Wil u crypto-dagleer leer en ‘n konstante $ 500 per dag maak? Ons hoor gereeld van al die geld wat u bedags kan verdien . Maar wat van crypto-daghandel ? In die les van vandag leer u hoe om cryptocurrency te verhandelmet behulp van ons gunsteling crypto-analise-instrumente .

Our team at Trading Strategy Guides is fortunate to have over 50 years of experience in the day-to-day business. We are going to share with you what it costs to day trade and hopefully, by the end of this trading guide, you will know if you have what it takes to succeed in this business.

First, it is essential to have a structured approach and a rules-based strategy when day trading. Same as swing trading or positional trading you don’t trade every day and you’re not going to make money every day. So, you need a day-trading cryptocurrency strategy to protect your balance.

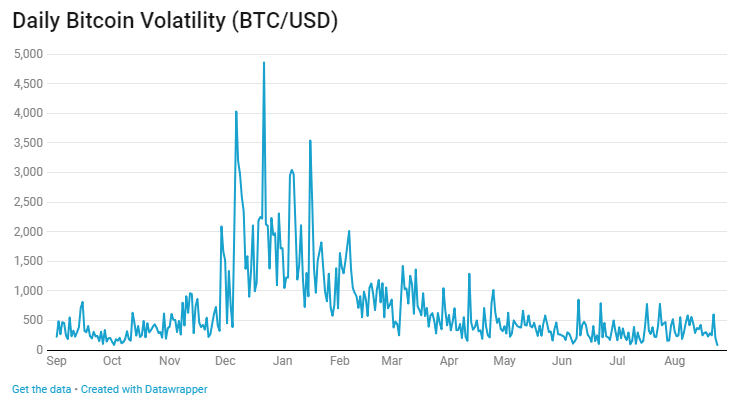

The high volatility of Bitcoin and other cryptocurrencies has made the crypto market like a roller coaster. This is the perfect environment for day trading because during the day you will have enough ups and downs to make a decent profit.

Moving forward, we’re going to teach you what you need to learn how to day trade cryptocurrency and we’re going to share some out-of-the-box rule-based day trading strategies.

How to day trade cryptocurrency

The unique characteristics of the crypto market require you to have a thorough understanding of how it works. Otherwise, your experience could be like skydiving without a parachute.

The good news is that we will provide you with everything you need to survive crypto day trading.

Day trading in the cryptocurrency market can be a very profitable venture due to the high volatility. Since the crypto market is a relatively new asset class, this has led to significant price fluctuations.

Before trading Bitcoin or any other altcoins, it is wise to wait until we have high volatility. The good news is that even if this is a low level of volatility relative to other asset classes, this volatility is still high enough that you can make a modest profit on your trades.

Crypto day trading also requires the right timing and good liquidity to make precise entries.

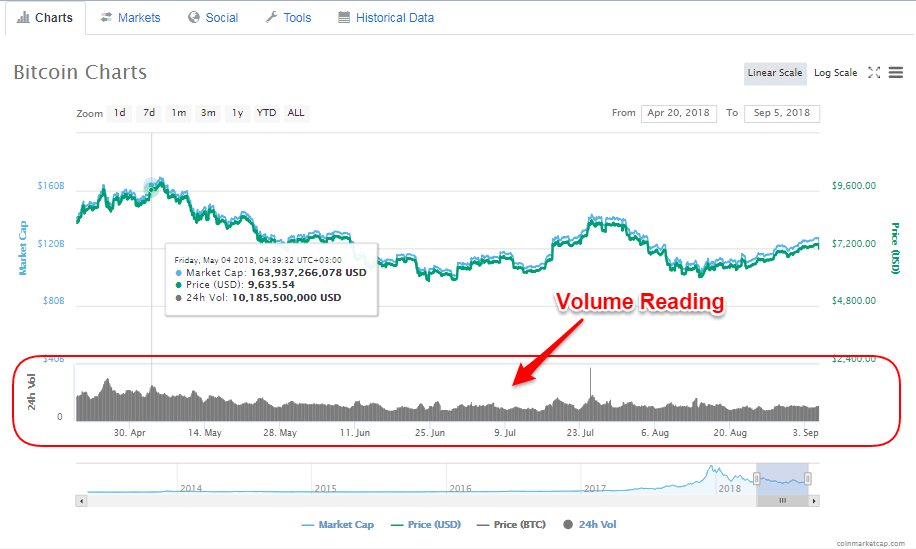

Many of the cryptocurrencies and crypto exchanges are very illiquid and do not have the liquidity to offer instant execution that you can find when trading Forex currencies.

Before trading Bitcoin or any other coins, it is also important to check how liquid the cryptocurrency you want to trade is. You can do this by simply verifying the 24-hour volume of the crypto trade.

CoinMarketCap is a great free resource to read and measure the market volume of any particular coin.

Note * Always remember that not enough liquidity can lead to significant slump and bigger losses.

As said before, crypto day trading is not every day. We only like cryptocurrencies for the day when all the conditions fit in our favor. In this case, avoid trading on weekends and limit trading only to the days with the highest volume.

Buckle up, because then we’re going to reveal how professional traders trade cryptocurrencies.

Crypto Day Trading Strategy

The idea behind crypto day trading is to look for trading opportunities that offer you the potential to make a quick profit. If day trading suits your own personality, then let’s dive in and get a step-by-step guide on how to day trade cryptocurrency.

Before going further, we always recommend to take a piece of paper and a pen and note the rules of this scalping strategy.

In this article we are going to look at the ‘buy’ side.

Step #1: Pick up coins with high volatility and high liquidity

As previously discussed, the number one choice you should make is to pick coins that have high volatility and high liquidity. If you don’t day trade in Bitcoin, which is the most liquid coin, you like the altcoins, then try to choose the coins that have good liquidity and volatility.

There are over 1600 coins on the market and growing. By following only the best cryptocurrencies, you narrow down your choice.

Trading smaller cryptocurrencies can also be a very profitable business, but there are higher risks. Remember, crypto prices can crash just as fast as they rose.

Moving forward, you are going to learn how to earn money with crypto day.

Step #2: Apply the Money Flow Index indicator to the 5-minute chart

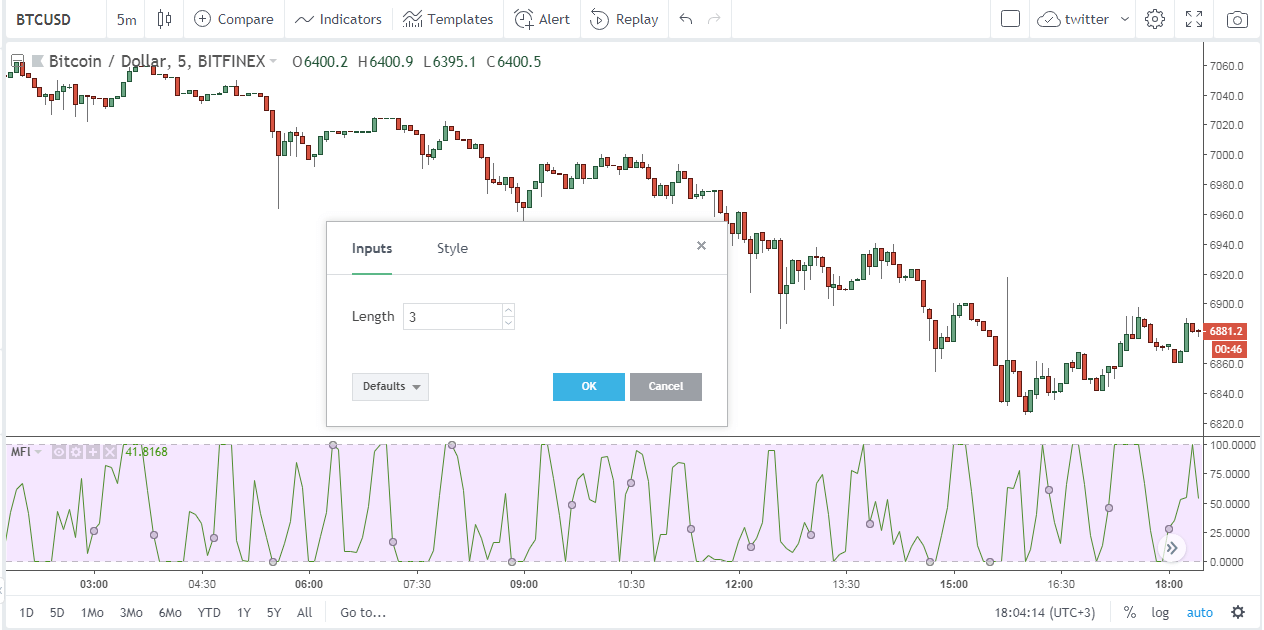

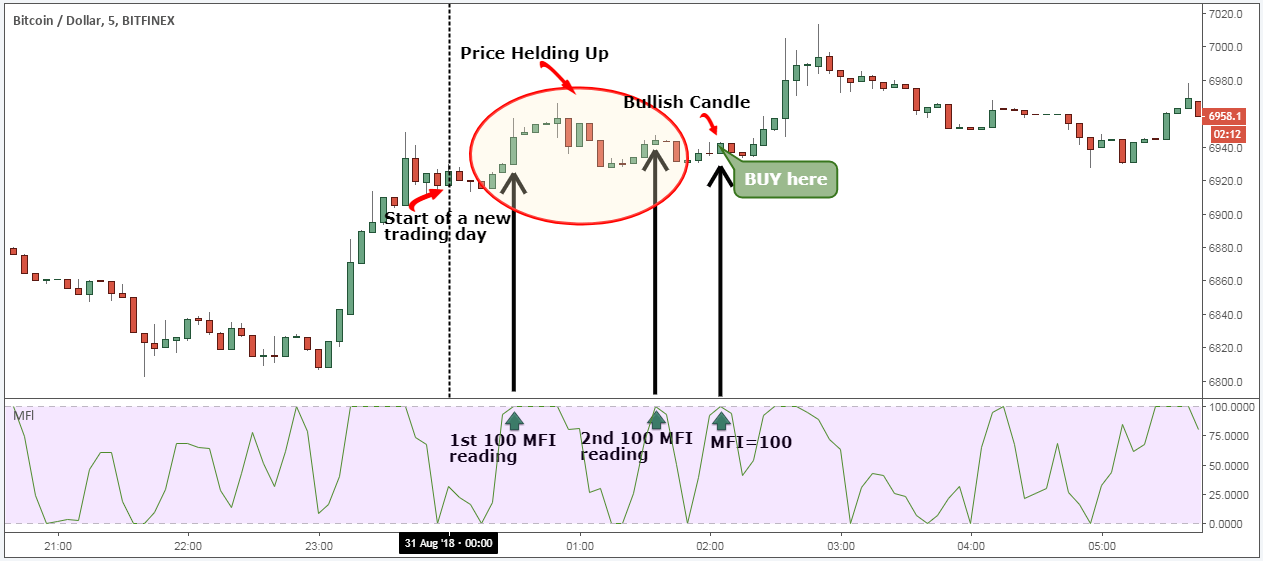

This particular day trading strategy uses one simple technical indicator, namely the Money Flow Index. We use this indicator to track and measure the activity of smart money when the institutions buy and sell cryptocurrencies.

The preferred settings for the MFI indicator are 3 periods.

We are also going to change the standard buy and sell levels from 80 to 100 and from 20 to 0 respectively.

In die volgende stap word uiteengesit hoe die IMF-aanwyser gebruik word.

Sien onder:

Stap # 3: Wag totdat die geldvloei-indeks die 100-vlak bereik

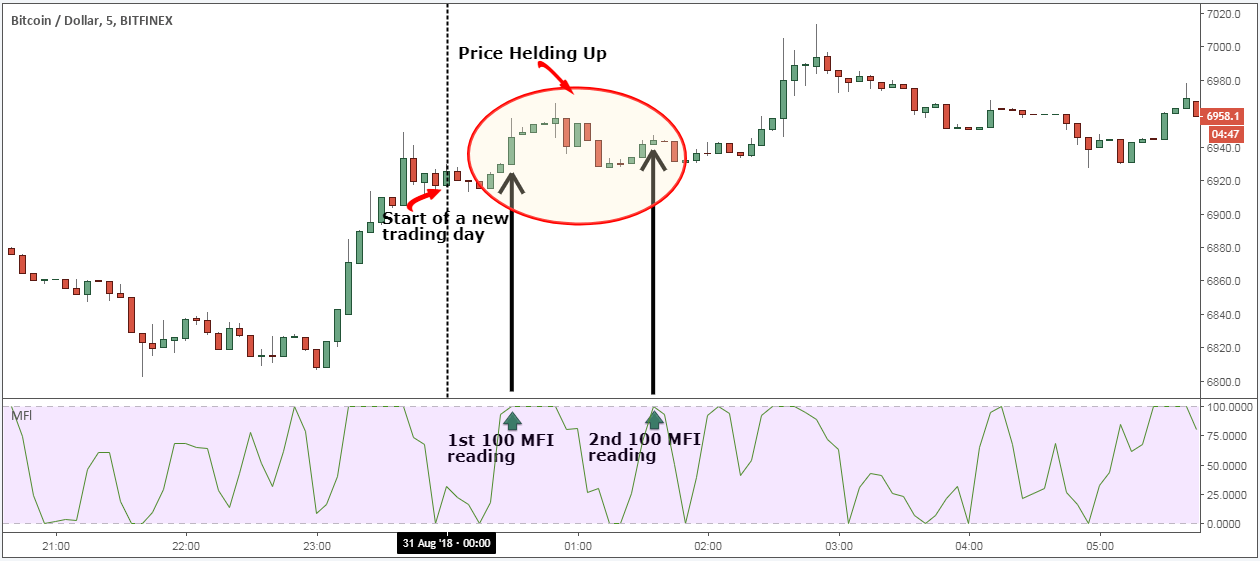

‘N MFI-lesing van 100 toon dat die groot haaie die markte binnekom. As u koop, kan slim geld nie hul voetstappe verberg nie. Hulle laat onvermydelik spore van hul aktiwiteit in die mark, en ons kan die aktiwiteit deur die MFI-aanwyser lees.

Tegniese aanwysers is nie altyd reg nie, en daarom het ons ‘n paar voorwaardes bygevoeg om ons daghandelstrategie te verfyn. Ons moet naamlik gedurende die huidige dag die eerste twee MFI-lesings van 100 oorslaan en die crypto-prysreaksie bestudeer.

Die prys moet byhou tydens die eerste en tweede 100 MFI-lesing.

If the price drops after the first two MFI 100 readings, it indicates that we are likely to have a decline.

Let’s now determine the suitable place to buy Bitcoin and what are the technical conditions that must be met.

See below:

Step #4: Buy if MFI = 100 and if the subsequent candle is bearish

We can now wait for the third MFI reading above 100. It does not necessarily have to be the third MFI = 100 reading; you can take every other MFI = 100 reading. If time does not allow you to reach the third 100 reading on the MFI indicator, you can choose the next one, as long as all other technical conditions are met.

Next, we also need the candlestick when we got the MFI = 100 reading to be a bearish candle. The closing of this candle should be near the top point, and this gives us a candle with very small spikes.

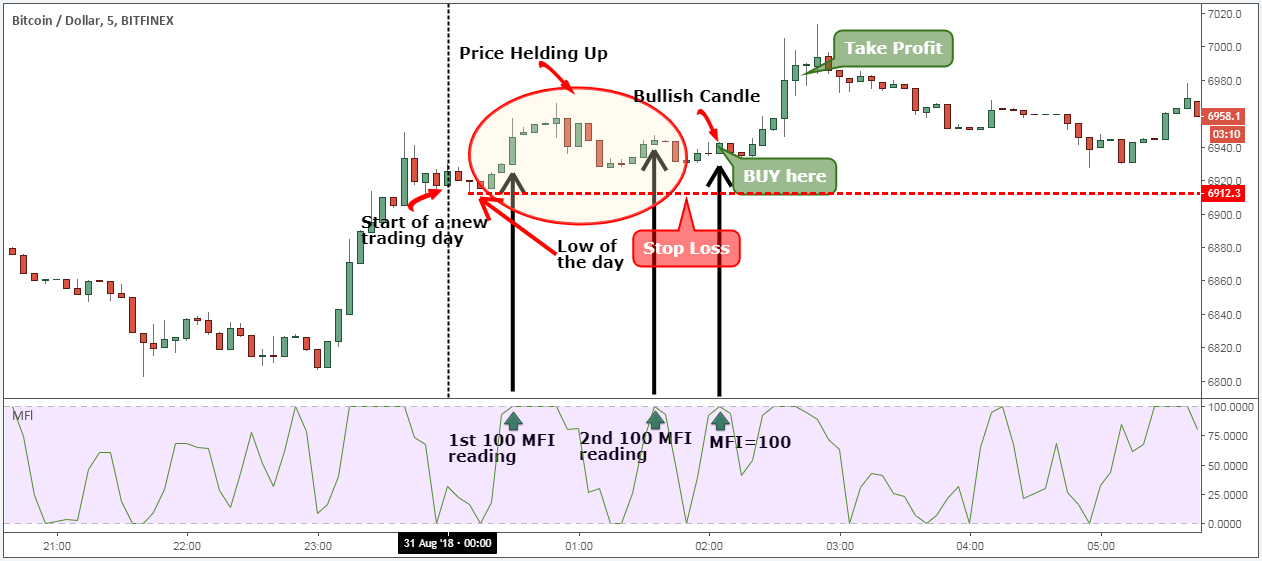

This brings us to the next important thing we need to determine when trading cryptocurrency, where to place our protective stop loss and where to take profit.

See below:

Step #5: Hide your protective stop loss below the low of the day. Take profit during the first 60 minutes after opening the trade.

The obvious place to hide your protective stop loss is lower than the day. A break below that indicates a change in market sentiment, and it is best to exit the trade. It can also indicate a reversal day.

We are more flexible when it comes to our exit strategy. The only rule you have to follow is to take profits during the first 60 minutes or the first hour after you start trading. Holding the trade for more than one hour will result in a lower success rate. At least that’s what our backtested results showed us.

Conclusion – Crypto Day Trading

If you took the time to read all day crypto guide you should be able to buy and sell Bitcoin and alts and make daily profit. If you are interested in learning how to trade cryptocurrency, you should arm yourself with enough information before diving into the market.

Crypto day trading can be a great way to grow your crypto portfolio, and it’s a very profitable alternative to the mentality that it cripples the crypto community.

A live day trading with cryptocurrency can be much easier due to the high volatility of the crypto market. High volatility suits day trading very well, so you have the right environment to succeed. You may also be interested in reading our guide on the best investments in cryptocurrencies for 2019.

Thanks for reading!