Heiken Ashi Strategy – Japanese Samurai Art

Believe it or not, successful traders have the mindset of a Samurai, a legendary Japanese warrior. Our Heiken Ashi strategy is descended from the Samurai culture because it follows the same principles that guided the Japanese Samurai.

Our team at Trading Strategy Guides believes that the Samurai honor known as Bushido, meaning warrior, has better principles that are extrapolated and applied to trading in any market. Like a warrior, you will need to be disciplined and pay close attention to the conditions in front of you.

One of the unwritten rules of the Samurai Code of Conduct expressly states that a Samurai is never afraid to act. A samurai lives life fully and wonderfully. Our Heiken Ashi Trading System PDF will create the confidence you need to successfully trade the markets and overcome trading fear.

The Heiken-Ashi technique is simply another way of looking at charts that traders can use to spot trading opportunities. This revolutionary new way of looking at charts can be applied to any time frame.

Regardless of your trading style (day trading, swing trading, trend following), you can implement this trading method to make better decisions. We also recommend learning how to identify the right swing to increase your profits.

Let us first understand what the Heiken Ashi charting technique is. Then we will outline the rules of the Heiken Ashi Trading System PDF.

Another advantage is that we will highlight some real trading examples to better understand the best Heiken Ashi PDF strategy.

What is the Heiken Ashi Technique?

The three most commonly used price settings are the bar chart, candlestick chart, and line chart. And then there are other less used charting techniques, such as the Heiken Ashi. The Heiken Ashi chart provides an in-depth look at the market. Use it when making trades with precise entries and exits.

The Heiken Ashi is a charting technique that can be used to read price action and predict future prices. It is similar to the traditional candlestick charts. Unlike the candlestick chart, the Heiken Ashi chart tries to make part of the market noise in order to better take advantage of the market trend.

Simply put, Heiken Ashi is another way to display the price on our charts.

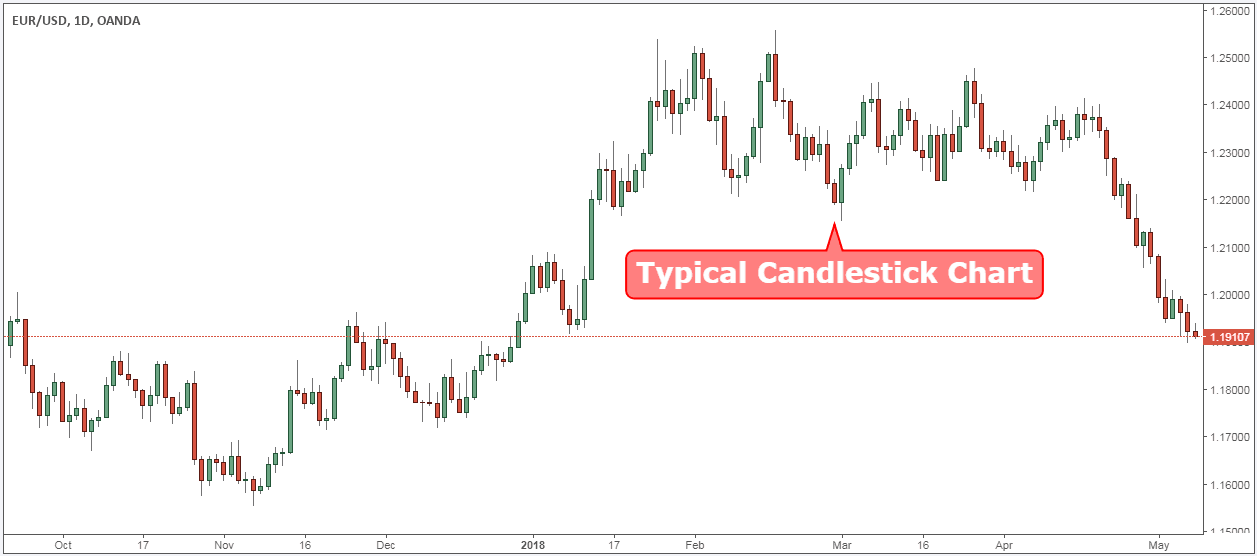

Here is a typical EUR/USD candlestick chart:

In Japanese, Heiken Ashi means “Average bar” and it represents the average price or pace of prices.

The Heiken Ashi candlestick chart helps you avoid trading periods and fluctuating periods.

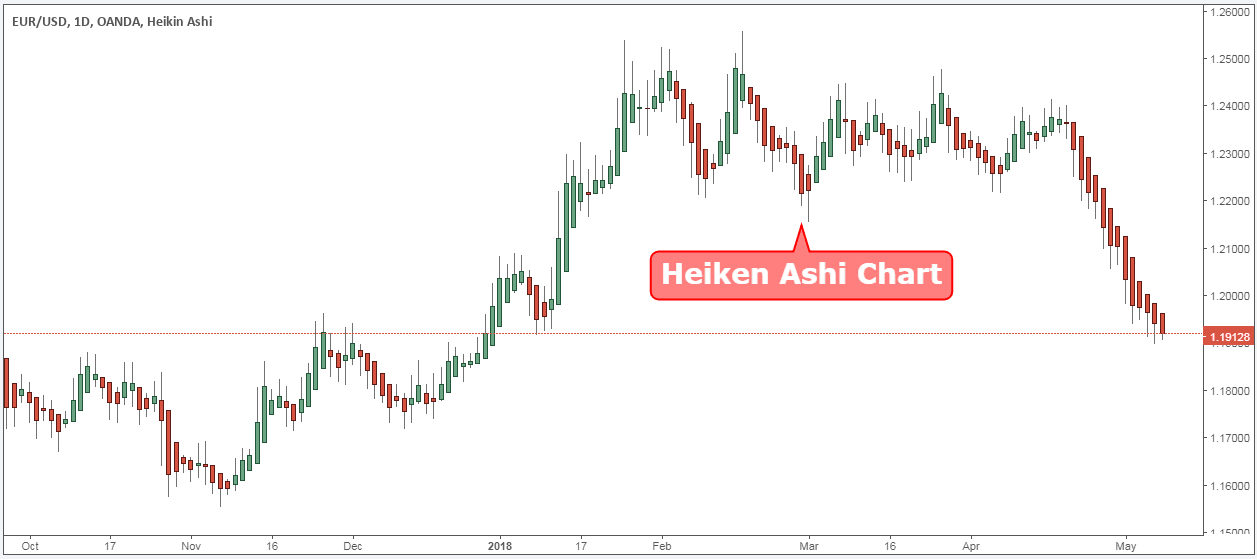

Here is the same EUR/USD chart, but with the Heiken – Ashi chart applied:

As we can see, there is a notable difference between the two types of cards. This is because the Heiken Ashi candlesticks use a complicated mathematical formula to determine the OHLC prices.

The good news is that you don’t need to be a math whiz to trade the best Heiken Ashi PDF Strategy. All you need to do is understand the principles.

There are two primary trading signals that we can identify with the Heiken Ashi candlestick:

- Bullish candlesticks have no wick or very small wicks. This indicates a strong rise and excellent buying opportunities.

- Small candlesticks are characterized by a small body, a large upper and lower wick. This indicates a possible reversal.

Here is the best way to conquer the market using the Heiken Ashi Trading System PDF:

The Best Heiken Ashi PDF Strategy

The best PDF strategy of Heiken Ashi can help you only as long as you apply strict risk management rules. You now know what Heiken Ashi candles are and how they differ from typical price candles. Let’s see how it can be beneficial over traditional price candles.

Heikin-Ashi Candles use three sets of data based on the open and close.

- Price data from the current open high low close.

- The current Heikin-Ashi values.

- The preceding Heikin-Ashi values.

Before we go any further, we always recommend that you get a piece of paper and a pen. Note the rules of this entry method.

Heiken Ashi Technique Formula

If you’re hoping to use the Heiken Ashi technique, you’ll probably want to use trading software that can create the charts for you. Therefore, memorizing the Heiken Ashi chart formula may not be absolutely necessary. However, if you know the formula, you can understand why this technique is useful.

Heiken Ashi uses a COHL formula, which stands for “Close, Open, High, Low.” These are the four components that affect the shape, size and direction of the bars. The formula for each of these components is listed below:

- Close (indicating the average price) = (Close + Open + High + Low) / 4

- Open (indicating the average of the previous bar) = (Previous Open + Previous Close) / 2

- High (the highest value) = the highest value of the recent high, open and close

- Low (the lowest value) = the lowest value of the recent lows, open and close

Once each of these variables is recognized, you can create a Heiken Ashi chart. Sometimes some of these values are equal, which will affect the appearance of the map as a whole. Adjusting the time frame will also have a big influence on the shape of the chart. Many day traders prefer to use a five-minute Heiken Ashi trading strategy. But it is also possible to use 15 minute, hourly or even daily time frames.

For this article we are going to look at the buy side.

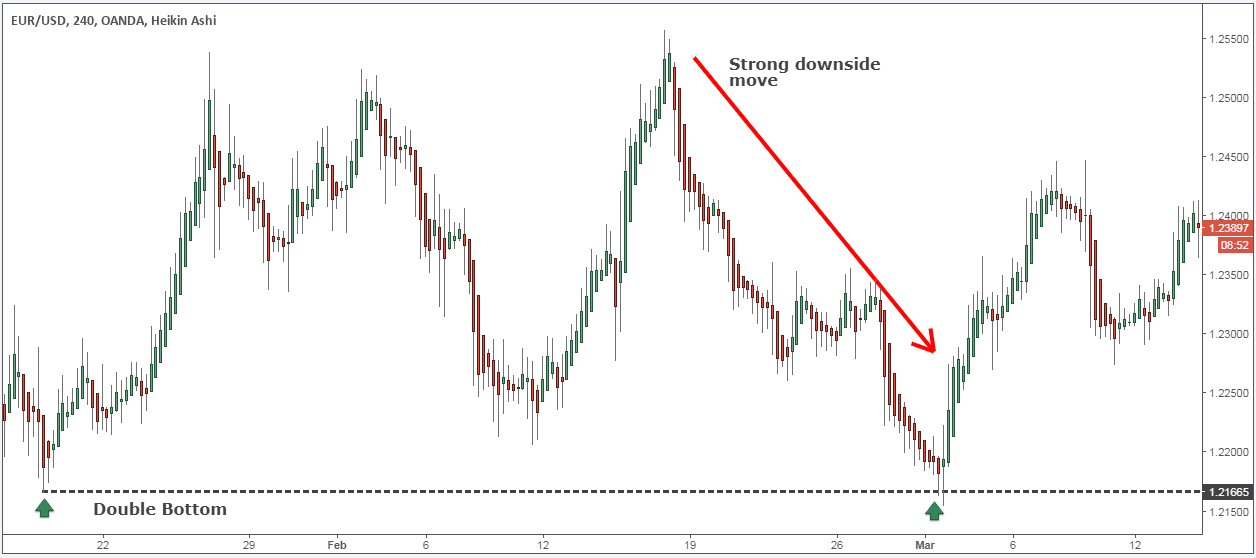

Step 1: Identify a strong move to the downside

What we’re going to look at now are some ways we can combine these Heiken Ashi candles with our traditional technical analysis and start looking for some specific trading ideas.

One of the simple ways we can use the Heiken Ashi candlesticks is to reverse turn when the candles change color.

First, we are going to look for a strong trend or a strong move to the downside.

Note * The Heiken Ashi chart tends to give much more extended and smoother runs of bearish and strong price candles. This is because the calculation is used to average the range of the beam.

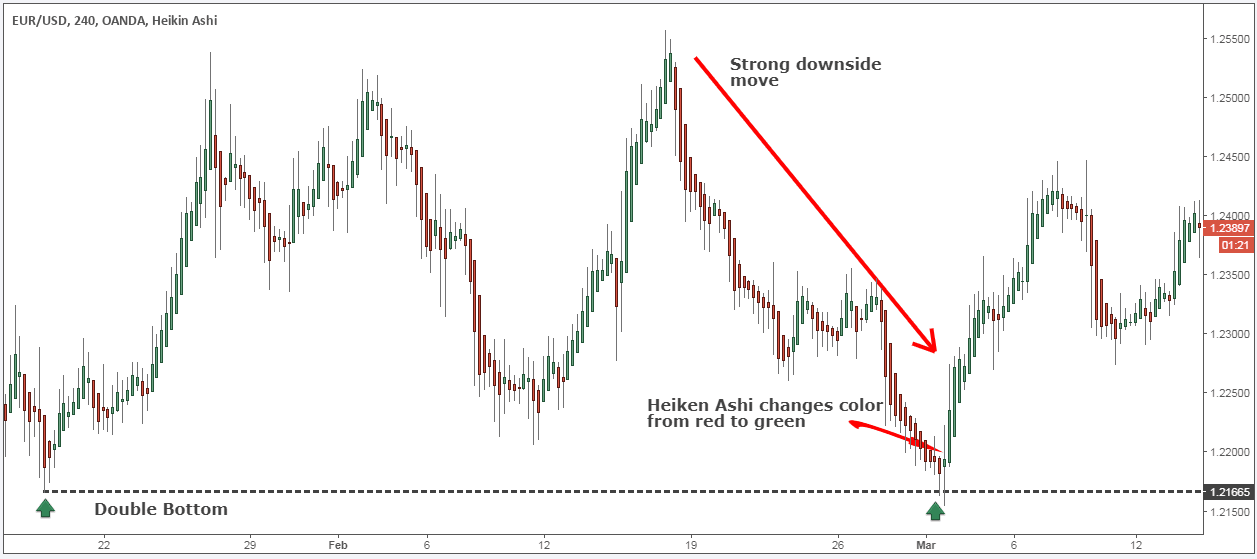

In the EUR/USD chart above, we have a double bottom, which is a classic technical setup.

The two lows formed almost at the same level. This is a traditional bullish reversal signal.

The Heiken Ashi strategy must follow one more condition before pulling the trigger.

See below:

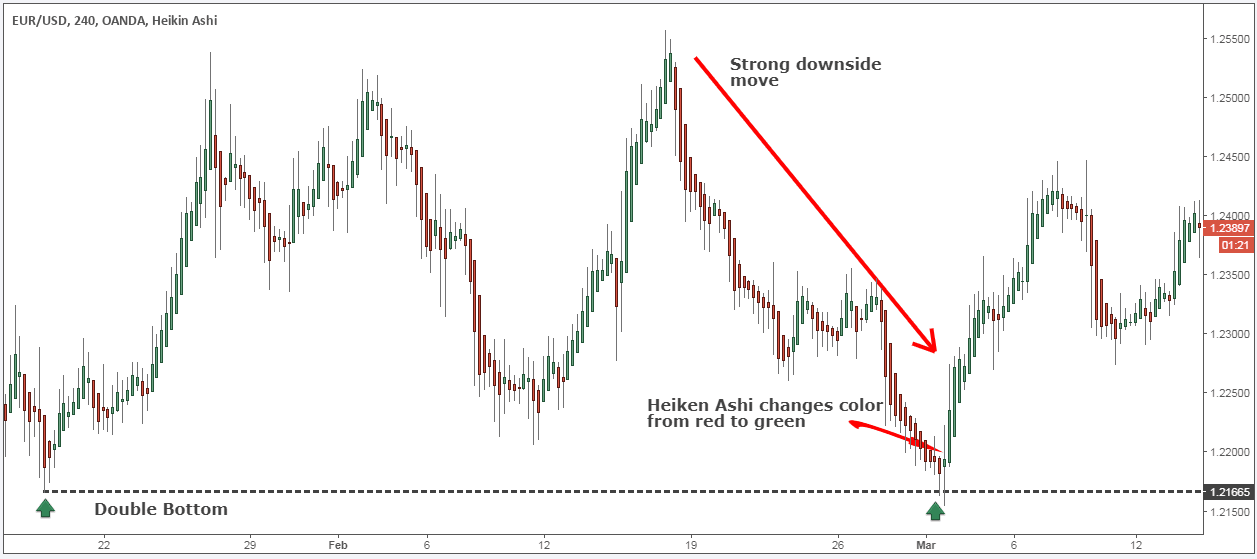

Step 2: Wait until the Heiken Ashi bar changes color from bearish (red) to bullish (green).

The first sign that the price is about to go higher is when we see a green Heiken Ashi candle.

For the Heiken Ashi bars to change color, there must be a strong shift in the sequence. This usually translates to a much more reliable signal than what we get when typical price candles change color on a normal price chart. Once the color changes, it may be time to trade.

The way we use this feature is simply to implement traditional technical analysis and locate potential reversal zones with the Heiken Ashi chart.

We use the price action reading skills as a filter to identify a potential trade. Then we use the Heiken Ashi chart as the confirmation to go ahead and execute the trade.

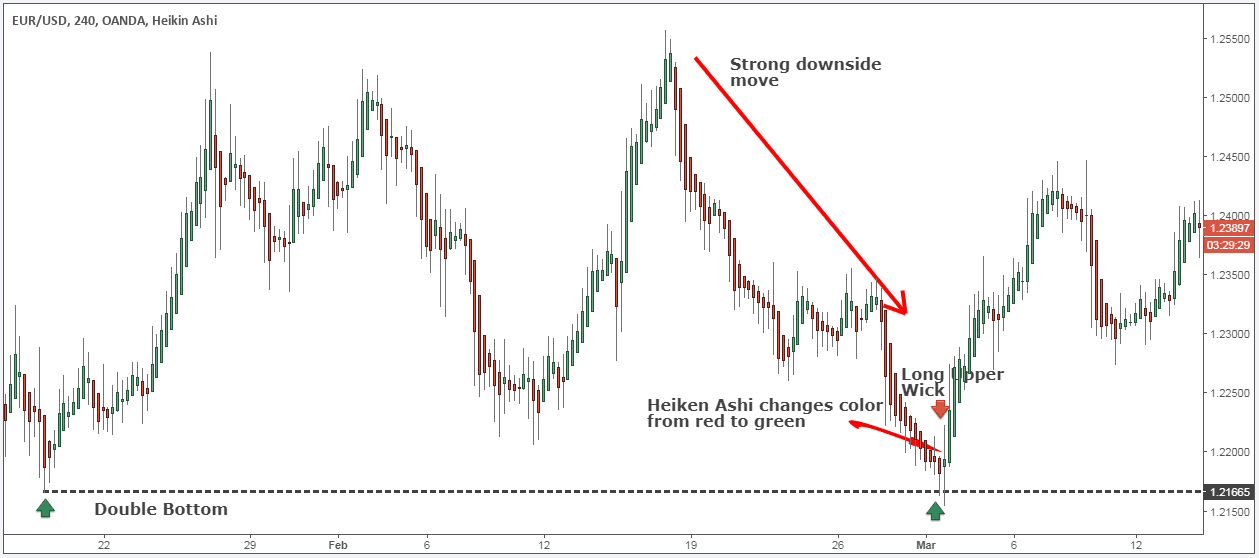

Step 3: The first bullish Heiken Ashi candle should have a larger above average bean

Long upper swings (upper shadows) can produce an incredible trading signal. Especially if you use the Heiken Ashi price chart.

You can also wait until you see a bearish Heiken Ashi candle without a lower wick. However, this approach costs you profits that are left on the table.

The Heiken Ashi trading strategy meets all trading conditions. This means that we can move forward and outline what the condition for entry into our entry is.

See below:

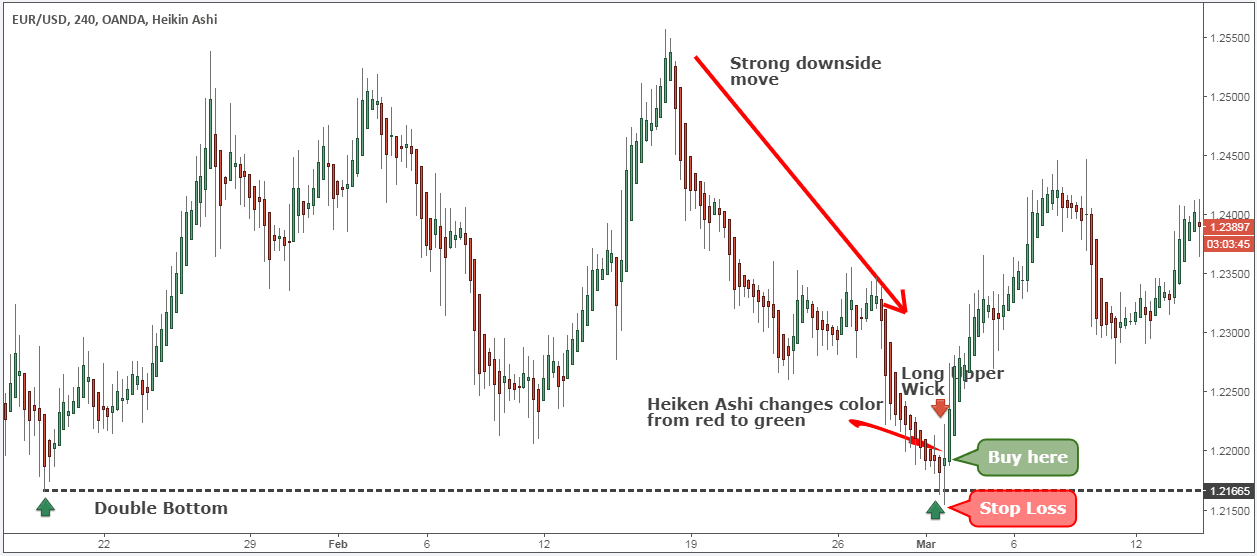

Step 4: Buy on the market at the opening of the next Heiken Ashi candle

Our access method is very simple.

This is a bullish reversal setup, so we are looking for buying opportunities once everything is in the right place.

We can now expect a turnaround to occur. We can continue to buy EUR/USD at the opening of the next Heiken Ashi candle.

This brings us to the next important thing we need to determine for the best Heiken Ashi PDF strategy. Where do we place our protective stop loss?

See below:

Step 5: Hide your protective stop loss below the first bullish candle low

One of the fantastic things about Heiken Ashi candles, and what makes them so good for trading, is how we can use them to place our protective stop loss.

Due to the tendency of the candles to continue, we can continue with our stop. We can simply place our stop loss below the signal light.

Last but not least, we also need to define where we should take profit.

See below:

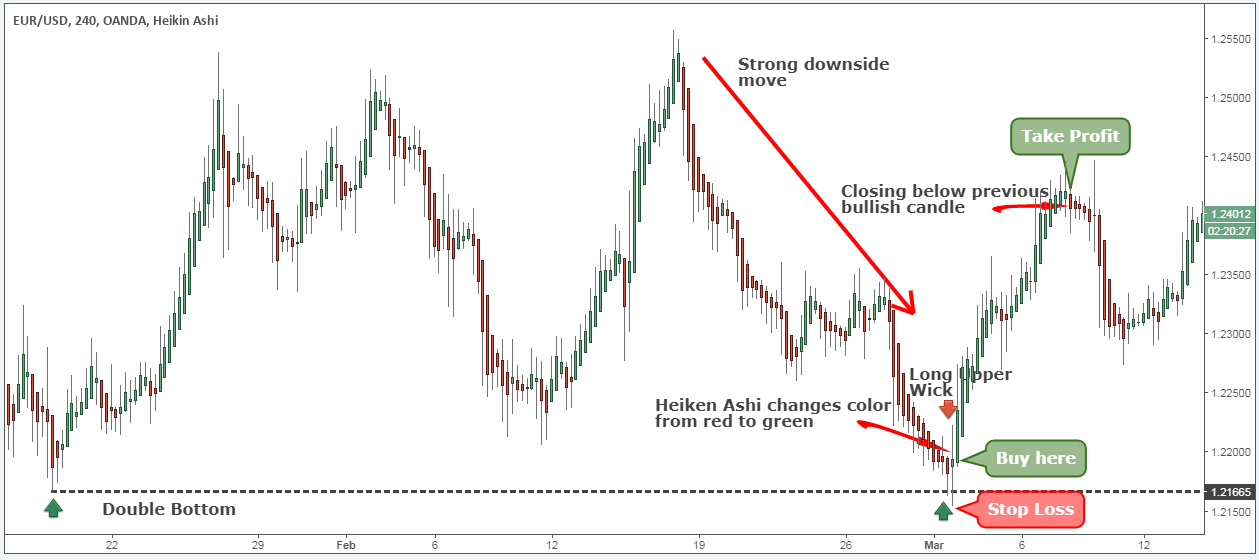

Step 6: Take profit after we get a close below a previous bullish candle

A good Heiken Ashi trade setup will tend to work much longer than a regular price action setup. When trading with Heiken Ashi candles, we really want to take advantage of it. It is important to keep our trades open longer than normal.

Because we are using such a tight loss, we will only need a small price movement to make a good profit from this trade.

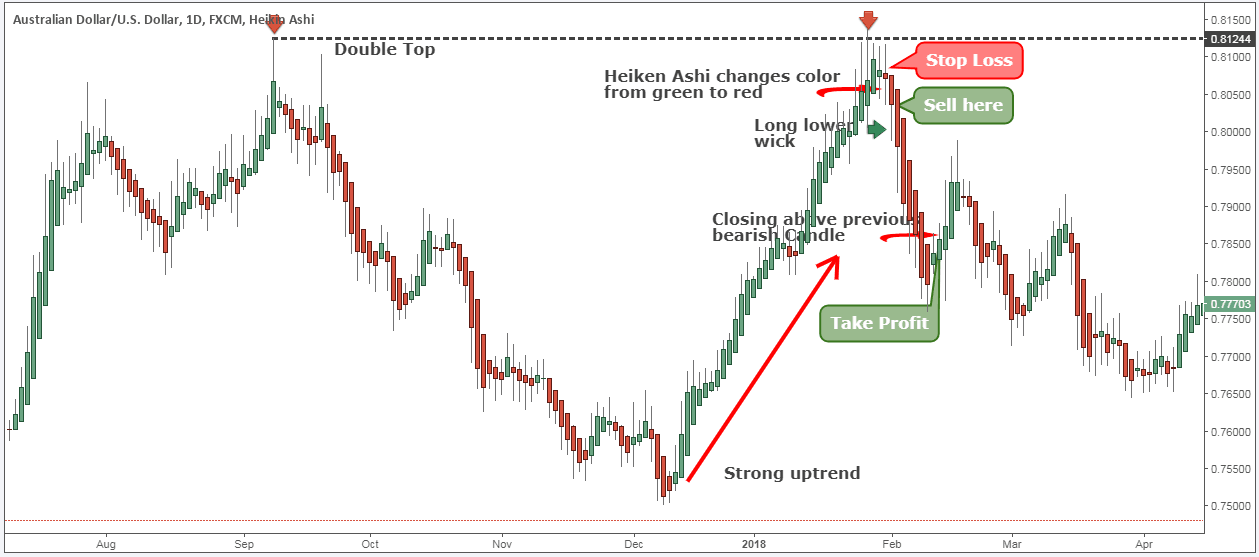

Note ** the above was an example of a BUY trade using our Heiken Ashi Trading System PDF. Use the same rules for a SELL trade – but in reverse. In the figure below you can see a real example of SALE.

Conclusion Heiken Ashi Trading System PDF

Unlike traditional candlestick readings where we want to reverse, the Heiken Ashi strategy can help you catch a falling knife. The other major benefit of using Heiken Ashi charts is that it improves your risk-to-reward ratio. This gives us a much tighter risk tolerance. We also have training on Japanese Candlesticks and how to use them.

The Heiken Ashi technique is one of the best reversal trading strategies. It provides us with a smart way to manage our trades. If you are fed up with the noise generated by the classic candlestick chart, you should switch to a Heiken Ashi forex strategy.

Thanks for reading!

Please leave a comment below if you have any questions about the Heiken Ashi PDF Trading System!

Also give this strategy a 5 star if you enjoyed it!