ETF Trading Strategies – How to Trade ETFs

In this article, we’re going to talk about how ETF trading strategies can help you grow a small account quickly. When combined with the right strategy, ETFs can be one of the best and safest ways to consistently generate profit from the financial markets.

If this is your first time on our site, our team at Trading Strategy Guides welcomes you. Make sure you click the subscribe button so you get your free trading strategy straight to your inbox every week.

ETFs are versatile financial instruments suitable for every trading style. This means you can start day trading ETFs or even trade ETFs. By taking care of the risk associated with ETF trading, you can start enjoying some of the benefits.

We are going to highlight the benefits of adding ETFs to your trading and investment portfolio. However, we are also going to shed some light on the risk associated with ETFs (Exchange Traded Funds).

If you are new to ETF trading and don’t have a complete understanding of how to trade ETFs, we hope this ETF step-by-step guide provides some guidance.

What is ETF Trading?

Exchange-traded funds (ETFs) are financial instruments designed to track the price of a specific basket of assets and traded on the US stock exchanges. ETF trading works exactly like stock trading.

ETF brings together some of the best features provided by mutual funds and stocks in one place. Most ETFs seek to track a benchmark index and trade in stocks like a stock. ETFs are available for every major asset class such as stocks or shares, fixed income or bonds, commodities and cash.

The SPDR S & For example, P500 ETF (SPY) tracks the S & P500 index.

ETFs provide a cheaper alternative for exposure to a sector that would otherwise be extremely difficult to trade.

As an example Joe will want to invest in gold, he has different alternative methods. Joe can buy gold bars or gold coins or trade gold futures. However, these are difficult methods, time consuming and expensive ways to purchase gold.

The cheapest option for Joe is to buy shares of a gold ETF like GLD, which tracks the market price of gold. Joe can do it at a fraction of the price and with less effort. Read more about how you can trade gold here.

If you believe that the entire stock market will rise, you can buy a stock index such as the Dow Jones. You can either buy all thirty companies that make up the Dow Jones index, or buy DJIA futures, which can be really expensive.

If you want to do this at a fraction of the price, you can simply buy shares of an ETF that tracks the Dow Jones, such as the DIA ETF.

Because of the volatile nature of ETFs, they are the perfect candidate for day trading. If we want to move forward, we want to learn how day trading ETF works.

Day Trading ETFs

Day trading is one of the best ETF trading strategies because this environment is characterized by high volatility. This means you can buy and sell ETFs at any time throughout the trading day. There are many ETF exchange traded funds, but the best ETF day trades are:

- SPDR S&P 500 (SPY)

- Gold Miners ETF (GDX)

- ProShares VIX Short-Term ETF

- Short Term ProShares Ultra VIX Futures ETF (UVXY)

- iShares MSCI Emerging Markets ETF (EEM)

It is also one of the five most actively traded ETFs in the US.

An ETF exchange-traded fund can offer you many profitable short-term opportunities. However, the chance of making money gambling on day trading ETFs is very low. This is the reason why you have to play the game according to some rules.

Before we go any further, we always recommend taking a piece of paper and a pen and laying down the rules on how to trade ETFs.

For this article, we’re going to look at how to buy ETFs.

Step # 1: Choose the Right ETF Exchange Traded Funds for Day Trading

SPY ETF or SPDR S&P 500 ETF is the most popular and the first ETF exchange traded funds listed in the US. We like day trading SPY because it has the largest AUM and has the largest trading volume. SPY ETF tracks the performance of the most popular stock index in the world, the S&P 500.

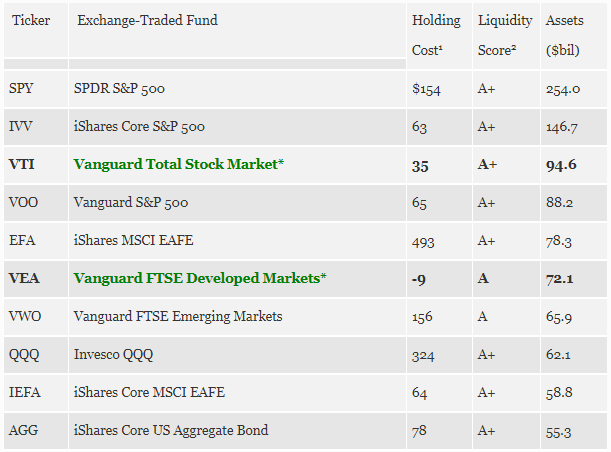

Source: Forbes

These are reasons why we can choose SPY ETF as the right candidate for our day trading ETF strategy.

Don’t assume that all exchange traded funds are the same, because they are not. If you are not sure which one to trade then go with the most trusted ETF which is the SPY ETF.

Moving forward, we will reveal the daily rules you need to implement to successfully trade the SPY.

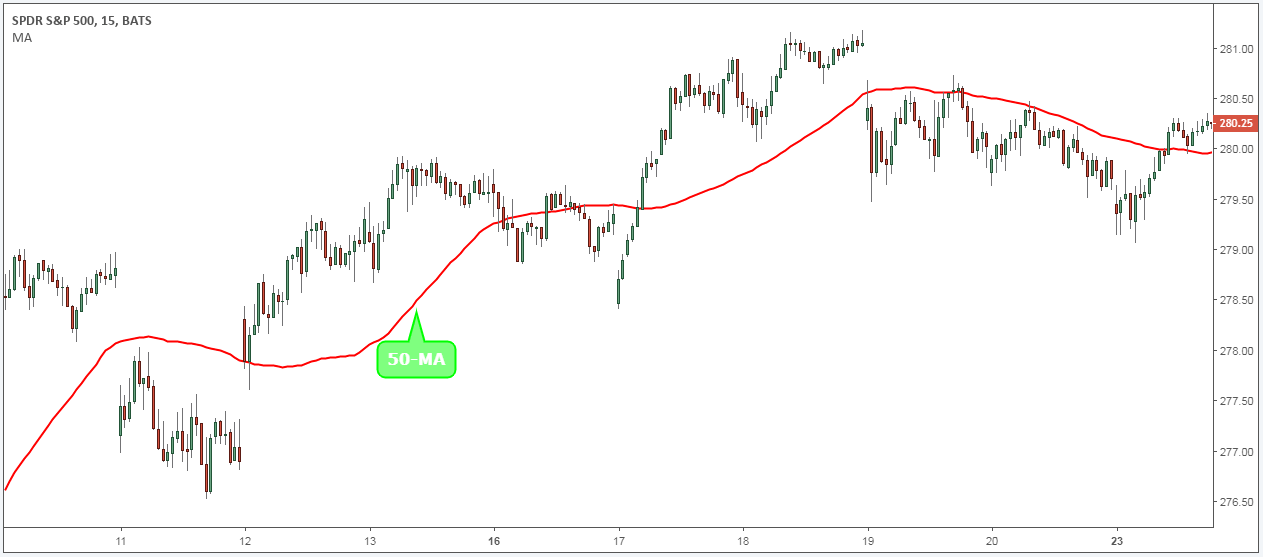

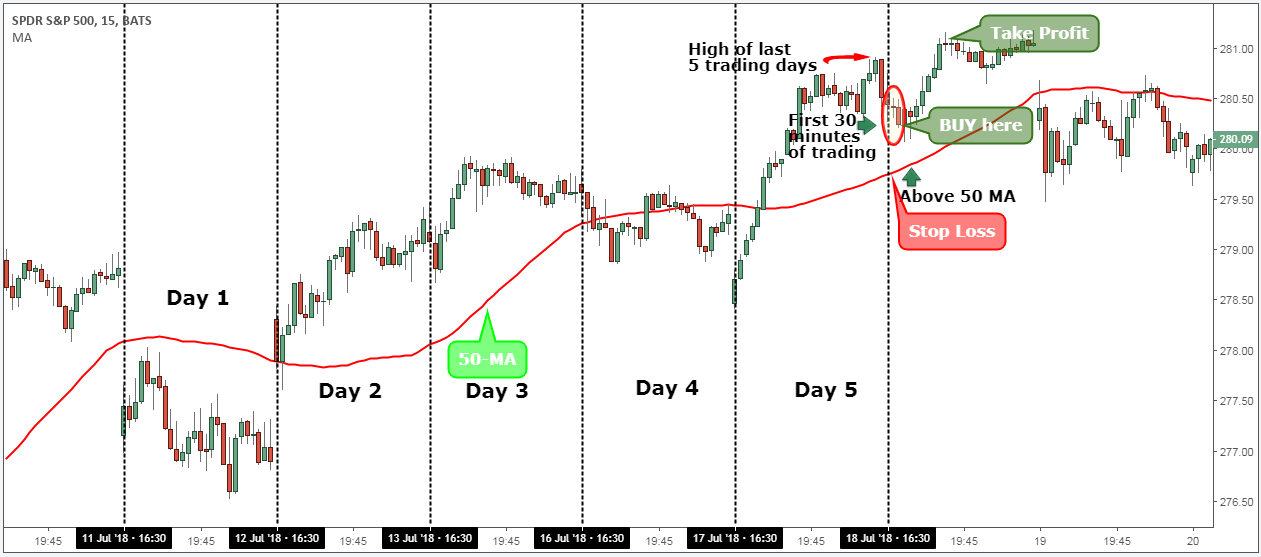

Step 2: Apply the 50-period moving average to the 15-minute chart

The 50-period moving average is one of the most popular indicators in stock trading. The 50 MA is a psychological level that many professional traders and investors use to gauge market sentiment.

Because many traders use the 50 moving average, it is more relevant to the price action. This is why we use the 50 MA in combination with the opening trading range.

Let’s see how we combine the 50 MA with the opening trading range.

See below:

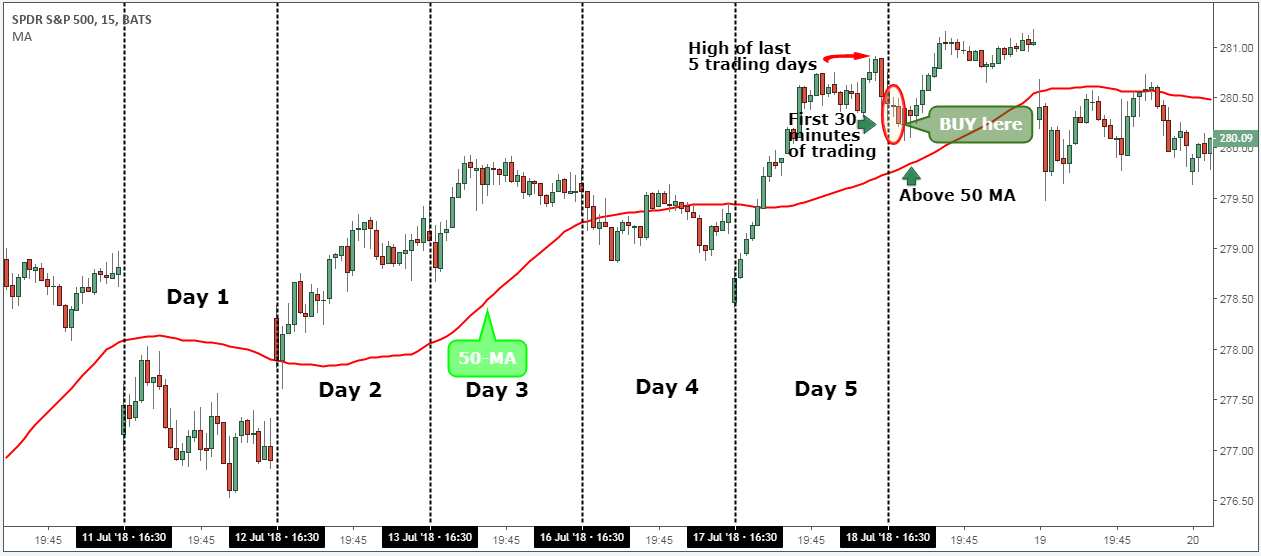

Step # 3: Only enter trades after 10:00 am. ET

We like to focus on the opening trading range when trading ETFs on the day. The morning session is when the smart money usually enters the market and consequently the most volume occurs during the morning session.

By concentrating only on the morning session, we avoid being stuck on the chart all day and only trading next to the institutional money.

Regular trading hours for the SPDR S&P 500 trust begin at 9:30 a.m. ET. But we like the first 30 minutes after the opening to wait and see what the smart money does.

Successful day-traded charge ETFs are about taking advantage of opportunities during the most volatile time of the trading day.

Step 4: Prices must last above 50-MA and open in the upper part of the previous 5-day trading range

After examining how the market is playing out for the first 30 minutes of the opening session, we look at the price above the average 50 moving average.

Second, the SPDR S&P 500 ETF must also open in the upper part of the previous five-day trading day. Mark only the previous 5 trading days on your chart and the highest price of that trading range.

If on the sixth day we are close to the highest price and above 50 MA, we are good to buy SPY.

This brings us to the next important thing we need to determine when trading ETFs, where we can place protective stop loss.

See below:

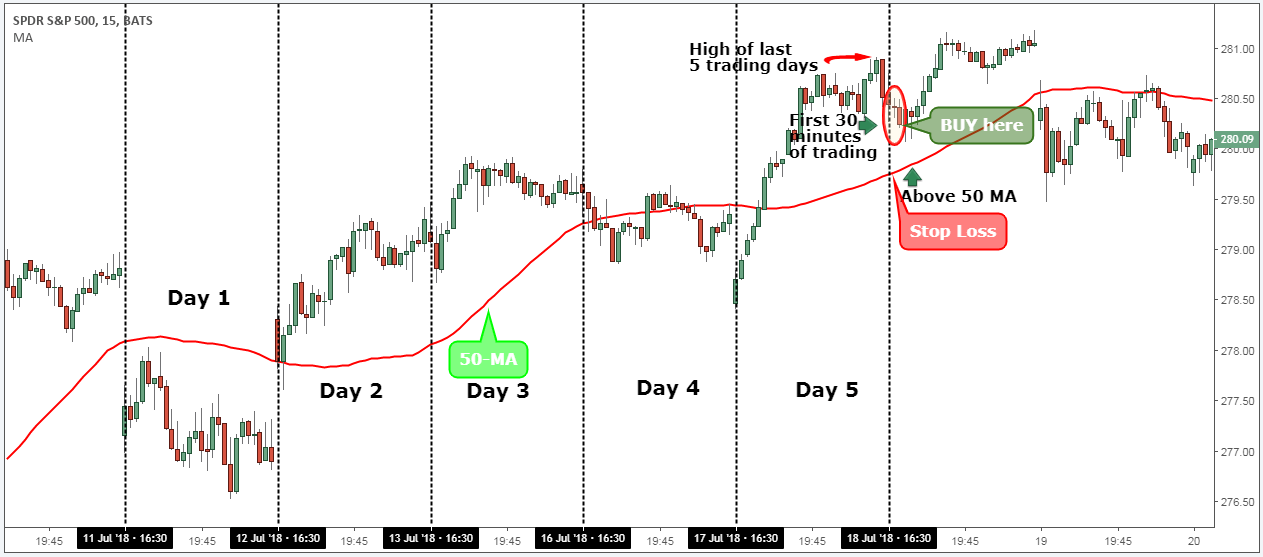

Step #5: Hide SL $0.25 below the 50 moving average

With this mechanical day trading strategy we place our stop loss $0.25 below the 50 moving average. If the SPY breaks to the 50 MA, it is important that the bulls are very weak. We found this technical reading very important for day trading.

Finally, we also need to define where we take profits.

See below:

Step #6: Take profit if SPY advances $1.00

This trade setup is based on our experience that if all the above conditions are met, the SPY ETF has a very high probability of compounding at least $1. If your profit target is not reached by 4:00 PM ET, close the trade manually.

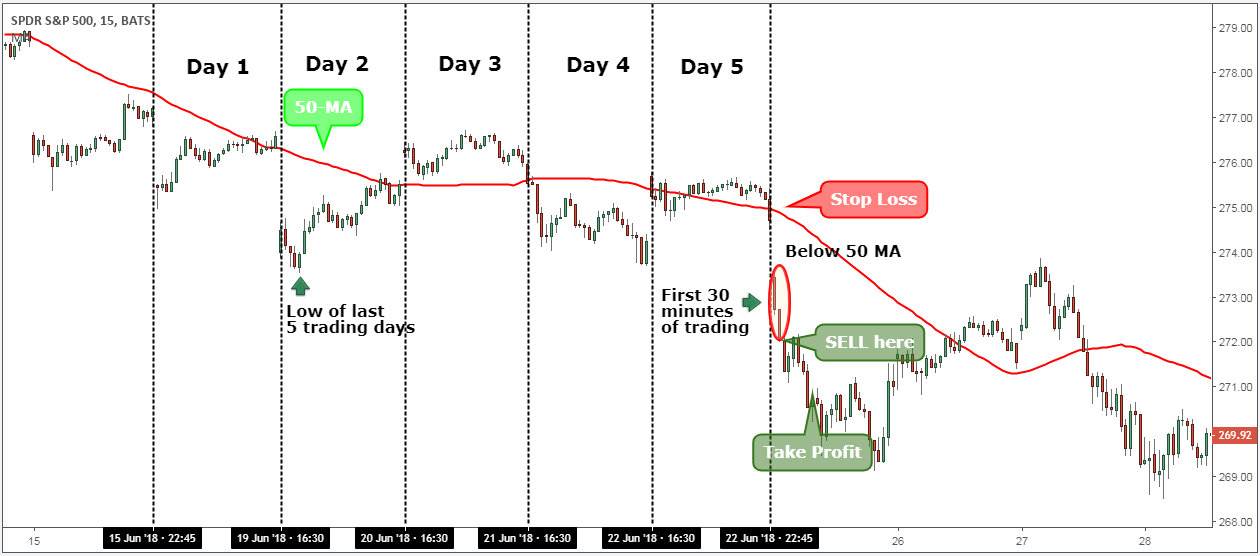

**Note: the above was an example of a BUY trade. Use the same rules for a SELL trade – but in reverse. In the figure below you can see a real example of SALE.

Conclusion – ETF Exchange Traded Funds

Day-trading ETFs offer simple investment opportunities and have lower operating costs than most other financial vehicles. Do not trade the strength of the traded ETFs if you want to take advantage of the intraday volatility.

At Trading Strategy Guides we focus on technical analysis. We love technical analysis because it has worked for many years in our trading and for many other professional traders.

Thanks for reading!