This simple, profitable trading guide teaches stock options for beginners. The strategy applies to the stock market, Forex currencies and commodities. In this article you will learn what options are, how to buy a call and call option, how to trade options and much more. If options trading isn’t for you, try our Harmonic Patterns Trading Strategy. It is an easy step-by-step guide that has generated a lot of interest among readers.

The trading strategies team believes that this is the most successful option strategy. When trading, we adhere to the principle of KISS: “Keep it simple, stupid!”

With simplicity, it is to our advantage that we have enormous clarity on price action.

We focus on buying put and call options through this options guide. Put options are a different animal. It takes more experience to fully understand the inherited risks. Why? Because you can’t control the downside, you do the same when you buy put and call options.

It is the most successful option strategy because it consistently produces profitable trading signals. Not because it doesn’t have losses. The best strategy for the best options trading is the 15 minute time frame.

We will first define what buying a Put and Call option is. After that we give the rules for the best strategy for trading in options. Here is another strategy called The PPG Forex Trading Strategy.

What are options?

Options are a specific type of derivative contract. The underlying securities can be stocks, indices, ETFs or commodities . With a derivative contract, you do not directly own the underlying asset. Instead, you own a related asset whose value is affected by price changes.

With an option contract, you have the right to buy or sell an asset at a predetermined price in the future. When that future point arrives, you will have the choice to exercise or let the option expire.

Here is an example. Assuming the asset sells for $110, a contract that gives you the right to buy at $100 will have an intrinsic value. As the expiration date approaches, the value of the option contract will adjust.

There are two different types of options: call options and put options. If used correctly, options trading will make your strategy much more dynamic. Let’s go to the next section.

What is a call option?

A call option gives you the right to buy an asset in the future. If exercised, this purchase will occur on a predetermined date. It will also occur at a pre-set value. If you are uncertain about the future value of an asset, a call option can provide protection. Call options are frequently purchased by stock traders. However, it can also be found in many other markets. In fact, call options are the most commonly traded options.

What is a put option?

A put option gives you the right to sell an asset in the future. Like call options, these contracts have predetermined prices and sale dates. Put options and call options are often bought together to make a ‘hedged’ position. Below we discuss the different types of option sales. After that we will discuss how these sales can be introduced into your trading strategy. You may also enjoy this article on Options vs Futures.

Different types of option sales

It is essential to remember that an option is a contract that allows you to buy an asset in the future at a specific price. There are four different types of option sales that can potentially occur. The differences between short and long sales and puts and calls will be very important.

- A long call option gives you the right to buy an asset at a specific price in the future. Holders of long options will benefit from price increases over time.

- A long put option will give you the right to sell at a specific price in the future. Unlike call options, the holders of long put options hope that market prices will fall.

- A short option gives you the right not to sell the underlying asset, but the option itself in the future. Because the “logic” of short positions is reversed, the holder of short options is in similar positions as long options.

- A short put option will hope that long put options become less valuable over time – as a result, holders will drive the price up.

Once you can understand the different varieties of options trading, you can enter into more complex trading strategies. These strategies usually involve buying different options to manage risk and increase the possibility of high returns.

Why use options?

Options are used for speculation or hedging. Hedge fund managers are notorious for using advanced risk management strategies to hedge their exposure to the market.

Options offer high leverage, giving you the chance to trade large contracts and potentially earn more money. It is the same for Forex. You need a smaller initial investment than buying ordinary shares. When buying options, the risk is limited to the initial premium price paid.

When using options, the risk is limited, but the potential profit is theoretically unlimited. Obviously, we are saying theoretically unlimited profits. However, option prices will be limited within certain parameters. There is no share price to infinity. Also read this article on Paper Trading Options – The Secret to Riches .

Types of options strategies

You can take your trade beyond basic call and put options. This is the beauty of options trading. Other trading strategies include covered call, married sell, bull call spread, bear spread and more. This can help you better manage your risk and look for new trading opportunities.

If you are a versatile trader, then take advantage of the flexibility that options trading can give you. Study the top 10 stock options trading strategies below:

- Covered call strategy or buy-write strategy – implies buying shares outright. At the same time, you want to sell call options on the same stocks. The number of shares you bought must be identical to the number of call option contracts you sold.

- Married Put Strategy – implies buying stocks outright. At the same time, you buy put options for an equivalent number of shares. The married put works like an insurance policy against short-term losses.

- Bull Call Spread Strategy – involves buying call options with a specific strike price. At the same time, you are selling the same number of call options at a higher strike price.

- Bear Put Spread Strategy – this is similar to the bull call spread, but involves buying and selling put options. In this option strategy, you buy put options with a specific strike price. Simultaneously sell the same number of put options at a lower strike price.

- Protective collar strategy – implies buying an out-of-the-money put option. At the same time, sell or write an at-the-money call option for the same stock.

- Long Straddle Strategy – implies buying both a call option and a put option at the same time. Both options must have the same strike price and expiration date.

- Long Entanglement Strategy – involves buying an at-the-money option and a put option at the same time. They have the same expiration date, but they have different strike prices. The sell price will typically be lower than the strike price.

- Butterfly spread strategy – implies the use of a combination of the bull spread strategy and the bear spread. The classic butterfly spread involves buying one call option at the lowest strike price. Sell two call options at the same time at a higher strike price. And then sell one last call option at an even higher strike price.

- Iron Condor Strategy – involves owning a long and a short position in two different stranglehold strategies.

- Iron Butterfly Strategy – involves using a combination of a long or short strategy. Buy or sell a choke strategy at the same time.

Let’s return our focus to the most successful option strategy.

Let’s define the indicators you need for the best strategy for trading. And how to use stochastic indicators.

The only indicator needed is RSI or Relative Strength Index.

Options trading is limited by the expiration date factor. It is therefore important to choose a technical indicator that is suitable for trading options. The RSI indicator is a momentum indicator which makes it the perfect candidate for options trading. This is due to the ability to detect overbought and oversold conditions in the market.

The location of the RSI indicator is on most FX trading platforms (MT4, TradingView). You’ll find it under the indicators library.

How does the RSI indicator really work?

The RSI uses a simple mathematical formula to calculate the oscillator:

There is no need to go further into the math behind the RSI indicator. All we need to know is how to interpret the RSI oscillation. Basically, an RSI reading equal to or less than 30 shows that the market is in oversold conditions. An RSI reading above 70 indicates that the market is in overbought conditions. At the same time, a reading above 50 is considered bearish. On the other hand, a reading below 50 points is considered bearish.

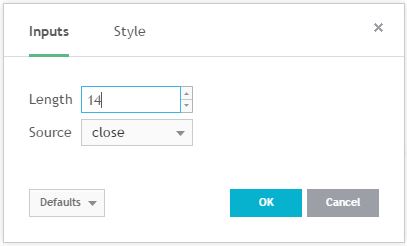

The preferred settings of the RSI indicator are the standard settings with a period of 14.

Voordat ons verder gaan, beveel ons altyd aan dat u ‘n stuk papier en ‘n pen neem en die reëls let.

Kom ons kyk na die tutoriaal vir opsies handel …

The most successful strategy for options

(Rules for buy call options)

Options Trading Manual Step #1: Wait 15 minutes after the stock market opens to determine your bias in the market.

The most successful options strategy does not focus only on the price. But they also use the time element as we do here.

The opening price of the stock market is usually the most important price. During the first minutes after opening the bell, we can notice a lot of trading activity. This is because this is the time when large investors establish their positions in the stock market.

Read Day Trading Price Action – Simple Price Action Strategy. You will learn about a strategy that is not limited to the time element and focuses on price action. This is one of the most comprehensive guides to successfully trading stocks or other assets using simply price action.

Our team at Trading Strategy Guides wants the best strategy for options trading. To do this, we need to think smarter. We need to track how the smart money works in the market.

The best strategy for options trading does not keep you glued to the screen all day. You just need to know when the stock market opens.

The NYSE opens at 9:30 AM EST or 1:30 PM GMT time for those trading from Europe.

This brings us to the next step in our options trading tutorial…

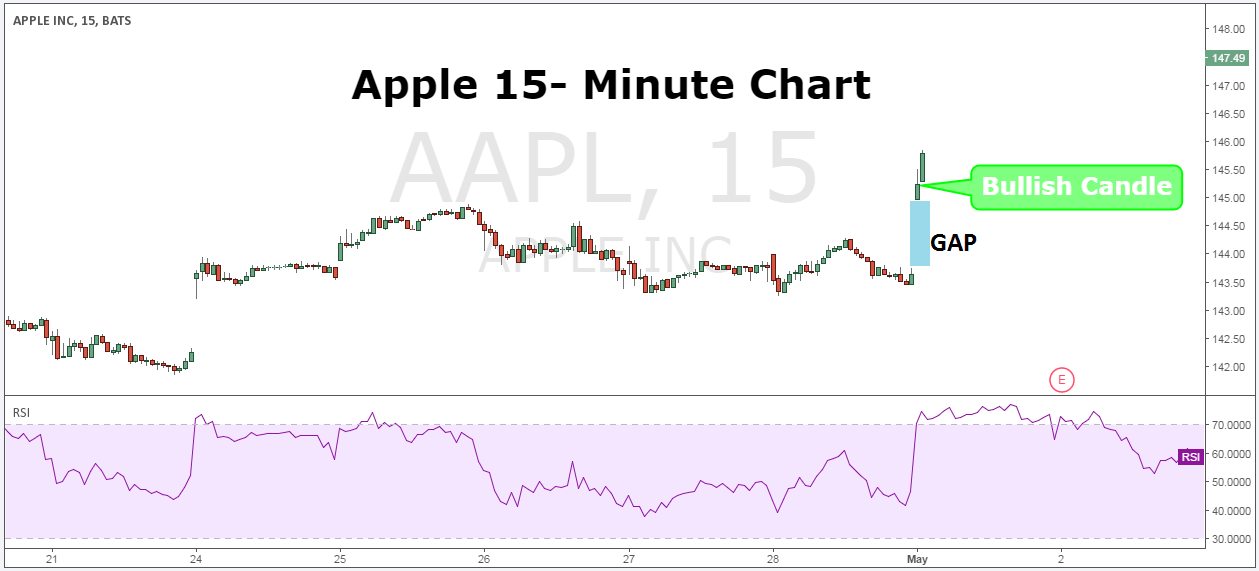

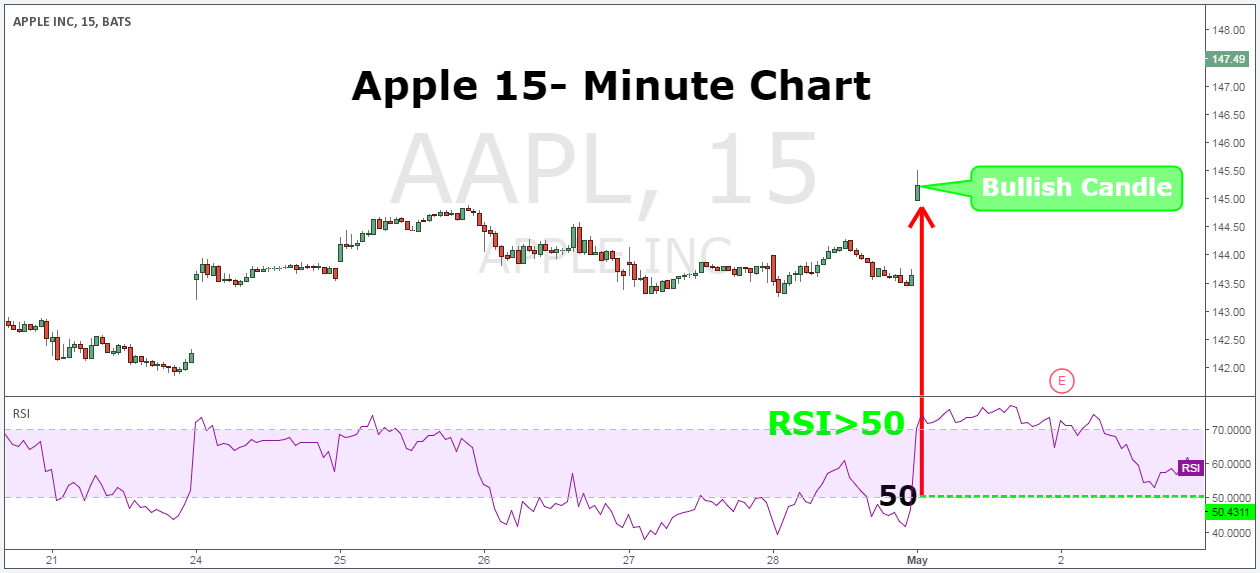

Options trading manual Step #2: make sure the 15-minute candle after the opening bell (9:30 EST) is bullish.

As established earlier, we only want to trade in the direction where the smart money is. If we are looking for an opportunity to buy Call Options, we want to make sure that smart money buys after the open. Conversely, if we are looking for buy options, we want to see sellers appear immediately after the opening bell.

Important note *: If we have an opening gap, it means that the buying power is still stronger, and we should give more weight to this trade setup.

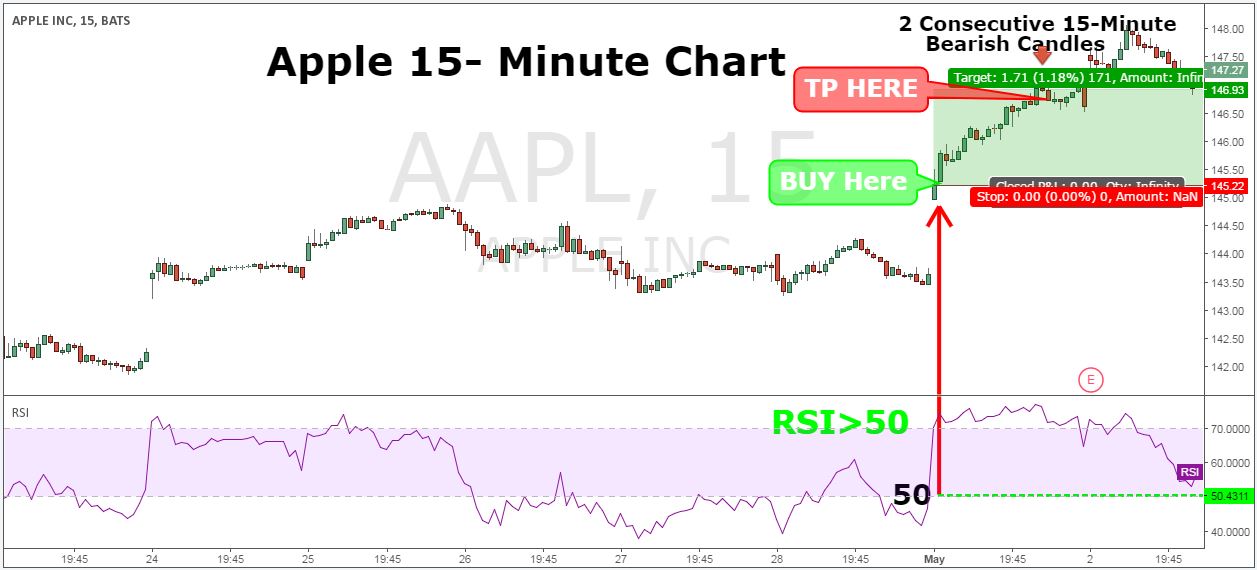

Options trading manual Step #3: Check if the RSI is higher than 50 – This is a bullish momentum signal.

We use the RSI indicator for confirmation purposes only. We want to make sure that once we have identified the positive price action, the momentum behind the move is confirmed by the RSI indicator. We don’t worry about overbought and oversold conditions because the market can stay in these conditions longer than you can stay solvent.

In the above chart, we can see that the RSI is well above 50 during the first 15 minutes of trading. The price action is confirmed by the RSI momentum reading.

Now let’s jump in and define where exactly we want to use our buy and call option.

Options trading manual Step #4: Buy a call option directly at the opening of the second candle 15 minutes after the opening bell.

Now that we have confirmation that smart money is buying, we don’t want to waste any more time and want to buy a call option at the opening of the next candle 15 minutes after the opening bell.

As easy as it sounds, this strategy requires you to dedicate 15 minutes of your time each day. You will either get a signal or you won’t, but to benefit from the best options trading strategy, you need to exercise discipline and not trade when you don’t have a signal.

At this point we are trading and profiting, but we still need to define when to exercise our call option and take profit.

Options trading manual Step #5: Choose the closest expiration cycle. Select the weekly cycle for day trading.

If you buy a Call Option, you must also specify an expiration date as part of the contract.

Perhaps you are asking yourself how to choose the right expiration cycle?

Well, since we are likely to sell our Call Option on the same day we bought it, it is more appropriate to choose the weekly cycle.

Time to switch our focus to the most important part: Where can you make PROFIT selling your Call Options?

Options Trading Manual Step #6: Take profit and sell the call option once you have two consecutive 15 minute long candles.

Knowing when to take profit is just as important as knowing when to enter a trade. We want to get out of our position as soon as we see the sellers enter. We measure this by counting two consecutive bearish candles as a sign of a strong sentimental presence in the market.

You don’t want to exercise your long Call option because you don’t want to own the stock, you just want to make a quick profit.

Note ** The above was an example of a buy call option using the trading tutorial. Use the exact same rules – but in reverse – to buy a call option trade. In the figure below you can see a real example of buying options using the trading tutorial.

We applied the same Step 1 through Step 4 to help us determine our trading bias and identify the call option, and followed Step 5 through Step 6 to identify when to sell your Call Option.

Choosing the option contract that is best for you

Now that you understand how to successfully trade options, you want to know how to choose the contracts that are best for you. All option contracts involve some degree of risk. This is especially true if you are trading binary options. This is due to the fact that options may be worthless on their expiration date. The risk of trading options can be managed.

Keep the following things in mind when choosing options:

- Your personal level of risk tolerance

- Your desired trading framework (day trading, long term trading)

- The volatility of each prospective asset

- Past returns on options contracts

Options contracts also have high levels of implied volatility. During the first 30 minutes of trading, options contracts experience large value changes. If the volatility is high, the risk level will be higher as well as the potential reward. During this time, your trading strategy will need to be much more active. Risk can be managed by issuing stop orders. It can also be managed by hedging your position and diversifying your positions.

Both call and put options can be very rewarding. To prepare yourself as an options trader, it is a good idea to practice. Fortunately, trading strategy guides make it easy to hone your skills and enter new markets. Combining the above steps carefully can help you unlock the best option trading strategy.

Conclusion – Options trading manual

This is one of the most successful option strategies because if you are trading stocks it is important to have a good understanding of the market sentiment and how the major players are positioned in the market. Another important reason why this is the best option trading strategy is that you don’t have to be glued to the screen all day.

Don’t forget to also read our Support and Resistance Zones – the Path to Successful Trading – one of the most comprehensive guides to successfully trading stocks or other assets using simple support and resistance levels.

Thanks for reading!