With last week’s price action, we’ve updated this article to make sure you take advantage of this price action.

Today’s article is about a strategy for crypto trading and day trading bitcoin. You’ve probably heard so much about it. There are tons of cryptocurrency trading strategies that promise to make you rich. Our team at Trading Strategy Guides understands that everyone wants a piece of the pie now. This is the reason why we have compiled the best PDF trading strategy for Bitcoin.

We also have a complete strategy article with a list of all the best trading strategies we have created.

The truth is that bitcoin is the hottest trading market right now. It is hotter than stock trading, oil trading, gold trading and any other market at this point. The reason people believe it will remain a hot market is because of blockchain technology. This is what allows transactions to take place without a central exchange. Here is another strategy for drawing trend lines with fractals.

Trading bitcoin for profit is actually a universal strategy for cryptocurrency trading. It can be used to trade any of the 800-plus cryptocurrencies available for trading today. If you are not already familiar with cryptocurrencies, it is best to start with a brief introduction first.

How to start trading Bitcoin:

The first thing you need to start trading bitcoin is to open a bitcoin wallet. If you don’t have a bitcoin wallet, you can open one at the largest wallet called Coinbase. We have arranged a special deal for everyone who wants to start with bitcoin to get a free $10 at Coinbase. Get your free $10 by opening your Coinbase account here.

Bitcoin traders are actively looking for the best possible solutions for trading and investing in bitcoin. We have some of the best methods outlined here in this article. We’ve learned this bitcoin wisdom through trial and error, and now we’ll show you what works. The methods we teach are not dependent on the price of bitcoin. It can be used whether bitcoin goes up or down.

Keep in mind that it is possible to lose money. Your capital is at risk while trading cryptocurrency because it still trades at the end of the day. We always recommend that you demo the trade before you get a chance for live money. Also read the Trading Volumes Guide.

These bitcoin strategies can also be used for trading bitcoin cash as well as other cryptocurrencies. In fact, you can use it as a trading guide for any kind of trading instrument. Blockchain technology is a huge step forward for access to information. Many companies are starting to develop applications to use Blockchain to their advantage. Remember that when trading in digital currencies, it may seem like it is not a real currency. But it is true. This is not a Ponzi scheme. Before buying bitcoins, you must have a good plan and do not underestimate the cryptocurrency markets. You should do your technical analysis just like you would trade any other instruments. You can also read our best trading strategy for Gann Fan.

Top exchange for trading Bitcoin and Cryptocurrencies

One of the reasons why Bitcoin is so popular with day traders is that there are many different Bitcoin exchanges available. The best Bitcoin exchange is dependent on many different factors. These include your home country, preferred method of payment, fees, limits, liquidity needs and other factors.

Here are some of the best crypto exchanges in the market:

- Coinbase is the largest crypto exchange in the world. Available in the United States, Canada and most countries in Europe. Offers multiple payment options.

- Binance is the second largest exchange that trades more than 130 different currencies. Has low transaction fees (0.1%).

- Bitmex is the third largest exchange and only trades BTC. Ideal for short trading and margin.

- Bittrex is an American exchange founded by ex-Microsoft security workers.

- Robinhood is a new exchange with 6 million users and takes no trading fees.

- OKEx is an exchange in Hong Kong. Trade more than 145 different cryptocurrencies.

- GDAX – Exchange in America that allows users to trade Bitcoin, Ether, Litecoin and other cryptocurrencies.

- itBit is an over the counter (OTC) and a global Bitcoin exchange platform.

- Coinmama – enables you to buy and sell easily. Accept credittcards and has a large global reach.

What is this Free Bitcoin Trading Strategy?

A cryptocurrency is really no different than the money you have in your wallet. It has no intrinsic value. And cryptocurrency is just pieces of data, while real money is just pieces of paper.

Unlike fiat money, Bitcoins and other cryptocurrencies have no central bank that governs them. This means that cryptocurrencies can be sent directly from user to user without any credit cards or banks acting as an intermediary. The main advantage of cryptocurrencies is that you cannot print them like central banks do to create fiat money.

If you print a lot of money, inflation rises which causes the currency value to fall. There is a limited amount of Bitcoins. This also applies to the majority of the other cryptocurrencies. The supply side cannot increase, making Bitcoin less likely to be affected by inflation.

Now let’s move forward and see how we can benefit from the cryptocurrency mania. We will use our best strategy for Bitcoin trading. We also have training for the best short-term trading strategy.

How to Trade Bitcoin

While long-term traders prefer to hold their bitcoin positions longer, day traders have discovered that Bitcoin is profitable for many reasons:

- Crypto trading is more volatile than stock trading.

- Bitcoin is traded 24 hours a day 7 days a week.

- Bitcoin allows for large trades with low overhead.

- Bitcoin is the most liquid form of cryptocurrency.

- Several trading opportunities emerge within a 24-hour period.

Because Bitcoin is more volatile than other tradable assets, a large number of profitable trading opportunities will occur every day. Just like regular currencies, using technical indicators will make it easier to know when price increases are likely to occur. Volume, relative strength, oscillators and moving averages can all be applied to Bitcoin day trading.

It is important to pay attention to technical indicators and the development of trends. In this next step we will talk about OBV trading and how to buy and sell cryptocurrencies.

The Best Strategy for Bitcoin Trading – 5 Easy Steps to Earn

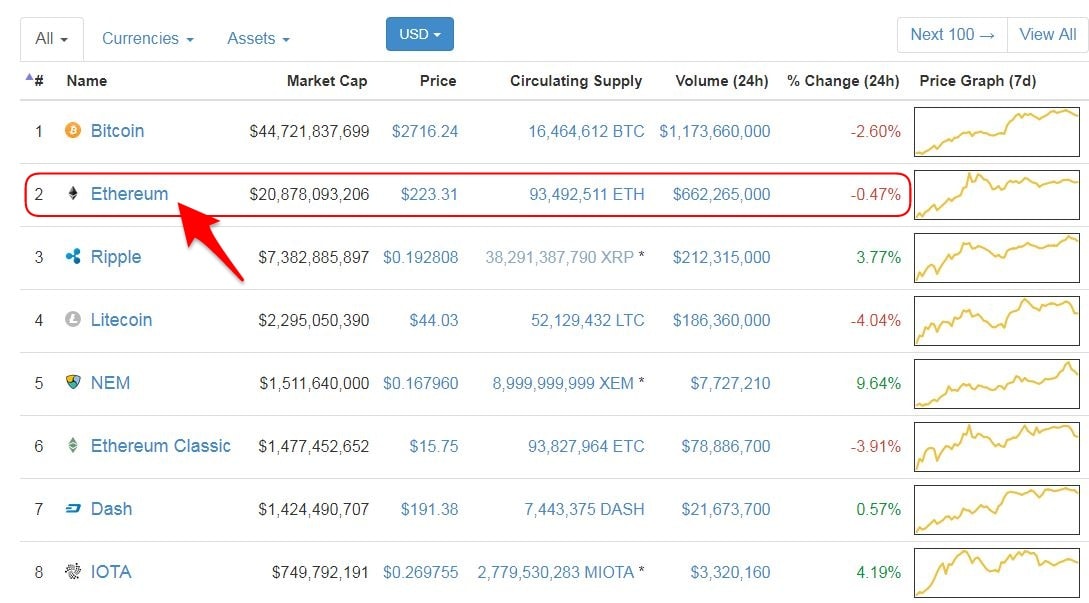

This is a crypto trading strategy that can be used to trade all the major cryptocurrencies. Actually, this is an Ethereum trading strategy just like a Bitcoin trading strategy. If you didn’t know Ethereum is the second most popular cryptocurrency (see figure below).

The best Bitcoin trading strategy is an 85% price action strategy and a 15% cryptocurrency trading strategy that uses an indicator.

Now…

Before we move forward, we need to define the mysterious technical indicator. You need this for the best Bitcoin trading strategy and how to use it:

The only indicator you need is the:

On Balance Volume (OBV): This is one of the best indicators for day trading bitcoin. It is used to analyze the total money flow in an instrument from an instrument. The OVB uses a combination of volume and price activity. It gives an indication of the total amount going in and out of the market.

OBV indicator

The OBV indicator can be found on most trading platforms such as Tradingview and MT4. How to read the information on the OBV indicator is quite simple. Here you can learn how you can profit from trading.

In theory, if Bitcoin is trading and the OBV is trading at the same time, this is an indication that people are selling in this rally. The move to the upside would not be sustainable. The same applies in reverse if trading Bitcoin and trading the OBV at the same time.

What we really want to see is the OBV moving in the same direction as the Bitcoin price. Later, you will learn how to apply this information along with the cryptocurrency trading strategy.

No technical indicator is 100% effective every time. In this regard, our team at Trading Strategy Guides uses the OBV indicator along with other supporting evidence to maintain our trades and get more confirmation. The next step comes from the Ethereum trading strategy that will be used to identify Bitcoin trades.

Before we go any further, we always recommend taking a piece of paper and a pen and writing down the rules of the best Bitcoin trading strategy.

Let’s get started…

The Best Strategy for Bitcoin Trading –

(Rules for a trade)

Step # 1: Cover the Bitcoin chart with the Ethereum chart and the OVB indicator.

Your map setup should basically have three windows. One for the Bitcoin chart and the second for the Ethereum chart. Last but not least, make one window for the OVB indicator.

If you have followed our cryptocurrency trading strategy guidelines, your chart should look similar to the figure above. For now, everything should be fine, so it’s time to move forward to the next step of our best Bitcoin trading strategy.

Step #2: Watch for smart money divergence between Bitcoin price and Ethereum price.

What do we mean by this?

Simply put, we are going to look at price divergence between Bitcoin price and Ethereum. Smart money divergence occurs when one cryptocurrency does not confirm the actions of the other cryptocurrency.

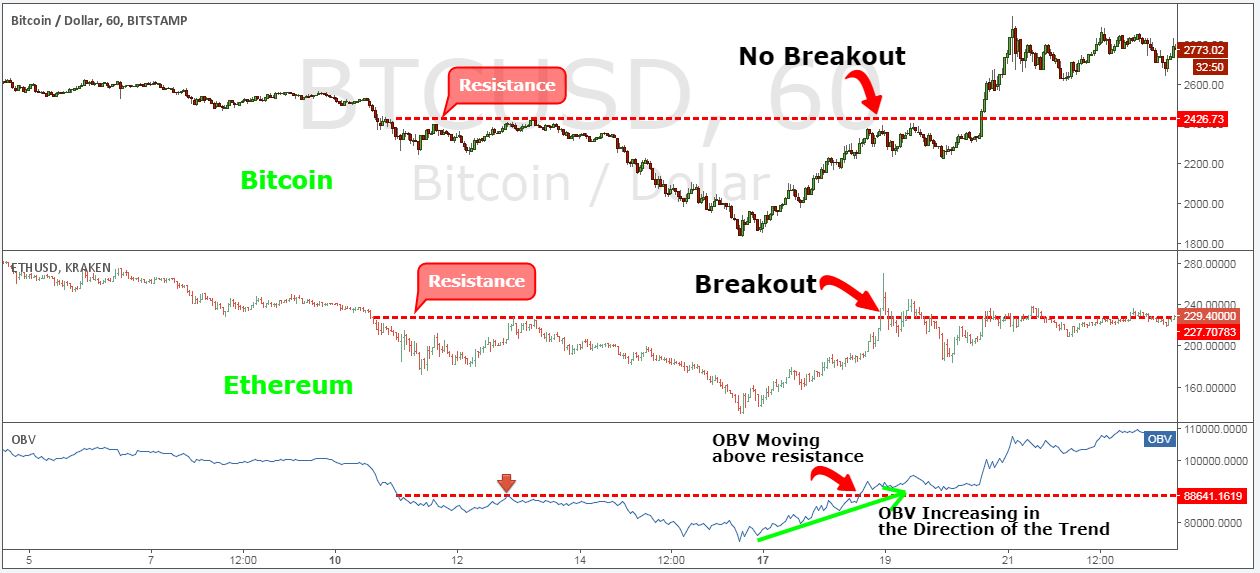

For example, if Ethereum price breaks above a key resistance or a swing high and Bitcoin does not do the same, we have smart money divergence. This means that one of the two cryptocurrencies is ‘lying’. This is the main reason why we used this strategy for cryptocurrency trading. And the Ethereum trading strategy too.

If you are still struggling to identify support and resistance, you can read our guide on: Support and Resistance Areas – Path to Successful Trading.

In the above figure, we can see that the price of Bitcoin has not broken beyond the resistance, while the price of Ethereum has broken above and reached a new high. This is the first sign that the best strategy for Bitcoin trading is about to give a trade.

The reason why the concept of smart money divergence works is because the cryptocurrency market as a whole should move in the same direction if we are in a trend. The same principles have applied to all the other major asset classes for decades. This is also true for cryptocurrency trading strategy.

Before we buy, we need to confirm the OBV indicator. This brings us to the next step of the best Bitcoin trading strategy.

Step # 3: Look for the OVB to increase in the direction of the trend.

If Bitcoin lags the Ethereum price, it means that sooner or later Bitcoin has to follow Ethereum and break above the resistance.

But how do we know that?

Simply put, the OBV is a remarkable technical indicator. This can show us if the real money is really buying Bitcoin or if they are selling. What we want to see when Bitcoin does not break above a resistance level or a swing high, and the Ethereum has already broken, is that the OBV will increase in the direction of the trend. We also want it to go beyond what it was when Bitcoin previously traded at this resistance level (see figure below). You can identify the right swing to increase your profit.

What we still need to do is place our buy limit order, which brings us to the next step of the best strategy for Bitcoin trading.

Step 4: Place a buy limit order at the resistance level in an attempt to reach the possible rate.

Once the OBV indicator gives us the green signal, it’s just to place a buy limit order. Place the order at the resistance level in anticipation of the possible breakout.

It is no surprise to see this trade being activated and the Bitcoin price higher than expected. After all, we said that the OBV is an incredible indicator.

All we need to determine is where to place our protective stop loss, and when to take profit for the best Bitcoin trading strategy.

Step 5: Place your SL under the candle and take profit once the OBV is 105,000.

Placing the stop loss below the candle is a smart way to trade. We wrote more about the reasons for hiding your SL above / below the candlestick in our most recent article here: Breakout Trading Strategy Used by Professional Traders.

When it comes to our profit, an OBV reading above 105,000 is usually an extreme reading that indicates at least a break in the trend. This is where we want to take profit.

Note ** The above was an example of a buy trade… Use the same rules – but in reverse – for a sell trade. In the figure below you see a real example of SELL, with the best Bitcoin trading strategy.

Ways to improve this strategy for the Bitcoin day

Although bitcoin day trading involves some risks, there are many ways in which these risks can be reduced. Here are some of the best ways to improve your Bitcoin trading strategy.

Remember to:

- Diversify your trades. Combining Bitcoin, Ripple, Litecoin, Ethereum and other cryptocurrencies will help reduce the daily risk associated with a particular coin.

- Limit the trading costs. Influence your daily ROI by opening multiple positions every day. Choose a reliable exchange with low fees to reduce the cost of trading.

- Look at trading hours. Plan trading times that are compatible with your schedule. Bitcoin trades 24 hours a day. This is different from the 9-5 NYSE.

- Follow Bitcoin News. Pay attention to cryptocurrency news to stay ahead of the market. Set up alerts and other types of notifications.

- Using technical analysis . Use strong technical indicators such as OBV. This will help you justify each of your trades.

- Use stop losses. Set stop-loss orders on each trade. Start with a ratio of profit loss of 2: 1.

Closing

Maybe one day our fiat money system will go down and be completely replaced by cryptocurrencies. We live in a digitized world and the possibility of Bitcoin or any other important cryptocurrencies to replace the way we pay for goods and services is not beyond the realm of possibility.

But as long as there is still profit to be made from currency trading, we encourage you to read our recipe for success in Forex trading: How to Trade Money – 2 Keys to Success.

We hope that the best strategy for Bitcoin trading sheds some light on how you can now use the same technical analysis tools that you use to trade the Forex currency market to trade the cryptocurrencies.

Ready to start? Learn about other top investments in our guide to the best cryptocurrencies to invest in 2019.

Tap here now to get the e-book absolutely free!

Thanks for reading!