Day trading in stocks is an exciting market for investors to get involved in. Shares are essentially capital acquired by a company through the issue and subscription of shares. While stocks and shares are considered long-term investments, stock trading can still offer opportunities for day traders with the right strategy. The ability to short prices, or to trade news and events in the business world, means that short-term trades can still be profitable.

This page will advise you on which stocks to look for when looking to buy or sell short-term positions. It will also provide you with some valuable rules for day trading stocks to follow. You will learn how to pick stocks and when to trade them, as well as some intelligent trading strategies that can help you make a profit.

View the best stocks per day based on volume and volatility – the most important metrics for day trading in any market.

Why day trade stocks?

Day shares today are dynamic and exciting. Plus, it’s easy to buy and sell. With the world of technology, the market is readily accessible. The liquidity in markets means that speculation about prices going up or down in the short term is absolutely viable.

- Stocks are also relatively simple to understand and follow.

While day trading in the complex technical world of cryptocurrencies or forex will leave you scratching your head, you can touch on the victories and potential pitfalls of Google and Facebook much more easily. This means that identifying which stocks are trading online intraday will hopefully not be as challenging as in other markets.

Day trading vs stock trading

Before starting with the day of shares, you should consider whether it definitely suits your circumstances.

For example, intraday trading usually requires at least a few hours per day. One of the hours will often have to be early morning when the market opens. However, longer-term investing usually takes less time. This is because you have more flexibility when doing your research and analysis.

In addition, the returns for intraday stocks can be traded as the long-term investment. This is partly due to the leverage. This allows you to borrow money to take advantage of opportunities (trading on margin). However, with increased profit potential comes a greater risk of losses. In addition, you will also invest more time in day trading for those returns.

You could also argue that short-term trading is more difficult unless you only trade on a day. This is because it is much easier to interpret the stock ticker and to see long-term gaps. You also don’t have to rush to make decisions. However, it also means that intraday trading can provide a more exciting environment in which to operate.

A major advantage of CFDs and spread betting over traditional stock investing is the ability to ‘short‘. There is no easy way to make money in a falling market using traditional methods. However, day traders can trade regardless of whether they think the value will go up or down.

In general, there is no right answer in terms of day trading versus long term stocks. Spotting trends and growth stocks in some ways can be simple if you invest for the long term. With that said, intraday trading can give you greater returns.

Trading Platforms

The trading platform you use for your online trading will be an important decision. Need advanced mapping? Can you automate your trading strategy? Can you trade the real markets, like ETFs or Forex?

There are some important decisions you need to make when choosing a trading platform or stockbroker, and many of them will depend on you and your trading style.

How to trade stocks

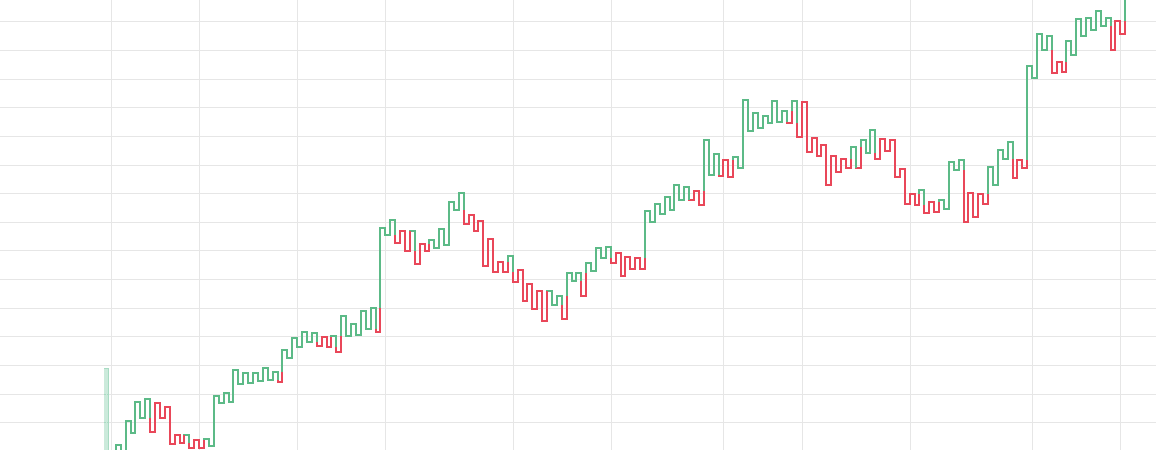

The best day stocks to buy offer you opportunities through price movements and an abundance of stocks being traded. This will allow you to quickly enter and exit those events. These factors are known as volatility and volume. You might be thinking ‘I’ve heard that volatile stocks and volumes are day traded before, but what does that really mean? ‘

SHARE

The volume simply deals with the total number of shares that are traded in a security or market during a specific period. Each transaction contributes to the total volume. If only twenty trades were made on that day, the volume for that day would be twenty.

How is it used by a day trader picking his stocks? Volume acts as an indicator that gives weight to a market movement. If there is a sudden rise, the force of the movement is dependent on the volume during that period.

Simply put, the bigger the volume, the more important the move.

Use volume

If you have significant capital behind you, you need stocks with significant volume. While your brokerage account will likely give you a list of the top 20-25 stocks, one of the best tips for day trading stocks is to broaden your search a bit.

This way, you can find opportunities that aren’t on every other trader’s radar. Look for stocks with an increase in volume. If a stock normally trades 2.5 million shares daily, but you see that it has traded 6 million shares by 10 hours, it may be worth investigating. If your chosen platform doesn’t offer a rigorous screening for high-volume stocks, use these alternatives:

- Bar graph

- The street

- Unusual volume at Yahoo Finance

Volatility

Volatility is concerned with the amount of risk / unpredictability in the magnitude of changes in the value of a security. If it has high volatility, the value can be spread over a large range of values. This would mean that the price of the security could change drastically within a short period of time, making it ideal for the fast-moving day trader. While it has low volatility, the value of the security will remain relatively steady, providing less opportunity for a quick profit.

Beta

One way to determine the volatility of a particular stock is to use beta. The beta predicts the total volatility of a security’s returns versus the returns of an appropriate benchmark (usually the S&P 500).

A stock with a beta value of 1.2 moved about 120% for every 100% in the benchmark, depending on the price level. On the other hand, a stock with a beta of just 0.8 moved 80% for every 100% in the benchmark index.

How to find stocks for day trading

So to find the best stocks to date, is to look for assets with a large volume or a recent increase in volume, and a beta higher than 1.0 (The higher the better). Stocks that lack these things will be very difficult to trade successfully.

How you use these factors will affect your potential profit and will depend on your day trading strategies. Profiting from a price that does not change is impossible. Buyers and sellers create price movement, a lack of volume shows a lack of buyers and sellers.

Now you have an idea of what to look for in an inventory and where to find it. Below is a breakdown of some of the most popular choices for day trading. The most popular exchange traded fund (ETF) is the S&P 500 (SPY). Regularly trading more than 100 million shares per day, you can trade with large amounts of small and large positions, depending on volatility.

Since volume is such an important element in finding the best stocks to date, it’s no surprise that the US market is the better stock:

Alternatives

However, aside from the popular options above, there are also a number of other popular exchanges worth considering, including the Toronto Stock Exchange, Karachi Stock Exchange, the Philippine Stock Exchange, the Tokyo Stock Exchange and the London Stock Exchange.

You can also start trading Australian stocks, Chinese stocks, Japanese stocks, Canadian stocks, Indian stocks, plus a variety of European stocks.

So there are a number of day parts and classes for you to explore. Furthermore, you can find everything from cheap foreign shares to expensive pieces. All of the strategies and tips below can be used regardless of where you choose to day trade stocks.

Penny Stock

‘Which penny stocks are best for day trading?’ is a popular question we face. However, if you have read above that volume and volatility are the keys to successful day trading, you will understand that penny stocks are not the best choice for day traders. This is low volume (very little buying and selling) and this results in a lack of volatility in the short term.

Volatility in penny stocks is often misleading because a small price change is huge in percentage terms, but the fact is that most penny stocks end the day exactly where they didn’t start at all. It is impossible to profit from it.

Keep an eye on the volume of these stocks as a sudden surge can lead to price movement. But low liquidity and trading volume mean that penny stocks are not a great option for day trading.

Using leverage is one way to make trading stocks ‘cheaper’, but ensure you understand the increased risk that leverage entails before using it.

Stocks to trade today

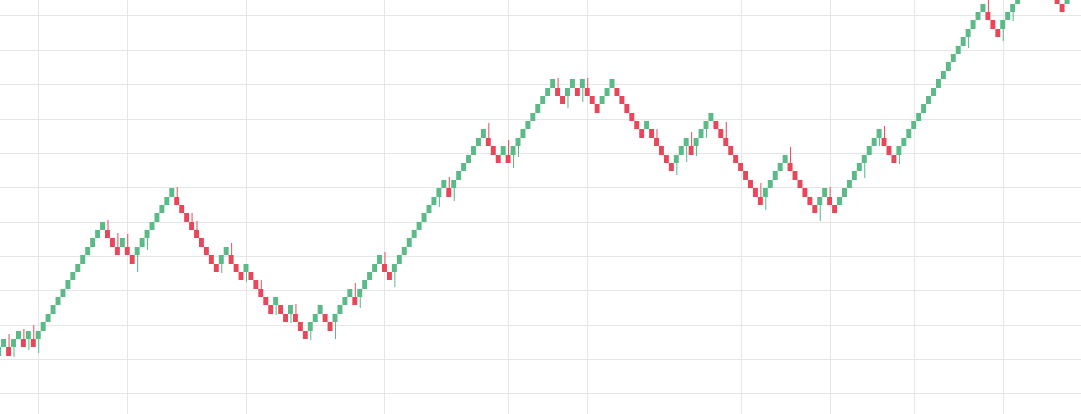

Now we know that volume and volatility are crucial; How can it help us find the best stocks today? ‘Risers and Fallers’ tables are a good shortcut to finding active markets. It means that something is happening, and it creates opportunity.

Most brokers will show a table of active stocks, whether they call it ‘Risers / Fallers’ or ‘Most Traded Stocks’. They should all point you to the most suitable opportunities for stocks.

When should you buy stocks today

Timing is everything in the day trading game. If you don’t know the best times to trade, you may struggle with day trading to earn shares. With this in mind:

- Start Early – If you want to start trading with a big lie, don’t be surprised if you struggle to make a profit. The increase in trading volume makes the market faster. You have to get up at 8 o’clock and prepare for the next day. This will give you time to undertake research and set up your monitors with the supplies you will be actively tracking that day.

- Keep it short – While you do make money trading all day, day traders see the best returns when they trade for only 1-3 hours. You might earn £750 within 2 hours and £1000 if you trade for 5 hours. So if you are looking at day trading stocks, you can get the best return per hour if you trade in short bursts.

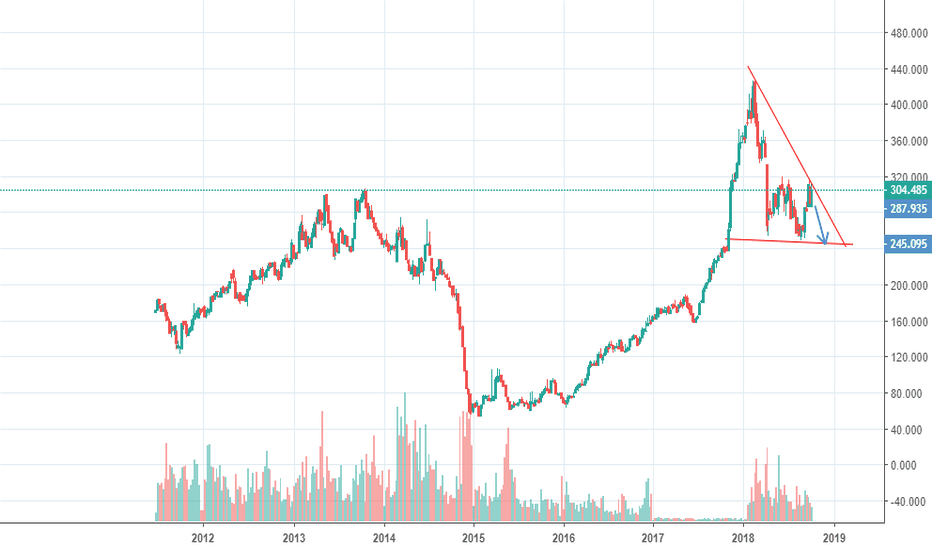

Pennant

The pennant is often the first thing you see when you open a pdf map pattern. It is simply created by significant stock movement and then consolidation. The converging lines bring the pennant shape to life. You should see a breakout move along the big stock move.

You will then see significant volume when the stock initially starts to move. Eventually the volume will decrease in the pennant section and then the volume will rise at the breakout.

Ascending triangle

You will usually see the triangle occur during an uptrend and is considered a continuation pattern. Less often it is created following a reversal at the end of a downtrend. If it does occur, ascending triangles are a bullish pattern (when the small black candlestick is followed by a large white candlestick that totally engulfs the previous candlestick).

Descending triangle

Although often a bearish pattern, the descending triangle is a continuation of a downtrend. Less frequently, it can be observed as a reversal during an uptrend.

Head & Handle

Just one look at the map and you can see how this pattern got its name. The cup is a nice curved ‘U’ shape and the handle hangs slightly downwards. Usually the right side of the chart shows a low trading volume that can last for a significant period.

Head and shoulders above

The form is brought straight forward, as both trends converge. They come together at the peaks and troughs. The lines create a clear barrier. If the price breaks through, you know to expect a sudden price move. You get different day trading stock patterns in every pdf you open. Rather than using everyone you find, do a few things.

Strategie

Die patroon hierbo en strategieë hieronder kan toegepas word op alles, van klein- en mikrokappievoorraad tot Microsoft- en Tesla-aandele.

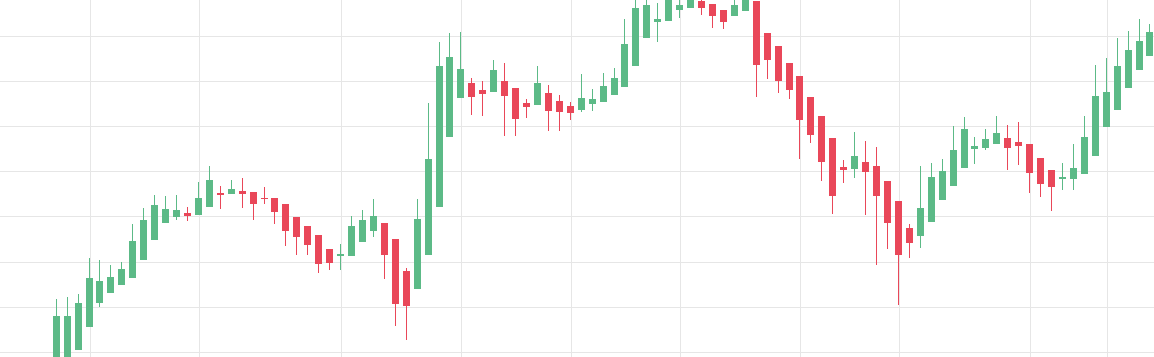

Heikin-Ashi

If you like candlestick trading strategies, you will like this spin. A candlestick chart indicates four numbers, open, close, high and low. But you use information from the previous candles to create your Heikin-Ashi chart.

- Close price – The Heikin-Ashi candle calculates an average over the open, close, low and high price.

- Open price – The candle is the average of both the open and close of the previous candle.

- High Price – The high price you see in your Heikin-Ashi candle is selected from the highest value of either the high, open and close price.

- Low price – this time the high price in the candle is selected from the high, open and close price, but this time with the lowest value.

This chart is slower than the average candlestick chart and the signals are delayed. This is part of its popularity as it comes in handy when volatile price action strikes. The strategy also uses the use of momentum indicators. A simple stochastic oscillator with settings (14,7,3) should do the trick. If you see two candles, either bearish or bullish, fully completed on your daily chart, you know the pattern is valid.

- Short Setup – If the price creates two consecutive red candles after a number of green candles, the uptrend has been exhausted and a reversal is on the cards. Short positions should be used.

- Long Setup – If the price creates two consecutive green candles after a series of red candles, the downtrend has been exhausted and is likely to be another reversal. You should consider long positions.

- Filters – You should also use other filters to prevent false signals and improve performance.

These charts, patterns and strategies can be useful when buying and selling traditional stocks. However, it can also come in handy if you are interested in the lesser known form of stock trading discussed below.

Penny Stock

There are thousands of people turning on their computers every day hoping to trade money for penny stocks day after day. But what exactly is it? The Securities and Exchange Commission (SEC) defines penny stocks as those stocks priced at or below $5. However, the majority of the trading community agrees that ‘penny stocks’ are any stocks that trade on the front cover (OTCBB) or pink sheets.

Advantages and disadvantages

Consider the pros and cons listed below to help you decide if day trading penny stocks is best for you.

- Excitement – there is no denying that day trading penny stocks can be exciting. The possibility of big profits and big losses makes for an attractive market.

- Speed – While many on your pin list may remain relatively constant, some prices will change significantly within a short period of time. This can lead to significant profit potential for affiliated day traders.

- Initial capital – Less than a thousand dollars you may only buy various shares of large companies. However, you can buy thousands of shares of the penny stocks you are interested in.

Disadvantages

Unfortunately, many of the day advertising penny stocks fail to point out a number of potential pitfalls:

- Low Quality Companies – no matter how effective your strategies are, you must account for the low quality of the majority of penny stocks. This means that companies in dire financial positions, with worrying balance sheets, are making significant losses.

- Risk Markets – There are some regulated penny stocks on the New York Stock Exchange, American Stock Exchange and the NASDAQ. However, those that trade on Pink Sheets, OTC or OTCQX will often lack adequate oversight. Unfortunately, there are simply no hard and fast rules for penny stocks. This means that listing fees, requirements and reporting regulations are virtually non-existent.

- Broker Costs – With traditional day trading versus penny stocks, you also need to factor in the less favorable price structures offered by brokers. Many will charge higher commission rates for penny stocks if they offer them at all. There are also not enough trade orders like stop losses.

- Low Volume – Volume is essential if you want to earn decent profits. But in penny stocks, a few thousand shares can be traded every day, and some even less. However, large companies can trade tens of thousands of millions of shares in one day.

- Scams – Head over to a penny stock trading forum and you will quickly come across tales of lies, scams, pumps and dumps. Unfortunately, there is a wealth of disinformationavailable, and it can be very challenging to make the right investment decision.

- Sell – Due to the trading of such goods quantities, it can be difficult to find a buyer when you want to sell. This is a serious problem, especially if you regularly profit at exactly the right time to buy and sell.

Spotted a winner

As you can see above, penny stock reviews highlight a number of serious problems when using these instruments for intraday trading. Perhaps focusing on traditional stocks is a more prudent investment decision. However, there are some individuals who earn profits from penny stocks. So, if you do want to join this minority club, make sure you know what a good penny stock looks like. Consider doing this:

- Is the business profitable?

- How many shares are currently outstanding?

- Do stocks and stock options dilute stocks?

- Can the company realize a profit based on its current business structure?

- Is the current management team dependent on issuing new shares to raise capital?

- Can the company compete effectively in its sector?

Plus, when it comes to penny stocks for dummies, it can give you an edge. For example, the metals and mining sector is known for the large number of companies that trade in pennies.

Final Word on Day Trading Penny Stocks

In general, penny stocks may not be suitable for active day traders. This is because even the best stocks for trading under $5 do not have the volume, regulation and accurate information needed to make informed investment decisions. However, if you would like to look further, there are a number of penny stock trading diaries and training videos available.

Supplies for children

This is a popular niche. Shares for children choose. Here the focus is on growth in the long term. “Day Trading” doesn’t really apply. If you’re looking for long-term ‘buy and hold’ growth (and pass on to future generations), this is the most important test for any stock.

Time filters almost everything, great ideas, great books, great music – the best of it is ‘the test of time’. Stocks (or companies) are similar. If you want to buy a stock and never have to worry about it again until you pass it on to your kids, look for the oldest businesses out there. Tech stocks are simply too new to know if they are ‘classics’ yet. A business that has been in business for 100 years has had (and survived) more drones and busts than any hotshot dealer. Let time be your guide.

Tips for day trading

From above you should now have a plan of when you will trade and what you will trade. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or losses from the highest limits. This discipline prevents you from losing more than you can afford while optimizing your potential profit. Think of these as general rules when trading stocks:

- Keep it simple – If you are new to the game, focus on just one or two securities to start with. This simple approach is ideal for those who don’t have sixteen hours a day to be glued to the screen. If you trade the same pair of securities daily, you will become an expert faster.

- Know your costs – Day traders often pay large sums in commissions simply by volume. Depending on the location and the day trading, your ‘work’ is an additional cost. Throw in the fact that you are competing against sophisticated algorithms that can enter positions in a fraction of a second and you will realize the importance of effective money management strategies for day trading stocks.

Tools

If you want to get ahead for tomorrow, you need to learn about the resources available. It is especially important for beginners to use the following tools:

-

- Blogs and Forums – These provide a fantastic opportunity to learn from experienced traders. Traders can offer techniques for scanning potential stocks. Additionally, you can learn the secrets to profiting from short, sharp price swings. You can even get free daily returns.

- Courses – There are now a plethora of online and in-person courses available. It can teach you everything from the fundamentals of day trading stocks to in-depth technical stock market analysis. In addition, you discover the risks of certain strategies and how to avoid them. This can help you avoid the most common mistakes made by intraday traders.

- Tutorials – These can be in the form of training videos, PDFs or other written documents. It can help you set up new stock picking software and create stock alerts. This can help you take advantage of the most volatile stocks and increase the overall salary.

- Newsletters – Newsletters for online stocks can be useful. They regularly do the searching for potential stocks for you, while showing stock charts to support their findings. If you’re looking for the best stocks right now, it might be worth investigating.

- Stock Sites – These sites are another great place to visit for supplies and recommendations. Often they also provide useful definitions for beginners and help you define criteria when looking for opportunities.

Stock Picking Software

You may want to start day trading full time, with so many different securities and markets available, how do you know which to choose? Do you want to start trading gold stocks, bank stocks, stock prices or maybe Hong Kong stocks? This is where a service inventory count can be useful. But what exactly does it do and how exactly can it help? It is essentially a computer program that helps you pick the best stocks from the market, especially in scenarios. It can then help in the following ways:

- The software usually streamlines the dumping of large amounts of data and finds possible opportunities that fit within certain criteria.

- You will receive regular real-time email and SMS alerts when new trading opportunities arise.

- Many stock pickers have an active and helpful chat room that will help you learn how to start looking at the stocks you are interested in.

- Many presenters offer market outlooks at the start of the day, plus stocks and stock techniques to take advantage of the day trading of the most active stocks.

- The software is often versatile. So it can be used to help you trade dividend stocks, IPO stocks and blue-chip stocks.

In general, such software can be useful if used correctly. It can quickly create a list of stockists, so you can focus your time on designing a strategy. However, it is important to note that such systems should only be used to supplement your strategy and not as comprehensive day trading advisors.

Demo account

A free day trading simulator is a fantastic way to learn about the markets. How does it work? Funded with virtual money, you can do stock selection, so you practice buying and selling your favorite Apple or Biotech shares, for example. This allows you to practice handling liquidity and stock analysis skillsto develop ghede.

Because you are training against real historical data, you can develop specific strategies that are best for the NASDAQ or NYSE, for example. All of these can help you find the right day trading formula for your stock market. Not to mention, due to the time spent on a demo account, it can be much easier to make predictions in the future.

Final Word

Hundreds of millions of shares are traded in the hundreds of millions every day. This makes the stock market an exciting and action-packed place to be. When day trading, look for stock patterns that indicate encouraging volume and opportunistic volatility. There are several user-friendly screens to view the day’s shares and help you identify which ones to buy. Expert stock day traders also have a clear strategy. In addition, they will follow their own rules to maximize profits and minimize losses.