your learning curve and you will become a better trader.

Let’s start…

Exponential moving average strategy

(Trading Rules – Sell Trade)

Our exponential moving average strategy consists of two elements. The first step to capturing a new trend is to use two exponential moving averages as an entry filter.

By using one moving average with a longer period and one with a shorter period, we automate the strategy. This removes any form of subjectivity from our trading process.

Step 1: Draw the 20 and 50 EMA on your chart

The first step is to set up our charts correctly with the right moving averages. We can identify the EMA transition later. The exponential moving average strategy uses the 20 and 50 period EMA.

Most standard trading platforms have standard moving average indicators. Locating the EMA on your MT4 platform or Tradingview should not be a problem.

Now we’re going to take a closer look at the pricing structure. This brings us to the next step of the strategy.

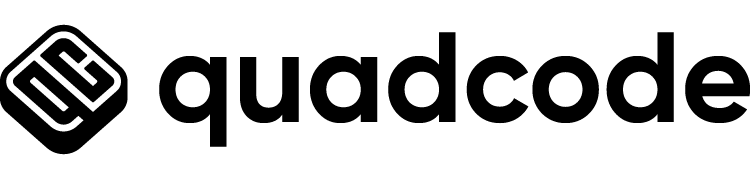

Step #2: Wait for the EMA crossover and the price trades above the 20 and 50 EMA.

The second rule of this moving average strategy is that the price must trade above 20 and 50 EMA. Second, we need to wait for the EMA crossover, which will add weight to the bullish case.

We refer to the EMA crossover for a trade when the 50-EMA crosses above the 50-EMA

.

By looking at the EMA crossover, we create an automatic buy and sell signals.

Since the market is prone to false breakouts, we need more evidence than a simple EMA crossover. At this point, we don’t know if the bullish sentiment is strong enough to push the price further after we bought to take profit.

To avoid the false exposition, we have added a new confluence to support our view. This brings us to the next step of the strategy.

Step 3: Wait until the zone between 20 and 50 EMA is tested at least twice, then look for buying opportunities.

The belief behind this moving average strategy rests on several factors. After the EMA transition has taken place, we need to exercise more patience. We will wait for two consecutive and successful tests of the zone between the 20 and 50 EMA.

The two successful retests of the zone between 20 and 50 EMA give the market enough time to develop a trend.

Never forget that no price is too high to buy in the trade. And no price is too low to sell.

Note * When we refer to the “zone between 20 and 50EMA”, we actually do not mean that the price should trade in the space between the two moving averages.

We just wanted to cover the entire price spectrum between the two EMAs. This is because the price will only briefly touch the shorter moving average (20-EMA). But it’s still a successful retest.

Now we still have to decide where exactly we are going to buy. This brings us to the next step of the strategy.

Step 4: Buy the market when we test the zone between 20 and 50 EMA for the third time.

If the price successfully tests the zone between 20 and 50 EMA for the third time, we go ahead and buy it at the market price. We now have enough evidence that the strong momentum is strong to continue pushing this market higher.

Now we have to determine where to place our protective stop loss and where to take profit. This brings us to the next step of the strategy.

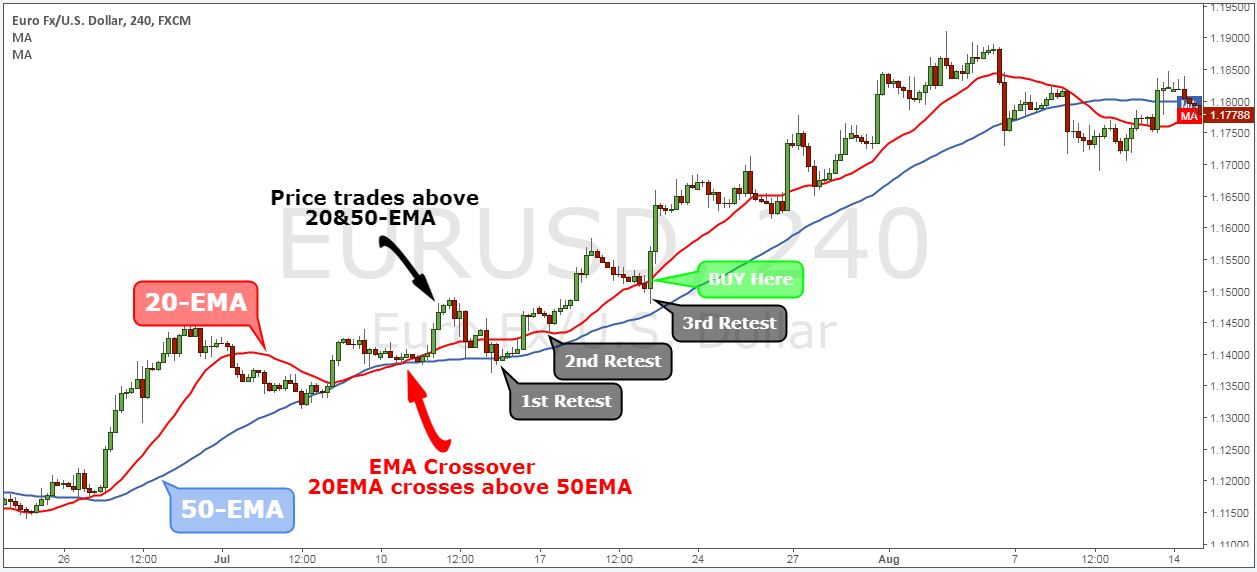

Step 5: Place the protective Stop Lose 20 pips below the 50 EMA

After the EMA crossover occurred, and after we had two consecutive retests, we know that the trend is on. As long as we trade above both exponential moving averages, the trend remains intact.

In this regard, we place our protective stop loss 20 pips below the 50 EMA. We added a buffer of 20 pips because we understand that we don’t live in a perfect world. The market is prone to false breakouts.

The last part of our EMA strategy is the exit strategy. This is again based on the exponential moving average.

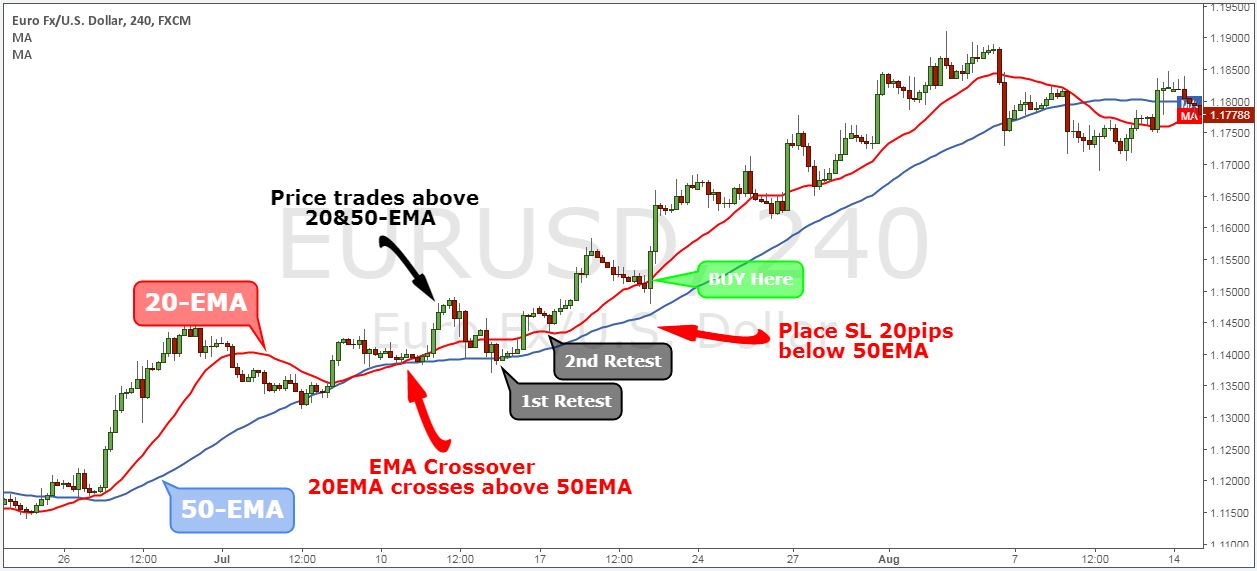

Step 6: Take profit once we break below the 50-EMA and close

In this particular case, we are not using the same exit technique as our entry technique, which was based on the EMA crossover.

If we had waited for the EMA crossover to occur on the other side, we would have given back some of the potential gains. We must consider the fact that the exponential moving averages are a trailing indicator.

The exponential moving average formula used to plot our EMAs allows us to still take profits at the moment the market is about to reverse.

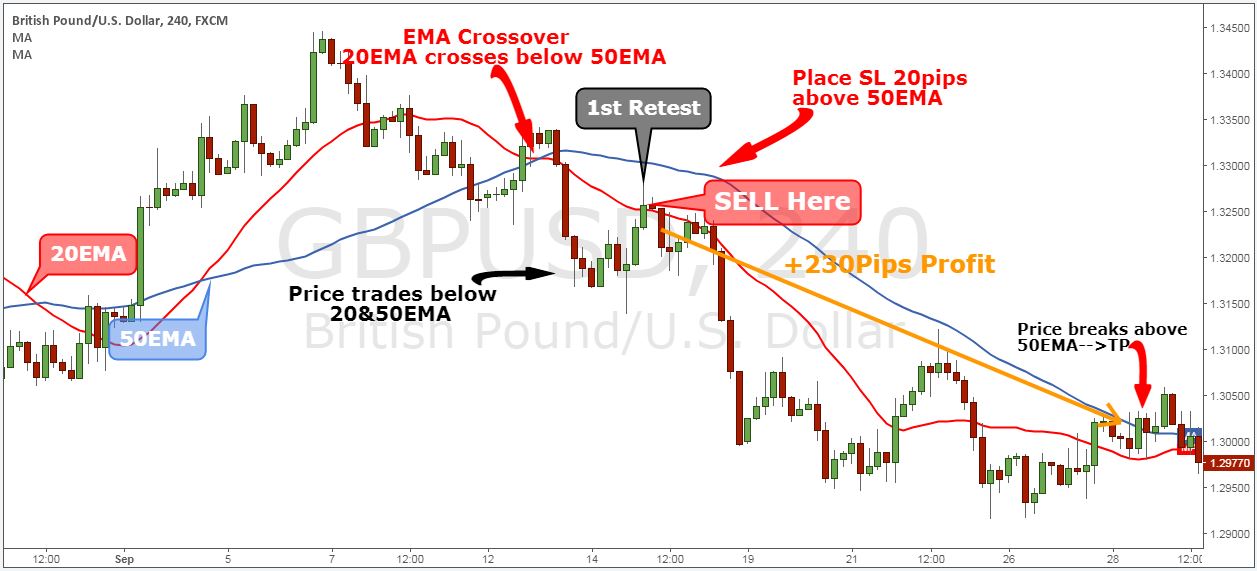

Comment ** The above was an example of a BUY trade. Use the same rules – but in reverse – for a SELL trade. However, because the market is falling much faster, we sell the first test of the zone between 20 and 50. After the EMA transition occurs.

In the figure below you can see a real example of SELL using our strategy.

Summary

The exponential moving average strategy is a classic example of how to set up a simple EMA crossover system. With this exponential moving average system, we are not trying to predict the market. We try to react to the current market condition, which is a much better way to trade.

The advantage of our trading strategy lies in the exponential moving average formula. This is a much smoother EMA that gives better entries and exits.

We understand that there are different trading styles. If the following futures trends are not for you, you can read the best strategy for short term trading – Profitable Short Term Trading Tips. This reveals a short-term trading trap used by institutional traders.

Thanks for reading!