These articles will elevate your trading to a new level. This technique gives you a framework to methodically examine the battle between the bulls and the bears.

By trading the most profitable pattern patterns, you can deduce who is winning the battle between the bulls and the bears. This strategy can be used to identify a stock chart pattern. It is also used to identify any instrument you plan to use for day trading.

We share this because it will greatly improve your ability to understand the price movements and price breaks. Ultimately, this will make you a much better trader. The key to this trading style is identifying how a pattern is forming. You will also have a greater understanding of market analysis as a whole. This article will introduce different entry-level patterns and then move on to some specialty patterns.

These patterns are the symmetrical triangle and the double bottom. We also believe that it is important to use it with hubs as well. This type of training sets you apart from the average traders.

To get started, I recommend getting a basic stock charting software with some simple tools, such as moving averages and other indicators. It can help you perform market analysis and also be ahead of the charts when a pattern forms. The ascending triangle will be a valuable pattern in your arsenal.

The rounding bottom, head and shoulders patterns, inverted head and shoulders, inverted head and shoulders, triple bottom, cup and handle and the descending triangle are also valuable. These patterns will help you find trading ideas faster than the average trader will be able to find. This will help you to make sure that you are entering the trade at the right price levels.

These types of patterns allow you to trade any currency pair. The trades are not dependent on market trends or the economic calendar to find successful trades during day trading. This write-up is not like other blog articles you have read. This is because we will give you step-by-step instructions on how to place trades with the exact price pattern for the strategy.

There are thousands of traders around the world who trade this particular kind of formations like the triangle pattern. Famous trader Dan Zenger turned $10,000 into $42 million in less than 23 months using a trading pattern strategy.

To be truly successful in trading, you can simply start imitating what professional traders do. Start testing the strategy and then measure the results.

We spend a lot of time studying price action. You can see some evidence by studying some of the best pure common card pattern strategies:

- Forex Strategy: How to Trade Bullish Flag Pattern

- Simple wedge trading strategy for big profits

- Price action Pin Bar trading strategy

Let’s move forward and define exactly what we’re looking at. More importantly, we will define how we can benefit from it.

What are chart patterns?

In technical analysis, chart patterns are simply price formations represented graphically.

Without a doubt, it is one of the most useful tools for performing technical analysis of price charts. Chart patterns are a very popular way to trade any type of market. The most profitable chart patterns give us a visual representation of the supply and demand forces. It also shows the relative strength of the specific price levels.

If we have a supply and demand, we recommend that you study more on this topic: Trading and Demand and Trading – Learn more about market movement.

What makes card patterns so attractive is that they also reveal what is happening behind the scenes. This refers to the buying and selling pressure.

Comment * A chart has its own language and it speaks through chart patterns and they leave behind the traces of the big money or the smart money. These footsteps can lead us to very profitable trades.

Why are card patterns so important?

If you remove all your indicators and momentum indicators from the charts, and everything that can make your chart less clear, and you just have to look at the price action, whether it’s a 5-minute chart, a daily chart or similar is, this is your preferred time frame. You will actually gain more insights into what is happening in the market.

As long as the candlesticks have the variable open, high, low and close; you can only use it to confirm your position or enter a new trade. You can build a very successful chart pattern trading strategy without the need for any other technical indicator. Here is an example of a main candlestick setup.

There are bullish and bearish chart patterns. What makes them work is that they tend to reappear over time, making it possible to test them again and determine the probability of success rate.

Types of Chart Patterns:

In this article series we are going to discuss how to make money with the most profitable chart patterns. Some of the most profitable strategies for pattern trading are:

- Triple Top Chart Pattern Trading Strategy

- Cup with handles strategy

- Bump and Run chart pattern

- Price channel pattern

- Symmetrical Triangle

- Double Top Card Pattern Strategy

- Pattern with double bottom card

- Rectangle chart pattern strategy

- Forex chart patterns

- Reversal Chart Patterns

- And many more.

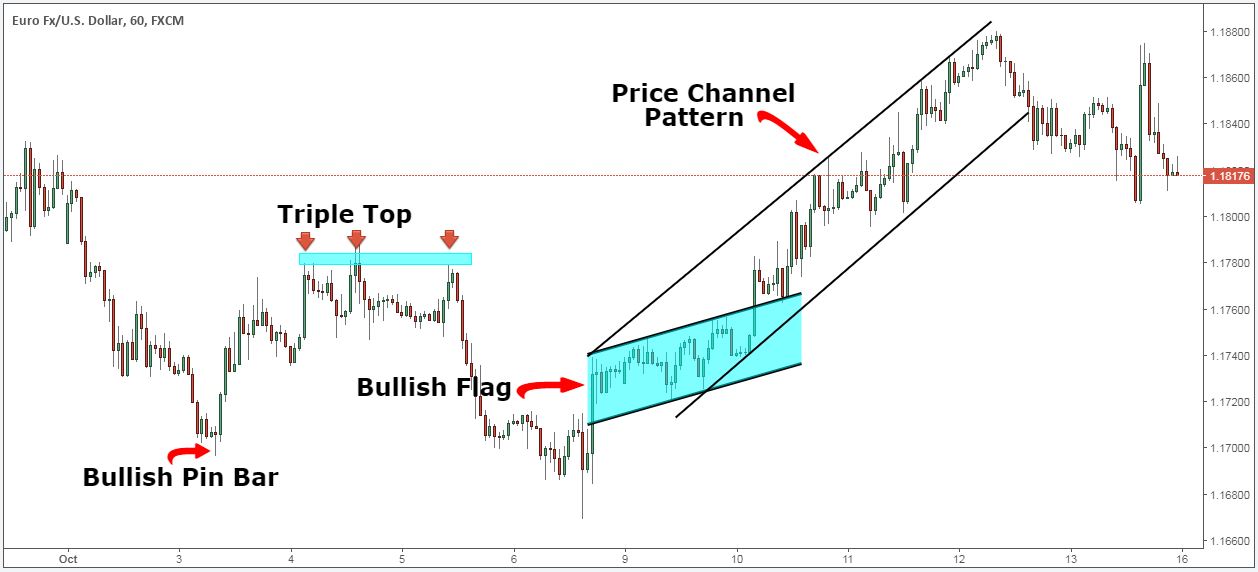

Earlier we posted a clear price chart of the EUR/USD. But if you take a closer look and read the language pattern language, we can identify some of the most profitable chart patterns (see figure below).

It doesn’t matter what time frame or market you are trading because there are patterns everywhere when there is a battle between buyers and sellers.

Let’s discuss how we can use the trading strategy and trade money in any market. The key is to look at the lower trend line and try to find a triple bottom anywhere on your chart.

Chart Pattern Trading Strategy – Rules

We have developed five step-by-step guidelines that are important to consider when trading any of the chart patterns:

Step 1: Always determine if the market is trending or consolidating.

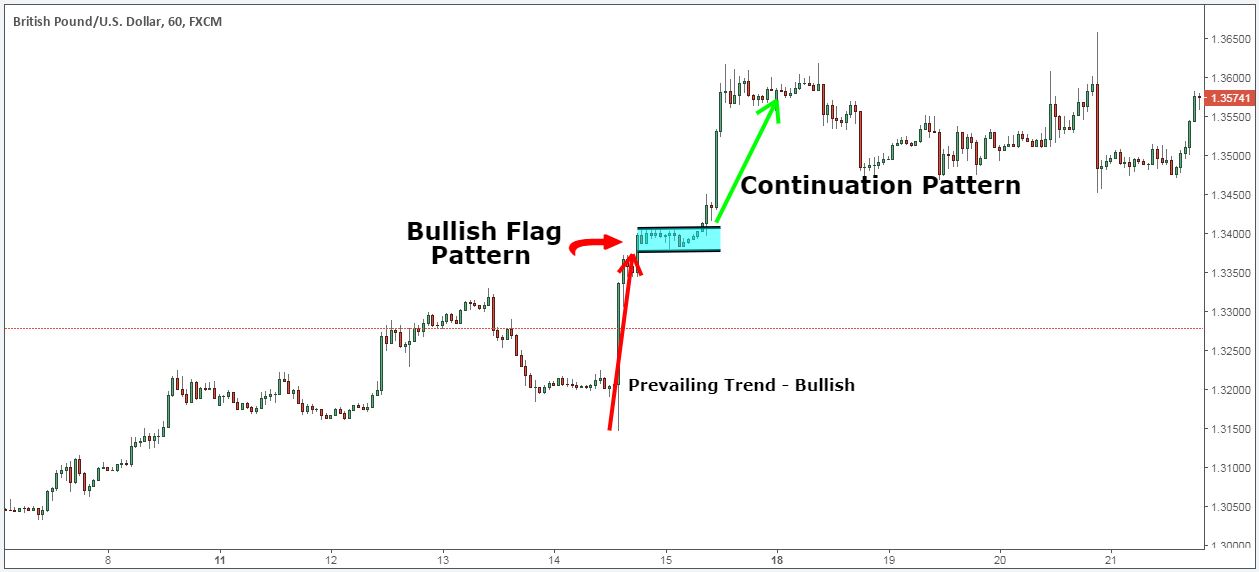

This step is important, although some of these simple chart patterns are often forms of consolidation, they are actually a continuation pattern of an underlying trend.

For example, a bullish flag pattern – read more about this HERE – is a pattern that forms after a larger upward movement. The pattern itself is only a brief form of relief, or consolidation, of the underlying trend, before it breaks to new highs.

Basically, the bullish flag pattern is a continuation pattern.

We can mainly distinguish two types of chart patterns:

- Continuation patterns: indicate that the trend will continue.

- Reversal patterns: indicate the possible end of a trend and the beginning of a new trend.

An example of a reversal pattern is the double top pattern highlighted in the figure below:

It is important to determine whether the market is trading or consolidating. This is because it will reveal what type of chart patterns work best for each trading environment.

Note ** The reason many price action traders fail is because they don’t follow this first rule. They try to trade every pattern regardless of the big picture.

Step 2: Decide which card patterns you want to use.

Do you like trading reversal patterns, or are you more comfortable processing the pattern from trading continuation charts?

Figure it out first! Try to master the specific trade setup once you have decided.

Repetition is the mother of all learning. The more you trade the most profitable chart patterns, the better you will be at tracking them in real time.

Our team at TSG is a big fan of the triple top card pattern . This is because of the potential profit available once a new trend has developed.

Step 3: Find the story in the card patterns.

What you need to do here is to construct a story behind your favorite setups.

What do we mean by that?

Simply look at the whole price, don’t just focus on the chart patterns. What you need is for this story to confirm your price action pattern. All other things must point in the same direction. Finding the right direction to place your trades will help you increase your profit rate.

For example, the narrative behind the bullish flag highlighted in Step #1 is easy to see. We move very quickly because we have developed a series of higher highs and higher lows.

Second, our broker and close above an old high; no resistance above the market price are good ingredients. This speaks volumes in favor of our bullish flag pattern.

Step 4: Trading Strategy Pattern Strategy in conjunction with a good price location.

Chart patterns work best with a good price location that can add cooperation in our trade.

What do we mean by the price point?

In simple terms, a price location is just an important area on the chart where we usually expect a price reaction. That price location can be a support/resistance level, swing high/low points or some pivot points. The location can even be technical indicators if you combine the two.

For example, the price channel pattern highlighted in figure 3 worked out because we had confluence with the higher time frame resistance. The EUR/USD was simply trading in an upward channel, but heading towards a resistance level.

Step 5: Create non-subjective trading rules for trading pattern patterns.

The final step to creating a chart strategy trading strategy is not only to have some non-subjective trading rules, but also to write them down and strictly follow your plan.

There are many ways a trader can profit from these chart patterns.

For example, the bullish flag pattern may enter at the test of the flag support or the break above the flag. You can also trade with the breakout triangle strategy.

Become a master of only one setup and one chart pattern trading strategy. Prove to yourself that you can be profitable trading one pattern before moving on. In simple terms, find a pattern you like and become very good at chart pattern trading strategy.

Conclusion – Trading Patterns Patterns

We hope you enjoyed this article on Trading Patterns.

We can fast track your career by giving you the most profitable chart patterns, which is easy. But the one thing we can’t give you is screen time and experience. This is something you have to get over a period of time. Below is another strategy called trading volume in forex.

When it comes to pattern trading strategy, there is no magic. That’s because you’re going to make mistakes. Second, you will still lose trades. The whole idea is to become selective on the chart patterns you trade.

Thanks for reading!