Learn how to use the trading strategy of Aroon Indicator to detect trend direction with deadly accuracy. Every professional should know how to determine the strength of a given trend and asset. The Aroon Oscillator is a two-in-one technical indicator that will help you correctly identify the reversals, their strengths and weaknesses. This tutorial is about identifying trend changes with this powerful tool.

If this is your first time on the site, our Trading Strategy Guide team welcomes you.

Market trends are constantly changing. Don’t be fooled by following the trend that is about to change gears. The point is that most traders have trouble identifying when the trend is changing. Market Tizard and hedge fund manager billionaire Paul Tudor Jones say how to spot trend changes:

“There is no training, in class or otherwise, that can prepare you to trade the last third of a move, whether it is the end of a bull market or the end of a bear market .”

If you want to detect important trend changes, you need the right tools.

So, what is the best indicator?

The Aroon Oscillator is the best indicator to identify a trend change and its strength.

Next, you will setup the Aroon MT4 indicator and reveal the secret formula for the Aroon oscillator.

What is the Aroon Indicator

The Aroon Oscillator is a technical indicator that is part of the oscillator indicator family. Developed by Tushar Chande in 1995, Aroon can help you identify received trends and their strength or weakness. Chande was born in India, and in the Sanskrit dialect, Aroon means “Light of dawn”.

As the name suggests (early light), this oscillator is designed to reveal the beginning of a new trend.

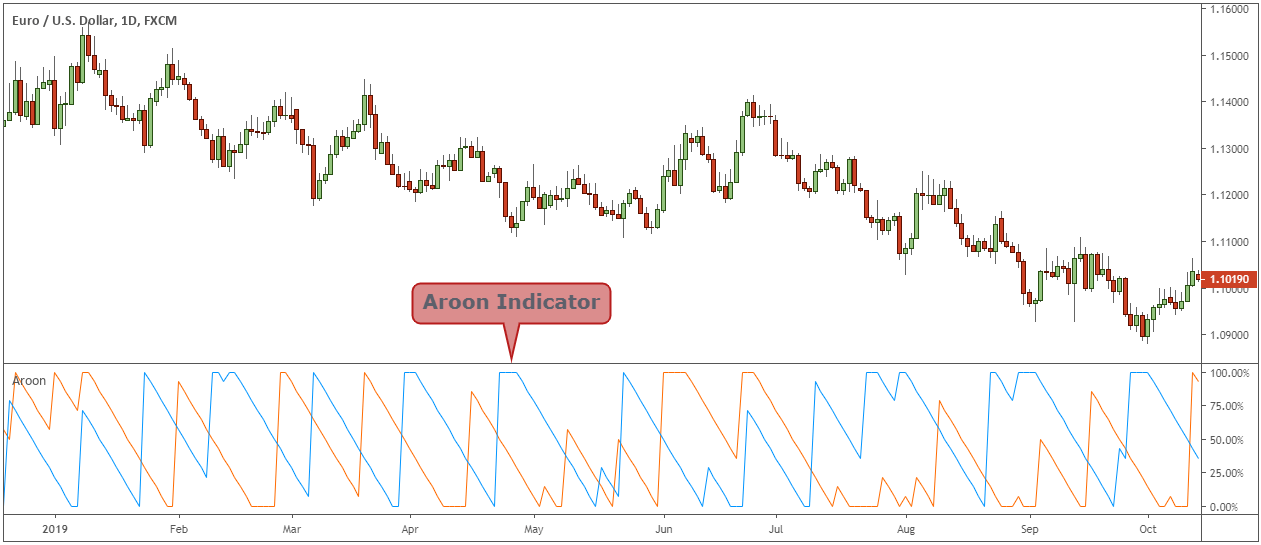

Check out the Aroon chart below:

Typical moment indicators focus only on detecting the relative strength of a trend. For example, the ADX indicator can be used to determine only strong directional movements.

See how to measure the strength of the trend with the best ADX strategy created by professional traders.

In essence, the Aroon technical indicator combines the advantages of two other oscillators:

- On the one hand, we can identify when a new trend will emerge. To identify the market reversal, you can use the Mass Index indicator.

- But on the other hand, we can identify the strength of the trend without using other technical indicators.

We can see the technical indicator of Aroon as a combination of the mass index and the KST indicator.

Many technical indicators can lead to the paralysis of the analysis.

Being able to use only one indicator and extract different information from it is therefore a great advantage.

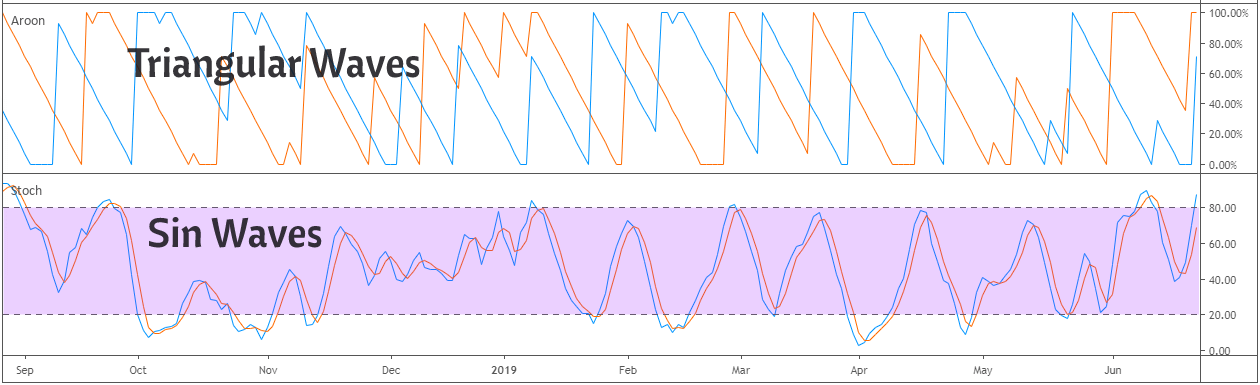

Second, traditional oscillators use sine waves to give us a visual representation of the indicator reading. However, the Aroon lines are more triangular. For technical traders who are more visually oriented, this can provide an advantage in itself, as trading signals are a million times easier to detect.

The trick to determining trend reversal and strength depends on understanding the Aroon oscillator formula.

So let’s get started.

What is the Aroon oscillator formula?

The main idea behind the Aroon technical indicator is that strong bullish trends are likely to see new highs, and strong bearish trends are likely to see new lows. Essentially, Aroon will give you important information as we shape these new ups and downs.

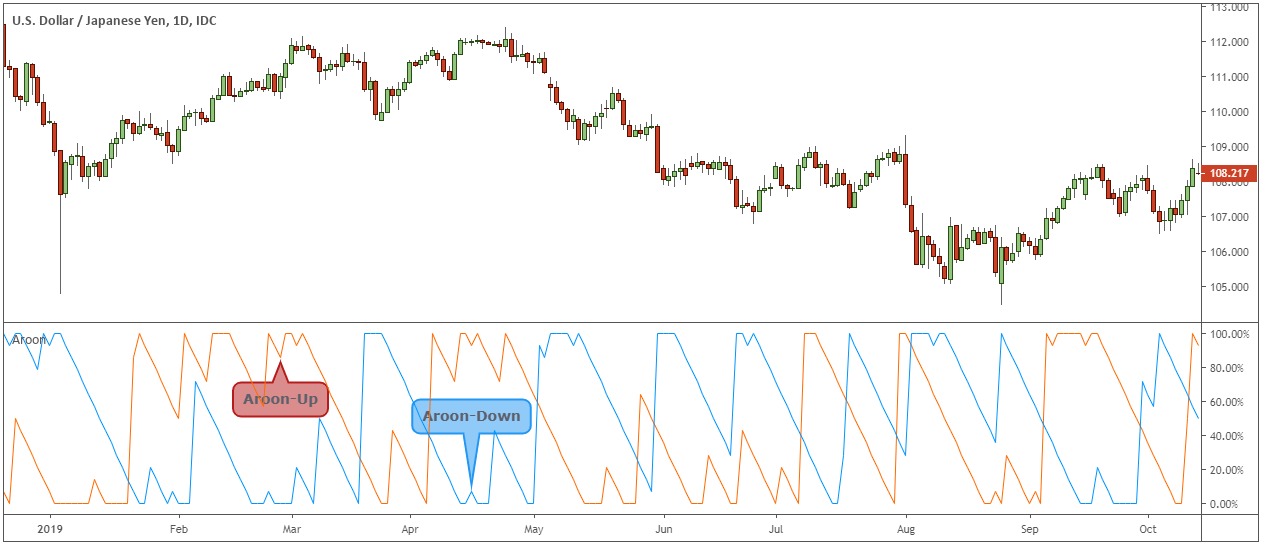

The Aroon indicator consists of two lines ranging from 0 to 100:

- Aroon-Up, which measures the strength of the bullish trend.

- Aroon-Down, which measures the strength of the trend.

The Aroon-up line uses the highest prices in its calculations, while the Aroon-up line uses the low prices in its calculations. These two lines are dotted next to each other for a better visual representation.

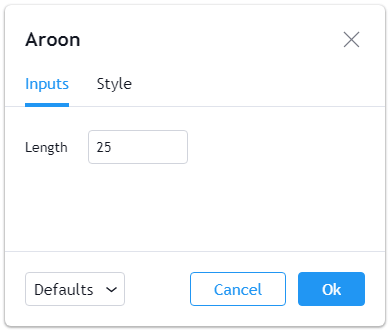

The default settings for Aroon are 14 periods.

But what are the best settings for the Aroon indicator?

Chande recommends applying the best setting for the Aroon indicator as a 25 data period:

- Aroon-up shows how many periods have passed since the last 25 period walk.

- Aroon-down shows how many periods since the last 25 period low.

Note * For long-term trading strategies, we want to look very far into the past price (> 25 periods). However, for short-term trading strategies, we want to examine the latest price data (<25 periods).

Aroon indicator settings:

Unlike other oscillators at the moment, based on price and time changes, the Aroon indicator is quite exclusive. We also included the maximum and minimum of 25 periods in the Aroon oscillator formula:

The above mathematical formula shows how you can calculate the Aroon indicator lines.

The up and down Aroon indicator takes high and low prices during the past 25 periods.

Fortunately, we don’t have to remember the math behind Aroon’s calculation. Our trading platform will do it for us.

Let’s see how you can use the Aroon indicator to trade with cash.

How to get started with the Aroon technical indicator:

How to use the Aroon Oscillator

For example, traders can use the Aroon technical indicator to:

- Identifying new trends (up or down trend).

- Evaluating the strength of trends.

- Reach zone identification and consolidations.

- And expect reversals in the market.

The above description are only a few examples of the use of the Aroon indicator.

For inputs we also use the upper (100) and lower (0) limits along the center (50).

Here is the basic interpretation of Aroon’s lectures:

- A reading near level 100 indicates a strong up/down trend.

- A reading near level 0 indicates a weak up/down trend.

If the crown of Aroon is near level 100 and Aline’s downline is near level 0, the market is in a strong uptrend.

On the other hand, if the Aroon downline is near level 100 and the Aroon downline is near level 0, the market will be in a strong downtrend.

Depending on the time between a new high or low rise, the lines above and below Aroon will decrease.

When should you negotiate based on a new high formation versus a new low formation?

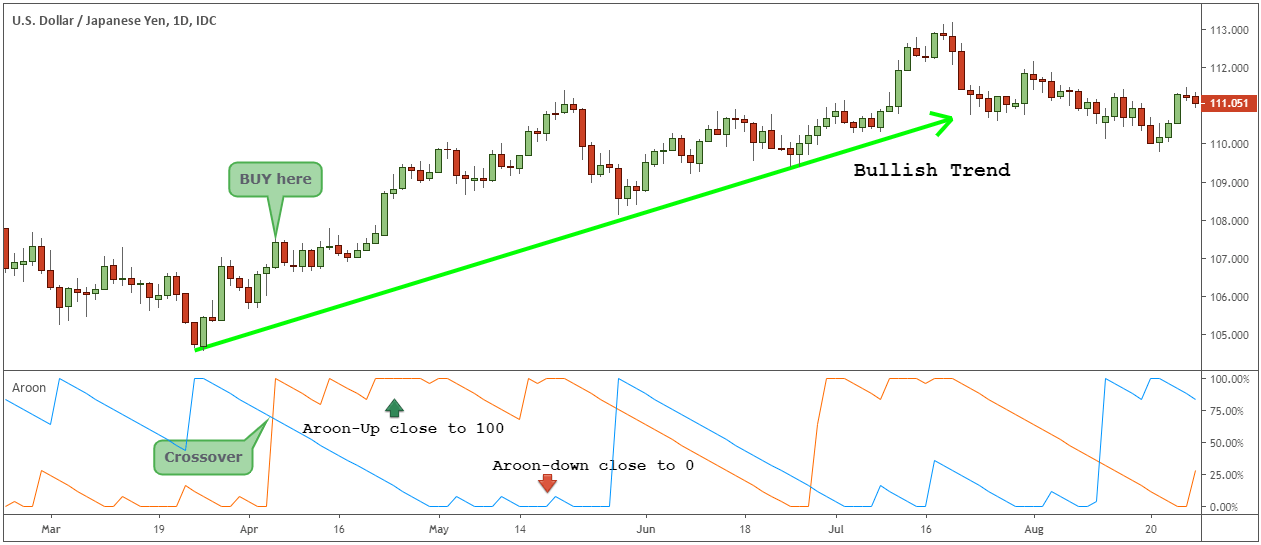

The buy and sell signals for Aroon are simple.

The most important buy signal for Aroon will occur when Aroon-Up rises. As Aroon-up increases and goes on level 100, the chart will also show the price in upward direction. The logic behind it is that our chart forms these higher highs. We get more bullish candles, revealing the Aroon line.

In addition to Aroon-Up moving up, Aroon-Down must move down to confirm the uptrend. If the Aroon-up crosses over the Aroon-down, a buy signal is generated.

The interpretation of this signal is that we are reaching more recent and distant highs. All of this is a clear indication of an up market.

Note ** Aroon’s sell signals will be the exact opposite. A sell signal for Aroon is triggered when Aroon-Down crosses below Aroon-Up.

Next, we explore three powerful Aroon trading strategies to navigate any type of asset and market.

Aroon Oscillator Trading Strategy

Aroon is a very versatile trading indicator that has many commercial functions. You can use it as a trading system on your own. Here are the top three trading strategies based on the Aroon indicator, which you can use to get more profits:

- Aroon breakout trading strategy (helps you find consolidations and breakouts).

- Aroon trend strength strategy (will help you determine the trend).

- Aroon’s Trade Withdrawal Strategy (will help you negotiate withdrawals).

# 1 Aroon Breakout Trading Strategy

How can you identify consolidation and business negotiations with Aroon?

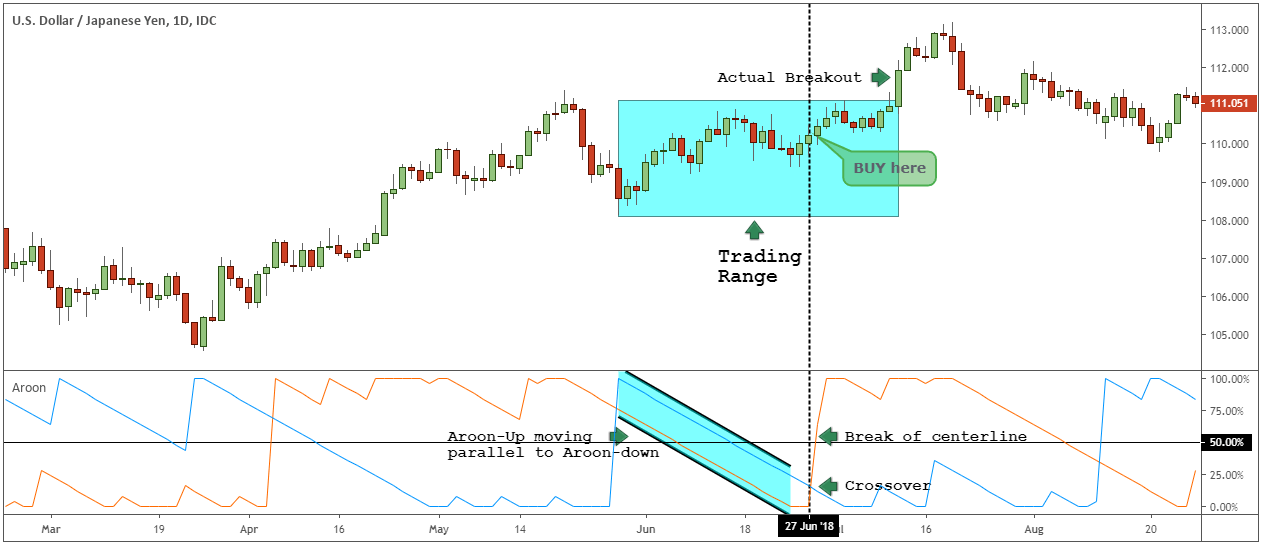

If the Aroon Up and Aroon Down lines are parallel to each other, this is a sign that the price is consolidating. Aroon’s interpretation is that there are no new highs or lows during the standard period.

You have two options for negotiating consolidations.

Wait until the escape occurs and take the negotiation in the direction of the escape.

Or wait for the crossing of Aroon, followed by a crossing of the central line to add more confluence to the direction of the trade.

These Aroon signals mostly come before the flight.

Check out the Aroon chart below:

So, you basically expect the escape.

It is as if we face all market participants.

You start negotiating in front of someone else.

Let’s see how to follow strong trends with Aroon. Also, learn how to trade using the RSI oscillator.

#2 Aroon trend strength strategy

The underlying strength of the trend can be revealed by the Aroon lines.

After reaching level 100, we sometimes begin to experience periods of small change.

Aroon UP simply falls down, like reaching a plateau.

This is the same type of activity that can be found when a traditional oscillator reaches the overbought readings. And it remains in the overbought reading for some time.

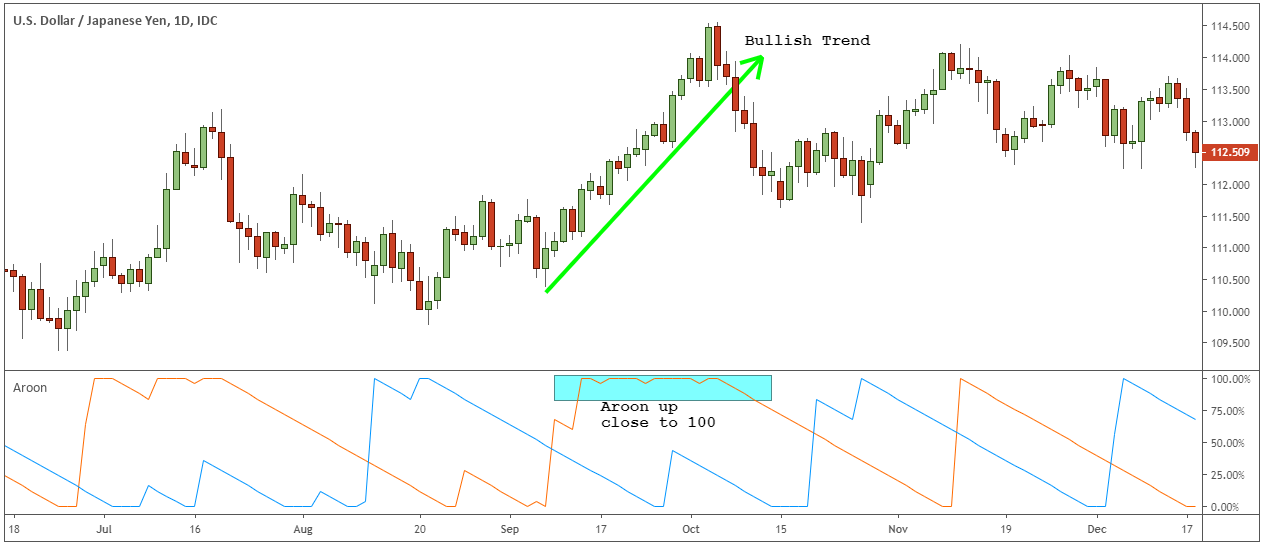

A picture is worth a thousand words:

The continuous reading of Aroon-Up near level 100 is an indication of a very strong trend. However, at some point one or two trading scenarios may occur:

- Expect a trend reversal

- Or expect a backlash

Aroon’s interpretation of this kind of reading suggests that we have been forming these higher elevations for a very long time. For Aroon-Down we form lower minimums.

These excessive readings on the Aroon Oscillator often indicate the presence of a strong trend. However, if you just want to extend the market, you can exit the market as soon as the Aroon-Up crosses below the center line.

But we want to negotiate with the trend.

And we have developed a proven way to distinguish between a setback and a total reversal.

We call this the law of effort versus result.

The effort is the activity measured by the Aroon lines (in our case Aroon-Up). And the result is the activity measured by the price action. The theory is that if the Aroon-UP redefines itself, moving away from 100 readings and moving to 0, the price should follow the example of the Aroon-Up reading.

We hope that the effort will lead to lower prices. If not, and we see only a small price change, we know the uptrend is very strong.

This is how you can get bounces with Aroon and trend trading.

We combine Aroon’s trend strength strategy and Aroon’s drawdown strategy into a significant market advantage. If you like this method, be sure to check out others in the Best Trading Strategies article.

Final Words – Aroon Oscillator

The Aroon indicator is an unusual indicator that can help you identify the strength of a trend and track it until a buy or sell peak is reached. We like the versatility of the Aroon Up and Down indicator. The triangular lines of the Aroon oscillator make it easier for the untrained eye to detect buy and sell signals.

Overall, you have a moment oscillator that can easily be one of the top three technical indicators for profitable trading. Which indicators you use affects the way you interpret trends. It is clear that the Holy Grail of the negotiations is no indication.

Aroon is an effective tool for detecting changes in the trend direction and the strength of the trend.

If you want to equip yourself with the right knowledge to win the war with the world’s largest financial market check: How to Trade Forex for Beginners?