This guide helps you design algorithmic trading strategies to control your emotions while letting a machine trade. Why would you want to use high frequency algorithmic trading strategies? What types of algorithmic bots are best? All will be revealed in this algorithmic trading strategies manual. At the end of this tutorial, you will learn the secret ingredients you need to develop profitable Forex algorithmic trading strategies.

If this is your first time on our site, our team at Trading Strategy Guides welcomes you. Be sure to click the subscribe button to get your free trading strategy delivered straight to your inbox every week.

With the advancement of electronic trading, algorithmic trading has become more popular in the last ten years. Algo trading only started in the 1980s. Today, it accounts for nearly 70% of all trading activity in developed markets.

If you want to improve your knowledge of quantitative trading, we recommend that you read Algorithmic Trading Winning Strategies and The Rationale by Ernest P. Chan. Ernest wrote one of the best books for algorithmic trading strategies. What sets this informative book apart from others is its emphasis on examples of algorithmic trading strategies as opposed to just theory.

Now let’s answer some of the most common questions:

- What are forex algorithmic trading strategies?

- How do they work?

- Who should trade forex algo strategies?

- And when should you use forex algorithmic trading strategies?

What is algorithmic trading?

Algorithmic trading is a technique that uses a computer program to automate the process of buying and selling stocks, options, futures, FX currency pairs and cryptocurrency.

On Wall Street, algorithmic trading is also known as algo trading, high frequency trading, automated trading or black box trading. These terms are often used interchangeably.

If you want to learn how high frequency trading works, check out our guide: How High Frequency Trading Works – The ABCs.

Basically, the algorithm is a piece of code that follows a step-by-step set of operations that are performed automatically. The step-by-step operations are based on the inputs you have programmed into it. The input variable can be something like price, volume, time, economic data and indicator readings. Any kind of variance of those input variables can be used.

After these criteria are satisfied, a buy or sell order is executed.

Next, you will learn how trading algorithms work. You will also learn what you need to do to execute your trade in an automated way:

How does algorithmic trading work?

Algorithmic trading works by following a three-step process:

- Do you have a business idea.

- Turn your trading idea into a trading strategy.

- The trading strategy is converted by means of an algorithm.

Once the algorithmic trading program is created, the next step is backtesting. Backtesting involves using historical price data to determine its viability. If the algorithm gives you good back-tested results, you can consider yourself lucky to have a head start on the market. Finding an advantage in the market and then coding it into a profitable algorithmic trading strategy is not easy.

Read how to test a trading strategy based on our retesting strategy.

The first (and most important) step in algorithmic trading is to have a proven profitable trading idea. Before learning how to create a trading algorithm, you need to have an idea and strategy.

After finding an advantage in the market, you must have skill and skill. The best algorithmic traders have skill and proficiency in these three areas:

- Knowledge of trading and financial markets.

- Quantitative analysis or modeling.

- Programming skills.

What are the best programming languages used in algorithmic trading?

Python algorithmic trading is probably the most popular programming language for algorithmic trading. Matlab, JAVA, C++ and Perl are other algorithmic trading languages used to develop unbeatable black box trading strategies.

At the moment, the best coding language for developing Forex algorithmic trading strategies is MetaQuotes Language 4 (MQL4).

Let’s discuss the things you need to develop your Algorithmic Trading Strategies PDF:

- A trading strategy based on quantitative analysis.

- Choose the right algorithmic trading software that is connected to the exchange and automatically executes trades for you.

- Live data for trading.

- Historical price data for testing your algae.

- IT infrastructure for high frequency trading. Examples of this are a powerful computer to handle advanced mathematical models, servers, backup power, fast internet connection.)

- Colocation facility to have your servers installed at the location of the stock exchange (eg NYSE, if you trade stocks). This will help minimize trade execution and give you an edge over the competition. Colocation is often used in high-frequency trading.

Now let’s see who the players are in the market. Who is most likely to use algorithmic trading in the trading landscape?

See below:

Who uses algorithmic trading?

Essentially, any experienced trader with coding skills can use programmed trading strategies to trade on their behalf. An individual trader can code his own algo trading robot to do more than just open buy and sell orders. Algorithms can be used for much more complicated things such as:

- To make complex mathematical calculations.

- Prediction of market movements.

- Generate trading signals.

- Risk management

- Etc

The most skilled algorithmic traders are large institutions and smart money. Hedge funds, investment banks, pension funds, real estate traders and brokers trade with market-making algorithms. These guys make up the technically savvy global elite of algorithmic trading.

Note: These days market making is done through machine learning. You can learn more about this by reading Intelligent Market Making Strategy in PDF Algorithm.

Moving forward, we are going to look at the types of algorithmic trading strategies.

See below:

Introduction to algorithmic trading strategies

Some algorithmic trading strategies are used to generate profits. Others are used for order fulfillment. Throughout this algorithmic trading guide, you are going to focus on profitable algorithms. We are not so concerned about algorithmic order management or order filling algorithms.

Order filling algorithms execute a large number of stocks or futures contracts over a period of time. The sequencing algorithms are programmed to divide a large order into smaller pieces. In this way, it will not move the market against the position taken.

The most popular algorithmic orders and techniques that the smart money uses are:

- Icebergs

- Time slice

- VWAP

- TWAP

- PEG / BBBO

The herd mentality is to follow the big money. If you understand how a large order can affect the market, you know that if the whole street knows your intentions, you will end up not getting the price you want.

If you intend to buy ABC stock and the whole street jumps to buy it, the stock price will be artificially pumped higher. This is a classic case of supply and demand.

Next, we are going to outline the best algorithmic strategies. What are the most common trading strategies used in algo trading? Keep reading.

What are the best algorithmic trading strategies?

We have a large number of examples of algorithmic trading strategies. We’re going to give you a broad list so you can see big trends.

Broadly speaking, most high-frequency algorithmic trading strategies will fit into one of the highlighted categories:

- Momentum strategies

- Average Reversal Strategies

- Sentiment based strategies

- Statistical arbitrage strategies

- Marketing Strategies

The Algorithmic Trading Profit Strategies and Their Rationale book teaches you how to implement and test these concepts in your own systematic trading strategy.

Algorithmic strategy for trading moments

Momentum-based algae simply follows when there is a spike in volatility or momentum ignition. The algo jumps on that momentum surge with buy or sell orders and a tight stop. The idea behind the momentum-based algorithms is simple. Once the ball starts rolling, he will do so until he finds some kind of resistance.

You can determine the market momentum using indicators and price statistics.

One very simple automated trading algorithm used in the S&P 500 E-mini futures is programmed to feed buy orders when the Emini S&P 500 makes a new intraday high after the open.

Discover some secrets and techniques developed by a 35-year veteran trader for day trading Emini futures: Day Trading Strategies Emini Futures .

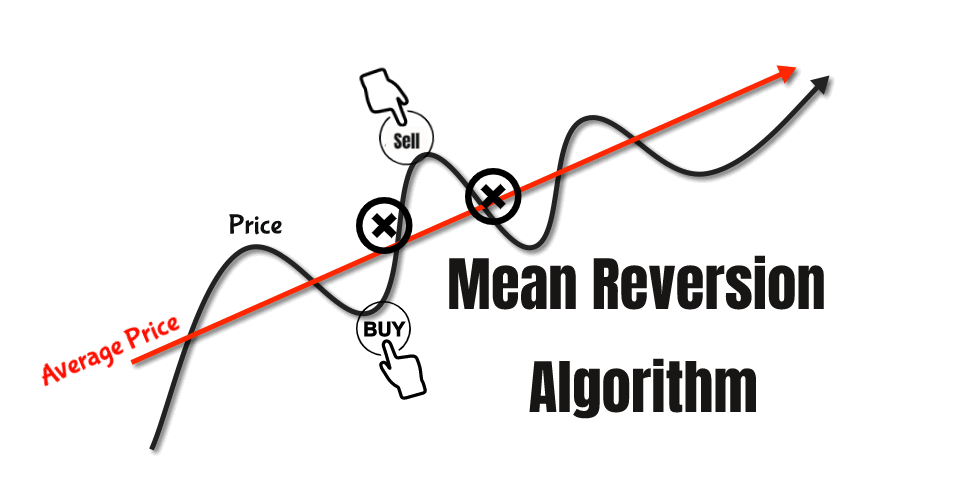

Mean reversion algorithmic strategy

The mean reversion system is another type of algorithmic system that operates under the assumption that the market stretches 80% of the time. The price usually includes the average price.

Algorithmic traders use the historical price data to determine the average price of a security. They then open buy or sell orders in anticipation of the current price reverting to the average price.

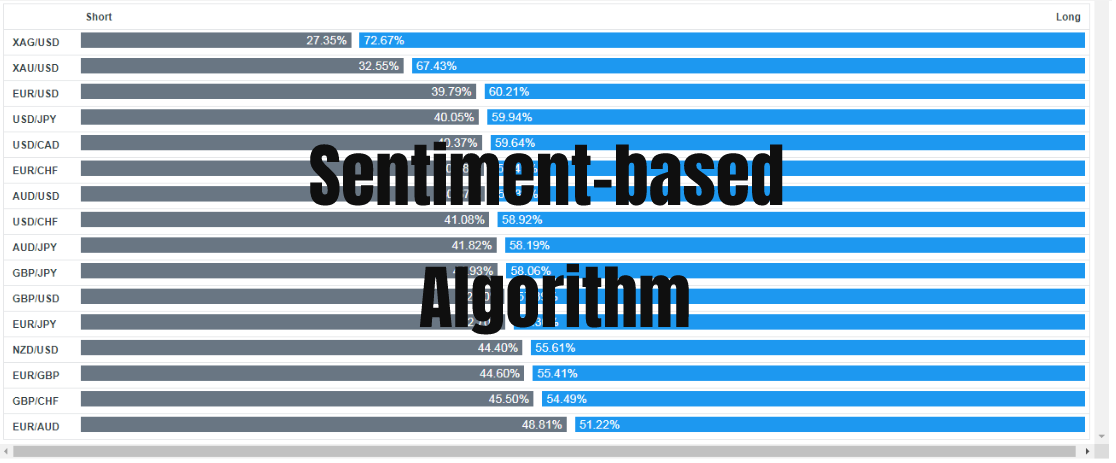

Algorithmic trading sentiment strategy

The sentiment-based algorithm is a news-based algorithmic trading system that generates buy signals and trade signals based on how the actual data appears. These algorithms can also read the general sentiment on the retail market by analyzing the Twitter data set. The purpose of this algorithm is to predict future price movement based on the actions of other traders.

You must have a thorough understanding of how the financial markets operate and strong skills in developing algorithms for sentiment trading.

Algorithmic trading strategy for markets

The market makers, also known as the liquidity providers, are broker-dealers who make a market for an individual instrument. These can be stocks, bonds, commodities, currencies and cryptocurrencies. The main task of an algorithm that develops on the market is to offer the price to price and buy quotes. Algae for marketing can also be used to match buy and sell orders.

One of the most popular market-making algorithmic strategies involves placing buy and sell orders simultaneously. These types of market making algorithms are designed to capture the spread.

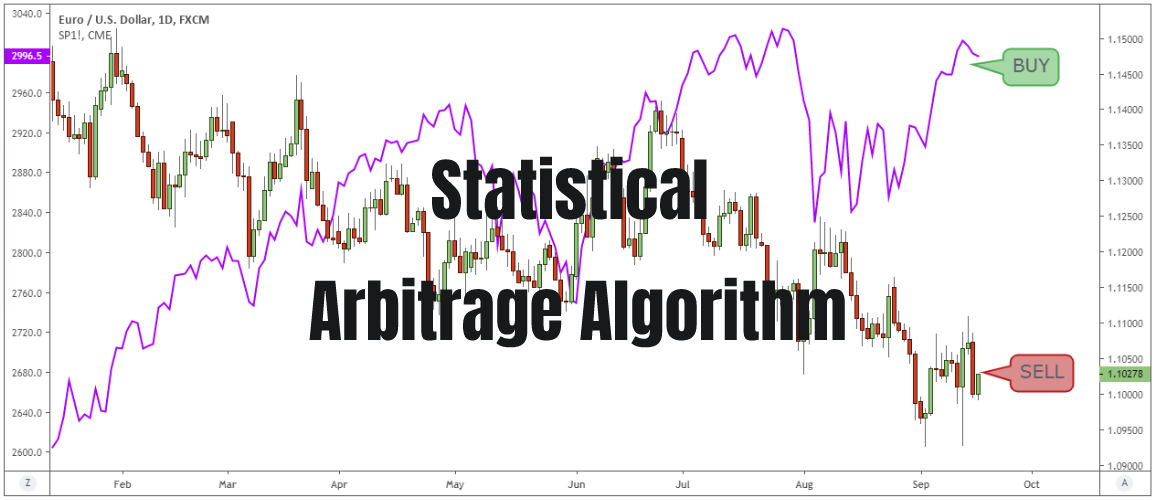

Statistical arbitrage algorithmic trading strategy

Most statistical arbitrage algorithms are designed to take advantage of statistical mispricing or inefficiency of one or more assets. Statistical arbitrage strategies are also referred to as stat arb strategies and are a subset of mean reversion strategies.

Stat arb involves complicated quantitative models and requires large computational power.

The most popular form of statistical arbitrage algorithmic strategy is pairs trading strategy. Pairs trading is a strategy used to trade the differences between two markets or assets. Pairs trading is essentially taking a long position in one asset while simultaneously taking an equal-sized short position in another asset.

Be sure to check out our favorite arbitrage trading bot: How to make money from arbitrage trading software before you read on.

Forex algorithmic trading strategies

FX algorithmic trading strategies help reduce human error and the emotional pressure that comes with trading. The goal is to build smarter algorithms that can compete and beat other high frequency trading algorithms.

Most merchants do not have the money to pay for powerful computers and expensive collaboration servers. Competing against other HFT trading algorithms is like competing against Usain Bolt.

So how can you compete with other questions?

What is the secret of winning this race?

As Sun Tzu said in The Art of War, “Keep your friends close and your enemies closer.”

The best way to follow this principle is to analyze how other Forex algorithms behave and study their movements.

For example, a dirty secret and standard practice used by many algae is the momentum ignition strategy. This purpose is to cause a rapid rise in the price above a certain key level. This algorithm typically contains support and resistance, swing high / low, pivots or other important technical indicators. This action will prompt other traders to move backwards from the move.

The Forex chart below shows you the Forex momentum ignition algorithm in action:

You can train and program your Forex algorithm to react to this type of behavior. If you have excellent programming skills, you can build your Forex algorithmic system to sniff out when other algae are taking on the momentum ignition.

Final words – algorithmic trading strategies

It takes time to develop your algorithmic trading strategy, but the benefits and peace of mind you get make it worth it. It is a very competitive space that requires sophisticated knowledge and programming skills to develop high frequency trading algorithms.

The rise of high-frequency trading robots has led to a cyber-battle being waged in the financial markets. Forex algorithmic trading strategies have also brought to life several other trading opportunities that a keen trader can take advantage of.

Thanks for reading!