Best Ichimoku Strategy for Fast Profit

The Best Ichimoku Strategy is a technical indicator system used to assess the markets. This unique strategy offers trading signals of a different quality. Forex trading carries significant risks of loss. Although, with Ichimoku cloud trading, these losses are limited and kept small.

The Ichimoku system is a Japanese chart method and a technical analysis method. Our team at Trading Strategy Guides has mastered the method over a long period of time.

The Ichimoku indicator was published in Japan in 1969 by a reporter, Ichimoku Kinkou Hyo. This candlestick trading technique has stood the test of time.

The name Ichimoku tells a lot about the trading system, or at least it gives a description of the system.

Ichimoku = “One look, look”.

Kinkou = “Balance, equilibrium”.

Hyo = “Chart, graph”.

Ichimoku cloud trading tries to identify a likely price direction. It helps the trader to determine the most suitable time to enter and exit the market by providing you with the trend direction. It gives you reliable support and resistance levels and the strength of these market signals.

Now….

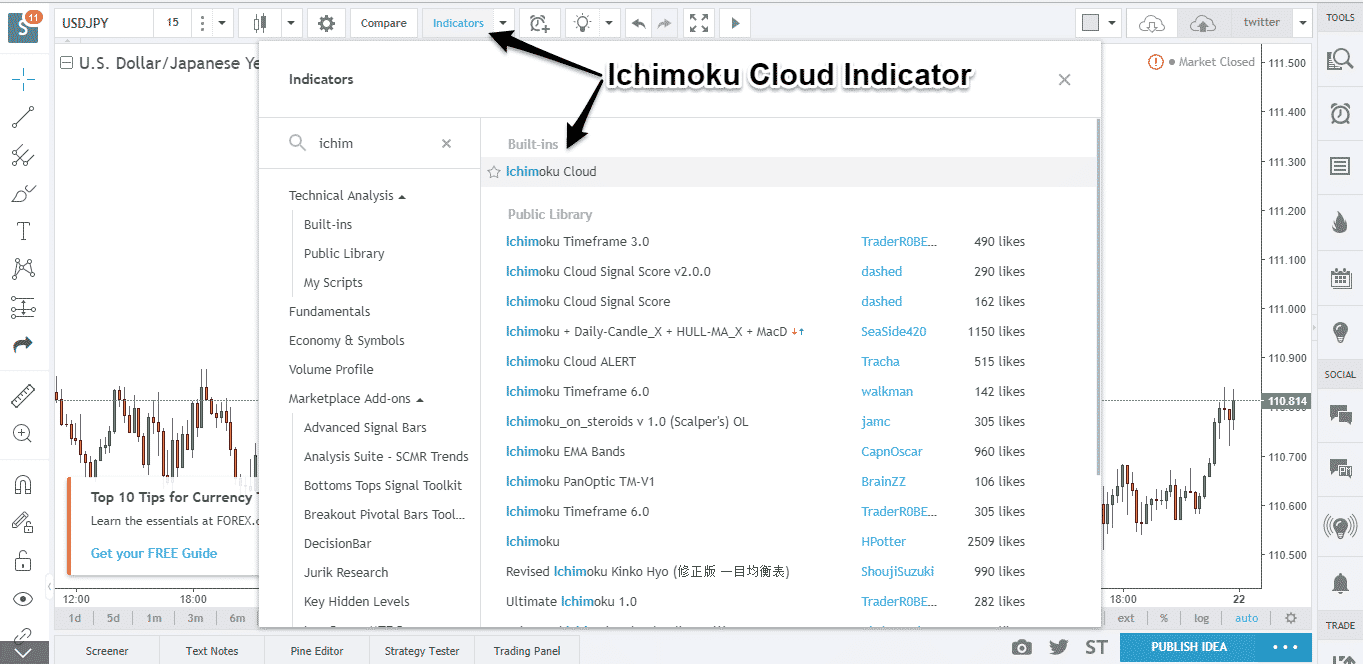

Before we delve deeper into the Ichimoku Cloud strategy, let’s look at the indicators needed to successfully trade the strategy.

The most popular Forex trading platforms use the Ichimoku Cloud indicator. The Ichimoku indicator paints all the components needed to better visualize the price action. The Ichimoku cloud is one of the most comprehensive technical indicators in modern use. Surprisingly, it quickly became the ‘go-to’ indicator for forex traders around the world.

In the Ichimoku cloud section, we are going to give you an in-depth overview of the Ichimoku components.

So before we move forward, let’s define all the Ichimoku Cloud components. We will look at how you can correctly interpret the trading signals generated by this technical indicator.

Ichimoku Cloud explained

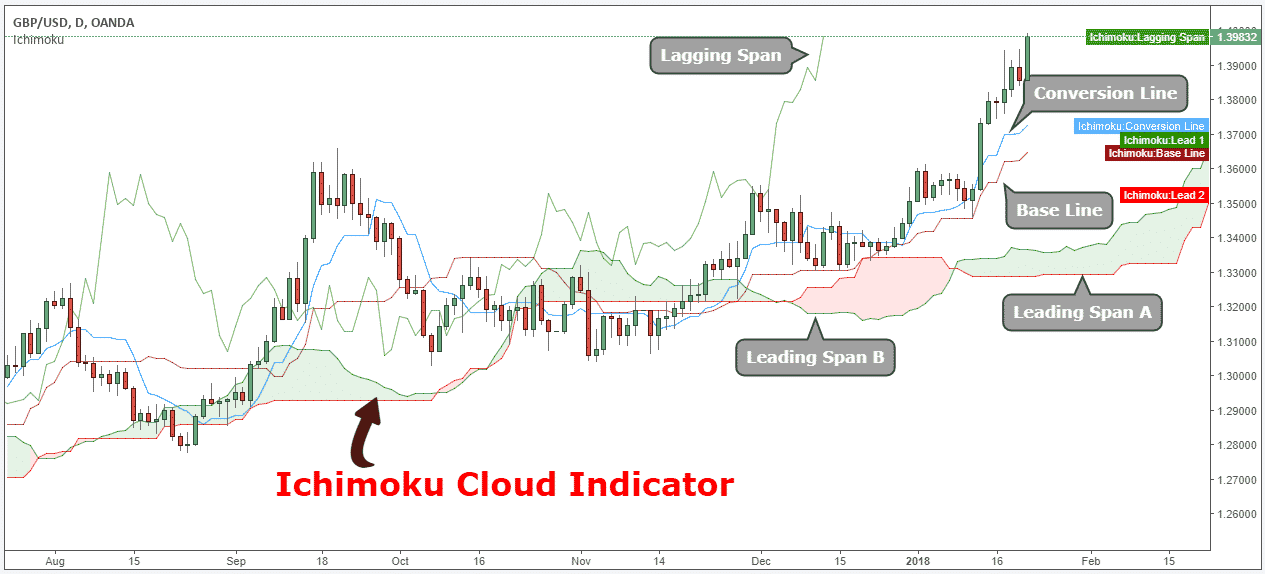

The Ichimoku Hinko Hyo is a momentum indicator that is used to recognize the direction of the trend. It can also define accurate support and resistance levels. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trading signals:

- The line of Tenkan-Sen, also called the Conversion Line, represents the center of the last 9 candlesticks. It is calculated using the following Ichimoku formula: [(9-period high + 9-period low) / 2].

- Kijun-Sen line, also called the baseline, represents the midpoint of the last 26 candlesticks. It is calculated using the following formula: [(26-period high + 26-period low) / 2].

- Chiou Span, also called the Lagging Span, lags behind the prize (as the name suggests). The Lagging Span is back 26 periods.

Senkou Span A, also called the Leading Span A, represents one of the two cloud boundaries and it is the midpoint between the Conversion Line and the Base Line: [(Conversion Line + Base Line) / 2]. This value is entered 26 periods into the future and is the faster Cloud Frontier. - Senkou Span B, aka the leading Span B, represents the second cloud boundaries and is the center of the last 52 price bars: [(52-period high + 52-period low) / 2]. This value is selected 52 periods into the future and is the slower Cloud Boundary.

Chikou Span , represents the closing price and is 26 days back. - While the Ichimoku Cloud indicator involves several (five) different lines, it is very easy to read the chart. Using the trend lines mentioned above, determine whether Leading Span A or Leading Span B is currently higher.

- Once the leading team A and the leading team B have been identified, the ‘cloud’ component of this graph will be coloured. If the leading team B is above the leading team A, it indicates to the traders that the price momentum is currently increasing. If this is the case, the graph will be shaded green.

On the other hand, if Leading Span A is below Leading Span B, the underlying asset is likely moving in a negative direction. If this happens, the cloud will be red. Despite the complications of the chart, you can simply look at the colors of the cloud to determine the direction of the market.

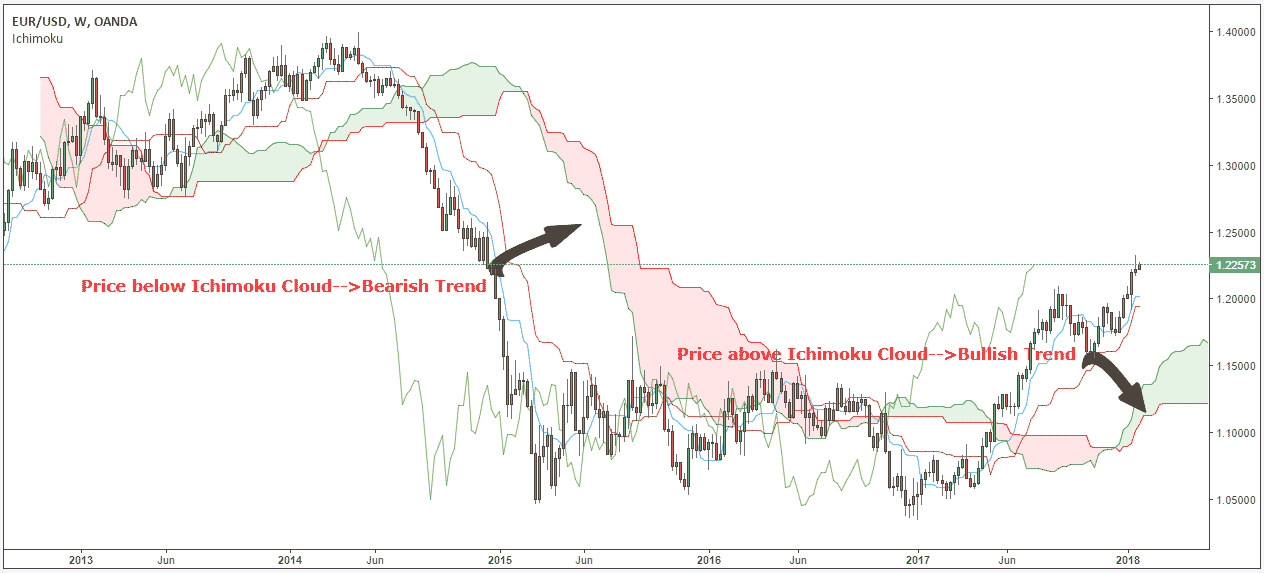

Here are some basic interpretations of the Ichimoku cards:

- If the price is above the Cloud, we are in a bearish trend.

- If the price is lower than the cloud, we are in a strong trend.

- If the price is in the middle of the cloud, consolidate or fluctuate.

Furthermore, the Ichimoku chart technique provides bullish and bearish signals of different strengths.

If the Tenkan Kijun crosses from below, it is considered a bullish signal. If the Taken crosses the Kijun from above, it is considered a bearish signal. The Kijun line is shown as the red line above.

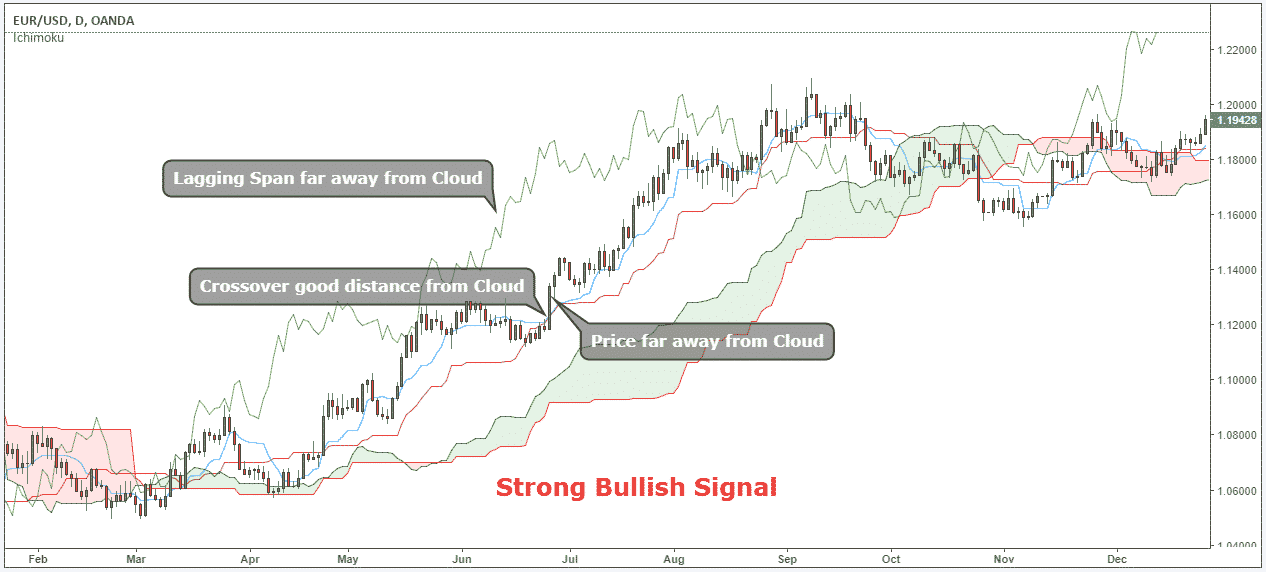

The strength of the Ichimoku trading signals is judged by three factors:

- How far is the price movement relative to the Cloud?

- How far is the Chiou Span relative to the cloud?

- How far is the Cross-over relative to the Cloud?

Because many of the lines on the Ichimoku Cloud chart are created using averages, the chart is often compared to a simple moving average chart. However, Ichimoku is more dynamic than a simple moving average chart because it is designed to detect changes in support and resistance.

The relationship between Leading Span A and Leading Span B will indicate whether there is a strong downtrend or uptrend. Note both the color (green for bullish, red for bearish) and the size of the cloud. If the “cloud” between these lines is small, the trend will not be very strong.

The Ichimoku Cloud is useful for day traders and others who need to make quick decisions. The cloud is often paired with other technical indicators, such as the Relative Strength Index, so traders can get a complete picture of resistance and support. Many traders will also look out for crossovers to determine when the trends have reversed.

Ichimoku cloud trading requires a lot of self-discipline. This is because you need to wait for the best trading signals. We are going to use the default settings of the Ichimoku Cloud system.

Now let’s go one step further and learn how to make money by applying the Ichimoku trading rules.

Note * Moving forward, we will not remove the moving average of the Lagging Span from our charts. This is because we don’t base our trading decision on it, because it follows the price.

The best Ichimoku strategy – buying rules

The Ichimoku Cloud system is designed to keep traders on the right side of the market. Our trading rules will help you follow the trend as long as possible. At least until it is clear that a turnaround is taking place. The Ichimoku system is best suited in swing trading. This is because it maximizes the profits while lowering the risk associated with the trade. You can identify the right swing to increase your profit.

The best time frame for the Ichimoku Kinko Hyo is the one that suits you best. As we do not have a preferred time frame.

This swing trading strategy will teach you how to take advantage of the trend from the start. You will also learn how to obtain as many profits as possible.

Ichimoku Cloud Trading: Step by Step

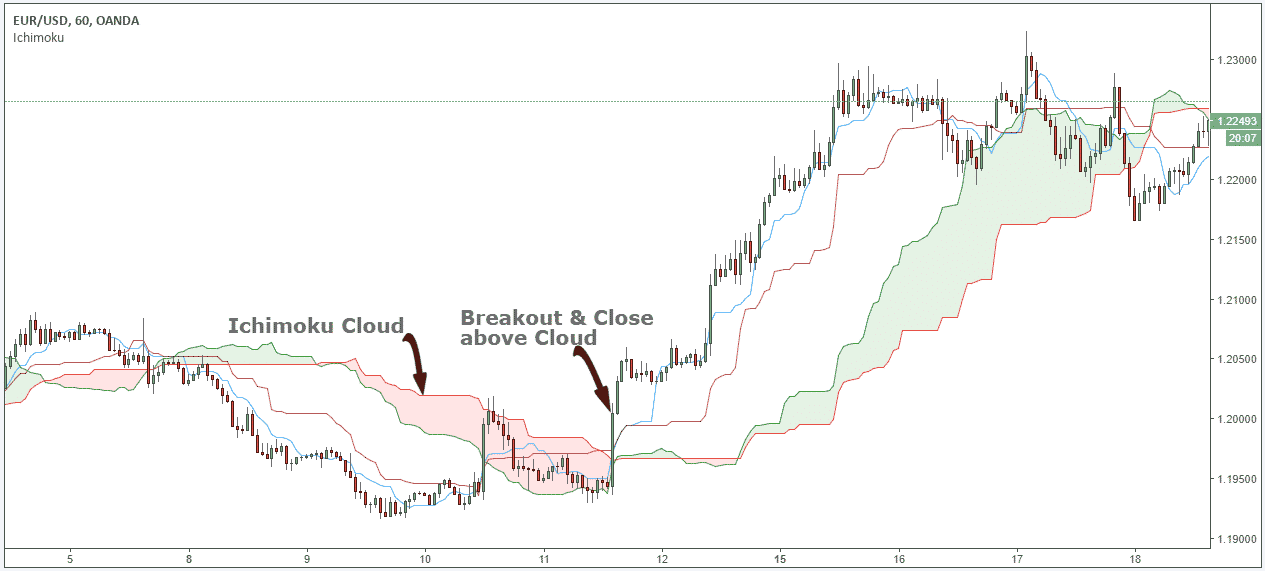

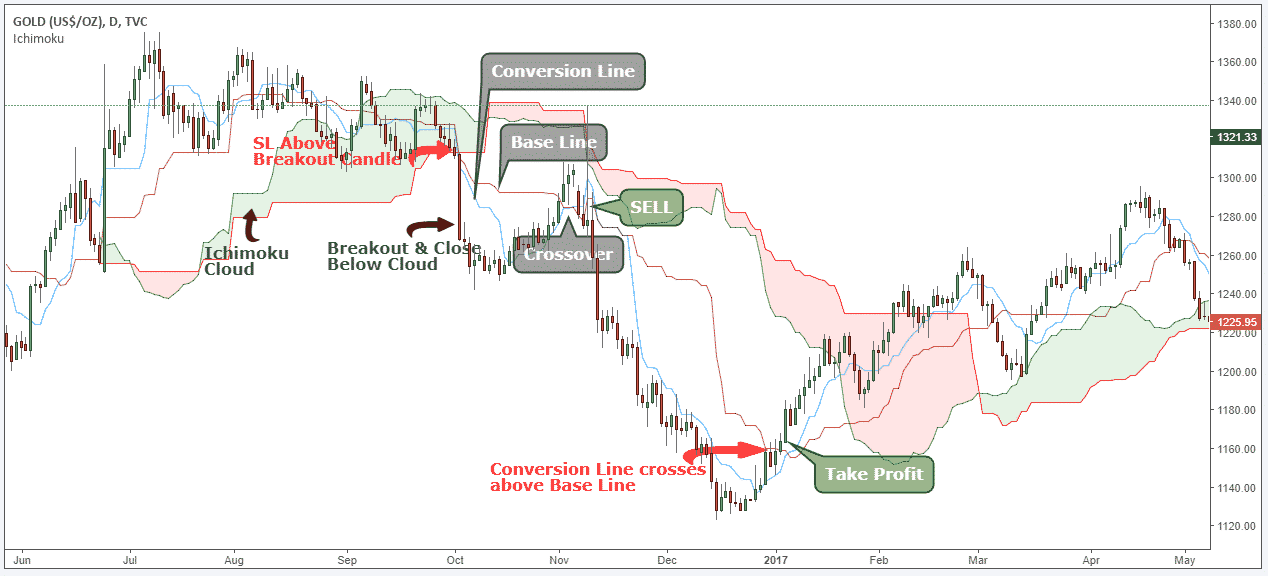

Step #1 Wait for the price to break and close above the Ichimoku cloud.

Ichimoku cloud trading requires the price to trade above the Cloud. This is because it is a bullish signal and possibly the start of a new uptrend.

The cloud is built to highlight support and resistance levels. It highlights several layers deep because support and resistance are not a single line in the sand. It is several layers deep.

So if we break above or below the Ichimoku cloud, it indicates a deep shift in market sentiment.

A high probability trade setup requires more layers of confluence before pulling the trigger.

This brings us to our next requirement for a high set of trade truths.

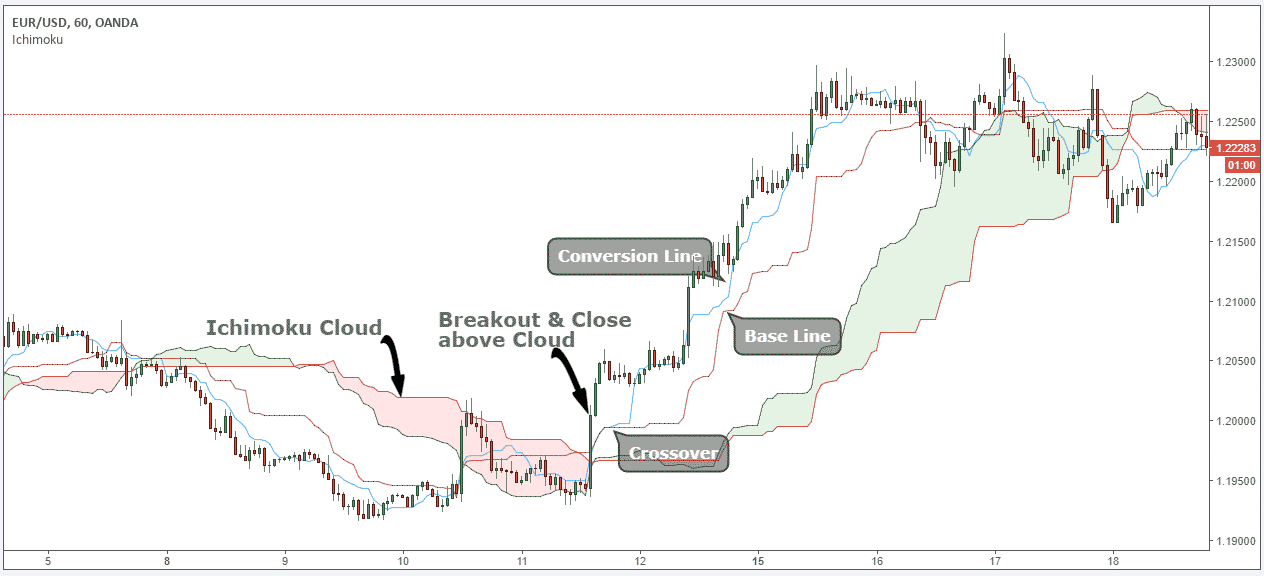

Step # 2 Wait for the transition: the conversion line must break above the baseline.

The price distribution above the cloud needs is followed by the transition of the conversion line above the baseline. Once these two conditions are met, we can look to enter a trade.

The Ichimoku Cloud indicator is a very complicated technical indicator. The indicator is even used as a moving average crossover strategy.

Now we are going to set up a very simple entry technique for the trading system Ichimoku Kinko Hyo.

See below….

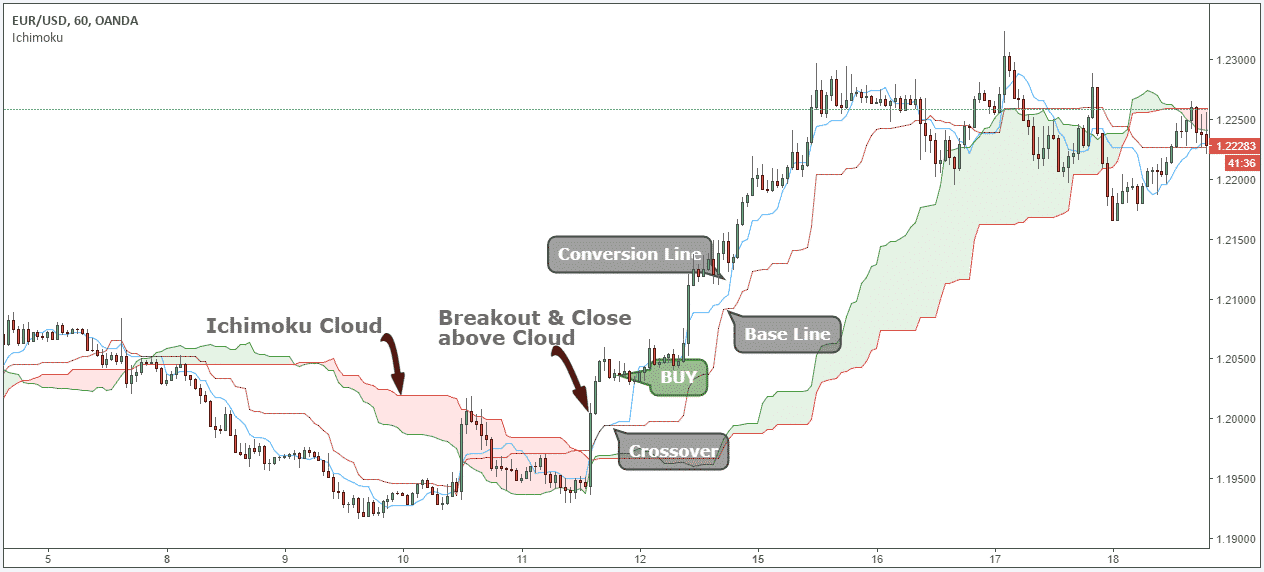

Step #3 Buy after the crossover at the opening of the next candle.

Ideally, any long trades using the Ichimoku strategy are taken when the price is trading above the Cloud. Our team on the TSG website took a more conservative approach. We added an extra factor of confluence before pulling the trigger.

So, after the crossover, we buy at the opening of the next candle.

(Note the strong buy signal in the chart below.)

The next important thing we need to determine is where to place our protective stop loss.

See below…

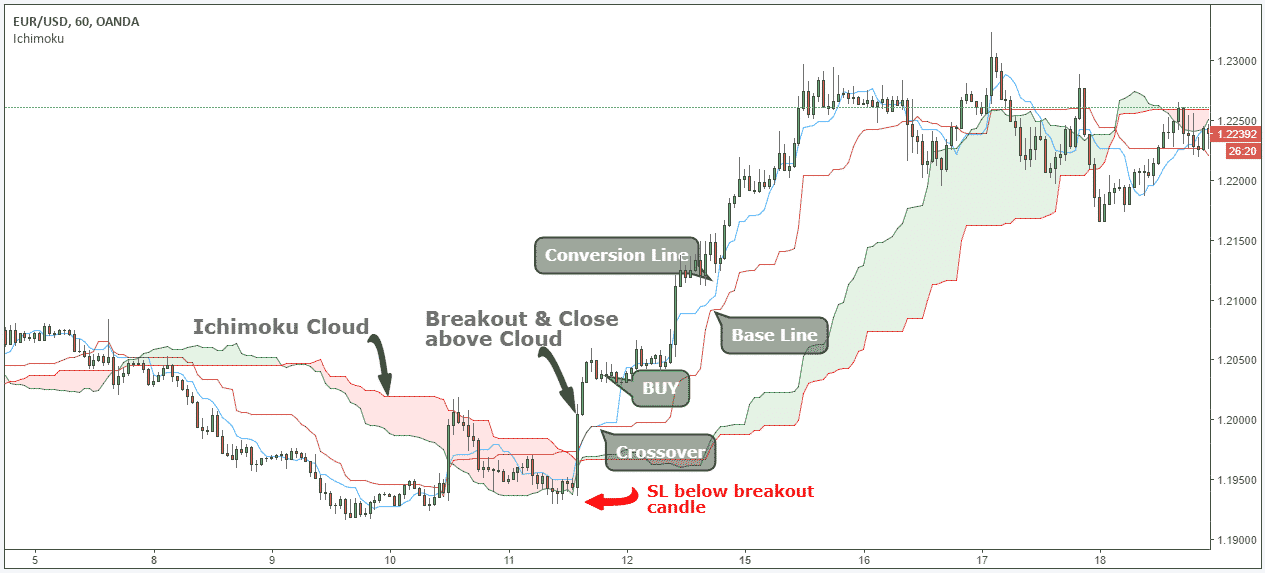

Step 4: Place protective stop loss below the candle.

The ideal location to hide our protective stop loss is below the low of the candle. This trading technique accomplishes two important things. Here is an example of a main candlestick setup.

First, it significantly lowers the risk of losing big money. Second, it helps us deal with the market order flow.

Since this is a swing trading strategy, we want to absorb as much of this supposedly new trend as possible. We will see our stop loss level below the Cloud or exit the position as soon as a new crossover occurs in the opposite direction.

The next logical thing we need to determine for the Ichimoku trading system is where we can take profit.

See below…

Step #5 Take profit when the reversal line crosses below the base line.

We only need one simple condition to be satisfied with our profit taking strategy.

If the reversal line crosses below the base line, we want to take profit and exit our trade.

Alternatively, you can wait until the price breaks below the cloud, but this means you lose part of your profit. In order to earn more, sometimes you have to be willing to lose some.

Note ** the above was an example of a BUY trade using the advanced Ichimoku trading strategies. Use the same rules for a SELL trade – but in reverse. In the figure below you can see a real example of SALE.

(See the strong sell signal in the conversion line.)

Conclusion: Ichimoku Cloud Explained

The best Ichimoku strategy is slightly different than probably anything you are used to when it comes to technical analysis. If you are having a really hard time finding true support and resistance, then apply the Ichimoku cloud trading techniques in this course.

We hope you are now convinced that the Ichimoku Cloud system is a great way to identify the trends and profit from any market on any time frame. It can easily absorb 80% of the trend if you follow the rules in the Ichimoku Cloud section.

Thanks for reading!