The best candle PDF guide will teach you how to read a candle chart and what each candle says. Candlesticks are the most common and easiest to understand. The candle pattern strategy described in this guide will reveal the secrets of how bankers trade in the forex market.

When you start your business journey, you are bombarded left and right with new concepts. It can be scary and confusing to assimilate everything. This trading tutorial shows you how to read candlestick charts for beginners.

We will explain the chandeliers in a way that you will remember. If you are a more advanced trader, this candlestick PDF guide is also for you. We will share with you a powerful candle pattern strategy.

First, let’s start with the basics of candlestick trading and how to correctly read candlestick charts.

Understanding candle charts for beginners

If you remove everything in your charts, you will have a simple candlestick chart. What you see in the table below is the raw price data, which in the jargon of foreigners are also called naked charts.

Note 1: Unlike Renko charts, which we discuss in our previous chart trading guide, candlestick charts contain the element of time.

The most important information you need as a trader is current and historical prices. The price of the candlestick will tell you exactly what the price is doing at any given time. The candlestick chart also provides a unique view of the market sentiment.

A candle price chart consists of many individual candles with different shapes, which form different candle patterns.

There are three types of chandeliers:

- High candlestick – these are green candles and show that the price has risen during the selected period. In other words, the closing price is higher than the opening price.

- Low candlestick – these are red candles and show that the price has fallen in the chosen period. In other words, the closing price is less than the opening price.

- Neutral candlesticks – these are candles without a body and the opening price is equal to the closing price.

In addition to the opening and closing price, the candlestick chart also provides information on the highest and lowest price during the selected period.

The bars above and below the body are called shadows. In Forex jargon they are also called ‘wicks’ or ‘tails’.

In technical analysis, Japanese candlesticks can display different types of prices that underlie many candlestick pattern strategies.

For now, let’s focus on the best candle patterns that many banks use against retailers.

Candlestick Pattern Strategy

If you want to get the most out of what the candlesticks are showing, let’s explore the best candlestick patterns you can use. We will show you some Christmas patterns, explained with examples. Understanding the psychology behind the candlesticks can make your life as a professional much easier.

In addition, you get a possible picture of the battle between buyers and sellers. Graphic patterns can also be used to activate your business.

In this best candlestick PDF guide, we will reveal a secret candlestick pattern used among bank traders. This currency candlestick pattern we are talking about is the ORB No. 4 standard developed by hedge fund manager Toby Crabel.

Toby Crable is probably one of the lesser known profitable traders. Although Toby Crabel was described by the Financial Time in 2005 as “the most famous trader on the counter-tender side”, he remains an unknown name in the retail sector.

The reason we mention Toby Crabel’s work is because he is the father of the ORB standard, also known as the series opening pattern. The ORB standard is considered the most powerful trading tools in the last 25 years.

This powerful trading technique helped legendary gurus trader Larry Williams turn $10,000 into $1 million in less than a year.

Step 1: how to identify ORB Nr4

The ORB standard is defined as a trade executed at a fixed opening interval value.

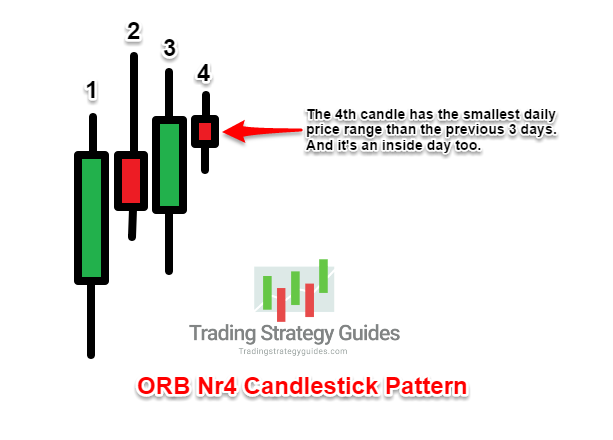

The opening negotiation for the opening range is more effective if it is carried out after an internal day with a smaller daily range than the previous three days. This is what No. 4 represents. You have three candles followed by another candle, with a narrower daily interval than in the previous three days.

Note 2: the fourth day does not necessarily have to be an internal day, it only has to have the daily interval smaller than the previous three days. However, weekdays produce higher success rates.

What does a real Nr4 ORB pattern look like on a Forex candlestick chart:

The ORB Nr4 standard is also one of the best candlestick standards for intraday trading. You simply need to apply the same rules described in this guide to your favorite intraday chart

And if we tell you that 40% of the time, the first hour of trading can indicate the day’s high and low. Our candle pattern strategy incorporates this price behavior so you can better manage your risks and set your goals.

You can basically become a skilled professional.

Step 2: Identify the best candlestick patterns and mark the highs and lows of the fourth candle

Remember two things when looking for the ORB Nr4 candlestick pattern:

- The daily range of the fourth candle should be narrow and smaller than the previous 3 candles.

- The price range of the fourth candle must also be within number 3 of the candle.

The ORB No4 pattern in the above chart is a bullish candlestick pattern because it leads to a bullish move.

Narrow daily trading intervals indicate contraction. And contraction always leads to expansion. This is a general rule because markets move from periods of contraction to periods of expansion.

That’s why this ORB No4 candlestick pattern is so powerful.

Step 3: change to 1 hour TF and buy if we break the high, sell if we break the lowest candle of the Nr4.

Our trade is executed the next day after the emergence of the Nr4 standard. To have a clear picture of the short-term price action, we need to shift our focus to an hourly period.

Note 3: buy or sell only if the leak occurs during the first 5 hours of the new trading day.

We use the opening technique for open gaps to tap the market in time and have an effective commercial entry.

Trading based on the ORB – No4 candlestick pattern will yield immediate profit.

If the trade does not show profit immediately, your trade will become more vulnerable. As a general rule, you can safely close the trade on the market after the first hour of trading.

Obviously, you can only do this if your stop loss has not been triggered in the meantime.

Now let us describe where we should place protective stop loss and where we should exit profitable trade.

Watch below:

Step 4: place the SL below the low of NR4, take a profit with a SL below right every 1 hour sail

Hide your stop loss under No. 4 of the minimum day for buy trades. The ORB – Nr4 standard tends to precede strong activity on trend days; therefore, your stop loss should rarely be reached.

Our strategy for profitability is quite easy and is slightly modified from the original strategy highlighted in the book “Trading Short-Term Price Patterns and Openings”, written by Toby Crabel.

Although the ORB nr4 standard is prone to days of trend trading, we are more conservative and want to make quick profits. We prefer to follow our SL below each 1-hour candle and wait for the market to reverse for profit.

Conclusion – Better candlestick patterns

The best candle PDF guide is the result of a series of surveys that lead us to find marketable trends. The price of any market follows some mechanical laws that can be observed by candlestick standards. Having some definable rules for entry based on candle patterns can really help the real trader.

Some of the best candle patterns are more predictable if you develop a structure around these card patterns. As a trader, your obligations to apply these trading concepts are within your own understanding of the market.

If you can combine the two, you can develop a strategy for candlestick patterns.